- Home

- »

- Medical Devices

- »

-

Weight Loss Services Market Size & Share Report, 2030GVR Report cover

![Weight Loss Services Market Size, Share & Trends Report]()

Weight Loss Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Function (Fitness Equipment, Surgical Equipment, Services), By Payment (Out-of-pocket, Government, Private), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-787-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Weight Loss Services Market Size & Trends

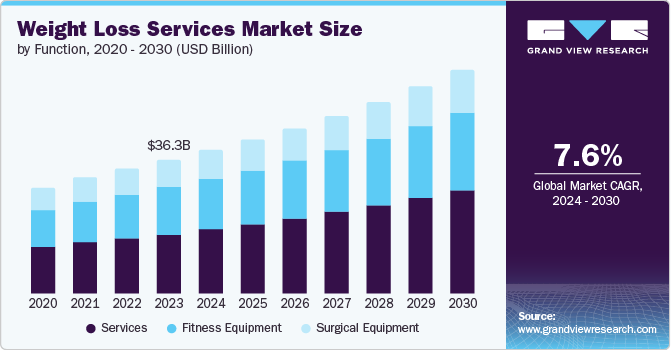

The global weight loss services market size was valued at USD 36.31 billion in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030. The weight loss services market is expected to grow with the increasing obesity index globally. The increase in the population of obese population, the rise in the adoption of online weight loss programs, and rise in the disposable income in developing countries are the main factors driving the market growth. Lack of exercise to put into use the energy stored leads to obesity as it is converted to fat. During the period of pandemic, people registered themselves to overeat, and lack of exercise led to obesity.

The global weight loss services market is a vast and diverse industry, encompassing various products and services aimed at helping individuals achieve and maintain a healthy weight. This market includes sub-segments such as fitness centers and slimming centers, which cater to the growing demand for weight management solutions. The key drivers of market growth include the increasing prevalence of obesity and related diseases, rising awareness of the importance of health and wellness, as well as the influence of media and celebrity endorsements.

The global obesity epidemic has been steadily rising over the past few decades, driven by factors such as the increasing consumption of processed foods and sedentary lifestyles. As a result, the demand for weight loss services and products has surged, with more individuals seeking effective solutions to manage their weight. Moreover, the rise in disposable income has enabled consumers to invest in recommended weight loss programs and products, further fueling market growth.

Government initiatives, healthcare institutions, and corporate wellness programs are also playing a significant role in promoting healthy lifestyles and combating obesity. These efforts are encouraging individuals to adopt healthier habits and seek out weight loss solutions. As the global obesity crisis continues to worsen, the demand for weight loss services is likely to remain strong, driving innovation and growth in the industry.

Function Insights

The services function segment dominated the global weight loss services market with a revenue share of 44.1% in 2023. Services that may be provided by slimming centers may include body shaping, detoxification, and metabolic profiles among other body-specific custom-made fat-burning programs. Fitness centers are aimed at helping people to slim down, using diets, workouts, and sometimes with the help of weight loss medications. In addition, this segment also comprises consultation services via online weight loss programs and other virtual health services whereby people get to seek advice from experts if they develop such conditions or ailments.

The fitness equipment segment is expected to register a significant growth of 7.4% in the forecast period. Our fitness equipment portfolio comprises innovative products that cater to diverse customer needs. Cardiovascular training equipment, such as treadmills, stationary bicycles, and trainers, promotes heart health, calorie burn, and muscle toning. Strength training equipment includes dumbbells, barbells, and resistance bands, designed to enhance muscle bulk, metabolic rate, and overall strength.

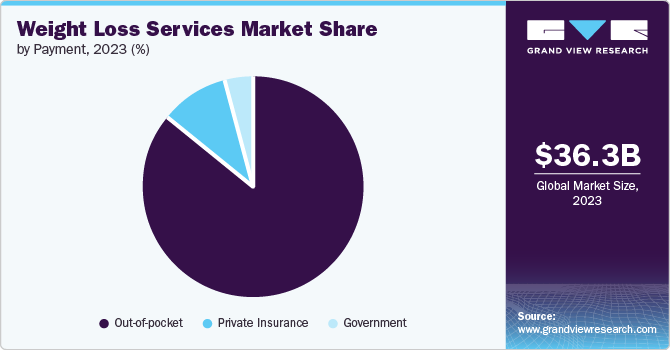

Payment Insights

Out of pocket payment segment dominated the global weight loss services market with a revenue share of 85.7% in 2023. Out-of-pocket payments provide consumers with the freedom to choose weight loss services that cater to their specific needs, unencumbered by insurance restrictions. This flexibility enables individuals to select the best programs and products for their goals, allowing for personalized solutions that are tailored to their unique needs and preferences.

The government payment segment is expected to register the fastest CAGR of 8.1% in the forecast period. As governments and health organizations promote healthier lifestyles worldwide, we're seeing an increased demand for weight loss solutions. Government-backed insurance coverage reduces the financial barrier for those without private insurance, making weight loss services more accessible and utilized. Furthermore, governments' awareness campaigns to combat rising obesity rates are driving growth in the industry.

Regional Insights

North America weight loss services market dominated the global weight loss services market with a revenue share of 35.0% in 2023. Changing consumer preferences, and technological advancement are the major factors driving the growth of the market in North America. Moreover, the availability of weight management wearable fitness devices, mobile applications, and platforms has also given people easier ways to access the products/services. It creates the technological framework that raises the expansion of weight loss services in the North America market.

U.S. Weight Loss Services Market Trends

The weight loss services market in the U.S. dominated the North America weight loss services market with a revenue share of 28.8% in 2023. Factors such as health awareness and nutritional concerns such as obesity have boosted the demand for weight management services with the support from the government agencies for healthier America have fueled the growth of the market in the U.S.

Europe Weight Loss Services Market Trends

Europe weight loss services market was identified as a lucrative region in 2023 due to the high obesity index in the region. According to the World Health Organization, approximately 60% of adults worldwide are struggling with obesity. The primary factor driving the surge in regional obesity trends is the widespread availability of high-sugar content food items, which are further fueled by the aggressive marketing tactics used by unhealthy food manufacturers. As a result, the demand for weight loss services is on the rise in Europe, driven by the growing need for individuals to manage their weight and adopt healthier lifestyles.

The weight loss services market in the UK is expected to grow rapidly in the coming years. The UK weight loss services market consists of many new products such as slimming centers, fitness centers, consulting services, slimming treatments, weight loss program products, and many others including food products, beverages, drugs, supplements, fitness, and surgical types of equipment. These diverse choices are favorable to the consumer and play a vital role in the market growth.

Germany weight loss services market held a substantial market share in 2023 owing to well-established healthcare infrastructure, regulatory environment, and quality standards. Germany is endowed with a highly developed healthcare system that employs qualified personnel and modern equipment. This facilitates the provision of competent services for weight loss hence satisfying the customer’s needs.

Asia Pacific Weight Loss Services Market Trends

Weight loss services market in Asia Pacific is expected to register the fastest growth in the forecast period with a CAGR of 8.6%. The market shifts towards the preventive & proactive approach for weight regulation due to an increase in awareness about health and diseases such as diabetes. The rise in disposable income and the increasing number of fitness clubs and healthcare programs are the reasons that have seen this market growth in this region.

China weight loss services market is expected to grow rapidly in the coming years due to a rise in disposable income, and increased awareness regarding weight loss. Consumers in China have also been influenced by Western cultures especially in matters regarding slim figures as being preferred.

Weight loss services market in India held a substantial market share in 2023 owing to the change of diet from traditional Indian foods to fast foods and sedentary lifestyles. The rise in obesity has also paved the way for more population in need of weight control and loss services. Prominent players in the market have been engaging in R&D processes to come up with new weight-control products.

Key Weight Loss Services Company Insights

Some key companies in the global weight loss services market include Atkins Nutritionals, Inc.; Precor Incorporated; Apollo Endosurgery, Inc.; Johnson Health Tech, Inc.; and others. Key players are undertaking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Precor Incorporated, a subsidiary of Peloton, delivers fitness experiences for business customers and exercisers. The company's product services cover diverse classes consisting of cardio, strength, functional fitness, and connected fitness solutions.

-

Torque Fitness is a fitness system enterprise organization with a significant level in designing and manufacturing revolutionary strength training structures. The business enterprise's award products are Life Fitness, Hammer Strength, and Parabody. The company was installed to create strength training products that provide particular attributes to meet purchaser needs in comparison to many different products in the marketplace.

Key Weight Loss Services Companies:

The following are the leading companies in the weight loss services market. These companies collectively hold the largest market share and dictate industry trends.

- Atkins Nutritionals, Inc.

- Precor Incorporated

- Apollo Endosurgery, Inc.

- Johnson Health Tech, Inc.

- WW International, Inc.

- Life Fitness, Inc.

- iFIT, Inc.

- Torque Fitness, LLC

- Core Health & Fitness, LLC

Recent Developments

-

In May 2024, WW International Inc. announced its partnership with Personify Health to support employers looking to provide weight healthcare solutions to their people. This partnership can avail customers of virtual and real-life coaching support.

-

In March 2024, Precor announced its exclusive partnership with Glutebuilder, a company producing glute training products. This partnership aims to launch new products that offer exceptional adjustability, setting a benchmark for the fitness industry.

Weight Loss Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.90 billion

Revenue forecast in 2030

USD 60.48 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, payment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; South Arabia; UAE; Kuwait

Key companies profiled

Atkins Nutritionals, Inc.; Precor Incorporated; Apollo Endosurgery, Inc.; Johnson Health Tech, Inc.; WW International, Inc.; Life Fitness, Inc.; iFIT, Inc.; Torque Fitness, LLC; Core Health & Fitness, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Weight Loss Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global weight loss services market report based on function, payment, and region.

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Fitness Equipment

-

Cardiovascular Training Equipment

-

Strength Training Equipment

-

Others

-

-

Surgical Equipment

-

Minimally Invasive Surgical Equipment

-

Noninvasive Surgical Equipment

-

-

Services

-

Fitness Centers

-

Slimming Centers

-

Consultation Services

-

Online-weight Loss Services

-

-

-

Payment Outlook (Revenue, USD Million, 2018 - 2030)

-

Out-of-pocket

-

Government

-

Private Insurance

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.