- Home

- »

- Advanced Interior Materials

- »

-

Wood Plastic Composites Market Size & Share Report, 2030GVR Report cover

![Wood Plastic Composites Market Size, Share & Trends Report]()

Wood Plastic Composites Market Size, Share & Trends Analysis Report By Product (Polyethylene, Polypropylene), By Application (Automotive Components), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-849-7

- Number of Pages: 198

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Market Size & Trends

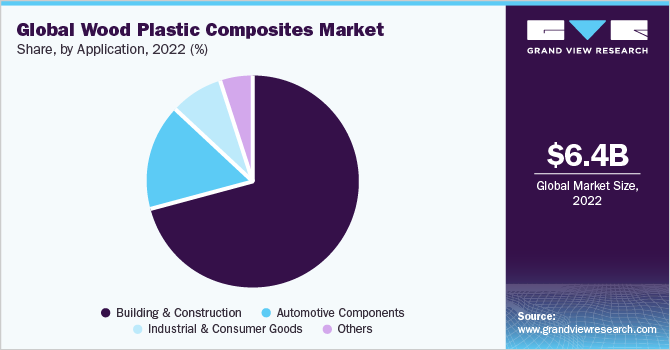

The global wood plastic composites market size was estimated at USD 6.41 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 11.6% from 2023 to 2030. The market is driven by the rising demand for sustainable construction materials along with an increase in the renovation and repair activities in the residential sector across the globe. These products are increasingly being used in construction applications. Wood plastic composites are being employed in roofing applications as well as in the manufacturing of glass windows. Due to the extended lockdown in major nations such as the United States, China, Japan, India, and Germany, the breakout of COVID-19 resulted in the partial or entire shutdown of non-essential products manufacturing facilities. In most industrial units throughout the world, this resulted in the closure or suspension of their manufacturing activity.

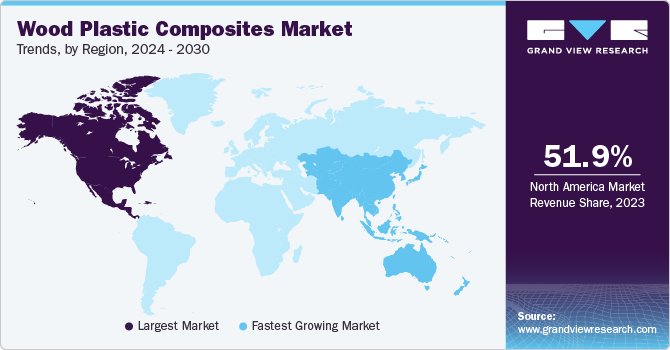

Due to lockdown and labor shortages, the coronavirus epidemic impacted the supply chain, delaying deliveries of wood composites and other raw materials from yards. Across the globe, industries are being shut down. People's purchasing power is decreasing, which has a direct effect on the automobiles and construction sectors, reducing demand for wood-plastic composites and restricting industrial growth. The automotive sector in North America is one of the biggest in the world. The U.S. is the second-largest producer of automobiles. The high market size and disposable income of consumers along with the ability of mass production and high product variation have boosted industry growth in the country.

Wood plastic composite have a lower melting temperature as compared to conventional wood products, which lowers the energy cost for end-users and also reduces the environmental impact of the product. Wood plastic composite can be worked upon by the same tools utilized for wood products. This factor eliminates the investments to be made by the manufacturers and the risks associated with recouping the same.

Biggest tech companies such as IBM, Microsoft, and Cisco are investing in megaprojects to build smart, sustainable cities across the globe. The investments in these cities are expected to reach USD 135 trillion in the next two years. In addition to these cities, international megaprojects such as Hudson Yards and Masdar City have created opportunities for interior construction manufacturers resulting in surging the wood plastic composite demand over the coming years.

Wood flour is hygroscopic in nature and must be wetted properly with the use of thermoplastic matrix otherwise it can absorb moisture which leads to weak mechanical properties, unwanted odors and microbial attacks. The technique requires complex machine arrangements and skilled laborers resulting in increasing the overall cost of the products. This in turn can restrict the market growth over the next eight years.

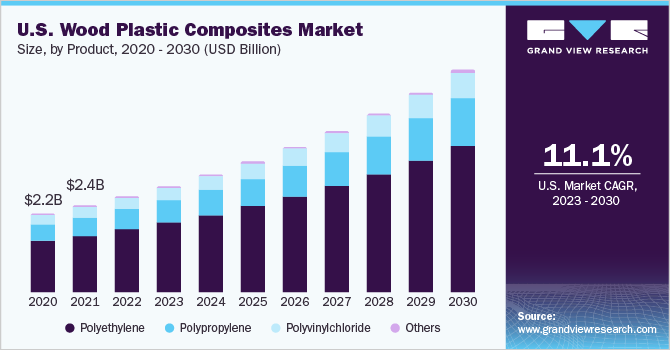

Product Insights

Polypropylene product segment led the market and accounted for more than 12% share of the global revenue in 2022. The polypropylene segment is anticipated to see a boom, over the forecast period, owing to its heavy use in the niche application segments such as water-resistant coatings on furniture and high temperature controllable wooden units.

Polyvinyl chloride product segment is projected to register a CAGR of 11.0% in terms of value over the forecast period. Growing demand for polyvinylchloride thermoplastics in automotive applications for manufacturing door panels, seat cushions, cabin linings, backrests and dashboards on account of its excellent insulation properties is expected to have a positive impact on the market growth over the forecast period. Polyvinyl chloride thermoplastics have insulation properties and are thus employed in the manufacturing of insulative products for applications in electrical, and automotive industries.

The polyethylene segment is one of the fastest growing product segments on account of its high demand in manufacturing furniture for homes, offices, restaurants, resorts and hospitals. Moreover, the rising demand for polyethylene composites in the automotive industry owing to its low cost, high stiffness and biodegradability is expected to further propel the market growth over the coming years. Low cost, high stiffness, abundant raw material availability and biodegradability offered by polyethylene-based wood plastic composite products are likely to open new avenues for the market growth.

The rising demand for polystyrene and acrylonitrile butadiene styrene composites in a wide range of applications such as kitchen furniture, shower receptors, bathtubs, windowsills and whirlpool baths on account of its high durability and environment friendly characteristics is expected to boost the market growth over the next eight years.

Application Insights

Building and construction segment led the market and accounted for more than 71% of the global revenue share in 2022. Increasing infrastructural development activities in the emerging economies such as China, India, Thailand and Brazil coupled with the growing demand for aesthetically appealing furniture and flooring solutions across the globe, has surged the demand for wood plastic composite in the construction industry. Rising demand for various wood plastic-based wood products in construction applications, especially for decking is expected to propel market growth.

The use of recyclable or biodegradable wood-plastic composite-based parts in automobiles is expected to improve mechanical strength and acoustic performance, reduce material weight and fuel consumption, reduce manufacturing costs, improve passenger safety and shatterproof performance which will boost the demand for wood plastic composites in the automotive industry.

Wood filled PVC is gaining popularity because to its balance of thermal stability, moisture resistance, stiffness, and strength, although being more expensive than unfilled PVC. Wood-plastic composites are used in a variety of sectors across the world, although their methodologies differ. For longevity, they extrude wood filled PVC with an unfilled PVC cap stock, while others extrude a PVC core with a paintable wood filled PVC surface.

Increasing demand for wood plastic composite in manufacturing noise barriers for street construction, sheet pilings for landscaping and garden furniture, is expected to surge the product demand over the forecast period. In addition, the rising demand for wood plastic composite in manufacturing consumer goods including, toys, and showpieces is anticipated to further propel the market growth over the coming years.

Regional Insights

Asia Pacific led the market and accounted for over 30.11% share of global revenue in 2022. The region is expected to emerge as the fastest-growing market for wood plastic composite owing to the increased per capita income, coupled with rapid industrialization. The shift in Chinese consumer behavior, growing local competition, fragmented distribution and rising dual income is expected to create opportunities for wood plastic composite manufacturers over the forecast period.

Construction activities in the Central and South American economies have grown substantially owing to the rising income levels and shifting consumer preference towards green buildings. Expanding commercial construction sector coupled with the government initiatives to create awareness about green buildings among people is expected to stimulate the market growth over the forecast period. Public-private initiatives taken by the governments in the region have paved the way for foreign investment in the construction industry.

The rising concerns about the global economy because of the continued deceleration in the Eurozone and China, US-China trade discussions, political situation between China and Hong Kong and uncertainty over Brexit are expected to impact the global investments, trade, upcoming and ongoing residential/commercial projects and equity markets across the globe which is anticipated to restrict the market growth over the coming years.

The construction industry in South America mostly remained resilient even after the economic slump caused due to the pandemic. Factors such as uncertainty with respect to the economic policy and reforms in Brazil, and recent social unrest in various countries such as Colombia, Chile, Bolivia, and Ecuador are expected to have a negative impact on the region’s economic growth.

Key Companies & Market Share Insights

The market participants are adopting various strategies to gain a competitive edge, and thus sustain the growing industry rivalry. CertainTeed Corporation, a subsidiary of Saint Gobain is a major player in the industry with a variety of wood plastic composite products. The company is indulged in mergers & acquisitions, as well as production capacity expansion strategies in order to gain a strong foothold in the market.

The companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations for the production of an advanced product with superior performance characteristics to increase the company revenues. Some prominent players in the global wood plastic composites market include:

-

Advanced Environmental Recycling Technologies, Inc. (AERT)

-

Axion Structural Innovations LLC

-

Beologic N.V.

-

CertainTeed Corporation

-

Fiberon, LLC

-

Fkur Kunststoff GmbH

-

Guangzhou Kindwood Co. Ltd.

-

Jelu-Werk Josef Ehrler GmbH & Co. KG

-

Woodmass

-

PolyPlank AB

-

Renolit

-

TAMKO Building Products, Inc.

-

TimberTech

-

Trex Company, Inc.

-

Universal Forest Product

Wood Plastic Composites Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.15 billion

Revenue forecast in 2030

USD 15.41 billion

Growth Rate

CAGR of 11.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Mexico; Canada; U.K.; Germany; France; Spain; Italy; Russia; Netherland; Switzerland; China; Japan; India; South Korea; Australia; Indonesia; Thailand; Singapore; New Zealand; Philippines; Brazil; Argentina; Chile; Saudi Arabia; South Africa; UAE; Egypt; Iran

Key companies profiled

Advanced Environmental Recycling Technologies; Inc. (AERT); Axion Structural Innovations LLC; Beologic N.V.; CertainTeed Corporation; Fiberon; LLC; Fkur Kunststoff GmbH; Guangzhou Kindwood Co. Ltd.; Jelu-Werk Josef Ehrler GmbH & Co. KG; Woodmass; PolyPlank AB; Renolit; TAMKO Building Products; Inc.; TimberTech; Trex Company; Inc.; Universal Forest Product

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

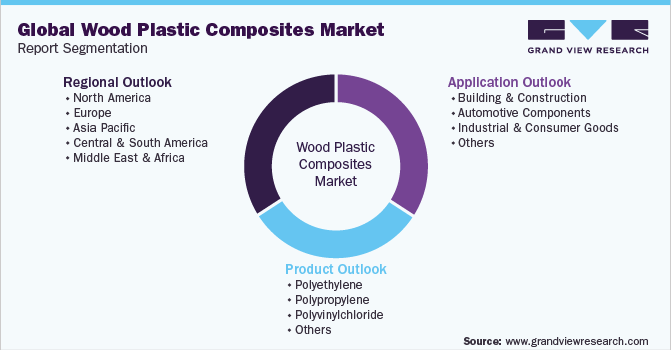

Global Wood Plastic Composites Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the wood plastic composites market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Polyethylene

-

Polypropylene

-

Polyvinylchloride

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Building and Construction

-

Decking

-

Molding & siding

-

Fencing

-

-

Automotive Components

-

Industrial and Consumer Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Russia

-

Netherlands

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Singapore

-

New Zealand

-

Philippines

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

United Arab Emirates (UAE)

-

Egypt

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global wood plastic composites market size was estimated at USD 6.41 billion in 2022 and is expected to reach USD 7.15 billion in 2023.

b. The wood plastic composites market is expected to grow at a compound annual growth rate of 11.6% from 2023 to 2030 to reach USD 15.41 billion by 2030.

b. Polyethylene product segment dominated the market and accounted for more than 65.9% share of the global revenue in 2022. The market is driven by the rising demand for sustainable construction materials along with an increase in the renovation and repair activities in the residential sector across the globe.

b. Some of the key players operating in the Wood Plastic Composites market include Advanced Environmental Recycling Technologies, Inc. (AERT); Axion Structural Innovations LLC; Beologic N.V.; CertainTeed Corporation; Fiberon, LLC; Fkur Kunststoff GmbH; Guangzhou Kindwood Co. Ltd.; Jelu-Werk Josef Ehrler GmbH & Co. KG; Woodmass; PolyPlank AB; Renolit; TAMKO Building Products, Inc.; TimberTech; Trex Company, Inc.; Universal Forest Product

b. The key factors driving the Wood Plastic Composites market include increasing products use in several residential, industrial and commercial sectors. This increased demand is primarily driven by population growth, rapid urbanization, and rising per capita income in the developing countries. Increasing consumer preferences for green buildings is projected to boost the demand for wood plastic composite in the construction industry over the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."