- Home

- »

- Advanced Interior Materials

- »

-

Wet Scrubber Market Size & Share, Industry Report, 2030GVR Report cover

![Wet Scrubber Market Size, Share & Trends Report]()

Wet Scrubber Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Packed Bed Scrubber, Venturi Scrubber), By End Use (Power Generation, Chemical, Cement, Refinery And Petrochemicals), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-055-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wet Scrubber Market Size & Trends

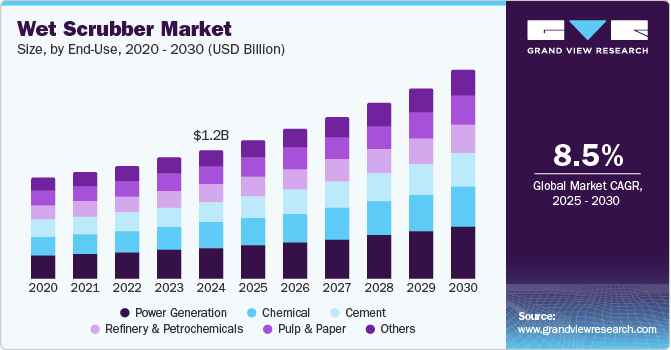

The global wet scrubber market size was valued at USD 1.17 billion in 2024 and is anticipated to grow at a CAGR of 8.5% from 2025 to 2030. The market is expected to be driven by rising awareness about stringent environmental regulations and the need to control industrial air pollution. Wet scrubbers play a critical role in removing gases and pollutants from the exhaust stream, making them necessary for several end-use industries, such as power generation, manufacturing, and chemical processing. Furthermore, the shift toward sustainability and cleaner energy products is increasing the adoption of wet scrubbers. Technological advancements are enhancing the efficiency and cost-effectiveness of wet scrubbers, thereby driving their adoption across various industries.

Technological advancements are leading to the development of energy-efficient scrubbers, which require less water and reduce pollutants such as sulfur dioxide and nitrogen oxide. These scrubbers also reduce volatile organic compounds such as ammonia and hydrogen sulfide. Market players are engaged in innovations focused on making wet scrubbers efficient and cost-effective, with the introduction of hybrid systems, scrubbing liquids, and others.

The transition toward using eco-friendly scrubber materials and solutions is expected to positively impact the market growth. According to an article published by Global News in April 2021, St Marys Cement installed a wet scrubber worth USD 19.9 million at the Bowmanville cement plant in Ontario. The installation reduced 90.0% of the sulfur dioxide emissions and improved the plant's environmental performance.

The International Maritime Organization (IMO), under MARPOL Annex VI, has enforced regulations to limit sulfur oxide emissions from ships by using alternative technologies and methods, such as the installation of gas cleaning systems, leading to the adoption of wet scrubbers in the maritime sector. According to an article published by The Free Press Journal in June 2023, Mira-Bhayandar Municipal Corporation (MBMC) in Maharashtra, India, attached wet scrubber machines at Liquid Petroleum Gases (LPG) pyres at five crematoriums, thereby benefiting people staying in the vicinity.

Product Insights

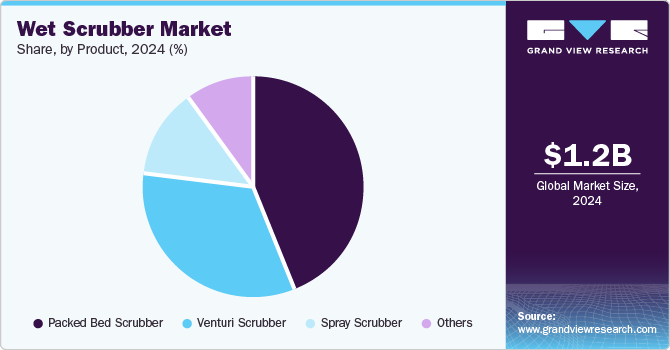

Packed bed scrubbers dominated the market and accounted for the largest revenue share of 44.4% in 2024, owing to their efficiency in removing pollutants, such as volatile organic compounds and acidic gases from exhaust streams. Innovations in structured packing designs, such as corrugated sheets, have increased the surface area for gas-liquid contact. Such designs help achieve good control over gas flow, leading to high mass transfer rates and efficient removal of pollutants. Advancements in the design also include the inclusion of taps and spray systems to maintain the flow of liquids and reduce the risk of flooding within the scrubber system.

Venturi scrubbers are expected to grow at the fastest CAGR of 8.8% over the forecast period, as they offer high efficiency in collection of gaseous and particulate pollutants. Venturi scrubbers operate by using a high-velocity gas stream that passes through a section, where it is mixed with a scrubbing liquid, allowing it to capture gaseous pollutants. It is suitable for use in power generation, chemical processing, and mining to capture high dust loads such as explosive and steel dust. The rise in industrial activity and environmental regulations that drive the need for effective air pollution control technologies is expected to favor the demand for this type of wet scrubbers in the coming years owing to their ability to absorb and neutralize gaseous pollutants.

End-use Insights

The power generation end-use segment accounted for the largest revenue share of 24.5% in 2024 and is expected to grow at the fastest CAGR of 9.3% over the forecast period. The growth in demand for wet scrubbers in this segment is attributed to their increasing use for reducing harmful emissions from fossil-fuel-based power plants such as those that use coal and oil. Rising focus on improving air quality and reducing greenhouse gas emissions and the implementation of stringent regulations have prompted power generation facilities to adopt wet scrubber technology.

The demand in this segment is expected to grow with rising regulatory pressure and the need for effective pollution control technologies. Regulations are imposed to combat air pollution, especially on power plants that rely on fossil fuels, to reduce harmful emissions such as sulfur dioxide and nitrogen oxide. The transition toward cleaner energy sources is driving power plants to invest in emission control technologies to reduce their environmental footprint and improve compliance with regulatory guidelines.

Regional Insights

North America wet scrubber market is expected to grow at the fastest CAGR of 7.5%, over the forecast period, on account of increasing industrial activities and emphasis on improving air quality in the region. The Clean Air Act, enforced by the U.S. Environmental Protection Agency (EPA), has set standards for improving air quality and reducing harmful pollutants by installing wet scrubbers in food processing and chemical manufacturing industries. Therefore, the demand for reducing air pollution and the need to adopt wet scrubbers is expected to increase in the market.

U.S. Wet Scrubber Market Trends

The U.S. wet scrubber market dominated the market in North America and accounted for the largest revenue share of 65.9% in 2024. Technology advancements, including the integration of IoT (Internet of Things) and automation in web scrubber systems, enable real-time monitoring and data analytics. This helps optimize performance, predict maintenance needs, and ensure compliance with emission standards. Innovations in scrubbing liquids, such as alkali chemicals, help capture pollutants, leading to higher removal rates and reduced volume of waste generated. Therefore, the wet scrubber industry in the U.S. has recorded a significant share in the North America region.

Asia Pacific Wet Scrubber Market Trends

Asia Pacific wet scrubber market dominated the global and accounted for the largest revenue share of 36.1% in 2024. This can be attributed to rapid industrialization and rise in environmental awareness. Initiatives aimed at improving air quality have driven the demand for wet scrubbers. For instance, China enacted policies to reduce sulfur dioxide in power plants and chemical processing industries. This led to the adoption of pollution control technologies that effectively reduce emissions and align with environmental regulations.

The wet scrubber market in China accounted for the largest revenue share of 36.0% in 2024 in the APAC region. This can be attributed to the growth of urbanization and industrial expansion. The country has several coal and gas-fired power plants, which are major sources of air pollutants such as sulfur dioxide and nitrogen oxide. Wet scrubbers are essential for controlling sulfur dioxide, a byproduct of coal combustion. In addition, the country continues to experience industrial growth in petrochemicals, manufacturing, and power generation, which is further expected to favor the adoption of advanced pollution control technologies such as wet scrubbers.

India wet scrubber industry is expected to grow at the fastest CAGR of 9.6%, over the forecast period, due to rising awareness about effects of poor air quality and industrialization. The country is witnessing substantial growth in chemicals, petrochemicals, power generation, and manufacturing industries. Pollution control technologies such as venturi scrubbers and packed bed scrubbers are increasingly implemented in such industries to reduce the emission of harmful pollutants. Initiatives such as the National Clean Air Programme (NCAP) are implemented in the country to improve air quality. These strategies are expected to favor the market growth in the country over the forecast period.

The wet scrubber market in Mexico is expected to grow at the fastest CAGR of 9.1% over the forecast period. Initiatives such as The General Law on Ecological Balance and Environmental Protection have led to the implementation of air pollution control measures including the use of wet scrubbers in industries such as cement production, power generation, and petrochemicals. In addition, campaigns such as BreatheLife have raised public awareness regarding the need to control air pollution. This rise in awareness is expected to drive industries to adopt wet scrubbers that can effectively reduce harmful pollutants and thereby improve the air quality.

Key Wet Scrubber Company Insights

The global wet scrubber industry includes several key companies such as Babcock & Wilcox Enterprises, Inc.; Alfa Laval; CECO Environmental; DuPont; Evoqua Water Technologies LLC; and Fuji Electric Co., Ltd.

-

Babcock & Wilcox Enterprises, Inc. specializes in advanced energy and environmental technologies and provides solutions that promote clean energy and sustainability. The company offers a wide range of wet scrubber systems designed for controlling air pollution and removing harmful pollutants. It is also focused on innovations including configuration of wet scrubbers as a multi-pollutant control device to manage sulfur dioxide and particles such as acid mist and mercury.

-

Alfa Laval is a manufacturing company specializing in heat transfer, separation, and fluid handling technologies, offering solutions to various industries such as food processing, marine, and energy. The company focuses on sustainable solutions with its wet scrubber technology designed to minimize water usage and waste generation.

Key Wet Scrubber Companies:

The following are the leading companies in the wet scrubber market. These companies collectively hold the largest market share and dictate industry trends.

- Babcock & Wilcox Enterprises, Inc.

- ALFA LAVAL

- CECO ENVIRONMENTAL

- DuPont

- Evoqua Water Technologies LLC

- Fuji Electric Co., Ltd.

- GEA Group Aktiengesellschaft

- Wärtsilä

- KCH Engineered Systems

- Nederman Holding AB

- Tri-Mer Corporation

- Verantis Environmental Solutions Group

- Manta Marine Technologies (Yara)

Recent Developments

-

In January 2023, Babcock & Wilcox Enterprises, Inc. acquired Hamon Research-Cottrell (HRC), enhancing its portfolio of emission control solutions. This acquisition allowed Babcock & Wilcox Enterprises to provide a wide range of advanced air quality control systems, such as wet and dry electrostatic precipitators, spray dryer absorbers, and wet flue desulfurization systems designed for oil & gas refineries.

-

In May 2021, CECO Environmental received a USD 3.5 million contract to provide environmental solutions for a global semiconductor chip manufacturer. The project involved supplying over a dozen CECO HEE-Duall Scrubber and Exhaust Systems, capable of removing 98.0% of acidic and other gaseous emissions. The contract highlighted increasing demand for pollution control technologies and compliance with environmental regulations.

Wet Scrubber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.26 billion

Revenue forecast in 2030

USD 1.89 billion

Growth Rate

CAGR of 8.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue Forecast and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, End Use, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

Babcock & Wilcox Enterprises, Inc.; ALFA LAVAL; CECO ENVIRONMENTAL; DuPont.; Evoqua Water Technologies LLC; Fuji Electric Co., Ltd.; GEA Group Aktiengesellschaft; Wärtsilä; KCH Engineered Systems; Nederman Holding AB; Tri-Mer Corporation; Verantis Environmental Solutions Group; Manta Marine Technologies (Yara)

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wet Scrubber Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wet scrubber market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Billion,2018 - 2030)

-

Packed Bed Scrubber

-

Venturi Scrubber

-

Spray Scrubber

-

Others

-

-

End-use Outlook (Revenue, USD Billion,2018 - 2030)

-

Power Generation

-

Chemical

-

Cement

-

Refinery and Petrochemicals

-

Pulp and Paper

-

Others

-

-

Regional Outlook (Revenue, USD Billion,2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.