- Home

- »

- Drilling & Extraction Equipments

- »

-

Mining Chemicals Market Size, Share & Growth Report, 2030GVR Report cover

![Mining Chemicals Market Size, Share & Trends Report]()

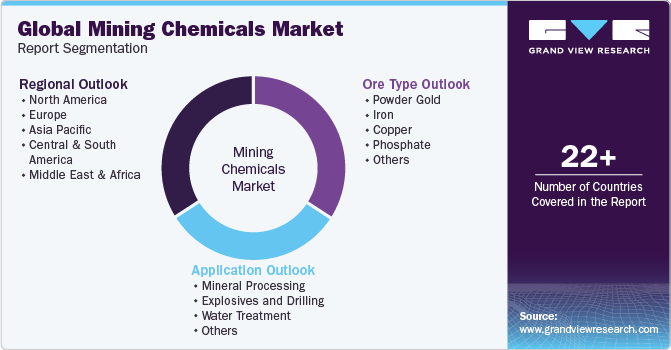

Mining Chemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Ore Type (Powder Gold, Iron, Copper), By Application (Mineral Processing, Explosives & Drilling), By Region, And Segment Forecasts

- Report ID: 978-1-68038-329-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mining Chemicals Market Summary

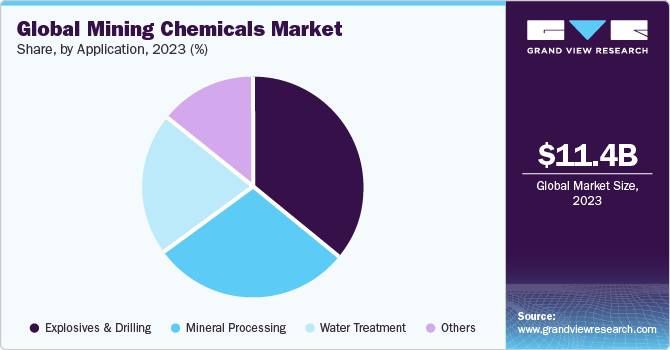

The global mining chemicals market size was estimated at USD 11.44 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. This growth is attributable to a growing demand for minerals in various end-user industries such as electronics, medical equipment, paints & coating, and others.

Key Market Trends & Insights

- North America dominated the global mining chemicals market with the largest revenue share in 2023.

- The mining chemicals market in the U.S. led the North America market and held the largest revenue share in 2023.

- By ore type, the iron segment led the market, holding the largest revenue share of 18.9% in 2023.

- By application, the explosives and drilling segment held the dominant position in the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.44 Billion

- 2030 Projected Market Size: USD 17.54 Billion

- CAGR (2024-2030): 6.4%

- North America: Largest market in 2023

According to a World Bank article published in March 2020, the production of minerals such as graphite, cobalt, and lithium will grow by 500% by 2050 due to the growing demand for clean energy technologies. Thus, increasing demand for minerals boosts the demand for mining chemicals in the market.

The demand for the product in North America is primarily driven by the increasing mining operations and mineral production in the U.S. and Canada. The coal industry is the key end-user of the product as it is highly reliable on coal for generating electricity. In the U.S., over 19.3% of electricity was generated from coal in 2020, as per the data by the U.S. Energy Information Administration.

In the coming years, digital mines are likely to utilize evolving digital technologies such as the Industrial Internet of Things (IIoT). For instance, purposively placed sensors that are connected to the internet can be used for the collection of data from mines in real time. They help in improving the efficiency of operations, reduce costs, and enhance safety. They also help in eliminating injuries and fatalities caused by high-energy environments. These factors are expected to create new opportunities for the mining industry over the forecast period.

Mining chemicals are manufactured using raw materials such as nitric acid, mercury, sulfuric acid, cyanide, lead, and uranium. These chemicals are highly harmful and toxic to humans and the environment. As a result, they are regulated by several regulations, including the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), the Industrial Chemicals Act, and the OSPAR Convention.

Market Concentration & Characteristics

Companies such as BASF SE, Ashland Inc., AECI, and Dow dominate the market due to their global presence and extensive product portfolio catering to each application market. The market is highly competitive due to the presence of multinationals that are engaged in constant expansion and research & development activities. In January 2023, BASF SE and Eramet announced an agreement worth USD 2.6 billion to establish a facility in Indonesia for processing nickel, specifically for use in electric vehicle (EV) batteries.

Companies such as BASF SE, Clariant AG, and Ashland Inc. have very diverse product portfolios. These companies have well-established brands, such as Rheomax, Derakane, and FLOTIGAM 5806, which have a prominent presence in the market. A majority of the players are integrated across the value chain to gain a competitive edge in the market. For instance, Clariant AG manufactures iron and copper ores for various end-use industries such as agriculture & animal feed, automotive & transportation, coatings, building & construction, paints, inks, and consumer goods.

Key players in the industry are focused on increasing the production of their core product portfolios, including high-quality mining chemicals, to gain significant market shares. The discovery of new chemicals and technological advancements have led to the development of eco-friendly products, which are used in green manufacturing processes of production. Arkema, SNF Flomin, and ArrMaz are some of the players in the market that offer raw materials for the production of such products.

Ore Type Insights

Iron ore type dominated the market and accounted for a share of 18.9% in 2023. Its high share is attributable to the increasing demand for products with fewer impurities from the steel industry. The propelling demand for iron ore in various industries, including petroleum and wastewater are expected to drive the market growth.

The demand for iron ore is witnessing a rise globally. However, with decreasing reserves of high-grade iron ore, froth floatation is extensively used as a process intermediate. Froth floatation is used to remove the impurities from iron ore. Flotation of iron ore is done through two methods, namely direct floatation of iron oxides and reverse floatation of gangue minerals with depression of iron oxides. Reverse floatation is the most widely used method in iron route floatation.

Phosphate is another major ore segment after iron, accounting for a high share owing to augmenting demand from cement industries worldwide coupled with growing phosphate mining activities in major economies, including China, the U.S., Indonesia, Australia, and others.

Other products include carbonate oxides, sulfide, zinc, and aluminum. Depressants are used in zinc ore to increase the efficiency of the flotation process by inhibiting the interaction of the metal with the collector. Zinc is used in coatings to improve corrosion protection against white rust. The function of depressants is to prevent the flotation of the desired mineral from being floated. Thus, the rising application of the aforementioned ores in wastewater treatment activities is expected to positively impact the market growth.

Application Insights

Explosives and drilling applications segment dominated the market, with a revenue share of 35.6% in 2023. This high share is attributable to the growing demand for minerals and metals. Rising mineral mining activities in the major economies are expected to drive the segment's growth.

According to the World Bank report, the growing role of metals and minerals in a low-carbon future and green energy technologies necessary for achieving environmental sustainability are likely to fuel the demand for minerals and metals, including zinc, aluminum, copper, lead, lithium, steel, silver, manganese, nickel, neodymium, silver, indium, and molybdenum.

Growing demand for major commodities, including iron ore and copper, is driving the growth of the mineral processing market globally. The mining industry has witnessed a growth in the demand for technologies for processing complex minerals.

Furthermore, the major issues faced by mining companies include resource management, regulations regarding the water usage, and challenges associated to reduce environmental impact. For instance, water & wastewater treatment is crucial to abide by the regulations regarding the use of water and reduce environmental impact.

Water treatment systems are used in several mineral processing plants, such as gold, copper, and others. The water treatment help minimizing corrosion and equipment blockages, improves water quality and flow, reduces scaling, and lowers chemical costs and dosages. The demand for water treatment in the mining industry is witnessing considerable growth owing to rising concerns regarding the release of pollutants to natural water sources and the highly acidic nature of mining water.

Regional Insights

The North America mining chemicals market is growing significantly owing to the increasing mining activities in the region. High production of minerals to meet the growing demand is likely to fuel the utilization of mining chemicals. Moreover, increase in the prices of commodities such as iron, gold, and copper, favorable government norms, and the availability of vast reserves in the region are expected to propel the demand for mining chemicals.

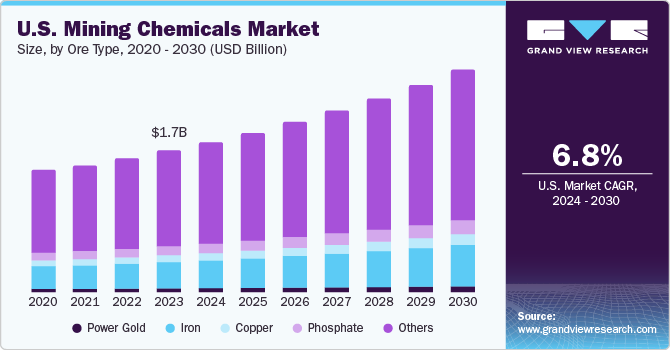

U.S. Mining Chemicals Market Trends

The demand for mining chemicals in U.S. is primarily driven by the increasing mining operations and mineral production in the country. According to the U.S. Geological Survey and U.S. Census Bureau, the U.S. accounted for 3.07 million pounds per capita consumption of minerals in 2023. The coal industry is the key end-user of mining chemicals on account of the heavy reliance on coal for generating electricity. In the U.S., over 19.3% of electricity was generated from coal in 2020, as per the data by the U.S. Energy Information Administration.

Europe Mining Chemicals Market Trends

Europe mining chemicals market is mature, technologically advanced, and innovative. The region has abundant mineral resources and therefore, mineral extraction plays a vital part in the economy. Increasing consumption of metals and minerals in Europe is anticipated to drive the demand for mining chemicals over the forecast period. However, rigid environmental regulations concerning CO2 emissions, particularly from the coal industry, are anticipated to restrain the market growth over the coming years.

Russia mining chemicals market is growing due to increased new mining activities. The demand for flocculants for gold ore is expected to increase owing to the declining freshwater resources. Furthermore, the Russian government has advised industries to reduce the emission of toxic chemicals by treating wastewater using flocculants. This is expected to drive the demand for flocculants in the coming years.

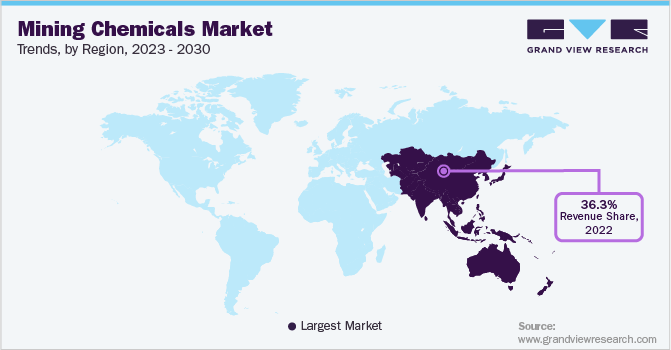

Asia Pacific Mining Chemicals Market Trends

Asia Pacific region dominated the market with a revenue share of 36.5% in 2023. This high share is attributed to growing mineral processing activities in countries including India, China, and others which are projected to promote the utilization of the product in the region over the forecast period. Additionally, China accounts for the largest market share in Asia Pacific as China is the largest producer of coal, gold, and other earth minerals. China has a large number of mines, which are going through improvements such as setting up new sewage treatment plants and the development of sewage and wastewater treatment plants.

Increasing foreign investments in emerging countries of Asia Pacific, including India and China, have contributed to the growth of the mining chemicals industry in the region. India has an abundance of natural reserves of coal, titanium, diamond, bauxite, and limestone.

India mining chemicals market is the second-largest producer of coal and the fourth-largest producer of iron ore globally. Significant mining activities in the country are expected to promote the utilization of mining chemicals over the forecast period. In addition, liberalized FDI policies to promote investment in India are anticipated to boost mining sector, thereby, positively influencing the mining chemicals market. Increasing drilling & extraction activities on account of high concentration of rare earth metals in India is expected to drive the demand for mining chemicals over the coming years.

Mining chemicals market in China in 2023, accounts for the largest share in the mining globally. In terms of Asia Pacific regional production, China is the largest producer of coal, gold, and other earth minerals. China has numerous mines, which are undergoing improvements such as the development of existing sewage and wastewater treatment plants as well as setting up new sewage treatment plants. Mining chemicals are extensively utilized in mining operations such as mineral processing and wastewater treatment, which is expected to propel the market growth in the region over the coming years.

Central & South America Mining Chemicals Market Trends

The demand for mining chemicals in Central & South America is majorly driven by an increase in mining and mineral processing activities in countries such as Brazil, Colombia, Argentina, and Chile. The region majorly produces iron ore, copper, and ubiquitous gold. The expanding mining industry can be attributed to the large-scale foreign investments by private companies for exploration activities across the region. As of 2023, Brazil and Argentina are among the top mineral-producing countries in the region, and Argentina was the third-largest lithium producer in the world.

The mining chemical market in Brazil is among the largest producers of manganese, iron ore, tin, and bauxite globally. Rising government initiatives to develop new opportunities in emerging countries due to increasing budgets for mining and exploration activities are expected to fuel the growth of the mining chemicals market in CSA.

Middle East & Africa Mining Chemicals Market Trends

The demand for mining chemicals in the Middle East & Africa is primarily driven by the growing mining operations such as exploration, extraction, and mineral processing in the region. Africa accounts for 30% of the global mineral reserves. The region has large deposits of crude oil and increasing oil extraction activities are likely to drive the demand for mining chemicals in explosives & drilling applications. Many countries in the Middle East and Africa have introduced new laws to encourage investments in the mining sector.

Saudi Arabia mining chemical market is focused on enhancing their mining sectors amid the political and economic challenges such as high unemployment, poor quality of education, and high military spending. The government of Saudi Arabia has revamped its mining laws to draw the attention of domestic and international investors. The production of copper, aluminum, gold, steel, iron, zinc, and tin in the country is anticipated to increase over the forecast period, which, in turn, is expected to fuel the demand for mining chemicals in the market.

Key Mining Chemicals Company Insights

Some of the key players operating in the market include BASF SE, Ashland, Dow, Cytec Solvay Group, and Clariant, among others.

-

BASF SE is a German chemical production company with 13 operating divisions and about 84 sub-business units across the globe. The company operates through five business segments, namely performance products, chemicals, agricultural solutions, functional materials & solutions, and oil & gas. The product portfolio of the functional materials & solutions segment includes construction chemicals, coatings, performance materials, and catalysts.

-

Ashland is engaged in the manufacturing of specialty chemicals. The company has several divisions, namely food & beverage, chemical intermediates & solvents, composites, personal & home care, industrial specialties, pharmaceuticals, and agriculture. It operates through three reportable segments, namely specialty ingredients, performance materials, and valvoline. Valvoline segment includes premium-branded automotive, commercial, and industrial lubricants and automotive chemicals. Major products offered through the specialty ingredients segment include cellulose ethers, vinyl pyrrolidones, and biofunctionals. Performance materials segment is composed of two divisions including composites and intermediates & solvents.

Shell Chemicals., Solenis., AECI Ltd are some of the emerging market participants in the mining chemicals market.

-

AECI Ltd (AECI) is a diversified group with regional and international businesses in Africa, Europe, Southeast Asia, North America, South America, and Australia. The company is headquartered in Sandton, South Africa, and operates major manufacturing sites in Johannesburg and Durban, South Africa. AECI specializes in explosives and specialty chemicals, developing and manufacturing a wide range of products including commercial explosives, initiating systems, chemical raw materials, resins, agricultural chemicals, and more. Its products and services find application in various markets such as mining, water treatment, plant and animal health, food and beverage, infrastructure, and manufacturing sectors in both domestic and international markets.

-

Shell chemicals is one of the key petrochemical manufacturing companies in the world. The company caters to key industries including aviation, chemicals, commercial fuels, polymers, catalysts, industrial lubricants & oil, marine, and liquefied petroleum gas. Shell chemicals offers dust suppressants throughout the globe using different distribution channels including e-commerce, and third-party distributor. The company has its operations in over 70 countries across the world including Europe, the U.S., and Asia Pacific.

Key Mining Chemicals Companies:

The following are the leading companies in the mining chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- AECI Mining Chemicals

- BASF SE

- Ashland

- Dow

- Kimleigh Chemicals SA (Pty) Ltd

- Cytec Solvay Group

- Arkema

- Clariant

- Nowata

- Kemira

- Shell Chemicals

- Quaker Chemical Corporation

- Akzo Nobel N.V.

- Solenis

- Sasol

Recent Developments

-

In March 2023, Clariant, a Swiss multinational specialty chemicals company, has announce to expand its production of mining chemicals in Indonesia. It aims to Clariant's broader focus on the Natural Resources sector, which includes providing innovative and sustainable solutions for customers in various industries.

-

In November 2023, AECI, a South Africa-based company, has set goals to solidify its position as a top three integrated mining explosives and chemicals solutions provider by 2030.

-

In November 2023, Brazil's natural resources projects have invested worth over USD 50.4 billion in mining over the next decade. This influx of investments is expected to create new demand for caustic soda in the medium term, as the mining sector expands in the country.

Mining Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.08 billion

Revenue forecast in 2030

USD 17.54 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ore type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Russia; Italy; China; India; Japan; South Korea; Argentina; Peru; Chile; Columbia; Saudi Arabia; Africa; South Africa; Ghana; Morocco; DRC; Zambia; Zimbabwe; Tanzania; Mali; Ivory Coast; Sudan

Key companies profiled

AECI Mining Chemicals; BASF SE; Ashland; Dow; Kimleigh Chemicals SA (Pty) Ltd (PTY) LTD; Cytec Solvay Group; Arkema; Clariant; Nowata; Kemira; Shell Chemicals; Quaker Chemical Corporation; Akzo Nobel N.V.; Solenis; Sasol

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mining Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mining chemicals market report based on ore type, application, and region.

-

Ore Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder Gold

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Iron

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Copper

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Phosphate

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Others

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral Processing

-

Explosives and Drilling

-

Water Treatment

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Peru

-

Chile

-

Columbia

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Ghana

-

Morocco

-

DRC

-

Zambia

-

Zimbabwe

-

Tanzania

-

Mali

-

Ivory Coast

-

Sudan

-

-

Frequently Asked Questions About This Report

b. The global mining chemicals market size was estimated at USD 11.44 billion in 2023 and is expected to reach USD 12.08 billion in 2024.

b. The global mining chemicals market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 17.54 billion by 2030.

b. Asia Pacific dominated the mining chemicals market with a share of 36.3% in 2023. This is attributable to rising mineral processing and explosives & drilling sectors in the region.

b. Some key players operating in the mining chemicals market include Ashland Inc.; The Dow Chemical Company; Chevron Phillips Chemical Company LP; BASF SE; and ExxonMobil.

b. Key factors that are driving the mining chemicals market growth include increasing mining activities, rising emphasis on water & wastewater treatment, and increasing focus on the recovery of high-quality minerals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.