- Home

- »

- Homecare & Decor

- »

-

Wine Tourism Market Size, Share & Trends Report, 2030GVR Report cover

![Wine Tourism Market Size, Share & Trends Report]()

Wine Tourism Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Wine Tastings & Tours, Wine Festivals & Events), By Tourist Type (Domestic, International), By Booking Mode (Direct Booking, Travel Agencies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-423-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wine Tourism Market Summary

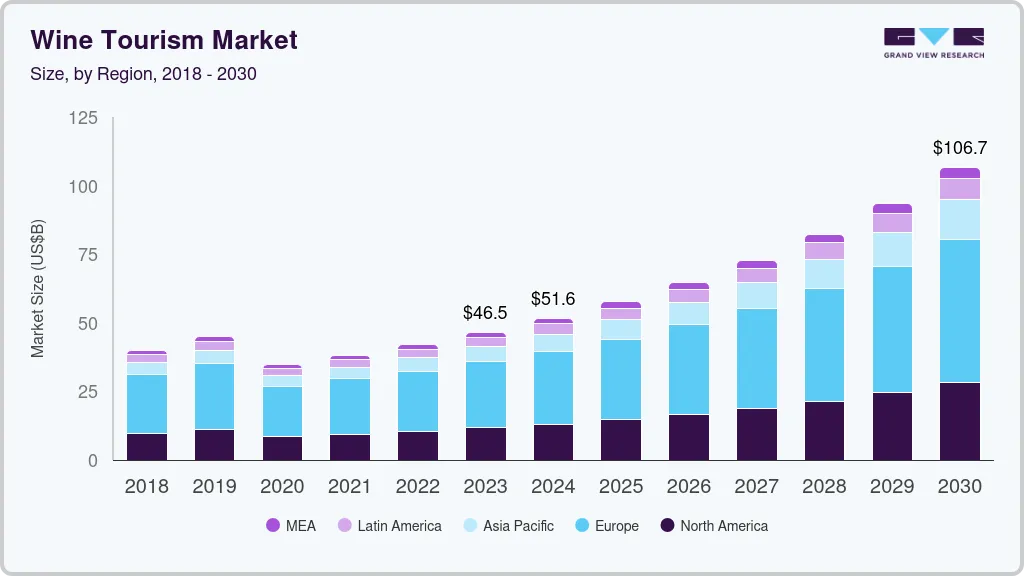

The global wine tourism market size was estimated at USD 46.47 billion in 2023 and is anticipated to reach USD 106.74 billion by 2030, growing at a CAGR of 12.9% from 2024 to 2030. This growth is driven by increasing consumer interest in unique and immersive wine experiences, expanding global travel, and rising investments in wine-related tourism infrastructure.

Key Market Trends & Insights

- The wine tourism market in North America accounted for a share of 25.10% of the global market revenue in 2023.

- Wine tourism market in the U.S. is expected to grow at a CAGR of 14.0% from 2024 to 2030.

- Based on service, the wine tastings and tours segment accounted for over 57% of revenue share in 2023.

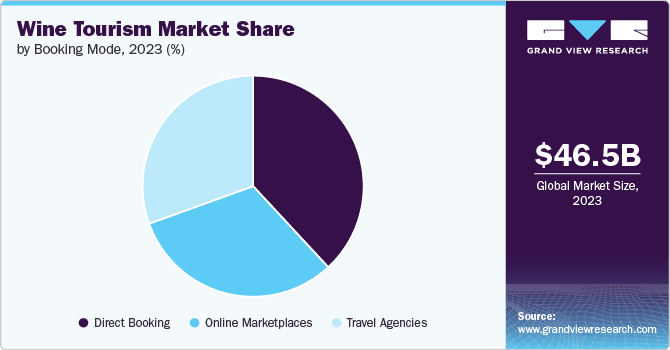

- Based on booking mode , direct bookings segment accounted for over 38% of revenue share in 2023.

- Based on tourist type, the domestic tourists segment contributed over 64% of the revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 46.47 Billion

- 2030 Projected Market Size: USD 106.74 Billion

- CAGR (2024-2030): 12.9%

- North America: Largest market in 2023

Enhanced digital tools and sustainable practices are also contributing to the market's growth. Emerging wine-tourism destinations are increasingly gaining prominence as global interest in wine tourism expands. Central and Eastern European countries, such as Moldova, with its extensive underground cellars and historical wine heritage, and Croatia, known for its Istrian Peninsula's combination of wine, agritourism, and gastronomy, are notable examples. Georgia, with its ancient winemaking traditions, is developing its wine tourism sector alongside support for rural communities.

Bulgaria and Ethiopia also show potential, with Bulgaria's historical wineries and Ethiopia's new wine production venture by Castel Group highlighting their emerging wine-tourism appeal. These regions are positioning themselves as attractive destinations by leveraging their unique cultural and historical assets.

Millennials, born between the early 1980s and 2000, have become the leading consumers of wine, with a preference for value-focused wines and a strong interest in immersive wine experiences. Millennials are the key consumer groups in the wine tourism market. Technologically savvy and environmentally conscious, they leverage online tools and apps for wine education and planning. Despite tighter budgets, they are significant spenders on experiences, with 43% having visited multiple winery tasting rooms annually, according to a survey by Wine Opinions.

According to the 2023 Arizona Wine Tourism Industry Report, around 40% of tourists take day trips to wineries or festivals, while 30% opt for stays of two to three nights. Over 70% of visitors purchase wine during their visits, with wine festivals becoming increasingly popular for wine purchases, averaging 2.25 bottles per party compared to 1.89 bottles at wineries. Additionally, 35% of festival-goers use these events as opportunities to explore other areas, with some extending their trips by up to five days. Word of mouth is the primary driver of winery awareness, while social media is most effective for wine festivals. The Verde Valley region sees the highest visitor spending at $109 per night, and wine tourism is particularly popular among middle- to upper-income individuals.

Service Insights

Wine tastings and tours accounted for over 57% of revenue share in 2023. These experiences offer tourists a unique opportunity to explore vineyards, learn about winemaking processes, and sample a variety of wines directly from the source. The growing consumer interest in authentic and experiential travel, coupled with the ability to connect with local culture and traditions, has made wine tastings and tours highly appealing. Additionally, the rise of premium and boutique wineries, which often offer personalized and exclusive experiences, has further fueled demand, making tastings and tours the most lucrative service type in the wine tourism market.

The revenue from wine festivals & events is expected to grow at a CAGR of 13.7% from 2024 to 2030. Wine festivals & events are a vital revenue source in the wine tourism market, drawing large crowds of both local communities and international visitors. These events, often held after the grape harvest, celebrate regional wine culture through tastings, local cuisine, music, and arts, enhancing the visitor experience and driving significant economic impact. Notable festivals like Germany's Bad Dürkheim Wurstmarkt, France's Bordeaux Wine Festival, and Argentina's La Fiesta Nacional de la Vendimia attract hundreds of thousands of attendees, boosting local businesses, increasing wine sales, and promoting the wine region globally, making them integral to the growth and sustainability of wine tourism.

Booking Mode Insights

Direct bookings accounted for over 38% of revenue share in 2023, reflecting the preference for personalized booking experiences and the increasing ease of accessing winery websites for reservations. Direct bookings offer consumers better control over their itineraries, immediate confirmation, and often exclusive deals, which drives their substantial contribution to market revenue.

Revenue from online marketplace bookings is projected to witness a CAGR of 13.4% from 2024 to 2030. This growth is fueled by the expanding digitalization of travel planning, the convenience of comparing multiple options in one place, and the increasing trust in online platforms for secure transactions. For example, platforms like Viator and GetYourGuide enable travelers to easily compare wine tours and tastings from various operators, offering extensive choices and real-time booking options.

Tourist Type Insights

In 2023, domestic tourists contributed over 64% of the revenue share in the wine tourism market due to their proximity to wine regions and the growing trend of local travel. Economic factors such as cost-effectiveness, ease of access, and a deeper cultural connection to domestic wine traditions have also played a significant role in driving local wine tourism.

The demand for wine tourism among international/foreign tourists is expected to grow at a CAGR of 13.3% from 2024 to 2030, driven by increasing global interest in unique cultural experiences, the rising popularity of wine regions as vacation destinations, and enhanced marketing efforts by wineries targeting foreign visitors. Additionally, the expansion of direct flights and improved infrastructure in emerging wine regions are making these destinations more accessible to international travelers, further boosting growth.

Regional Insights

The wine tourism market in North America accounted for a share of 25.10% of the global market revenue in 2023. Wine tourism in America has experienced notable growth, driven by increasing consumer interest and the allure of immersive vineyard experiences. Regions such as California's Napa Valley, Oregon's Willamette Valley, and New York's Finger Lakes have become prominent destinations, attracting visitors and boosting local economies. This expansion is not only reflected in direct wine sales and event revenues but also in job creation and the broader economic benefits to surrounding communities, including increased demand for hospitality and related services.

U.S. Wine Tourism Market Trends

Wine tourism market in the U.S. is expected to grow at a CAGR of 14.0% from 2024 to 2030. According to the Economic Policy Institute (EPI), 2023 Arizona Wine Tourism Industry report, strong satisfaction levels were observed among visitors to Arizona's wine tourism experiences, contributing to the growth of the U.S. wine tourism market. Specifically, 96% of winery visitors reported that their experiences met or exceeded expectations, with 67% finding their visit better than expected. Similarly, 94% of wine festival attendees expressed high satisfaction, with 66% stating they "loved" the event, and 94% likely to recommend it to others. These positive experiences are likely driving the continued expansion and appeal of wine tourism in the U.S.

Europe Wine Tourism Market Trends

In 2023, Europe led the global wine tourism market, accounting for over 51% of total revenue, driven by the region's deep-rooted wine culture and the appeal of visitor-friendly wineries in Spain, Italy, and France. Continuous innovation and professionalization in the sector, highlighted by France's Vignobles & Découvertes label with its 72 destinations, have significantly boosted visitor numbers. Additionally, the U.K.'s rapidly expanding wine tourism industry, marked by a 55% increase in vineyard visits in 2024, according to WineGB, further highlights Europe wine tourism market growth.

Asia Pacific Wine Tourism Market Trends

The Asia Pacific wine tourism market is expected to grow at a CAGR of 14.9% from 2024 to 2030, driven by the increasing popularity of wine tourism destinations in countries like Australia, New Zealand, and China. In Australia, the Barossa Valley and Hunter Valley are attracting a growing number of international tourists, drawn by premium wine tastings and vineyard experiences. New Zealand's Marlborough region, known for its Sauvignon Blanc, is also seeing a surge in wine tourism, with visitors engaging in winery tours and culinary events. In China, regions like Ningxia are rapidly emerging as key wine tourism destinations, supported by government initiatives and the growing domestic interest in wine culture. Meanwhile, India’s Nashik Valley, known as the "Wine Capital of India," is also seeing a rise in wine tourism, bolstered by the country's growing middle class and expanding wine culture.

Key Wine Tourism Company Insights

Key companies in the wine tourism market are leveraging their strong brand presence and innovative offerings to capture a significant market share. Companies are also focusing on digital marketing and partnerships with travel agencies to attract a global audience. Travel agencies and tour operators in the wine tourism market are adopting several strategies to gain a competitive edge. They are increasingly offering personalized and exclusive experiences, such as private vineyard tours, curated wine-tasting sessions with expert sommeliers, and behind-the-scenes access to wineries. To cater to the growing demand for experiential travel, operators are bundling wine tours with other cultural and gastronomic experiences, including cooking classes, local food pairings, and visits to historical sites.

Key Wine Tourism Companies:

The following are the leading companies in the wine tourism market. These companies collectively hold the largest market share and dictate industry trends.

- The Prisoner Wine Company

- VIAVINUM, S.L

- Wine Paths

- Grape Escapes

- Cellar Tours

- BKWine Tours

- Pure Luxury Transportation

- Backcountry Wine Tours

- Sula Vineyards

- Wine Compass

Recent Developments

-

In July 2024, Wine Enthusiast Companies launched the Wine Enthusiast Tasting Room Directory, developed in partnership with Tock, to enhance wine tourism. This new platform features thousands of global tasting room listings with interactive maps, ratings, reviews, and direct booking options. The directory aims to provide a comprehensive and user-friendly resource for travelers seeking unique wine experiences, reflecting the growing demand for digital and dynamic tools in wine tourism.

-

In July 2024, the Lugana DOC region, centered around Lake Garda in Italy, witnessed major investments from prominent wineries and a new “Wine Tourism Project” by the Lugana Consortium. This initiative includes a comprehensive guide for visitors, highlighting local wineries and experiences, and underscores the economic importance of direct wine sales.

-

As of February 2023, wine tourism is reviving with a range of new experiences. Notable updates include new cellars and renovations at Château Balastard la Tonelle, Château Pichon Baron, and Château Haut-Brion, alongside innovative offerings like the low-carbon wine road trip with La Bulle Verte in Bordeaux. The Route de Bordeaux Graves et Sauternes now features eco-friendly travel options, while Château Kirwan in Margaux introduces unique activities such as wine and sophrology experiences. Wine tourism is increasingly blending traditional tastings with wellness and sustainability.

Wine Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 51.63 billion

Revenue forecast in 2030

USD 106.74 billion

Growth rate (Revenue)

CAGR of 12.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, tourist type, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Australia; Brazil; Argentina; South Africa

Key companies profiled

The Prisoner Wine Company; VIAVINUM S.L; Wine Paths; Grape Escapes; Cellar Tours; BKWine Tours; Pure Luxury Transportation; Backcountry Wine Tours; Sula Vineyards; Wine Compass

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wine Tourism Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wine tourism market based on service, tourist type, booking mode, and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wine Tastings and Tours

-

Wine Festivals and Events

-

Others

-

-

Tourist Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Travel Agencies

-

Online Marketplaces

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wine tourism market size was estimated at USD 46.47 billion in 2023 and is expected to reach USD 51.63 billion in 2024.

b. The global wine tourism market is expected to grow at a compound annual growth rate of 12.9% from 2024 to 2030 to reach USD 106.74 billion by 2030.

b. In 2023, Europe accounted for over 50% share of global wine tourism market, owing to the region's region's deep-rooted wine culture and the appeal of visitor-friendly wineries in Spain, Italy, and France.

b. Some of the key market players include VIAVINUM, S.L, Wine Paths, Grape Escapes, Cellar Tours, Wine Compass, and BKWine Tours.

b. Key factors that are driving the wine tourism market growth include increasing consumer interest in unique and immersive wine experiences, expanding global travel, and rising investments in wine-related tourism infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.