- Home

- »

- Renewable Energy

- »

-

West Africa Solar PV Panel Market Size, Share, Report 2030GVR Report cover

![West Africa Solar PV Panel Market Size, Share & Trends Report]()

West Africa Solar PV Panel Market Size, Share & Trends Analysis Report By Technology (Thin film, Crystalline Silicon), By Grid (On-grid, Off-grid), By Application (Residential, Industrial, Commercial), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-961-6

- Number of Report Pages: 198

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

West Africa Solar PV Panel Market Trends

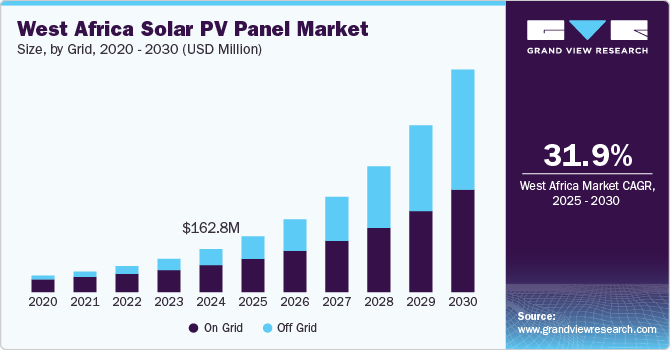

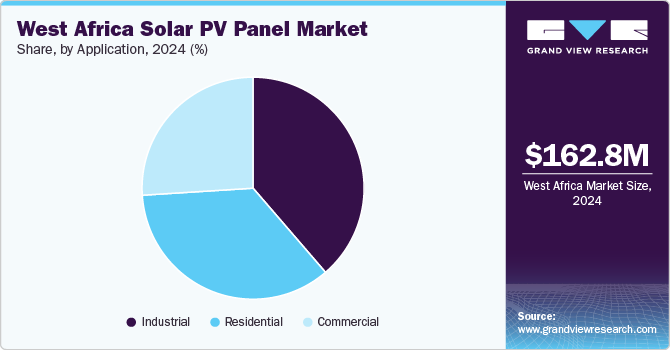

The West Africa solar PV panel market size was estimated at USD 162.84 million in 2024 and is projected to grow at a CAGR of 31.9% from 2025 to 2030. West Africa possesses some of the highest solar irradiance levels globally, with sunlight available throughout the year. This natural abundance makes solar energy a particularly suitable and dependable energy source for the region. By harnessing this resource, countries can increase energy availability without the variability often associated with hydropower or fossil fuel-based generation. As the population in West Africa grows and urbanization accelerates, energy demand has surged across residential, industrial, and commercial sectors. This increased demand puts pressure on existing infrastructure, much of which is insufficient to meet current needs. Solar PV presents an efficient, decentralized solution, alleviating stress on the grid while meeting rising electricity requirements.

Many West African countries rely on imported fossil fuels, which exposes them to global market fluctuations and geopolitical risks. By investing in solar PV, nations can diversify their energy mix, decrease dependence on imported fuels, and enhance energy security. Solar energy thus reduces vulnerability to price volatility and foreign exchange pressures, improving national resilience.In West Africa, a substantial portion of the rural population lacks access to reliable electricity. Governments and international organizations are therefore prioritizing rural electrification, with solar PV being a cornerstone of these initiatives. Solar mini-grids and off-grid solutions can bring affordable electricity to remote communities, promoting economic growth and improving living standards.

Many governments in West Africa have introduced policies, incentives, and tax breaks aimed at accelerating renewable energy deployment. National energy plans increasingly prioritize solar PV development, while regional frameworks such as the Economic Community of West African States (ECOWAS) Renewable Energy Policy reinforce these efforts. Such regulatory support creates a favorable environment for investment in solar energy projects.As part of the global commitment to mitigating climate change, West African nations are under pressure to reduce greenhouse gas emissions. Solar PV represents a clean energy solution that aligns with both national and international climate objectives. Integrating solar power into the energy mix can significantly lower emissions, helping countries achieve their climate action targets as stipulated in the Paris Agreement.

Technology Insights

Based on technology, the thin film segment led the market with the largest revenue share of 51.44% in 2024. Thin-film panels demonstrate higher efficiency under low-light conditions, such as cloudy days or partial shading, which can be common in parts of West Africa. This adaptability allows thin-film technology to continue generating electricity even when sunlight conditions are not optimal, enhancing energy reliability in diverse weather patterns. The manufacturing process for thin-film solar cells is often less resource-intensive and more scalable than for crystalline silicon cells, which translates to lower production costs. Thin-film PV offers a more economical solution for large-scale deployments in West Africa, making solar installations feasible in areas where budget constraints might otherwise limit investment in renewables.

The crystalline silicon segment is expected to grow at a significant CAGR of 32.1% over the forecast period. Manufacturing advancements have steadily reduced the costs of crystalline silicon panels. This affordability is critical in West Africa, where budget constraints are often a concern. The declining cost per watt of c-Si technology makes solar projects more economically feasible and boosts the region’s capacity to adopt renewable energy on a larger scale. The high efficiency and stability of crystalline silicon technology make it ideal for integration into grid-based systems, which West African governments increasingly prioritize. Crystalline silicon’s compatibility with utility-scale installations enables a steady supply of electricity, essential for grid-connected solar farms in urban areas.

Grid Insights

Based on grid type, the on grid segment led the market with the largest revenue share of 63.16% in 2024.Rapid urbanization in West African countries has led to an increased demand for reliable electricity, particularly in major cities and industrial zones. On-grid solar PV installations provide a scalable solution to meet these growing electricity needs without straining conventional fossil fuel plants, aligning with the industrial and commercial sector’s energy requirements.

The off grid segment is expected to grow at the fastest CAGR of 40.0% over the forecast period. Off-grid solar PV systems enable communities to achieve energy independence, reducing reliance on national grids and fuel imports. This independence enhances local energy security and makes communities more resilient to grid outages or fluctuations in fuel prices. Small businesses and agricultural enterprises in rural areas require consistent and reliable power to operate machinery, irrigation systems, and refrigeration units. Off-grid solar PV systems provide dependable power that supports local economic activities, boosts productivity, and improves the livelihoods of rural populations.

Application Insights

Based on application, the industrial segment led the market with the largest revenue share of 38.57% in 2024. Many industries are embracing sustainability targets, both to comply with international standards and to enhance their market reputation. Solar PV adoption aligns with corporate environmental, social, and governance (ESG) goals, enabling industries to reduce their carbon footprint. Sectors like mining, manufacturing, and agriculture, which are energy-intensive, are expanding in West Africa due to economic growth and rising local demand. Solar PV systems offer a scalable energy solution that can meet the high energy requirements of these industries while reducing their environmental impact, enabling them to grow sustainably.

The residential segment is expected to grow at fastest CAGR of 33.5% over the forecast period. Rising electricity costs across the region make solar PV an attractive option for households looking to reduce monthly energy expenses. By installing solar panels, homeowners can significantly lower their electricity bills over time, benefiting from the long-term savings associated with self-generated solar power. Technological progress has improved solar panel efficiency and storage solutions, making it easier for residential users to generate and store solar power for use during nighttime or cloudy days. Better energy storage options ensure continuous electricity supply, addressing previous limitations and making solar more practical for household use.

Country Insights

Nigeria Solar PV Panel Market Trends

The Nigeria solar PV panel market accounted for the largest revenue share of 6.24% in 2024. Nigeria is the most populous country in Africa, with a rapidly growing population that drives significant demand for electricity. This growth is accompanied by increased urbanization, which puts additional pressure on the country’s power supply. Solar PV offers a scalable solution to bridge the energy gap, providing access to affordable, clean electricity. Nigeria’s grid faces chronic reliability issues, with frequent blackouts affecting residential, commercial, and industrial sectors. Solar PV systems, especially when coupled with storage solutions, can provide a stable and independent power source, helping to mitigate the impact of grid failures on daily operations and productivity.

A substantial portion of Nigeria’s population lives in rural areas without access to reliable electricity. The government’s Rural Electrification Agency (REA) actively promotes solar solutions to reach underserved rural communities. Solar PV is a key part of Nigeria’s rural electrification strategy, particularly through mini-grids and standalone solar systems that provide affordable, decentralized power. The Nigerian government has introduced various policies and incentives to encourage renewable energy development, including solar PV. Programs such as the Nigeria Electrification Project (NEP), which receives support from the World Bank, provide funding and infrastructure support for solar initiatives. This regulatory and financial backing makes Nigeria an attractive market for solar investments.

Key West Africa Solar PV Panel Company Insights

Some of the key players operating in the market include SunPower Corporation, Canadian Solar, Trina Solar

-

SunPower Corporation is a solar technology company, specializing in the design and manufacturing of high-efficiency solar panels. The company's product offerings include a range of solar panels suitable for residential, commercial, and utility-scale applications, featuring advanced technologies that enhance energy conversion and system performance. In addition to solar panels, SunPower also provides services related to system design, installation, and energy management, contributing to the deployment of solar photovoltaic solutions in various markets, including West Africa.

-

Canadian Solar Inc. is a global provider of solar photovoltaic (PV) modules and smart energy solutions, recognized for its commitment to sustainable energy and innovation. In the West Africa solar PV panels market, Canadian Solar offers a diverse range of products, including monocrystalline and polycrystalline solar panels, solar inverters, and energy storage systems. Their solutions cater to residential, commercial, and utility-scale applications, providing reliable and efficient energy generation while contributing to the region's transition towards renewable energy sources.

Key West Africa Solar PV Panel Companies:

- SunPower Corporation

- Canadian Solar

- Trina Solar

- First Solar

- Jinko Solar

- JA Solar Technology Co., Ltd.

- Hanergy Holding Group Ltd.

- HIANS Energy Solutions Ltd.

- ARTsolar (Pty) Ltd.

- Sunhive

West Africa Solar PV Panel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 211.32 million

Revenue forecast in 2030

USD 844.27 million

Growth rate

CAGR of 31.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, grid, application, country

Regional Scope

West Africa

Country scope

Nigeria

Key companies profiled

SunPower Corporation; Canadian Solar; Trina Solar; First Solar; Jinko Solar; JA Solar Technology Co., Ltd.; Hanergy Holding Group Ltd.; HIANS Energy Solutions Ltd.; ARTsolar (Pty) Ltd.; Sunhive

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

West Africa Solar PV Panel Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the West Africa solar PV panel market report based on the technology, grid, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Thin film

-

Crystalline Silicon

-

Others

-

-

Grid Outlook (Revenue, USD Million, 2018 - 2030)

-

On-grid

-

Off-grid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

West Africa

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The West Africa solar PV panel market size was estimated at USD 162.84 million in 2024 and is expected to reach USD 211.32 million in 2025.

b. The West Africa solar PV panel market is expected to witness a compound annual growth rate of 31.9% from 2025 to 2030 to reach USD 844.27 million by 2030.

b. The thin film was the largest technology segment accounting for about 49.0% of the total revenue in 2024 owing to its narrow design, durability, and flexible & lightweight materials.

b. Some of the major solar PV players include SunPower Corporation, Hanergy Solar, Trina Solar, and ARTsolar (Pty) Ltd.

b. Key factors driving the growth of the West Africa solar PV panel market include the increasing demand for photovoltaic cells and favorable policies and regulations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."