- Home

- »

- Advanced Interior Materials

- »

-

Ferroalloys Market Size, Share, Growth Analysis Report 2030GVR Report cover

![Ferroalloys Market Size, Share & Trends Report]()

Ferroalloys Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Ferrochrome, Ferromanganese), By Application (Carbon & Low Alloy Steel, Stainless Steel), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-836-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ferroalloys Market Summary

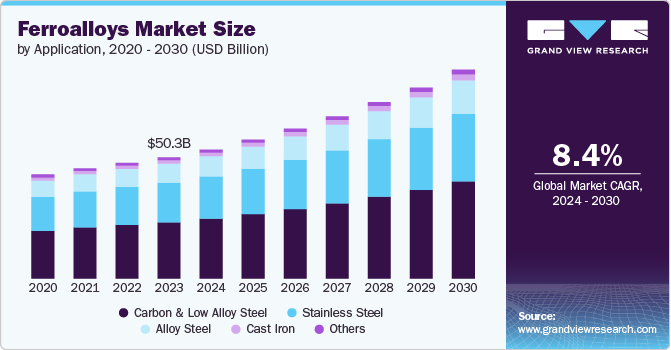

The global ferroalloys market size was estimated at USD 50.35 billion in 2023 and is projected to reach USD 86.72 billion by 2030, growing at a CAGR of 8.4% from 2024 to 2030. The market growth is driven by the demand for ferroalloys for use in global steel production.

Key Market Trends & Insights

- Asia Pacific dominated the global ferroalloys market with the largest revenue share of 62.1% in 2023.

- The ferroalloys market in China led the Asia Pacific with the largest revenue share of 77.0% in 2023.

- By application, the carbon and low alloy steel segment led the market with the largest revenue share of above 46.0% in 2023.

- By product, the ferrosilicon segment is expected to register at the fastest CAGR of 6.8% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 50.35 Billion

- 2030 Projected Market Size: USD 86.72 Billion

- CAGR (2024-2030): 8.4%

- Asia Pacific: Largest market in 2023

The manufacturing of steel, in turn, is anticipated to be driven by the risen consumption of construction steel worldwide. Hence, the increasing requirement for non-residential and commercial construction, as well as the development of affordable housing units in emerging economies, is anticipated to drive ferroalloys consumption.

According to the United Nations, the global population is projected to reach 8.6 billion by 2030. It is expected to increase the urbanization rate and boost the demand for affordable housing worldwide. This, in turn, is anticipated to surge the demand for steel for use in the construction industry, thereby leading to the risen consumption of ferroalloys in steel manufacturing.

Drivers, Opportunities, and Restraints

The stabilization of the U.S. Federal Rates resulted in the easing of inflation across the U.S. toward the end of 2023. This paved the way for increased spending in the manufacturing and consumer markets. Moreover, the devaluation of two currencies of the world, namely the Euro and the Yuan, against the U.S. dollar surged the purchasing parity and subsequently improved construction spending.

Rising construction expenditure worldwide is one of the major drivers for the growth of the global ferroalloys market. According to the U.S. Census Bureau, construction spending in the U.S. rose by 7% y-o-y in 2023. The surge in spending can be attributed to the rise in demand for single-family housing and a decline in mortgage rates in the country. Hence, the increasing consumer spending indicates favorable investor sentiment and a gradual revival of manufacturing activities. This is anticipated to drive the growth of the ferroalloy market during the forecast period.

The demand for green steel and the corresponding government support for its technology development and production are expected to act as key opportunities for the growth of the ferroalloy market in the coming years. This is because ferroalloy production is an energy-intensive process. As such, the corresponding reduction in coal usage in this process will result in high energy savings and cost control for ferroalloy producers. In light of the ongoing clean energy transition worldwide, the global demand for green steel is anticipated to increase in the coming years. This is expected to become an opportunity for the growth of the ferroalloys market during the forecast period.

The global prices of ferroalloys are highly dependent on power and raw material costs that have been witnessing upside fluctuations over the past few years. The volatile raw material costs are considered a key restraint to the profitability of the market since a disproportionately high increase in input costs can erode producer realization gains.

Price Trends of Ferroalloys

Profit gains of the ferroalloy market were high in 2022 owing to increased prices. However, in 2023, the market experienced a decline in ferroalloy costs across the world, except for China wherein ferrochrome prices remained stable at USD 988-1,185 per ton. The main reason for this price decline worldwide in 2023 was high input costs and corresponding low profit margins. Coal prices witnessed a spike, increasing by almost 20% y-o-y in 2023. Apart from this, energy, coke, and raw material costs also surged. For instance, the spot prices of the metcoke and manganese ore in India increased by about 16% and 30%, respectively. The slow revival of steel growth has also added to the cost pressure on the ferroalloy market. Hence, demand growth was slower than anticipated. In January 2024, Outokumpu announced that it will partially shut down the ferrochrome production in its Finland plants until the third quarter of 2024. It quoted the slow revival of the stainless steel market has resulted in its high inventory levels.

Market Concentration & Characteristics

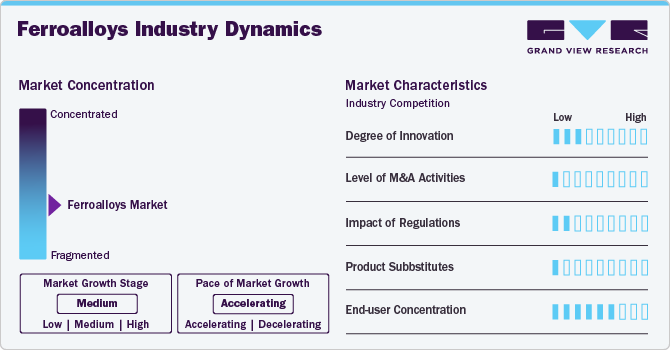

The ferroalloys market is at a medium stage of industry growth, thereby indicating an accelerated pace of development. The market is fragmented with a high concentration of ferroalloy producers located in India and China. It is a capital- and energy-intensive market. Thus, the market entry barriers are high for new players. As such, large-scale producers cater to the global demand for ferroalloys.

The degree of innovations in the market is moderate and is characterized by the use of mid-level technology for mining and processing ferroalloys. Presently, companies worldwide are focused on sustainable production processes to achieve a low-carbon footprint and incur minimal costs.

The level of M&A activities remained low in 2023. The volatile raw material and energy costs resulted in producers resorting to cost optimization measures to remain competitive.

The ferroalloys market witnesses a medium regulatory impact as producers are governed by laws to obtain mining licenses and environmental clearance, as well as ensure the minimal socio-economic impact of their processes. Compliance with these regulations often requires significant investments in advanced technologies and sustainable production processes, thereby leading to increased operational costs.

The substitutes for ferroalloys are limited as it is an essential raw material for producing crude steel. The steel industry is the key end user of ferroalloys. As this industry is growing globally due to the use of steel in the construction, infrastructure, automotive, transportation, energy, and electrical and electronics industries, the demand for ferroalloys is anticipated to rise worldwide in the coming years.

Application Insights & Trends

“The cast iron segment of the market is anticipated to grow at the highest revenue CAGR of 7.0% over the forecast period.”

Cast iron is a class of iron-carbon alloys with a carbon content of more than 2% and silicon content of around 1–3%. It has a low melting temperature and cost. Since cast iron can be developed into different shapes, it is suitable for use in a wide range of applications, including cookware, pipes, machinery, and automotive parts such as cylinder heads, cylinder blocks, and gearbox cases.

The carbon and low alloy steel segment accounted for the largest revenue share of above 46.0% of the market in 2023. Carbon steel is primarily made from carbon, iron, silicon, and manganese. It is strong and durable but has low corrosion resistance and melting point. Carbon steel is also lesser ductile and weldable than other steel types. As such, it is suitable for use in building frames, steel pipes, cutting tools, washers, and fasteners. Carbon steel is also used in the manufacturing industry.

Low alloy steel generally comprises plain carbon steel and steel with a total alloying content of up to 12%. As such, its cost is lower than highly alloyed materials. Low alloy steel is often used in large volumes in heavy engineering industries.

Rising investments in the production of green steel and increasing adoption of sustainable construction practices are anticipated to surge the demand for steel. This is expected to subsequently contribute to the growth of the ferroalloys market in the coming years. For instance, the U.S. Department of Energy has announced an investment of USD 6 billion in 33 projects in over 20 states to decarbonize energy-intensive industries in the country. These projects will be funded by the Infrastructure Law and Inflation Reduction Act.

Ferroalloys are also used in military applications to produce hydrogen for balloons through the chemical reaction of sodium hydroxide, ferrosilicon, and water. Ferroalloys such as ferroaluminum are used to produce permanent (aluminum-nickel-cobalt (AlNiCo)) magnets. They are also used as alloying additions to welding wires and fluxes.

Product Insights

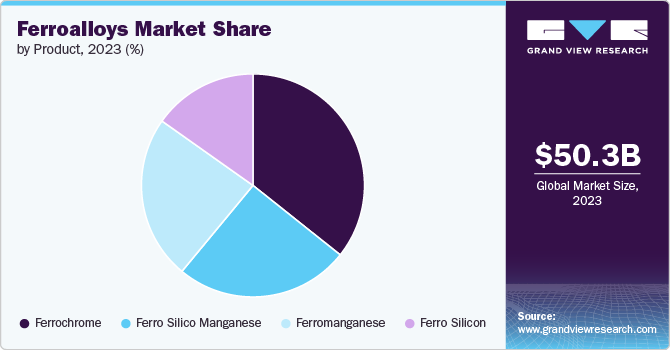

“The ferro silico manganese segment held the largest revenue share of over 45.0% of the market in 2023.”

Ferro silico manganese is an alloy of iron and manganese that contains a high amount of manganese and low levels of silicon. It is used as an alloying and deoxidizing agent during steel, stainless steel, and manganese-rich steel production. The global consumption of ferro silico manganese is anticipated to be driven by steel demand from the electric vehicle (EV) and aerospace industries. It imparts properties such as lightweight, as well as high strength and corrosion resistance to steel, which is desirable in the EV and aerospace industries and is preferred over other steel alloys.

The ferrosilicon segment of the market is anticipated to grow at a CAGR of 6.8% over the forecast period. Investments in public infrastructure projects are anticipated to boost the global demand for steel in the coming decade. For instance, the Bipartisan Infrastructure and Jobs Act in the U.S. has allocated USD 550 billion for improving the road, airport, port, and freight rail infrastructures.

Regional Insights

“China accounted for over 77.0% revenue share of the ferroalloys market in Asia Pacific.”

The growth of the North America ferroalloys market is anticipated to be driven by investments in construction and infrastructure development projects. Countries in the region, especially the U.S. and Mexico, are focusing on accelerating their economic growth by investing in infrastructure development projects and expanding their manufacturing industry.

U.S. Ferroalloys Market Trends

The ferroalloys market in the U.S. is the third-largest crude steel producer in the world. The growth of the market in the country is largely driven by the construction industry. As of June 2024, total construction spending in the U.S. was USD 2,148.44 billion, which was 6.2% higher than June 2023 levels of USD 2,023.01 billion. Thus, an increase in construction expenses is expected to surge the steel demand, thereby contributing to the growth of the ferroalloys market in the U.S. in the coming years.

Asia Pacific Ferroalloys Market Trends

Asia Pacific ferroalloys market dominated the global market and accounted for a share of 62.1% in 2023, owing to the large production volume of crude steel in China, India, and Japan for use in residential and commercial construction and infrastructure development projects, as well as in the automotive & transportation, energy, and electronics industries.

The ferroalloys market in China experienced a slow recovery in 2023 owing to the implementation of various economic revival policies, along with the restarting of the idled steel capacity of the country. A significant slowdown had primarily impacted the real estate market in the country that began in the fourth quarter of 2021 owing to the Evergrande debt crisis. However, the market in China witnessed a moderate revival in 2023. This encouraged ferroalloy producers to bank on stable prices, which were influenced by high energy and raw material costs in the country than in the rest of the world.

Europe Ferroalloys Market Trends

The Europe ferroalloys market has been vastly impacted by the Russia-Ukraine war, which has resulted in increased energy costs, as well as a shortage of raw materials (such as manganese ore) and skilled labor. Hence, the execution of energy-intensive manufacturing processes such as the ones employed for ferroalloys-ferrosilicon in particular-has become challenging to sustain in a high-cost environment. This has mostly impacted steel production activities in Europe with several producers halting their manufacturing processes and awaiting market normalcy to resume their operations.

The ferroalloys market in Germany accounted for a revenue share of over 16% of the market in Europe. The country is the largest exporter of semi-finished and finished steel in the region. The growth of the market for ferroalloys in Germany is anticipated to be driven by improved demand forecasts for steel for use in sustainable energy generation plants, consumer packaging, EVs, and green construction.

Central & South America Ferroalloys Market Trends

The Central & South America ferroalloys market is projected to witness growth in the coming years due to the expanding construction industry in the region. For instance, the Fundo Imobiliário Comunitário para Aluguel (FICA), a non-profit organization in São Paulo, Brazil, has initiated the Compartilha project to promote the renovation of crowded-living, single-family homes as projects among suitable investors for a grant amount of ~USD 173,195 (CHF 150,000) per year up from 2020 to 2026.

Middle East & Africa Ferroalloys Market Trends

The ferroalloys market in the Middle East & Africa is anticipated to grow at a moderate pace over the forecast period due to improving steel demand in the region. For instance, in June 2024, Emirates Steel Arkan (ESA), the largest steel producer in the UAE, signed an MoU with China-based Delong Steel Group to produce low-carbon raw materials for steel. Such projects are expected to improve the competitiveness of the country in terms of future steel, and hence, result in highly attractive pricing levels in the next few years.

Key Ferroalloys Company Insights

Some key players operating in the market are Tata Steel Limited and Gulf Ferro Alloys Company (Sabayek).

-

Tata Ferro Alloys and Minerals Division (FAMD) of India-based Tata Steel Limited is the largest non-steel vertical of the company. Since 2012, it produces and sells silicomanganese. The unit caters to the ferroalloy requirements of its integrated steel facility in Joda, Odisha. The company is also the largest ferroalloy producer that caters to the requirements of steel production facilities across Asia Pacific. It has manganese and chrome ore reserves in Odisha, India.

-

Gulf Ferro Alloys Company (Sabayek), which was established in 1992 and is headquartered in Jubail, produces ferroalloys that are used in steel making. Presently, it is the largest producer in the GCC region, with a capacity of manufacturing 140,000 tons per year. The company offers a wide range of products, including silico manganese, ferro manganese, SiMn/FeMn slag, and fumes.

Key Ferroalloys Companies:

The following are the leading companies in the ferroalloys market. These companies collectively hold the largest market share and dictate industry trends.

- Gulf Ferro Alloys Company (Sabayek)

- Glencore

- Jindal Group

- S.C. Feral S.R.L

- SAIL

- Samancore Chrome

- Shanghai Shenjia Ferroalloys Co. Ltd

- Tata Steel Limited

Recent Developments

-

In July 2023, Indian Metals and Ferro Alloys Limited (IMFA) announced its ~USD 65.2 million (INR 547 crore) ferrochrome expansion project in Kalinganagar, Odisha is underway. This facility can produce 100,000 tons and is expected to be commissioned by mid-2026.

-

In June 2022, Tata Steel Mining completed the acquisition of Rohit Ferro-Tech following the resolution plan under the Insolvency and Bankruptcy Code 2016. This deal is anticipated to further ferroalloy processing capabilities, particularly of ferrochrome, of Tata Steel in the coming years.

-

In March 2022, Tata Steel announced the completion of the acquisition of the ferroalloy-producing assets of India-based Stork Ferro and Mineral Industries for ~USD 18.5 million (INR 155 crore) in an all-cash deal as a part of its backward linkage strategy.

Ferroalloys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 53.57 billion

Revenue forecast for 2030

USD 86.72 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecasts, revenue forecasts, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Turkey; Russia; China; India; Japan; Brazil

Key companies profiled

Gulf Ferro Alloys Company (Sabayek); Glencore; Jindal Group; S.C. Feral S.R.L; SAIL; Samancore Chrome; Shanghai Shenjia Ferroalloys Co. Ltd; Tata Steel Limited

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase; addition or alteration to country, regional, and segmentation scope

Pricing and purchase options

Avail customized purchase options to meet your exact research requirements; Explore purchase options

Global Ferroalloys Market Report Segmentation

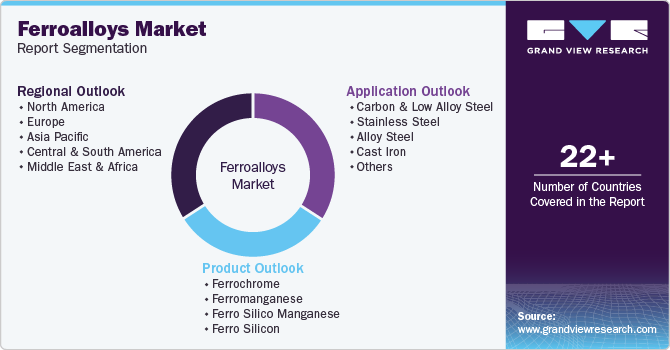

This report forecasts revenue and volume growth of the market at the global, country, and regional levels and provides an analysis of the latest trends in each of the sub segments of the market from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global ferroalloys market report based on product, application, and region.

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Ferrochrome

-

Ferromanganese

-

Ferro Silico Manganese

-

Ferro Silicon

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Carbon & Low Alloy Steel

-

Stainless Steel

-

Alloy Steel

-

Cast Iron

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global ferroalloys market was valued at USD 50.35 billion in 2023 and is expected to reach USD 53.57 billion in 2024.

b. The global ferroalloys market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 86.72 billion by 2030.

b. Based on product, the ferro silico manganese segment accounted for the largest revenue share of over 45.0% of the market in 2023 owing to the surging steel demand from the EV and aerospace industries.

b. Some key players in the global ferroalloys market are Gulf Ferro Alloys Company (Sabayek), Glencore, Jindal Group, S.C. Feral S.R.L, SAIL, Samancore Chrome, Shanghai Shenjia Ferroalloys Co. Ltd, and Tata Steel Limited.

b. The key drivers for the growth of the global ferroalloys market are the increasing non-residential construction in developed countries and the surging number of low-cost, affordable housing unit projects in emerging countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.