- Home

- »

- Consumer F&B

- »

-

Whipping Cream Market Size & Share, Industry Report, 2030GVR Report cover

![Whipping Cream Market Size, Share & Trends Report]()

Whipping Cream Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dairy, Non-dairy), By Application (B2B, B2C), By Distribution Channel (Online, Offline), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-3-68038-295-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Whipping Cream Market Summary

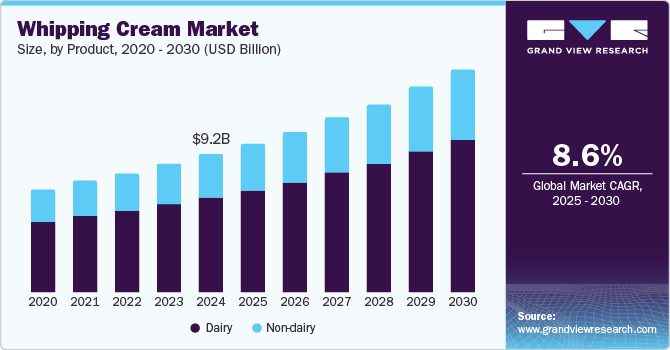

The global whipping cream market size was valued at USD 9.15 billion in 2024 and is projected to reach USD 14.91 billion by 2030, growing at a CAGR of 8.6% from 2025 to 2030. The rising global population and growing consumption of food and beverage items such as ice creams, cupcakes, pies, cakes, waffles, and hot chocolate milkshakes have created substantial demand for whipping cream.

Key Market Trends & Insights

- North America accounted for a leading revenue share of 38.1% in the global whipping cream market in 2024.

- The U.S. accounted for a dominant revenue share in the North American market in 2024.

- By product, the dairy segment accounted for a dominant revenue share of 69.1% in the global market in 2024.

- By application, the B2B segment accounted for a leading revenue share in the global market in 2024.

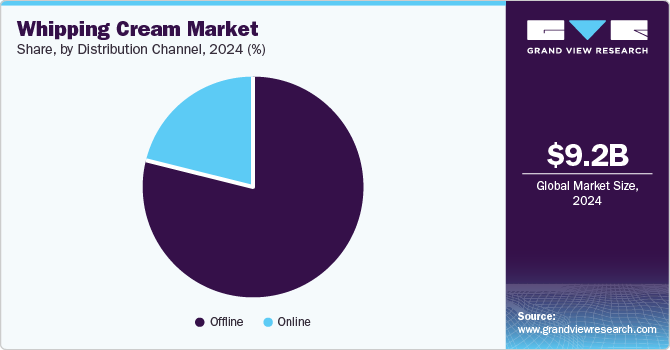

- By distribution channel, the offline segment accounted for the largest revenue share in the global whipping cream industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.15 Billion

- 2030 Projected Market Size: USD 14.91 Billion

- CAGR (2025-2030): 8.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, innovations such as ultra-high temperature processing have helped extend the shelf life of this product while preserving texture and flavor. This method allows manufacturers to offer products that require no refrigeration until opened, improving user convenience.The continued expansion of the baking industry presents another notable growth avenue for the whipping cream industry. Whipping cream is used in various baking recipes, including cakes, scones, muffins, and cookies, to add moisture, richness, and a tender crumb. The fat content in whipping cream helps to create a finer crumb in cakes and other baked goods, leading to a lighter, fluffier texture. Additionally, whipping cream can be added to various doughs and batters, such as those for biscuits, pancakes, or waffles, to achieve a softer and more delicate texture. Recent advancements and innovations in emulsification technology have helped improve the stability of whipped cream, thus lowering the risk of separation and improving its performance in culinary and baking applications.

The increasing popularity and sales of light whipping cream products containing around 30% fat have also been a major driver of market growth. This trend has been driven by the increase in health-conscious populations that aim to reduce their caloric intake while still enjoying creamy textures in their food. Furthermore, the emergence of flavored whipping creams such as chocolate, vanilla, coffee, orange, and cinnamon is expected to further boost the appeal of the whipping cream industry. Social media has played an important role in aiding product demand because of a steadily increasing number of food bloggers and the extensive availability of posts and videos that showcase various unique ways to utilize whipping cream as a decorative component in tarts, pies, and cakes, among other items.

Product Insights

The dairy segment accounted for a dominant revenue share of 69.1% in the global market in 2024. Dairy whipping cream has been conventionally preferred by retail customers as well as commercial bakers and chefs, owing to its widespread availability and economical nature when compared to its vegan alternatives. Furthermore, dairy-based products with different fat contents are available to help address a wider demographic of diet-conscious consumers. This type of whipping cream is generally associated with indulgence and premium quality, particularly in desserts and baked goods. As consumers look for richer and more luxurious options in food products, the demand for dairy-based whipping cream is expected to grow in the coming years.

Meanwhile, the non-dairy segment is expected to grow at a faster CAGR during the forecast period. The rapidly expanding vegan population and increasing prevalence of lactose intolerance have compelled manufacturers to launch non-dairy plant-based alternatives. Common examples of this type include coconut cream, soy-based cream, oat-based cream, cashew cream, and almond-based cream. Depending on the base used, plant-based whipping creams can offer a range of subtle flavors, enhancing both sweet and savory dishes. Many plant-based creams, especially those from oats, almonds, or soy, have a lower environmental impact compared to dairy products, including reduced water usage and lower greenhouse gas emissions. In January 2023, Alamance Foods announced the launch of the ‘Whipt’ dairy-free whipped cream alternative in three variants - almond, oat, and coconut. Similar developments by other companies have enabled healthy segment growth.

Application Insights

The B2B segment accounted for a leading revenue share in the global market in 2024. Whipping cream remains in high demand from several major industries, including food service, bakery, dairy, and confectionery, which heavily depend on this product during food and beverage production. Restaurants, cafes, and hotels use whipping cream in various applications, such as toppings for coffee drinks, desserts, and creamy sauces. Moreover, large-scale catering businesses that supply food for events such as weddings, parties, and corporate functions generally utilize whipping cream for desserts and creamy dishes, thus creating a steady demand. The trend toward premium products, convenience foods, and indulgent experiences has helped keep a consistent demand for high-quality dairy whipping cream in the B2B sector.

The B2C segment is anticipated to grow at the fastest CAGR from 2025 to 2030, as whipping cream plays a crucial role in households, catering to consumers who use it for various cooking and baking applications. The increasing popularity of home baking trends, particularly after the COVID-19 pandemic, has resulted in the increased use of whipping cream to enhance cakes, cupcakes, pies, pastries, and other baked goods. It is essential for making whipped cream for toppings and for integrating into batters and frostings. Moreover, consumers also use whipping cream to make rich sauces, soups, and creamy dishes at home, such as Alfredo sauce, creamy soups, or mashed potatoes. As a result, companies are launching different types of whipping creams that can effectively address varied consumer requirements.

Distribution Channel Insights

The offline segment accounted for the largest revenue share in the global whipping cream industry in 2024, as this mode ensures instant availability of the product, making it a preferred choice for customers. Furthermore, consumers generally prefer purchasing whipping cream in a fresh form without the presence of preservatives, which ensures steady product sales through convenience stores and supermarkets. Retailers often introduce seasonal packaging or promotions during peak periods such as holidays, which encourages higher sales. Consumers are more likely to buy whipped cream when it is promoted alongside other holiday-specific ingredients such as pies, cakes, or baking supplies.

The online segment is anticipated to grow from 2025 to 2030. Consumers are increasingly opting for online shopping platforms such as Amazon and Walmart and local grocery delivery services to purchase whipped cream. These channels offer consumers the ability to shop from home and have products delivered to their doorsteps. Brands are extensively making use of social media platforms to promote their products, which helps generate more sales. Online retailers typically list more options than local stores, including both dairy and non-dairy options, thus giving consumers more choices and the ability to compare different products easily.

Regional Insights

North America accounted for a leading revenue share of 38.1% in the global whipping cream market in 2024. Increasing use of this product in baking and culinary preparations and consistently strong demand for desserts and sweet food items have driven industry expansion. Additionally, the availability of plant-based and organic options has helped companies cater to a wider customer base in regional economies such as the U.S. and Canada, which have a steadily growing demographic of vegans.

U.S. Whipping Cream Market Trends

The U.S. accounted for a dominant revenue share in the North American market in 2024. The market has been mainly driven by factors ranging from consumer preferences in food preparation and dining trends to shifts in the broader dairy industry. The prevalent coffee culture in the economy has contributed significantly to market demand, as whipped cream is widely used in coffee shops for specialty drinks and seasonal offerings.

Europe Whipping Cream Market Trends

The European market for whipping cream accounted for a significant revenue share in 2024. Economies such as France, Italy, and Germany have traditionally been leading consumers of whipping cream in various savory and sweet dishes. Whipping cream is a staple ingredient in European cuisines, from making sauces and soups to creating rich pastries, desserts, and beverages. Moreover, the increasing demand for premium and gourmet food products across the region has contributed to the rising consumption of whipping cream.

Asia Pacific Whipping Cream Market Trends

The Asia Pacific region is anticipated to expand at the fastest CAGR from 2025 to 2030. The steadily increasing population in regional economies such as China, Japan, and India and a continued shift in dietary preferences have created a competitive market for whipped cream products. The emergence of a health-conscious customer base has led to a rise in demand for low-fat and sugar-free whipping creams. Many consumers are opting for healthier versions of traditionally indulgent products, and brands are addressing this requirement by introducing reduced-fat or zero-sugar whipping cream varieties. Such initiatives have created promising growth prospects for the regional market.

China accounted for the largest revenue share in the Asia Pacific market in 2024 and is expected to maintain its position during the forecast period. Increasing westernization and urbanization in the country have resulted in a substantial demand for Western-style desserts, including cakes, pastries, and ice cream, which often use whipping cream as a key ingredient.

Key Whipping Cream Company Insights

Some major companies in the global whipping cream industry include Hanan Products, Conagra Brands, and Cabot Creamery.

-

Hanan Products is a leading global manufacturer of high-quality whipped toppings, icings, and dessert fillings that food distributors and bakeries extensively use. The company develops a range of products, including natural whipped toppings, dairy whipped toppings, vegan whipped toppings, ready-to-whip, and pre-whipped icings, and tres leches.

-

Conagra Brands is a major packaged food company that is known for offering products across various categories, such as frozen foods, snacks, condiments, and meals. The company operates with a portfolio of well-known brands, catering to both consumers and food service markets.

Key Whipping Cream Companies:

The following are the leading companies in the whipping cream market. These companies collectively hold the largest market share and dictate industry trends.

- Rich Products & Solutions Pvt Ltd

- Hanan Products Co., Inc.

- GCMMF

- Conagra Brands

- Gay Lea Foods Co-operative Ltd.

- Cabot Creamery

- Borden Dairy

- Gruenewald Manufacturing Company, Inc.

- LACTALIS

- Granarolo S.p.A

Recent Developments

-

In October 2023, Hanan Products announced the launch of its novel ‘Top 'n Fil Deluxe’ ready-to-whip icing and filling. The topping can be used to fill doughnuts and decorate cakes and pies, offering a consistent texture and stability that makes it suitable for commercial usage.

-

In July 2023, Lactalis American Group announced the launch of the Président Whipped Crème gourmet-style line of whipped crème for outdoor occasions such as parties and gatherings.

Whipping Cream Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.88 billion

Revenue forecast in 2030

USD 14.91 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa; Saudi Arabia

Key companies profiled

Rich Products & Solutions Pvt Ltd; Hanan Products Co., Inc.; GCMMF; Conagra Brands; Gay Lea Foods Co-operative Ltd.; Cabot Creamery; Borden Dairy; Gruenewald Manufacturing Company, Inc.; LACTALIS; Granarolo S.p.A

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Whipping Cream Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global whipping cream market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy

-

Non-dairy

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.