- Home

- »

- Drilling & Extraction Equipments

- »

-

West Africa Gold Mining Chemicals Market Size Report, 2030GVR Report cover

![West Africa Gold Mining Chemicals Market Size, Share & Trends Report]()

West Africa Gold Mining Chemicals Market Size, Share & Trends Analysis Report By Application (Mineral Processing, Water Treatment), By Product (Collectors, Coatings), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-054-2

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

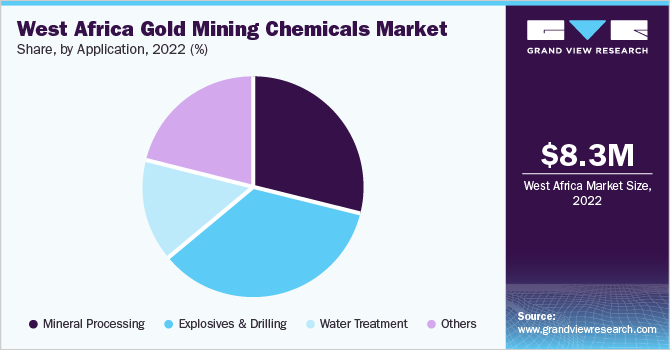

The West Africa gold mining chemicals market size was valued at USD 8.34 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. Factors such as rapid growth in gold mining and jewelry production from developing countries are expected to boost the market growth. The mining industry has been facing many challenges such as increasing demand for minerals and the presence of low-quality ore deposits, which result in a difficult mining process. Cyanide is majorly used to extract gold from its ore as this is the most economical extraction process. Mining chemicals are used to extract minerals more efficiently and effectively. Increasing demand for minerals is likely to drive the growth of the market over the forecast period.

Moreover, the depletion of non-renewable resources and the presence of limited reserves are the key challenges being faced by West African mining industry. Large-scale mining activities, along with improper waste disposal, have resulted in increased levels of impurity in water and air. The leakage of hazardous materials into the environment can also have a significant impact on human health. These factors are likely to restrain the growth of mining chemicals over the predicted period. For instance, according to Deutsche Welle (DW), in Ghana, mining activities have negative impact on the environment. The land quality has degraded, and majority of the water bodies have become muddy. Such hazardous effects of activities on the environment are expected to hamper the market growth in the forecasted period.

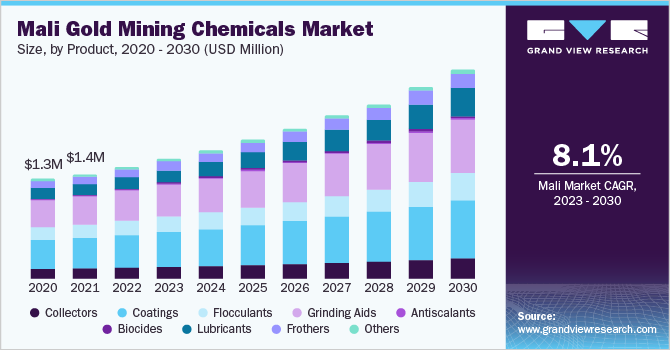

Mali is the largest consumer of the product in West Africa with a revenue share of 18.4% in 2022. This is attributed to the fact that Mali is the fourth-largest producer of gold in Africa, according to International Trade Administration (ITA). Gold mining is one of the biggest contributors to the GDP. This sector has experienced unproductive mines and other difficulties due to shut down of mines in the past years. However, its production is set to increase as new mines open, including a largest mine in Fekola.

Product Insights

Coatings product segment is expected to dominate the market with a revenue share of more than 29% in 2022. This growth is attributed to the fact that gold powder coating paints include satin, flat, candy, high gloss, and wrinkle finishes. Coatings provide durability, moisture & heat resistance, and gloss retention. They offer outstanding chemical and abrasion resistance and are commonly used in the water, wastewater, and petroleum industries. It is commonly used in electronics to impart a corrosion-resistant electrically conductive layer on gold, often in printed circuit boards and electrical connectors. Gold electroplating is used for making contacts and connectors, and hence represents a significant share in the electronics application.

The dust collector is very compact and easily portable and is an effective and economical solution for recovering gold dust. It is designed to control gold fumes effectively and preserve precious metals that are extracted along with the fumes due to high suction. Gold fumes may cause damage to the lungs of humans when inhaled and thereby it must be controlled. Collectors are used for improving the recovery and concentrated quality of ore. They are used to produce high-grade concentrations for ore pellet production and produce super-concentrated ore for advanced metallurgical applications.

The growing use of gold powder across various industries is likely to boost the growth of mining chemicals in Africa over the forecast period. Moreover, the demand for mining chemicals is expected to remain high in countries including Ghana, South Africa, Sudan, Mali, and Burkina Faso due to rising mining activities in these countries.

Application Insights

The explosives and drilling application segment is expected to dominate the market with a revenue share of 34.8% in 2022. This growth is attributed to the ongoing drilling and explosion operations used for opencast mining. Explosion/rock breakage mechanisms include penetration and fragmentation of rock. Rock penetration includes drilling, cutting, and boring, while blasting is used for fragmentation. There are several types of rock penetration depending on the form of application such as mechanical, fluid, thermal, sonic, and chemical.

Manufacturers have been striving to overcome the challenges associated with the adoption of new technologies. Advanced technologies for mineral processing require effective collaboration between the mineral processors, technology suppliers, and engineering companies. Although these advancements are likely to fuel the growth of the market over the coming years, the increasing considerable costs associated with the training of labors is expected to restrain the utilization of new technologies for mineral processing over the coming years.

Country Insights

Ghana emerged as the dominating country with a revenue share of 48.3% in 2022. This growth is attributed to the fact that Ghana is one of the top gold producers in the world. In addition, it is the largest gold producer in the West African region. Furthermore, according to AllAfrica publication, the output in Ghana is expected to increase in the coming year. Though Ghana lost its position as the top producer of gold in Africa because of a sharp decline of approximately 29% in the gold production in 2021, the future of production in Ghana is anticipated to witness a positive growth, according to Ghana Chamber of Mines

In addition, according to H2G consultancy, Ivory Coast, being one of the fastest growing economies, attracts numerous foreign investments, especially in the mining industry. In 2021, it raised total investments of 762 thousand euros (USD 811.34 Thousand) for the same. Furthermore, the government of Ivory Coast has laid down plans to consolidate and promote mining activities with a main focus on gold production of 65 tons by 2025.

Key Companies & Market Share Insights

The West Africa gold mining chemicals market is competitive with the presence of a large number of independent small-scale and large-scale manufacturers and suppliers. While large-scale companies concentrate on mergers, expansions and product development, small-scale players primarily compete based on price.

BASF SE, Clariant AG, Dow, Kemira, Sasol, Ashland, Shell Chemicals, and Arkema are some of the established players in the market. The market is highly fragmented owing to the presence of numerous manufacturers of West Africa gold mining chemicals. Some of the prominent players in West Africa gold mining chemicals include:

-

AECI Mining Chemicals

-

Arkema

-

Akzo Nobel N.V.

-

Ashland

-

BASF SE

-

Clariant

-

Cytec Solvay Group

-

Dow

-

Kemira

-

Kimleigh Chemicals SA (Pty) Ltd.

-

Nowata

-

Quaker Chemical Corporation

-

Sasol

-

Shell Chemicals

-

Solenis

West Africa Gold Mining Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.86 million

Revenue forecast in 2030

USD 14.6 million

Growth rate

CAGR of 7.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Regional Scope

West Africa

Country Scope

Burkina Faso; Ivory Coast; Mali; Niger; Ghana

Key companies profiled

AkzoNobel N.V.; Ltd.; BASF SE; Arkema; AECI Mining Chemicals; Ashland; Clariant; Cytec Solvay Group; Dow; Kemira; Kimleigh Chemicals SA (Pty) Ltd.; Nowata; Quaker Chemical Corporation; Sasol; Shell Chemicals; Solenis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

West Africa Gold Mining Chemicals Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the West Africa gold mining chemicals market report based on product, application and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral Processing

-

Explosives And Drilling

-

Water Treatment

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Burkina Faso

-

Ivory Coast

-

Mali

-

Niger

-

Ghana

-

Frequently Asked Questions About This Report

b. The West Africa gold mining chemicals market size was estimated at USD 8.34 million in 2022 and is expected to reach USD 8.86 million in 2023.

b. The West Africa gold mining chemicals market is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 14.6 million by 2030.

b. Ghana dominated the West Africa gold mining chemicals market with a share of more than 46% in 2022. This is attributable to increasing gold production in the region.

b. Some key players operating in the West Africa gold mining chemicals market includeAECI Mining Chemicals, Arkema, Akzo Nobel N.V., Ashland, BASF SE, Clariant, Cytec Solvay Group, Dow, Kemira, Kimleigh Chemicals SA (Pty) Ltd., Nowata, Quaker Chemical Corporation, Sasol, Shell Chemicals, Solenis.

b. Key factors that are driving the market growth include increased demand for gold from various applications, especially jewellery production from developing countries. With presence of large gold mining companies in the region such as Ahafo Gold Mine, Fekola Gold Mine, Syama Gold Mine and others, the region has stronghold in the global market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."