- Home

- »

- Clinical Diagnostics

- »

-

Women’s Health Diagnostics Market Size, Share Report 2030GVR Report cover

![Women’s Health Diagnostics Market Size, Share, & Trends Report]()

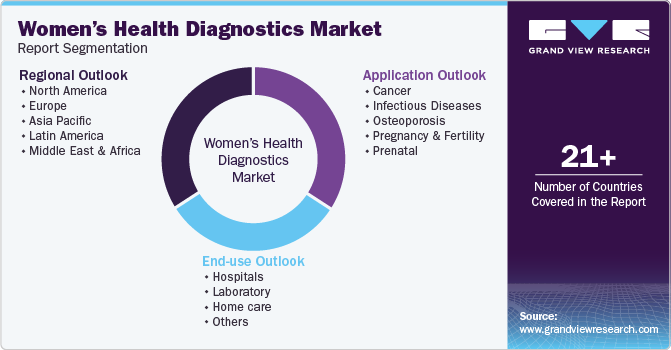

Women’s Health Diagnostics Market (2025 - 2030) Size, Share, & Trends Analysis Report By Application (Cancer, Infectious Disease, Osteoporosis), By End Use (Hospitals, Laboratory, Home Care), By Region

- Report ID: GVR-2-68038-581-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Women's Health Diagnostics Market Summary

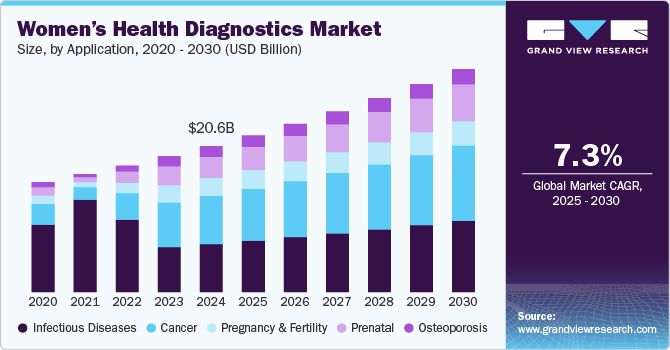

The global women's health diagnostics market size was estimated at USD 20,604.0 million in 2024 and is projected to reach USD 31,458.5 million by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The market growth is driven by the rising prevalence of various health conditions such as cancer, infectious diseases, and others in women, growing health awareness, technological advancements in diagnostic equipment, and the aging of the women's population globally.

Key Market Trends & Insights

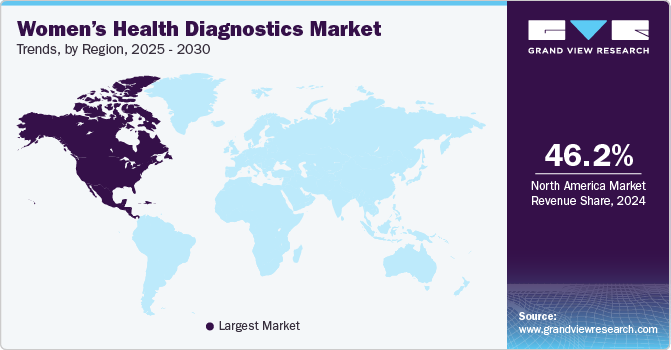

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of applications, cancer accounted for a revenue share of 33% in 2024.

- Prenatal is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 20,604.0 Million

- 2030 Projected Market Size: USD 31,458.5 Million

- CAGR (2025-2030): 7.3%

- North America: Largest market in 2024

Moreover, the developing global healthcare infrastructure is further increasing access to diagnostic care for women, thereby contributing to the market growth.

One of the major factors driving the industry growth is the rising prevalence of conditions specific to women, such as breast and ovarian cancers, endometriosis, and gynecological infections. According to the World Health Organization (WHO), in 2022, approximately 2.3 million women were diagnosed with breast cancer, resulting in around 670,000 deaths globally. The disease affects women of all ages, with higher incidence and mortality rates in low Human Development Index (HDI) countries compared to high HDI nations, highlighting significant healthcare disparities. This surge in disease prevalence has increased awareness and demand for early detection technologies, which are essential for managing women's health issues effectively. This shift towards preventive healthcare significantly contribute to industry growth, as more women engage in diagnostic procedures globally.

Moreover, various awareness initiatives aimed at improving women's health outcomes also contribute to industry growth. As awareness campaigns proliferate, they educate women about the importance of early detection and regular screenings for conditions such as breast cancer, cervical cancer, and reproductive health issues. For instance, the World Health Organization (WHO) initiated the Global Breast Cancer Initiative (GBCI) in 2021 with the aim of decreasing breast cancer mortality rates by 2.5% annually until 2040, ultimately saving 2.5 million lives. This initiative focuses on three main areas: promoting health for early detection, ensuring timely diagnosis, and providing comprehensive management of breast cancer.

Similarly, in December 2024, Horlicks Women's Plus and Apollo Diagnostics announced a partnership to promote women's bone health. The collaboration aims to raise awareness about osteoporosis and the importance of nutrition for strong bones, offering specialized health check-ups and nutritional guidance tailored for women to enhance their overall well-being and bone strength. Such initiatives promote preventive care, encouraging women to engage in regular check-ups and screenings, which directly increases demand for diagnostic services.

Similarly, several market players and organizations are launching diagnostics and screening programs for women, thereby increasing the demand for diagnostic solutions. For instance, in November 2023, FUJIFILM India launched a breast cancer screening and awareness campaign titled "Find It Early, Fight It Early," aimed at promoting early detection among women aged 30-65. Operating in 19 cities with 35 diagnostic centers, the initiative seeks to reach over 90,000 women annually, providing no-cost screenings to enhance healthcare accessibility. Such initiatives significantly increase the access to diagnostic solutions for various health conditions in women and are expected to fuel the industry growth over the forecast period.

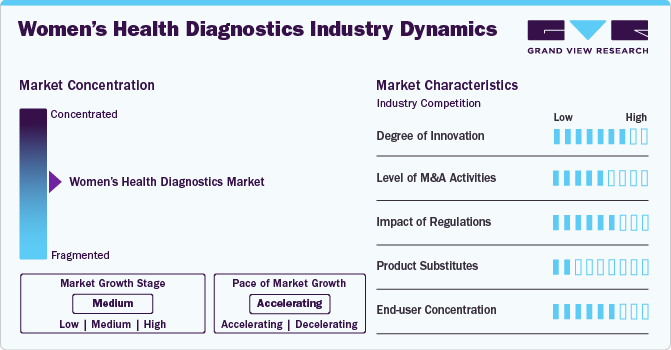

Market Concentration & Characteristics

The market growth stage is moderate, and the pace is accelerating. The women’s health diagnostics industry is characterized by a medium degree of growth due to the increasing prevalence of chronic conditions in women, growing awareness about importance of early disease diagnosis, increasing technological advancements and aging in women population.

The industry is characterized by a high degree of innovation owing to technological advancements in areas such as molecular diagnostics, imaging techniques, and point-of-care testing have significantly improved diagnostic accuracy and accessibility. Furthermore, the increasing adoption of technology to offer diagnostic solutions focused on women's health further contributes to a high degree of innovation. For instance, in April 2024, Included Health announced the launching of its virtual-first specialty care clinics focusing on cancer, women's health, and metabolic health in 2025. These clinics aim to enhance access to over 4,000 specialists, reduce waiting times, and provide integrated care with a focus on diagnostic and monitoring solutions.

The impact of regulations on the industry is significant due to several factors. Stringent regulatory frameworks ensure that diagnostic products meet safety and efficacy standards. However, compliance with these regulations can lead to increased costs and longer timeframes for product development and approval, potentially slowing innovation and market entry for new technologies. Furthermore, regulatory approvals from authorities such as the FDA can enhance market credibility, encouraging investments and driving growth in the market.

The industry is experiencing a surge in Mergers and Acquisitions (M&A) activities as these strategic activities allow companies to enhance their product portfolios and expand their market presence, positioning themselves competitively in the market. For instance, in March 2024, Halma acquired Rovers Medical Devices, a leader in cervical cancer sample collection devices. Rovers' innovative self-sampling brushes enhance screening accuracy and accessibility, supporting WHO’s goal to increase proactive screening by 2030. This acquisition aligns with Halma's mission to improve women's health and strengthen its position in cancer diagnostics.

The threat of product substitutes in the industry is significantly low owing to the high demand for specialized diagnostics: Women's health diagnostics, including tests for breast, ovarian, and cervical cancers, require specific expertise and technology that cannot be offered easily by substitutes. Moreover, the stringent regulatory environment surrounding medical diagnostics creates impacts potential substitutes to enter the market.

Key players operating in the market are increasingly adopting regional expansion strategies to enhance their market presence and address the growing demand. For instance, in March 2024, Lunit, a South Korean AI diagnostics company, is expanding its presence in Europe by securing contracts in France and Portugal to offer chest X-ray and breast cancer detection solutions respectively.

Application Insights

Cancer held the largest revenue share of around 33.00% in 2024. This can be attributed to the rising prevalence of various cancers, such as breast cancer, colorectal cancer, and cervical cancer. For instance, according to the World Cancer Research Fund, 856,979 women were diagnosed with colorectal cancer in 2022. Such a high cancer rate highlights the need for effective diagnostic tools and screening programs. Early detection through regular mammograms and clinical examinations is crucial, as it significantly increases survival rates. Similarly, the rising emphasis on these cancer diagnostics are leading to advancements in diagnostics technologies, further contributing to the segment growth.

The prenatal segment is expected to grow at the fastest CAGR of 9.71 % during the forecast. This growth can be attributed to the combination of rising maternal age, increasing awareness of genetic disorders, and advancements in non-invasive testing technologies. As more women choose to delay childbirth for various reasons, the threat of chromosomal abnormalities in their offspring increases significantly. This demographic shift has led to increased demand for prenatal testing solutions that can effectively screen conditions such as Down syndrome and other genetic disorders. Moreover, the increasing focus on maternal-fetal health awareness and the development of innovative solutions further contributes to this growth. For instance, in March 2023, Devyser launched its first IVDR-certified product, Devyser Compact, a rapid genetic test for testing prenatal chromosomes. This test, which detects chromosomal abnormalities including Down's and Turner syndromes, is the first approved under the new IVDR regulations.

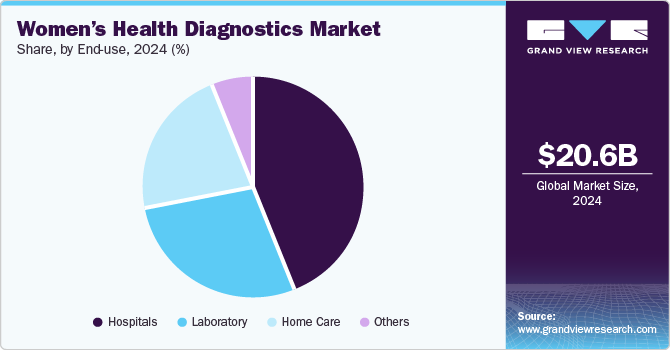

End Use Insights

Hospitals held the largest revenue share in 2024 owing to their being equipped with advanced diagnostic technologies and a multidisciplinary team of healthcare professionals, which enables them to provide a wide range of diagnostic tests and procedures specifically tailored to women's health. This includes essential screenings for conditions such as breast cancer, cervical cancer, and reproductive health issues. Moreover, the increasing partnerships and collaboration of diagnostics solutions companies and hospitals are further increasing the diagnostic capabilities of these facilities, further contributing to their dominance in the market. For instance, in November 2024, NGeneBio, a Korean precision diagnostics firm, signed a contract with Binh Dan Hospital in Vietnam, enhancing its presence in Southeast Asia. This partnership, the third with major Vietnamese hospitals, will provide NGS-based diagnostic reagents for breast cancer and solid tumors.

Home care is expected to witness the fastest growth from 2025 to 2030. This can be attributed to the increasing availability and adoption of self-testing kits, which allow women to manage their health from the comfort of their homes. These kits are designed for various concerns, including pregnancy, ovulation, and infectious diseases, allowing for timely diagnosis without the need for hospital visits. Moreover, the development of more user-friendly diagnostic solutions by market players further contributes to market growth. For instance, in December 2023, Arva Health launched an innovative at-home fertility test customized for women with PCOS and thyroid issues. This test measures 12 hormone levels, providing insights into reproductive health from the comfort of home. Developed with fertility specialists, it aims to empower women to make informed decisions about their fertility.

Regional Insights

North America women’s health diagnostics market accounted for revenue share of 46.21% of the global market in 2024 owing to various factors, including the rising prevalence of chronic diseases, increased awareness of women's health issues, and advancements in diagnostic technologies. The increasing incidence of diseases such as breast and ovarian cancer, which require regular screenings and early detection methods, is a major factor driving market growth. For instance, the American Cancer Society estimates that around 19,680 women can be diagnosed with ovarian cancer in 2024 in the U.S. alone. Moreover, around 12,740 mortalities are estimated to be caused by ovarian cancer in 2024. Such a high prevalence of cancer in women drives the demand for effective diagnostics solutions in the region.

U.S. Women’s Health Diagnostics Market Trends

The women’s health diagnostics market in the U.S. is driven by the increasing awareness of women's health issues and advancements in diagnostic technologies. Moreover, the shift towards preventive healthcare further contributes to market growth as there is a growing emphasis on regular screenings and early detection of diseases, which are crucial in managing women's health effectively. For instance, in February 2022, Eli Lilly launched an educational campaign in collaboration with breast cancer advocacy organizations, including Breastcancer.org and Susan G. Komen, to raise awareness about the complexities of early breast cancer (EBC) and the risk of recurrence. Such initiatives are expected to increase awareness about women's health conditions in the country, thereby increasing the demand for diagnostic solutions and driving market growth.

Canada women’s health diagnostics market is driven by a combination of increasing awareness of women's health issues, advancements in diagnostic technologies, and the changing women demographic of the country. The government and other organizations in Canada are undertaking various initiatives to increase the research initiatives and diagnostics of different health conditions in women. For instance, in November 2024, the Government of Canada announced a USD 545,000 investment in breast cancer research and awareness initiatives. This funding includes USD 295,000 for the Canadian Partnership for Tomorrow's Health to improve data on breast cancer screening practices and USD 250,000 for the Canadian Cancer Society to launch a public awareness campaign targeting women at risk. These efforts aim to enhance understanding and participation in breast cancer screening across diverse populations in Canada. Such initiatives are expected to fuel the market growth over the forecast period.

Europe Women’s Health Diagnostics Market Trends

The women's health diagnostics market in Europe is experiencing significant growth, driven by the increasing prevalence of various disorders among women, including cancers and reproductive health issues. Additionally, the aging population in Europe contributes to the rising need for women's health diagnostics, as older women are more susceptible to various health conditions that require regular monitoring and intervention. According to the World Bank data, around 23% of the women population in Italy was aged 65 years and above in 2023. Thus, this aging population in the region is expected to drive the market growth over the forecast period.

The UK women’s health diagnostics market is experiencing significant growth, driven by increasing awareness regarding women's health issues, particularly concerning conditions such as breast and cervical cancer. Additionally, technological advancements such as advanced imaging technologies and point-of-care testing (POCT), are also playing a crucial role in the growth of the UK market.

The women's health diagnostics market in Germany is driven by the increasing awareness of early disease detection and advancements in medical technology. Germany's healthcare system is highly developed and focuses on preventive care, which has increased demand for diagnostic tools specific to women's health, such as breast cancer screening and gynecological diagnostics. Moreover, the increasing advancements and development of effective solutions further contribute to this growth. For instance, in August 2023, Fertilly launched Europe’s first At-Home Fertility Test Kits utilizing Mitra microsampling devices, allowing individuals to collect blood samples via finger-stick for lab analysis. These medically certified kits aim to empower users with insights into their reproductive health, particularly measuring anti-Müllerian hormone levels, which is crucial for assessing ovarian reserves.

Asia Pacific Women’s Health Diagnostics Market Trends

The Asia Pacific women’s health diagnostics market is driven by a combination of demographic shifts, increased health awareness, and advancements in medical technology. Countries such as Japan, South Korea, and Australia have well-established healthcare systems and are at the forefront of adopting advanced diagnostic technologies, contributing to the overall market growth. Meanwhile, developing nations, such as India and Thailand, are witnessing significant developments in their services for women’s health. Moreover, the growing focus on maternal and reproductive health, breast cancer screening, and non-invasive diagnostic tools, coupled with supportive government initiatives and non-profit organizations aiming to bridge healthcare access gaps, further contributes to this growth.

The women’s health diagnostics market in China has experienced significant growth driven by several demographic, economic, and social trends in the country. China’s aging population, coupled with an increasing focus on health and wellness, has led to increased investments in healthcare infrastructure and diagnostic services customized to the needs of women. For instance, according to the World Bank data, around 16% of the women population in the country was aged 65 years and above in 2023. Moreover, the rise in health awareness and preventative care, especially among urban populations, has fueled the adoption of regular screenings and diagnostic tests.

Latin America Women’s Health Diagnostics Market Trends

The Latin America women’s health diagnostics market is experiencing significant growth, primarily driven by the developing healthcare infrastructure, increasing access to advanced diagnostics technologies, rising prevalence of various disorders in women, and increasing awareness about the importance of early disease diagnosis. Moreover, the increasing efforts by local and international organizations to increase awareness about early diseases in the region’s women are further expected to fuel the demand for diagnostics solutions, thereby driving the market growth.

Middle East and Africa Women’s Health Diagnostics Market Trends

The women's health diagnostics market in the Middle East and Africa (MEA) is experiencing significant growth, driven by the rising prevalence of cancers in women, increasing healthcare expenditures, rising awareness of women's health issues, and advancements in diagnostic technologies. The increasing prevalence of various conditions, such as prostate cancer, breast cancer, and cervical cancer among women, coupled with a growing geriatric population, has increased the need for effective diagnostic solutions tailored to women's health. For instance, according to the International Agency for Research on Cancer, breast cancer affects around 14,712 women in the country, accounting for 25% of all cancer cases in women. Such a high prevalence of cancer in the region’s women population drives the market growth.

Saudi Arabia women’s health diagnostics market is experiencing significant growth, driven by various factors, including increased healthcare expenditure and advancements in medical technology. The Saudi government has made substantial investments in healthcare infrastructure, which has allowed the establishment of modern diagnostic centers. Moreover, healthcare developments such as the Vision 2030 initiative, aimed at transforming the healthcare sector to provide comprehensive and efficient services, further contribute to this growth. Similarly, the increasing awareness of women's health issues among the population is another critical factor propelling market growth.

Key Women’s Health Diagnostics Company Insights

Key industry players are adopting various strategic initiatives such as launches, partnerships, collaborations, mergers & acquisitions, approvals, expansion and others to increase their presence in the global women’s health diagnostics industry. These advancements in the women’s health diagnostics market are anticipated to boost market growth over the forecast period.

Key Women’s Health Diagnostics Companies:

The following are the leading companies in the women’s health diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Quest Diagnostics Incorporated

- Abbott

- BD

- Ge Healthcare

- Koninklijke Philips N.V.

- Aspira Women's Health

- Thermo Fisher Scientific Inc.

- Cardinal Health, Inc.

Recent Developments

-

In October 2024, First Response launched the Multi Check Pregnancy Test Kit with an EasyCup, which simplifies the testing process by combining a sample collection cup with an integrated test strip. This innovative design enhances user experience, offering multiple testing options and addressing consumer preferences for ease and control in pregnancy testing.

-

In October 2024, Yourgene Health and Genetix launched Colombia's 1st local non-invasive prenatal testing (NIPT) service, utilizing Yourgene's IONA Nx NIPT Workflow. This service provides quick, accurate results for expectant parents, reducing reliance on overseas testing and associated costs. The test screens for trisomy conditions and determines fetal sex.

-

In June 2023, Salignostics launched an innovative saliva pregnancy test, Salistick, in the UK, providing an alternative to urine tests. It detects hCG hormone through a saliva sample. Results are available in 5 to 15 minutes.

-

In June 2021, Illumina and Next Generation Genomic Thailand launched the VeriSeq NIPT Solution v2 for noninvasive prenatal testing in Thailand. This CE-IVD solution offers comprehensive fetal genome insights, detecting chromosomal anomalies beyond standard tests. It allows testing as early as 10 weeks through a single blood draw, enhancing pregnancy management for healthcare providers and expectant parents.

Women’s Health Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.13 billion

Revenue forecast in 2030

USD 31.46 billion

Growth rate

CAGR of 7.29% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue, competitive landscape, growth factors, and trends

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd.; Hologic, Inc.; Quest Diagnostics Incorporated; Abbott; BD; Ge Healthcare; Koninklijke Philips N.V.; Aspira Women's Health; Thermo Fisher Scientific Inc.; Cardinal Health, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Women’s Health Diagnostics Market Report SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global women’s health diagnostics market report based on the application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Infectious diseases

-

Osteoporosis

-

Pregnancy & fertility

-

Prenatal

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Laboratory

-

Home care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global women’s health diagnostics market size was estimated at USD 20.60 billion in 2024 and is expected to reach USD 22.13 billion in 2025.

b. The global women’s health diagnostics market is expected to grow at a compound annual growth rate of 7.29% from 2025 to 2030 to reach USD 31.46 billion by 2030.

b. Based on application, infectious diseases segment accounted for the largest revenue share of 33.0% in 2024, due to the continued importance of diagnosing and managing infectious diseases in women's health.

b. Some key players operating in the women’s health diagnostics market include F. Hoffmann-la Roche Ltd.; Siemens Aktiengesellschaft; Quest Diagnostics Incorporated; Ge Healthcare; Koninklijke Philips N.V.; Abbott Laboratories; Becton, Dickinson, and Company; and Hologic, Inc.

b. Key factors that are driving the market growth include the rising prevalence of infectious diseases, such as urinary tract infections, increasing awareness and healthcare access, growing aging female population, and advancements in diagnostic technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.