- Home

- »

- Advanced Interior Materials

- »

-

Wet Pet Food Processing Equipment Market Report, 2033GVR Report cover

![Wet Pet Food Processing Equipment Market Size, Share & Trends Report]()

Wet Pet Food Processing Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment (Processing, Packaging, Cleaning & Sanitization), By Food Type (Dog Food, Cat Food), By Form, By Package Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-630-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wet Pet Food Processing Equipment Market Summary

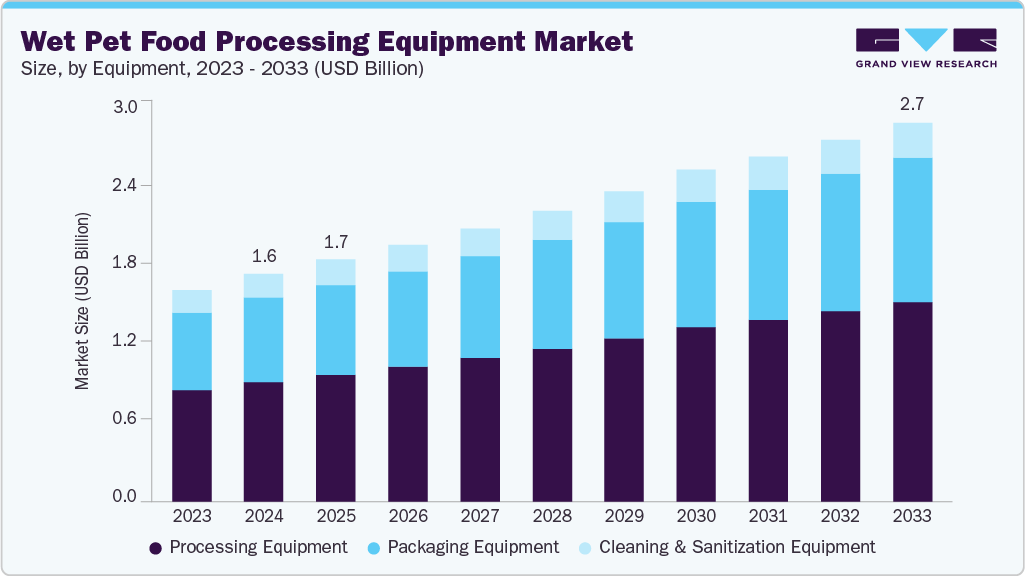

The global wet pet food processing equipment market size was estimated at USD 1,625.7 million in 2024 and is projected to reach USD 2,699.5 million by 2030, growing at a CAGR of 5.8% from 2025 to 2033. The market’s expansion is primarily driven by rising pet ownership worldwide-especially across emerging regions such as Asia Pacific and Central & South America-combined with the growing trend of pet humanization.

Key Market Trends & Insights

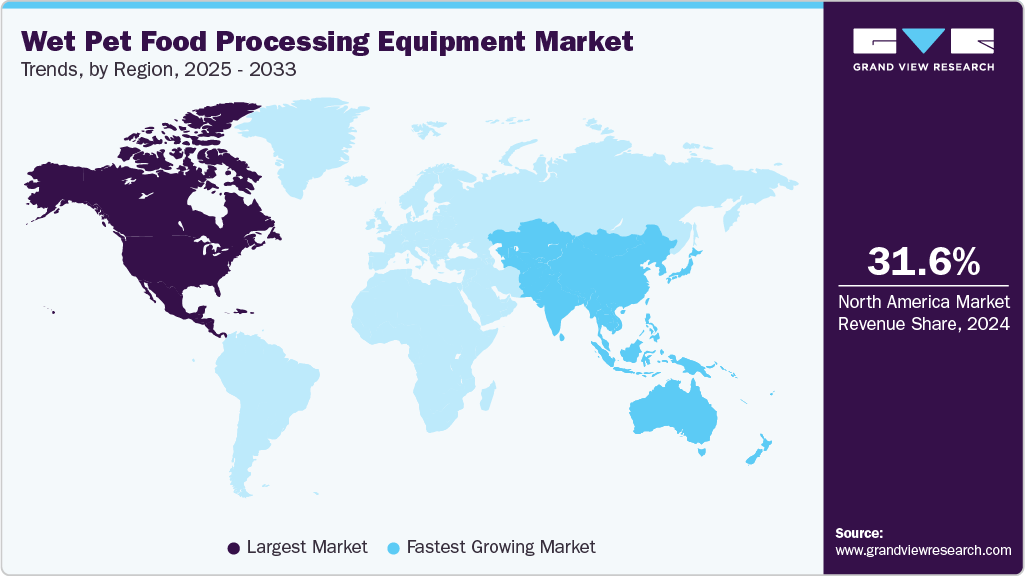

- North America dominated the wet pet food processing equipment market with the largest revenue share of 31.6% in 2024.

- The wet pet food processing equipment market in Mexico is expected to grow at a rapid CAGR of 8.5% from 2025 to 2033.

- By equipment, the packaging equipment segment is expected to grow at a considerable CAGR of 6.1% from 2025 to 2033 in terms of revenue.

- By food type, the cat food segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

- By form, the chunk in gravy segment is expected to grow at a considerable CAGR of 6.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1,625.7 Million

- 2033 Projected Market Size: USD 2,699.5 Million

- CAGR (2025-2033): 5.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

As pet owners increasingly seek high-quality, nutritious, and premium food options for their pets, manufacturers are investing in advanced processing technologies to meet evolving consumer preferences and regulatory standards. This shift is fueling demand for efficient, automated, and hygienic wet pet food processing equipment globally. Premiumization of pet food owing to the rising health-consciousness among the pet owners is expected to drive the market growth. Additionally, rising consumer preference for clean-label and organic pet food is pushing manufacturers to adopt advanced processing technologies, further fueling demand for specialized wet pet food processing equipment.

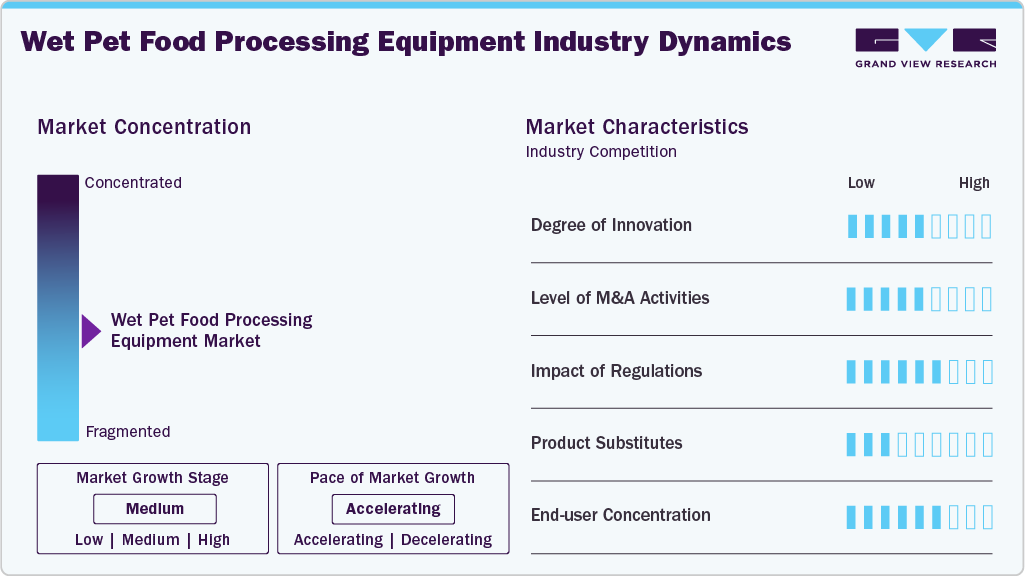

Market Concentration & Characteristics

The global wet pet food processing equipment market is characterized by diverse players, including large multinational corporations and specialized regional manufacturers, all competing for market share. Key manufacturers focus on developing advanced processing equipment that ensures high-quality, nutritious, and safe pet food products. Innovation in this market is driven by the growing demand for high-quality pet food, stringent food safety regulations, and the need for efficient production processes. Manufacturers are investing in advanced technologies to improve the quality, consistency, and safety of wet pet food products.

Regulatory pressures from organizations such as the FDA and EFSA play a crucial role in shaping the market, with stringent standards focused on food safety, hygiene, and nutritional content. Compliance with these regulations is essential for manufacturers to remain competitive, as pet owners increasingly prioritize the health and well-being of their pets. As the demand for high-quality and nutritious pet food rises, the need for advanced processing equipment designed for efficiency and safety continues to grow.

While opportunities are abundant, the wet pet food processing equipment market faces competition from alternative processing methods and technologies. To maintain market leadership, manufacturers must continue innovating, integrating smart technologies like IoT for real-time monitoring, and adapting to evolving regulatory landscapes. Emphasizing food safety, nutritional value, and efficient production processes is likely to lead to the expansion of wet pet food processing equipment market.

Drivers, Opportunities & Restraints

The wet pet food processing equipment market is driven by rising pet ownership and the trend of pet humanization. This has led to increased demand for premium, nutritionally balanced pet food with high protein content and added health benefits. Pet owners now seek the same food safety and transparency standards as in human food production, pushing manufacturers to invest in advanced processing technologies that ensure hygiene, real-time monitoring, and traceability. This shift towards high-quality, protein-rich, and minimally processed ingredients is driving the need for sophisticated wet pet food processing equipment.

A significant restraint facing the wet pet food processing equipment market is the high capital investment required to establish or upgrade manufacturing facilities. Wet pet food production involves complex processes that demand specialized, high-precision machinery and technology to ensure product quality, safety, and consistency. This equipment often includes mixers, sterilizers, retort systems, fillers, and advanced packaging machines, all of which come with substantial price tags.

Technological advancements and automation are transforming the wet pet food processing industry, creating significant opportunities for manufacturers to enhance efficiency, improve product quality, reduce waste, and implement predictive maintenance. The integration of artificial intelligence (AI), the Internet of Things (IoT), robotics, and smart sensors in wet food processing is revolutionizing how pet food is produced, packaged, and monitored throughout the supply chain.

Equipment Insights

The processing equipment segment dominated the market and accounted for 52.5% of the market share in 2024. The adoption of advanced wet pet food processing equipment is rising as manufacturers respond to evolving consumer preferences for healthier, high-protein, and grain-free pet food products. Production facilities are investing in high-efficiency extruders, vacuum fillers, and aseptic packaging machines that allow for precise ingredient control and extended shelf life to meet these demands. For instance, companies such as Andritz and Clextral have developed sophisticated processing systems that offer high output while ensuring nutritional consistency.

Packaging equipment plays a critical role in the wet pet food processing equipment market, ensuring that the finished products are safely sealed, preserved, and ready for distribution. The packaging process for wet pet food is highly specialized due to the need to preserve the product’s moisture content and prevent contamination. The increasing demand for convenience and extended shelf life in the pet food industry is a significant driving factor of packaging equipment in the market.

Food Type Insights

The cat food segment dominated the market and accounted for a share of 62.2% in 2024. In cat food production, wet pet food processing equipment is tailored to accommodate the specific needs of cats, particularly with regard to the texture, moisture content, and flavor profiles preferred by felines. The growing demand for premium and safe wet cat food has led to the adoption of more efficient and automated wet pet food processing systems that are capable of maintaining the delicate balance of quality and safety.

The growing demand for premium, nutritious, and safe dog food options is driving the adoption of advanced wet pet food processing equipment, ensuring high efficiency, product quality, and compliance with regulatory standards. In the production of dog food, wet pet food processing equipment is specifically designed to handle the unique requirements of meat-based, high-moisture products.

Form Insights

The chunk in gravy segment dominated the market with a share of 45.7% in 2024. Wet pet food processing technologies ensure a long shelf life while maintaining the sensory qualities that consumers associate with premium wet pet foods. The rising demand for human-grade aesthetics and variety in pet meals is driving manufacturers to invest in advanced equipment tailored specifically for chunk-in-gravy product lines.

In the wet pet food processing market, loaves are one of the popular formats for certain pet food products, particularly for dogs and cats that prefer a denser, meatier consistency. The demand for loaves in the wet pet food market has increased with the growing trend toward premium pet food offerings, where product texture and quality play a critical role in consumer choice.

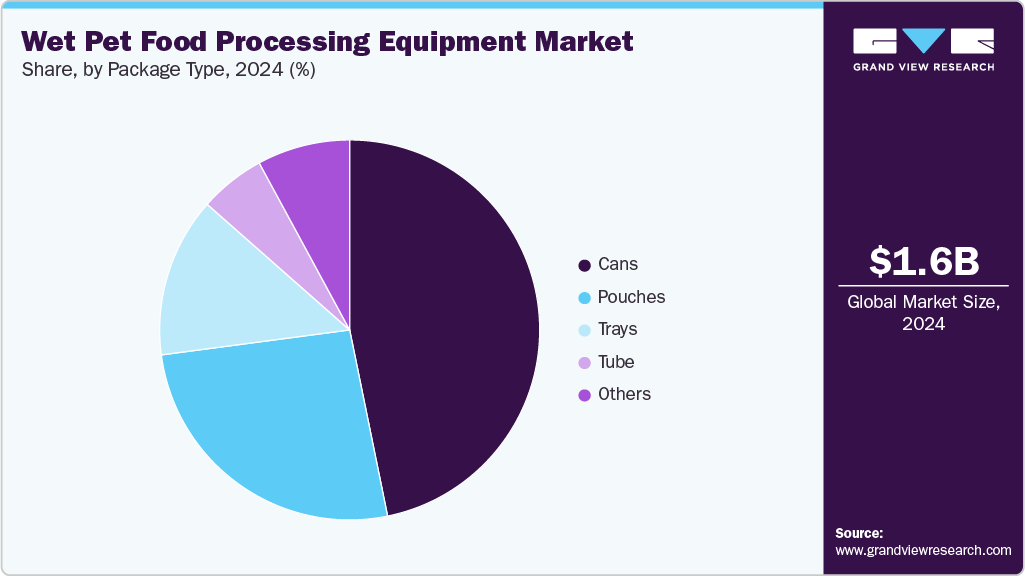

Package Type Insights

The cans segment dominated the market and accounted for a revenue share of 46.8% in 2024. Cans remain one of the most widely used packaging types in the wet pet food processing equipment market due to their durability, shelf stability, and compatibility with thermal sterilization processes. Their rigid structure allows them to withstand high-pressure retort sterilization, making them ideal for preserving the nutritional quality and flavor of dense, protein-rich wet pet foods such as loaves, pâtés, and chunks in gravy.

Pouches have emerged as a highly versatile and efficient packaging type in the wet pet food processing equipment market, driven by their convenience, lightweight nature, and extended shelf stability. As brands increasingly focus on differentiated product lines such as single-serving gourmet meals or functional pet diets, the demand for equipment that can support high-volume, hygienic, and precise pouch packaging continues to grow, positioning pouches as a key driver in wet pet food production innovation.

Regional Insights

North America wet pet food processing equipment market dominated in 2024 accounting for a revenue share of 31.6% driven by a strong emphasis on pet health and nutrition. The trend of pet humanization is particularly pronounced, with pet owners increasingly seeking high-quality, protein-rich, and minimally processed pet food products. This has led to a surge in demand for advanced processing equipment that maintains ingredient integrity and ensure food safety. The region's well-established industrial base and advanced technological infrastructure support the integration of sophisticated processing technologies, driving innovation and market growth.

U.S. Wet Pet Food Processing Equipment Market Trends

The wet pet food processing equipment industry in U.S. is projected to expand at a CAGR of 5.7% over the forecast perioddriven by a surge in pet ownership and evolving consumer preferences. 66% of households in the U.S. own a pet, marking a substantial increase from 56% in 1988 to 2024. This uptick in pet ownership has led to a heightened demand for pet food, particularly wet varieties, which are perceived as more palatable and nutritious.

Europe Wet Pet Food Processing Equipment Market Trends

The market in Europe is supported by a substantial and diverse pet population. This broad pet base supports a sophisticated market where consumer demand is shifting noticeably towards wet pet food products, valued for their higher moisture content and perceived health benefits. Countries such as Germany, France, and the UK lead in wet pet food consumption, driving the need for modernized processing equipment that can handle increasing volumes and diverse product formats.

The wet pet food processing equipment market in Germany is expected to grow at a CAGR of 7.6% over the forecast period due to the nation’s high pet density which creates a strong domestic demand for pet food, especially wet varieties favored for their palatability and nutritional benefits.

France wet pet food processing equipment market is expected to grow at a CAGR of 7.2% over the forecast period. The robust pet food production and export activity in France is a strong driver for the wet pet food processing equipment market, especially for dogs and cats.

Asia Pacific Wet Pet Food Processing Equipment Market Trends

The market in Asia Pacific is projected to be the fastest growing region with a CAGR of 6.3% over the forecast period. The Asia Pacific region is witnessing robust market growth across various sectors, driven by rapid urbanization, industrialization, and increasing consumer demand. The region's expanding middle class and rising disposable incomes are fueling the adoption of advanced technologies and premium products. In the wet pet food processing equipment market, the growing trend of pet humanization and increasing pet ownership are driving demand for high-quality pet food products.

The wet pet food processing equipment market in China is projected to expand at a CAGR of 7.9% over the forecast period. China's accelerating pet care industry is driving strong growth in the market, as consumer preferences shift toward higher-quality, ready-to-serve products-especially for cats.

India wet pet food processing equipment market is projected to expand at a CAGR of 8.4 % over the forecast period. India's pet food market is experiencing significant expansion, with retail sales projected to reach USD 1.3 billion by 2028, driven by a growing pet population and increasing consumer demand for high-quality pet food products.

Central & South America Wet Pet Food Processing Equipment Market Trends

The Central and South America region is seeing notable growth in the wet pet food processing equipment market, driven by increasing pet ownership and a growing middle class. The trend of pet humanization is gaining traction, with consumers demanding higher quality and more nutritious pet food products. The region's expanding pet food industry is investing in advanced processing, packaging, and sanitization technologies to meet these demands and comply with food safety standards.

The wet pet food processing equipment market in Argentina is projected to grow at a CAGR of 6.4% over the forecast period. The country has seen a marked rise in pet humanization, especially in urban centers like Buenos Aires and Córdoba, where consumers increasingly treat pets as family members. This trend has led to a notable shift toward premium wet pet food products, which in turn is driving demand for specialized processing equipment.

Middle East & Africa Wet Pet Food Processing Equipment Market Trends

The Middle East and Africa region is experiencing growth in the wet pet food processing equipment market, driven by rising pet ownership and changing consumer attitudes towards pet care. The trend of pet humanization is influencing consumer preferences, with pet owners increasingly seeking premium and nutritionally balanced pet food products. The region's growing pet food industry is investing in advanced processing technologies to meet these demands and comply with food safety standards. The presence of emerging markets and the increasing focus on export opportunities are further driving the adoption of sophisticated processing equipment.

The wet pet food processing equipment market in Saudi Arabia is projected to expand at a CAGR of 5.2% over the forecast period, largely driven by factors such as increasing disposable incomes, a growing expatriate population, western educational influences, and the widespread impact of social media. This shift in societal attitudes has led to the normalization of pets in both private and public spaces, with the popularity of pet-friendly venues such as cat and dog cafés and the proliferation of veterinary clinics and pet shops reflecting a more developed approach to pet care. As pet ownership becomes mainstream and responsible ownership practices take root, there is growing consumer demand for premium, health-focused pet food, particularly wet pet food, which is perceived as more nutritious and palatable.

Key Wet Pet Food Processing Equipment Company Insights

Some of the key players operating in the market include JBT Marel and DC Norris among others.

-

JBT Marel, also known as John Bean Technologies Corporation, is a global technology solutions provider primarily serving the food and beverage industry. The company was established as an independent publicly traded company in 2008 following FMC Technologies' divestiture of its non-energy businesses.

-

DC Norris designs, manufactures, installs, and services industrial and commercial food processing systems that cater to a broad range of food types, including ready meals, soups, sauces, beverages, pet food, and more. Their equipment portfolio includes advanced cooking kettles, cooling systems, sous vide technology, can opening and crushing machines, and vessels for safe food transfer and storage.

Key Wet Pet Food Processing Equipment Companies:

The following are the leading companies in the wet pet food processing pquipment market. These companies collectively hold the largest market share and dictate industry trends.

- JBT Marel

- DC Norris

- Kronitek – Food Processing Machines

- Cabinplant A/S

- Barry-Wehmiller Companies

- Scansteel foodtech A/S.

- Mepaco

- ANDRITZ

- The Middleby Corporation

- GEA Group Aktiengesellschaft

Recent Developments

-

In January 2025 JBT finalized its voluntary takeover of Marel hf., merging the two companies to form JBT Marel Corporation. Shares of the new combined entity started trading under “JBT MarelM” on both the Nasdaq Iceland and the New York Stock Exchange as of January 3, 2025. The merger is designed to create a stronger, more diversified company in food processing solutions by combining the expertise, technologies, and market reach of both JBT Marel and Marel.

-

In May 2025, DC Norris acquired AE Mixers, strengthening its capabilities in industrial food processing equipment pertaining to pet food, food & beverage, and confectionery industries. This acquisition complements their existing portfolio and supports growth by enhancing their mixing technology offerings.

Wet Pet Food Processing Equipment Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1,724.2 million

Revenue forecast in 2033

USD 2,699.5 million

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, food type, form, package type, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; India; Japan; Thailand; Malaysia; Indonesia; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

JBT Marel; DC Norris; Kronitek – Food Processing Machines; Cabinplant A/S; Barry-Wehmiller Companies; scansteel foodtech A/S; Mepaco; ANDRITZ; The Middleby Corporation; GEA Group Aktiengesellschaft.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wet Pet Food Processing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc has segmented the global wet pet food processing equipment market based on product, food type, form, package type, and region:

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Processing Equipment

-

Mixing & Blending Equipment

-

Grinding Equipment

-

Pre-breakers

-

Pallet Inverters

-

Holding Bins

-

Others

-

-

Pre-Cooking Equipment

-

Cooling & Chilling Equipment

-

Others

-

-

Packaging Equipment

-

Cans

-

Filling Machines

-

Can Seaming Machines

-

Retort Systems

-

Saturated Steam

-

Water Spray

-

Water Immersion

-

Steam-air

-

Hydrostatic Retorts

-

-

Labeling Machines

-

Cartoning and Case Packing Machines

-

-

-

Trays

-

Filling Machines

-

Sealing Machines

-

Lidding Film Handling Systems

-

Retort Systems

-

Saturated Steam

-

Water Spray

-

Water Immersion

-

Steam-air4

-

Hydrostatic Retorts

-

-

Labeling Machines

-

Cartoning and Case Packing Machines

-

-

Pouches

-

Pouch Feeding/Loading Machines

-

Filling Machines

-

Sealing Machines

-

Retort Systems

-

Saturated Steam

-

Water Spray

-

Water Immersion

-

Steam-air4

-

Hydrostatic Retorts

-

-

Labeling Machines

-

Cartoning and Case Packing Machines

-

-

Tubes

-

Tube Feeding Machines

-

Filling Machines

-

Sealing Machines

-

Trimming Machines

-

Retort Systems

-

Saturated Steam

-

Water Spray

-

Water Immersion

-

Steam-air4

-

Hydrostatic Retorts

-

-

Labeling Machines

-

Cartoning and Case Packing Machines

-

-

Others

-

Filling Machines

-

Sealing Machines

-

Retort Systems

-

Saturated Steam

-

Water Spray

-

Water Immersion

-

Steam-air4

-

Hydrostatic Retorts

-

-

Labeling Machines

-

Cartoning and Case Packing Machines

-

-

Cleaning & Sanitization Equipment

-

-

Food Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Dog Food

-

Cat Food

-

- Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Loaves

-

Stew

-

Chunk in Gravy

-

Others

-

-

Package Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Cans

-

Trays

-

Pouches

-

Tubes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

Malaysia

-

Indonesia

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wet pet food processing equipment market size was estimated at USD 1,625.7 million in 2024 and is expected to reach USD 1,724.2 million in 2025.

b. The global wet pet food processing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2033 to reach USD 2,699.5 million by 2033.

b. The market in North America dominated the market in 2024 accounting for 31.6% of the global revenue share driven by rising pet humanization and demand for premium, high-moisture pet food. Manufacturers are investing in automation and hygienic design to meet evolving safety standards and production efficiency needs.

b. Some of the key players operating in the wet pet food processing equipment market are JBT Marel, DC Norris, Kronitek – Food Processing Machines, Cabinplant A/S, Barry-Wehmiller Companies, scansteel foodtech A/S, Mepaco, ANDRITZ, The Middleby Corporation, and GEA Group Aktiengesellschaft.

b. Key drivers of the wet pet food processing equipment market include increasing consumer demand for premium, nutritious pet food and the growing emphasis on food safety and production automation. Additionally, rising pet ownership and brand competition are prompting manufacturers to expand and modernize processing capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.