- Home

- »

- Homecare & Decor

- »

-

Wedding Services Market Size & Share, Industry Report, 2030GVR Report cover

![Wedding Services Market Size, Share & Trends Report]()

Wedding Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Local, Destination), By Booking Type (Offline, Online), By Service Type (Catering Services, Decoration Services), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-409-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wedding Services Market Summary

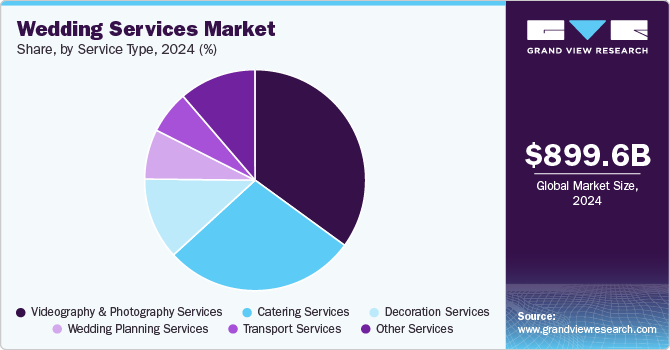

The global wedding services market size was estimated at USD 899.64 billion in 2024 and is projected to reach USD 1,842.54 billion by 2030, growing at a CAGR of 12.7% from 2025 to 2030. The increasing expenditure on extravagant and personalized weddings has expansion.

Key Market Trends & Insights

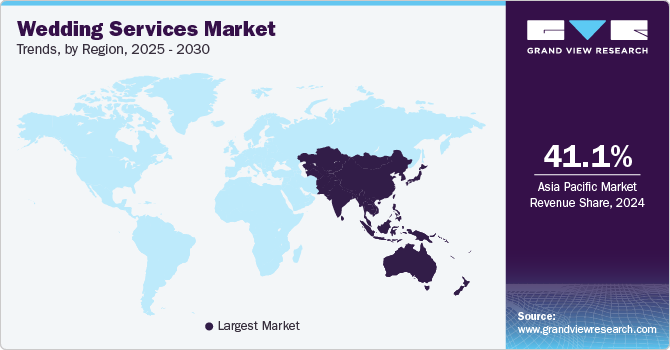

- The wedding services industry in the Asia Pacific accounted for a revenue share of 41.1% of the overall wedding service market in 2024

- By type, local wedding services segment accounted for a revenue share of 75% in the overall wedding services industry in 2024.

- By booking type, the Offline wedding services bookings accounted for a share of 75.8% in 2024.

- By service type, the videography & photography services accounted for a revenue share of 35.0% in the overall wedding services industry in 2024

- By service type, demand for decorative services are expected to grow at a CAGR of 13.0% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 899.64 Billion

- 2030 Projected Market Size: USD 187.54 Billion

- CAGR (2025-2030): 12.7%

- North America: Largest market in 2024

Couples are increasingly significantly contributed to the market's seeking unique experiences and themes for their special day, which boosts demand for various services, including event planning, catering, photography, and décor.

The rise in disposable income and the growing trend of destination weddings have further propelled market growth. Destination weddings, which often involve luxurious venues and elaborate arrangements, are becoming more popular, especially among millennials. This trend has led to increased demand for wedding services tailored to specific locations and cultural themes.

The influence of social media platforms showcase high-profile weddings and inspire couples to replicate similar experiences. The accessibility of online wedding service providers has made it easier for individuals to plan and customize their weddings, contributing to the market's rapid development.

For instance, in February 2025, Apple launched the Invites app, a new application for iPhones that enables users to create and share personalized e-invitations with friends and family. Leveraging generative AI-based Apple Intelligence features; the app allows users to select images from their photo library or app templates. It is designed to simplify the invitation process, replacing traditional in-person invitations, especially in the post-COVID era. Additionally, the app includes an RSVP feature for guests to respond promptly.

Consumer Survey & Insights

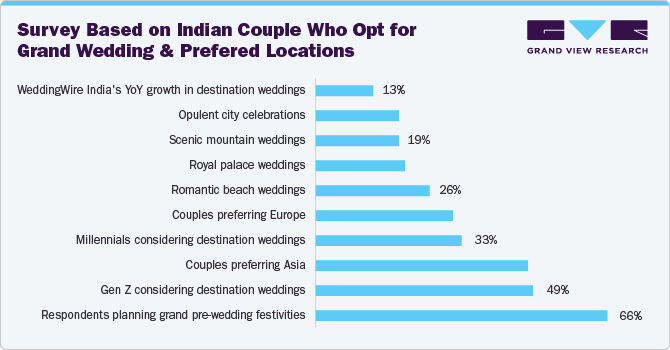

Leading global travel app Skyscanner, collaborated with WeddingWire India, unveiled its latest survey titled "Destination 'I Do'," revealing a strong desire for destination weddings among Indians. The survey shows that Indians are either planning or have already had a destination wedding, with Gen Z leading the charge at 49%, compared to 33% of Millennials. Goa tops the list for sun-soaked wedding celebrations, followed by Dubai. The trend also highlights a significant 66% of respondents planning grand pre-wedding festivities. Popular pre-wedding options include weekend getaways, cruise parties, Italian-style soirées, and gigs with friends. WeddingWire India reports a 13% year-over-year growth in destination weddings, driven by the influence of opulent celebrations like the Ambani wedding. This trend underscores the growing appeal of unique and adventurous wedding experiences among Indian couples.

Furthermore, the allure of Asia captivates 48% of Indian couples, favoring Thailand, Japan, and the Maldives for destination weddings due to their scenic appeal and proximity. Europe enchants 31%, with the UK, Spain, France, and Italy as preferred destinations. Indian couples also cherish destinations such as Goa, Dubai, Bali, and Bangkok. Romantic beach weddings entice 26%, while 20% prefer royal palace affairs. Scenic mountains and opulent city celebrations each attract 19%. Willing to increase budgets by 50%, 45% of couples pursue unique, unforgettable weddings, increasingly at lesser-known locales like Gokarna and Mahabalipuram, seeking meticulous planning and bespoke services.

Type Insights

The local wedding services segment accounted for a revenue share of 75% in the overall wedding services industry in 2024. Local service providers are often better equipped to cater to the cultural, regional, and traditional preferences of couples, which play a crucial role in wedding planning. Their familiarity with nearby venues, vendors, and logistical arrangements makes them a preferred choice for many. Moreover, the growing emphasis on community-driven events and personalized experiences has further boosted demand for local wedding services. These providers often offer more customized solutions and a personal touch that resonates with couples looking for meaningful and memorable weddings. Additionally, the cost-effectiveness of local services compared to outsourcing from distant providers has made them an attractive option, especially for budget-conscious clients.

Demand for the destination wedding services segment is expected to grow at a CAGR of 16.3% from 2025 to 2030. Unique and luxurious wedding experiences are becoming increasingly popular among couples seeking memorable celebrations. The rise in disposable income and the influence of social media showcasing picturesque destination weddings have further propelled this trend. Additionally, the availability of specialized wedding planners who cater to location-specific needs ensures seamless arrangements, making destination weddings an appealing choice.

Booking Type Insights

Offline wedding services bookings accounted for a share of 75.8% in 2024. This can be attributed to the desire for personalized service, trust in face-to-face interactions, and the complexity of wedding planning. Couples often prefer to meet vendors in person to discuss their specific needs and preferences, allowing for a more tailored experience that online platforms may not provide. In addition, the emotional significance of weddings leads couples to seek reassurance through direct communication, fostering trust and confidence in their chosen vendors. The intricate nature of wedding planning also necessitates detailed discussions that are often more effectively conducted in person, making offline bookings a preferred choice for many couples.

Online booking for wedding services is expected to witness a CAGR of 14.4% from 2025 to 2030. The growing trend of online booking for wedding services is primarily driven by the increasing reliance on digital platforms for convenience and accessibility, allowing couples to compare options, read reviews, and secure services from the comfort of their homes. In addition, the rise of social media and wedding planning websites has created a wealth of information and inspiration that encourages couples to explore various vendors online. Moreover, the integration of technology in wedding planning tools enhances user experience through features such as budgeting calculators and customizable checklists, making it easier for couples to manage their plans efficiently.

Service Type Insights

Videography & photography services accounted for a revenue share of 35.0% in the overall wedding services industry in 2024. The growth is attributed to the increasing importance of social media in sharing personal milestones, which drives couples to seek high-quality visual documentation of their special day. In addition, the rise of professional standards and expectations among clients has led to a greater appreciation for skilled photographers and videographers who can capture unique moments creatively. The emotional value attached to wedding memories further fuels this demand, as couples desire to preserve these experiences for future generations.

Demand for decorative services are expected to grow at a CAGR of 13.0% from 2025 to 2030. This growth is driven by the increasing emphasis on creating visually appealing and personalized environments for various events, including weddings, corporate gatherings, and celebrations. The rising trend of themed events and innovative décor solutions has further fueled the market, as consumers seek unique and memorable experiences. Additionally, advancements in materials and design technologies have enabled the creation of sophisticated and elaborate decorations, contributing to the expanding appeal of decorative services.

Regional Insights

Wedding services industry in the Asia Pacific accounted for a revenue share of 41.1% of the overall wedding service market in 2024, driven by the increasing desire for customized experiences, the influence of social media, and the growing inclusivity of different traditions and ceremonies. This encourages service providers to offer a broader range of options, further driving the industry's growth. For instance, Hilton India relaunched its Wedding Diaries initiative, introducing a Wedding Ambassador who acts as a liaison between the couple and the hotel. This expert will manage all aspects of wedding planning to ensure a personalized and seamless experience. The initiative also features partnerships with celebrity chefs for customized culinary experiences and offers sustainable options through its Meet with Purpose program, allowing couples to celebrate with reduced environmental impact.

Europe Wedding Services Market Trends

Wedding services industry in Europe accounted for a revenue share of 26.2% of the overall wedding service market in 2024, increasing number of extravagant celebrations, and a growing trend of destination weddings, which collectively enhance the willingness to spend on various wedding-related services.

North America Wedding Services Market Trends

Wedding services industry in North America is expected to grow at a CAGR of 12.3% from 2025 to 2030. The demand for wedding services in the region is primarily driven by a combination of cultural significance and the desire for personalized experiences. As weddings are seen as major life milestones, couples are willing to invest significantly in creating memorable events that reflect their unique identities and values.

Wedding services industry in the U.S. is expected to grow at a CAGR of 11.9% from 2025 to 2030. The trends such as destination weddings and the influence of social media have fueled market growth in the region, encouraging couples to seek out diverse and innovative services to enhance their celebrations.

Key Wedding Services Company Insights

The wedding services market is fragmented primarily due to the presence of several globally recognized players as well as regional or local players. Some key companies in the wedding services industry include BAQAA Glamour Weddings and Events, Nordic Adventure Weddings, Augusta Cole Events, and others.

-

A Charming Fête is an event planning and design company specializing in luxury weddings and events. Based in Cleveland, Ohio, with additional offices in Miami, Florida, the company is renowned for its personalized design approach and meticulous attention to detail. Its services include full-scale event planning, design vision creation, vendor management, and on-site coordination. It has been particularly celebrated for its ability to create cohesive, visually stunning environments that leave a lasting impression on guests.

-

David Stark Design is a creative event design and production company known for its innovative and artistic approach to weddings and other celebrations. Based in New York, the company is led by David Stark, a celebrated designer and author. They specialize in creating unique, immersive experiences tailored to their clients' visions. From intimate gatherings to grand celebrations, David Stark Design is known for its ability to transform spaces into extraordinary settings.

Key Wedding Services Companies:

The following are the leading companies in the wedding services market. These companies collectively hold the largest market share and dictate industry trends.

- BAQAA Glamour Weddings and Events

- Nordic Adventure Weddings

- Augusta Cole Events

- A Charming Fête

- David Stark

- Fallon Carter

- Lindsay Landman

- JZ Events

- Colin Cowie

- Eventures Asia

Recent Developments

-

In July 2024, Wedding services startup Meragi successfully secured USD 9.1 million in Series A funding, with the investment led by Accel. The funding round is expected to help Meragi expand its offerings and enhance its platform for wedding planning services.

-

In July 2024, The Knot Worldwide, a prominent global marketplace and family of brands focused on celebrations, unveiled significant new product enhancements for The Knot and WeddingWire. These updates aim to enhance the experience for wedding professionals by optimizing lead quality, improving storefront listings, and offering deeper insights to help vendors connect with more engaged couples.

Wedding Services Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 1,012.81 billion

Revenue forecast in 2030

USD 1,842.54 billion

Growth rate (Revenue)

CAGR of 12.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, booking type, service type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia & New Zealand & South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

BAQAA Glamour Weddings and Events; Nordic Adventure Weddings; Augusta Cole Events; A Charming Fête; David Stark; Fallon Carter; Lindsay Landman; JZ Events; Colin Cowie; Eventures Asia

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wedding Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the wedding services market based on type, booking type, service type, and region:

-

Type (Revenue, USD Billion, 2018 - 2030)

-

Destination

-

Local

-

-

Booking Type (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Service Type (Revenue, USD Billion, 2018 - 2030)

-

Catering Services

-

Decoration Services

-

Transport Services

-

Videography & Photography Services

-

Wedding Planning Services

-

Other Services

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wedding services market was estimated at USD 899.64 billion in 2024 and is expected to reach USD 1,012.81 billion in 2025.

b. The global wedding services market is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2030 to reach USD 1,842.54 billion by 2030.

b. Asia Pacific dominated the wedding services market with a share of 41.14% in 2024. The regional growth is driven on account of the increasing desire for customized experiences, the influence of social media, and the growing inclusivity of different traditions and ceremonies.

b. Some of the key players operating in the wedding services market include BAQAA Glamour Weddings and Events; Nordic Adventure Weddings; Augusta Cole Events; A Charming Fête; David Stark; Fallon Carter; Lindsay Landman; JZ Events; Colin Cowie; Eventures Asia.

b. Growth of the global wedding servivces market is majorly driven on account of Couples are increasingly seeking unique experiences and themes for their special day, which boosts demand for various services, including event planning, catering, photography, and décor.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.