- Home

- »

- Alcohol & Tobacco

- »

-

Wine Cork Market Size And Share Analysis Report, 2028GVR Report cover

![Wine Cork Market Size, Share & Trends Report]()

Wine Cork Market (2022 - 2028) Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Distribution Channel (Offline, Online), By Region (North America, Europe, APAC, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-938-5

- Number of Report Pages: 74

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wine Cork Market Summary

The global wine cork market size was valued at USD 5.7 billion in 2021 and is expected to reach USD 7.8 billion by 2028, growing at a CAGR of 4.6% from 2022 to 2028. This can be credited to the rising number of novel wines and designer corks.

Key Market Trends & Insights

- Europe dominated the market and accounted for the largest revenue share of 89.0% in 2021.

- Asia Pacific is expected to witness a CAGR of 3.5% from 2022 to 2028.

- By type, the natural type segment dominated the market and accounted for the highest revenue share of 92.5% in 2021.

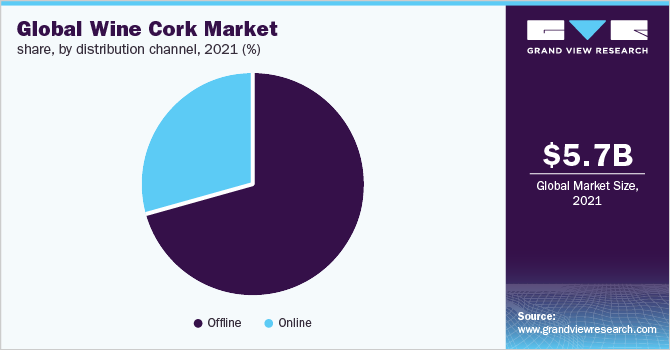

- By distribution channel, the offline segment dominated the market and accounted for the largest revenue share of more than 70% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 5.7 Billion

- 2028 Projected Market Size: USD 7.8 Billion

- CAGR (2022-2028): 4.6%

- Europe: Largest market in 2021

The demand for natural cork is on the rise owing to its ability to preserve wine for a longer time with good storage capability. There are also the latest types of cork available in the market such as synthetic, plastic, etc. which offer similar properties such as natural cork. All these factors are expected to boost market growth over the forecast period. The ongoing coronavirus crisis has resulted in unprecedented economic damage to various industries across both developed and emerging economies, and the wine cork industry is no exception.A large number of people have lost their jobs, and several more are in the process of joining the unemployment population. As a result, a growing number of individuals are hesitant about spending resources on non-essential goods and services. Also, bars, restaurants, hotels, cruise ships, etc., have increasingly had to bear severe economic losses during this period. As such, these sectors are aiming to minimize the risk of future crises. The production of alcoholic beverages has been disrupted, causing the industry to suffer significant losses. With the reduction in wine production, the demand for wine corks has dropped significantly, thus becoming a major restraining factor for the market.

As respective lockdowns are currently being relaxed/lifted in most countries, in all likeliness, in a phase-by-phase process, manufacturers operating in this target market are expected to continue to face challenges related to labor shortages and hampered logistical set-ups. In addition, a new strain of the virus has been detected in many countries, resulting in countries such as China, the United Kingdom, Germany, etc., going into a mandatory lockdown phase once again. Rising wine consumption, especially among the young population, owing to rising income levels, changing lifestyles, and emerging socialization trends, is one of the important factors that is expected to boost revenue growth for the market.

Apart from this, inclination toward luxury and premium products also contributes to the market growth as moderate consumption of wine is associated with a reduced risk of heart disease, stroke, diabetes, and digestive tract infections. In addition, the increasing use of fine wine varieties in gourmet cooking to enhance the flavor, aroma, and taste of finished dishes is driving the market. As a result, their application is expanding in the bakery and confectionery sector for baking cakes, brownies, candies, etc. The growing popularity of wine tourism is expected to boost the sales of exotic and unique wines and provide lucrative opportunities for market players.

The biggest consumer of corks is the wine industry. The suitable size and type of wine cork to be fitted on the bottle are considered according to the type of wine to be stored in a bottle. The manufacturers are anticipated to sustain the strong customer relationships by ruling new product design launches of corks for a variety of wine bottles. Upward investment by key players to launch new products is further expected to boost the industry sales. Recent developments in the wine and wine accessories industry such as the adoption of sensors and the advent of various types of new wine stoppers are expected to drive the market demand over the forecast period. While rising usage of plastic or metal caps in various regions could hamper the market.

The market is undergoing a green revolution as numerous players are developing recyclable corks. This trend of recyclable corks is gaining momentum across the industry For instance, in 2019, Burlington Drinks, an independent U.K.-based beverage company, has launched a range of beverages that comprises recycled corks made from more than 90% recycled sugar cane. Cork recycling services are also being rolled out around the world to facilitate seamless recycling. RecycleBox, a cork recycling service launched by U.K.-based First Mile, is a classic example. In addition, recently in January 2022, ReCORK, one of the largest natural wine cork recycling programs in North America, has collected 110 million natural wine corks for recycling. Such developments highlight the growing influence of recyclable cork.

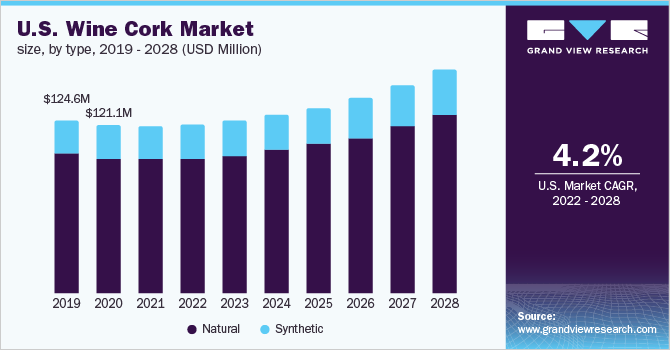

Type Insights

The natural type segment dominated the market and accounted for the highest revenue share of 92.5% in 2021. Natural corks have the ability to expand and contract as per the required degree to the airtight seal of a wine bottle. This natural cork guarantees the evolution and matureness of wine in the best conditions. These factors are projected to boost the growth of this segment in the upcoming years.

The synthetic segment is expected to register the highest growth over the forecast period owing to its growing demand. They last longer than natural cork as the material required for manufacturing is not natural, so there is less possibility of cork taint which is an important problem in wine storage. The oxygen transfer rates through synthetic cork are predictable and fixed. They are also antibacterial and have tight seals, thus, the segment is estimated to showcase growth over the forecast period.

Distribution Channel Insights

The offline segment dominated the market and accounted for the largest revenue share of more than 70% in 2021. Offline distribution channels of wine are expected to dominate the market owing to the organized wine retail network in developed and developing regions. Increasing product sales through specialty stores are expected to play an important role in the offline segment to maintain its market position.

The online distribution channel is the fastest-growing segment and is expected to witness significant gains over the forecast period. The segment is growing at 5.5% from 2022 to 2028 owing to the growing e-commerce platform globally. Higher Internet and smartphone penetration and the introduction of payment solutions for customers are driving the market. However, uncertainty about the product quality is challenging the growth of this segment over the forecast period.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 89.0% in 2021. The region held the majority of the industry’s share in 2021 as the majority of cork production is done in the region. In addition, the traditional culture of consuming wine at family gatherings, wedding ceremonies, functions, festivals, etc. is propelling the demand for corks. Increasing demand from young consumers for different types of wines will further drive market growth. Additionally, the rising per capita income and upsurge in the usage of social platforms are also positively affecting regional growth.

In Asia Pacific, the market is expected to witness a CAGR of 3.5% from 2022 to 2028. This can be endorsed by the growing demand for a variety of wines. Furthermore, there has been significant growth in millennials in this region. Meanwhile, the North American wine cork market is expected to flourish over the forecast period, owing to the growing trend of online alcohol shopping across the region. Major winemakers are likely to see an increase in cork sales due to the rising demand for wine on online platforms.

Key Companies & Market Share Insights

Key players are increasing investments in research and development in the industry for the advancement in wine machinery such as the implementation of sensors and influx of various types of new wine cork stoppers. Moreover, synthetic cork manufacturers are also developing techniques to utilize plant-based polymers from sugar cane and corn for cork stopper production. Players are also trying to develop wine corks that not only help preserve the wine but are also cost-effective. Plastic cork is also considered a better choice due to enhanced hygiene and manufacturing capacity. Therefore, players in the market are more focused on developing plastic corks. Some of the prominent players in the wine cork market include:

-

Amorim Cork, S.A, Ltd.

-

Jelinek Cork Group

-

Waterloo Container Company

-

J. C. Ribeiro, S. A.

-

We Cork Inc.

-

Elkem Silicones limited

-

Precision Elite limited company

-

WidgetCo, Inc.

-

Allstates Rubber & Tool Corp

-

M.A. Silva Usa, Llc

Recent Developments

-

In August 2022, Waterloo Container announced the renewal of its agreement with Amcor Flexibles Capsules, a leading distributor of the STELVIN® brand wine closure. This renewed partnership with Amcor allowed Waterloo Container to grow as a premier packaging provider in the wine sector

-

In February 2021, M. A. Silva USA collaborated with M. A. Silva, Portugal to launch their latest cork technology and product NEOTECH® for the wine industry. This micro-agglomerate cork is an upgraded version of the previous Pearl® and Pearl Prestige® corks, designed to offer cork with non-detectable levels of TCA

Wine Cork Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 5.8 billion

Revenue forecast in 2028

USD 7.8 billion

Growth Rate

CAGR of 4.6% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Portugal; Spain; France; China; Japan; Saudi Arabia; Chile

Key companies profiled

Amorim Cork, S.A, Ltd.; Jelinek Cork Group; Waterloo Container Company; J. C. Ribeiro, S. A.; We Cork Inc.; Elkem Silicones limited; Precision Elite limited company; Widgetco, Inc.; Allstates Rubber & Tool Corp; M.A. Silva Corks USA, LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global wine cork market report on the basis of type, distribution channel, and region:

- Type Outlook (Revenue, USD Million, 2017 - 2028)

- Natural

- Synthetic

- Distribution Channel Outlook (Revenue, USD Million, 2017 -2028)

- Offline

- Online

- Regional Outlook (Revenue, USD Million, 2017 - 2028)

- North America

- U.S.

- Europe

- Portugal

- Spain

- France

- Asia Pacific

- China

- Japan

- Central & South America

- Chile

- Middle East & Africa

- Saudi Arabia

- North America

Frequently Asked Questions About This Report

b. The global wine cork market size was estimated at USD 5.7 billion in 2021 and is expected to reach USD 5.8 billion in 2022.

b. The global wine cork market is expected to grow at a compound annual growth rate of 4.6% from 2022 to 2028 to reach USD 7.8 billion by 2028.

b. Europe dominated the wine cork market with a share of 89.0% in 2021. This is attributable to the traditional culture of consuming wine at family gatherings and wedding ceremonies along with increasing demand from young consumers for different types of wines.

b. Some key players operating in the wine cork market include Waterloo Container Company; J. C. Ribeiro, S. A.; Amorim Cork, S.A, Ltd.; We Cork Inc.; Jelinek Cork Group; Widgetco, Inc.; M.A. Silva Usa, Llc; Allstates Rubber & Tool Corp; Precision Elite limited company; and Elkem Silicones limited

b. Key factors that are driving the wine cork market growth include the rise in the population consuming alcoholic beverages and considering it as a way of social recognition.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.