Western U.S. Flat Steel Market Trends

The Western U.S. flat steel market size was valued at USD 33.82 billion in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2030. The rising construction activities in the region are driving market growth. According to the U.S. Census Bureau, the country's economy significantly benefits from its construction industry, which carries out construction activities close to USD 1.4 trillion annually. Furthermore, the construction industry accounted for approximately 4% of the U.S. GDP in 2021. The industry has been thriving in the Western U.S. due to the ongoing economic developments and rising infrastructure projects.

The steel industry in the western U.S. is increasingly focused on decarbonization, with Electric Arc Furnace (EAF) technology emerging as a pivotal solution. This method significantly lowers carbon emissions compared to traditional blast furnaces. Innovations such as hydrogen-fueled production and renewable energy-powered EAF plants are set to redefine market dynamics. The automotive sector is crucial in driving demand for flat steel, as manufacturers seek materials that meet stringent environmental standards while ensuring vehicle safety and comfort.

In addition, the primary drivers for the growth of the construction industry in the U.S. are the increasing population, ongoing urbanization, and accelerated nuclear family growth. The rising popularity of multiple-home ownerships and the growing number of home renovation and redevelopment projects contribute to the growth of the construction industry in the region and, thus, benefit demand for flat steel. Furthermore, the ongoing automotive manufacturing and upcoming developments in the Western U.S. are expected to be potential growth generators for flat steel manufacturers in the region, owing to the presence of companies such as Rivian Automotive and Tesla, Inc.

Moreover, the fluctuations in the steel market act as restraints for market growth. The product has experienced daily price swings in the U.S. and fluctuations in the costs of raw materials such as iron, coal, and scrap. The impact of demand and supply dynamics leads to extreme volatility in the prices of raw materials, which, thus, affects the production and supply of flat steel.

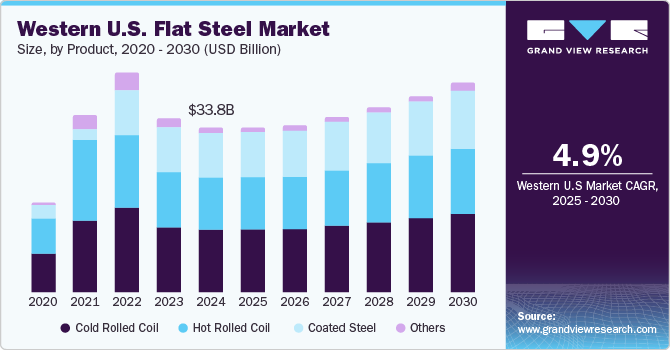

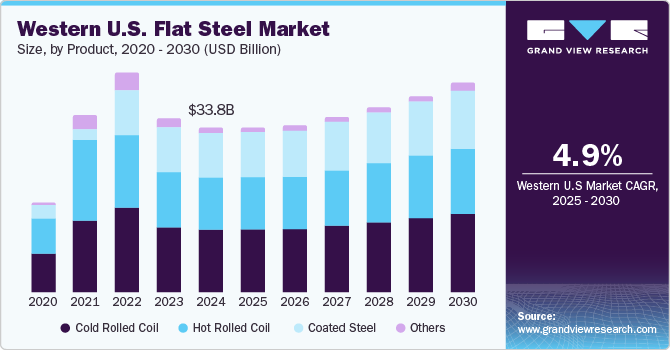

Product Insights

Cold rolled coil (CRC) held the largest revenue share of 37.3% in 2024. These coils have low carbon content. In addition, compared to the hot rolled coil, steel produced by this technique has a wider variety of surface finishes and is superior in terms of tolerance, concentricity, and straightness. Furthermore, projects requiring extreme precision are best served by cold rolled. The CRC coil has significant demand due to its smooth surface finish and better corrosion resistance.

The coated steel segment is expected to grow at a CAGR of 5.4% over the forecast period, owing to a strong commitment to sustainable construction practices and innovative architectural designs. In addition, the region's focus on green building initiatives promotes the use of coated steel due to its energy efficiency and recyclability. Furthermore, rapid urbanization and population growth in cities such as San Francisco and Los Angeles fuel demand for residential and commercial projects incorporating coated steel.

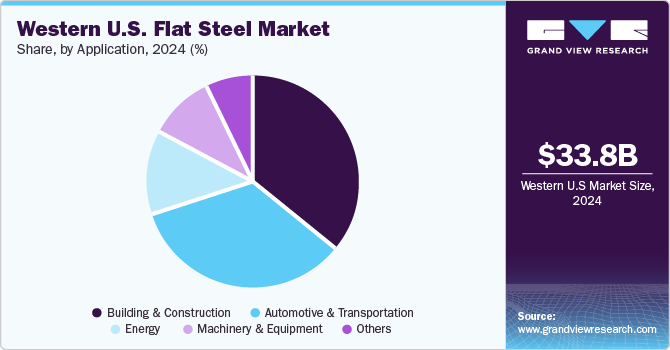

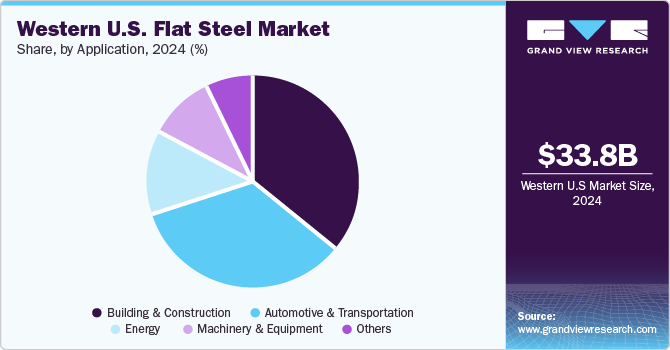

Application Insights

The building & construction dominated the western U.S. flat steel industry with the highest revenue share of 36.3% in 2024, primarily driven by the increasing urbanization and population growth creating a higher demand for residential and commercial structures. In addition, ongoing infrastructure projects and government investments in construction further stimulate this demand. Furthermore, the emphasis on sustainable building practices encourages the use of flat steel due to its durability and recyclability. Moreover, trends toward energy-efficient designs and modern architectural solutions are enhancing the appeal of flat steel in construction applications.

The automotive and transportation segment is expected to register the fastest CAGR of 5.0% from 2025 to 2030, owing to rising economic growth, improving transportation, and major investments by state governments in the EV industry propelling segment growth. For instance, California discounts consumers for compact plug-in hybrid electric vehicles (PHEVs) and zero-emission vehicles (ZEVs). Families with low incomes are also entitled to an additional discount of USD 2,000 in California.

Key Western U.S. Flat Steel Company Insights

Major companies in the western U.S. flat steel industry include Rolled Steel Products Corporation, Steel Dynamics, Steelco USA, and others. The market is fragmented, with established producers and smaller-scale service centers. Partners, collaborations, acquisitions, mergers, and agreements are some strategies leading manufacturers use to succeed. Furthermore, investing in sustainable practices and innovative manufacturing technologies is a focus, enabling firms to meet evolving customer demands while addressing environmental concerns.

-

Commercial Metals Company (CMC) manufactures long steel products, including rebar, angles, channels, flats, and rounds, utilizing advanced Electric Arc Furnace technology. Operating within the Americas Mills segment, the company serves diverse industries by providing high-quality steel solutions for construction and infrastructure needs. Their extensive product range and commitment to innovation position them as a key supplier in the flat steel sector.

-

Phoenix Steel Service, Inc. specializes in manufacturing flat rolled steel, including sheets and coils, tailored for various applications in construction and manufacturing. Operating primarily within the building and construction segment, the company provides high-quality materials that meet industry standards.

Key Western U.S. Flat Steel Companies:

- California Steel Industries

- Commercial Metals Company

- Phoenix Steel Service, Inc.

- Rolled Steel Products Corporation

- Steel Dynamics

- Steelco USA

- United States Steel Corporation

Recent Development

-

In May 2023, United States Steel Corporation has successfully closed a USD 240 million financing deal through Arkansas Development Finance Authority, issuing green bonds to support its new flat rolled steelmaking facility, Big River 2. This advanced facility, currently under construction near Osceola, Arkansas, is expected to recycle and process scrap steel into finished products. With a focus on sustainability, Big River 2 aims to operate with significantly reduced greenhouse gas emissions compared to traditional methods.

Western U.S. Flat Steel Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 33.83 billion

|

|

Revenue forecast in 2030

|

USD 43.03 billion

|

|

Growth Rate

|

CAGR of 4.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in Kilotons, Revenue in USD Million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, region.

|

|

Country scope

|

Western U.S.

|

|

Key companies profiled

|

California Steel Industries; Commercial Metals Company; Phoenix Steel Service, Inc.; Rolled Steel Products Corporation; Steel Dynamics; Steelco USA; United States Steel Corporation

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Western U.S. Flat Steel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global Western U.S. flat steel market report based on product, application, end use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Hot Rolled Coil

-

Cold Rolled Coil

-

Coated Steel

-

Others

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)