- Home

- »

- Communications Infrastructure

- »

-

Wireless Infrastructure Market Size, Industry Report, 2030GVR Report cover

![Wireless Infrastructure Market Size, Share & Trends Report]()

Wireless Infrastructure Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Macrocell RAN, Small Cells, RRH, DAS, Cloud RAN, Carrier WiFi, Mobile Core, Backhaul), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-121-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wireless Infrastructure Market Size & Trends

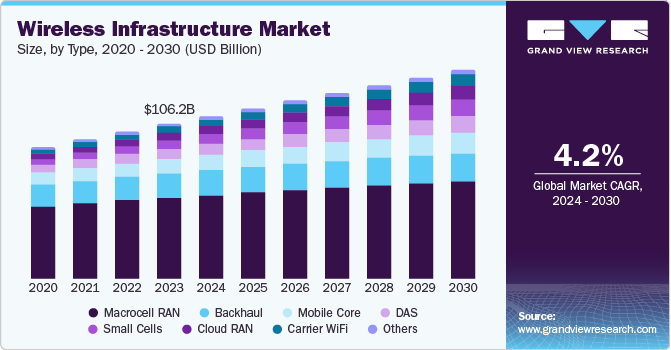

The global wireless infrastructure market size was valued at USD 106.2 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The market growth can be attributed to rapid technological advancements and the growing demand for connectivity. The rising need for high-speed internet is driven by the increasing popularity of fast internet connections and the widespread usage of mobile devices and IoT applications. Continuous improvements to the network and expanded coverage, particularly in developing regions, are essential to meet the increasing number of users and connected devices.

The significant increase in data usage on advanced gadgets such as smartphones, defense electronics, and rugged desktops is a key factor driving the demand for wireless networks worldwide. Moreover, developing smart cities with effective transportation systems, energy management solutions, and public safety networks highlights the significance of reliable wireless infrastructure. These intelligent urban initiatives require extensive network coverage, quick connections with minimal lag, and the capacity to expand to meet the growing demands of a digitally connected city.

The ongoing adoption of 5G technology is also a key driver for the wireless infrastructure market. 5G provides faster data speeds, minimal delay, greater bandwidth, and enhanced network capacity, enabling new innovative applications and services. In addition, 5G networks are expected to provide advantages in various industrial sectors, especially in the Internet of Things (IoT) and artificial intelligence (AI), in which real-time data transfer is essential. This necessitates the investment in fresh infrastructure, including base stations, backhaul networks, and core network equipment, to support the deployment of 5G and fully utilize its features.

Type Insights

The macrocell RAN segment dominated the market and accounted for a revenue share of 52.3% in 2023 attributed to several key driving factors, such as the ongoing deployment and expansion of 5G networks, which rely heavily on macrocells for broader coverage and increased capacity to handle the growing demand for high-speed mobile data. In addition, the demand for network efficiency and cost-effectiveness, enabling a surge in connected devices and data traffic, continues to propel the adoption of macrocells. The ability of macrocell RAN to provide broader geographic coverage makes a vital solution for delivering consistent mobile broadband services across vast regions.

The carrier WiFi segment is expected to register the fastest CAGR of 9.6% over the forecast period. The ongoing demand for continuous and widespread internet connectivity, particularly in high-traffic areas, is driving the segment growth. Furthermore, the increase in bandwidth-intensive applications such as video streaming and online gaming is fueling the demand for carrier WiFi networks. In addition, the rising adoption of smart devices and the Internet of Things (IoT) is expected to significantly increase network strain, driving the need for efficient carrier WiFi solutions to supplement cellular coverage and capacity. Furthermore, the advancements in WiFi technologies, such as WiFi 6 and WiFi 6E, which provide faster speeds and improved network management, are further propelling the growth of the carrier WiFi segment.

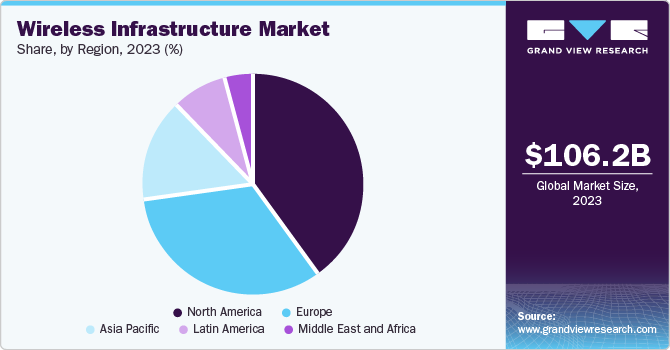

Regional Insights

North America wireless infrastructure market dominated the market with a revenue share of 39.8% in 2023. The region is the pioneer in wireless infrastructure services. Significant investment in infrastructure was driven by the widespread use of smartphones, strong 4G LTE coverage, and the rapid deployment of 5G networks by major carriers in the U.S. and Canada. North America's prioritization of cutting-edge technology such as 5G positions it as a global leader in the wireless infrastructure market.

U.S. Wireless Infrastructure Market Trends

The U.S. wireless infrastructure market dominated North America in terms of revenue share in 2023 due to the technology-savvy population with high adoption of smartphones. Furthermore, major U.S. carriers are invested in expanding and upgrading their networks, including aggressive 5G deployment. The U.S. leads in wireless infrastructure development in North America due to its focus on advanced technologies.

Europe Wireless Infrastructure Market Trends

The Europe wireless infrastructure market was identified as a lucrative region in 2023. Government initiatives and regulations across Europe are encouraging investments in telecommunications infrastructure, creating a favorable atmosphere for market expansion. In addition, the widespread adoption of smartphones and data-driven applications is fueling the demand for high-speed and reliable wireless connectivity, driving infrastructure upgrades in the region.

The UK wireless infrastructure market is expected to grow rapidly in the coming years due to the increase in the Internet of Things (IoT) network, which includes smart cities and connected industries that require wireless, solid infrastructure in the country. In addition, the government's ambitious "UK Wireless Infrastructure Strategy" is encouraging investment in gigabit broadband networks and expanding 4G coverage in rural areas of the country, driving significant investments in wireless infrastructure upgrades.

Asia Pacific Wireless Infrastructure Market Trends

Asia Pacific wireless infrastructure market is anticipated to witness the fastest CAGR during the forecast period. The expected growth in the Asia Pacific region is due to the growing population and rising internet usage. There have been significant rises in commercial mobile users and internet usage in countries such as India and China. The introduction of 5G services in the region and government efforts towards digital transformation are the major driving factors of market growth in the region.

China wireless infrastructure market is expected to grow rapidly in the coming years due to increased internet usage. The government is advocating the adoption of 5G technologies, and the large number of users. Further, a significant and tech-savvy population drives the market. The demand for faster speed and expanded connectivity motivates the country's investment in new base stations and network upgrades.

Key Wireless Infrastructure Company Insights

Some key companies in the wireless infrastructure market include Belden Inc., Comcast, General Cable Corporation, LS Cable & System Ltd., Nexans, and others. The major companies provide services to government, residential, and commercial establishments. The key players are taking several strategic initiatives to gain a competitive edge in the industry.

-

Belden Inc. provides industrial networking and cybersecurity services to its customers. It offers wireless solutions to create the infrastructure that simplifies, enhances, and secures the digital experience. It focuses on connectivity and enabling possibilities with a portfolio guided by performance, expertise in forward-thinking, and solutions designed with a specific purpose in mind.

-

Comcast Corporation is a multinational corporation in the media and technology industry. Comcast’s multi-functional devices provide internet, voice connectivity, complete WiFi coverage throughout the home, network security, control, and high speed for a fully connected experience.

Key Wireless Infrastructure Companies:

The following are the leading companies in the wireless infrastructure market. These companies collectively hold the largest market share and dictate industry trends.

- Belden Inc.

- Comcast

- Siemens Healthineers AG

- General Cable Corporation

- LS Cable & System Ltd.

- Nexans

- Prysmian Group

- Southwire Company, LLC.

- Sumitomo Electric Industries, Ltd.

- TE Connectivity.

- Zhuhai Hansen Technology Co., Ltd.

Recent Developments

-

In July 2024, Belden Inc. completed the acquisition of Precision Optical Technologies, Inc. This acquisition will benefit Belden to grow their solutions offerings in the Enterprise Solutions segment and broadband markets.

-

In July 2024, LS Cable & System (LS C&S) announced its contract to supply submarine cables in the Western United States, a notable achievement for the company. LS Cable & System will provide cables to be installed in Northern California's Sacramento River. The agreement, estimated to be worth around KRW 1 billion, is crucial for LS power as it will strengthen its presence in the U.S.

Wireless Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 111.5 billion

Revenue forecast in 2030

USD 143.0 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Belden Inc.; Comcast; General Cable Corporation; LS Cable & System Ltd.; Nexans; Prysmian Group; Southwire Company, LLC.; Sumitomo Electric Industries, Ltd.; TE Connectivity.; Zhuhai Hansen Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wireless Infrastructure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wireless infrastructure market report based on type and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Macrocell RAN

-

Small Cells

-

RRH

-

DAS

-

Cloud RAN

-

Carrier WiFi

-

Mobile Core

-

Backhaul

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.