- Home

- »

- Advanced Interior Materials

- »

-

Wood And Timber Products Market, Industry Report, 2030GVR Report cover

![Wood And Timber Products Market Size, Share & Trends Report]()

Wood And Timber Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Paper, Lumber, Textiles, Bio Chemicals), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-512-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wood And Timber Products Market Summary

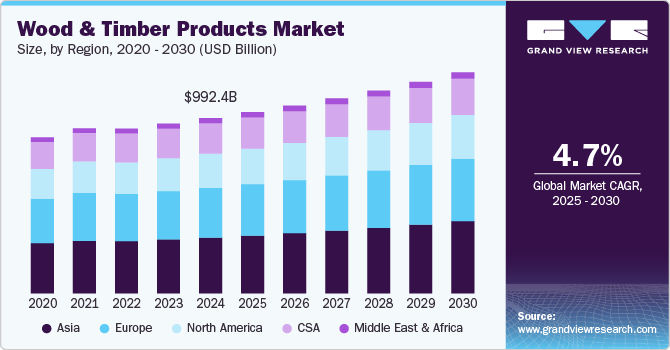

The global wood and timber products market size was estimated at USD 992.43 billion in 2024 and is projected to reach USD 1,251.26 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. One of the primary drivers of timber demand is the rapid expansion of urban areas worldwide.

Key Market Trends & Insights

- Asia Pacific wood and timber products market dominated the global market with a share of 31.8% in 2024.

- The wood and timber products market in China is the world’s largest consumer and importer of wood and timber products, relying on international sources for raw materials.

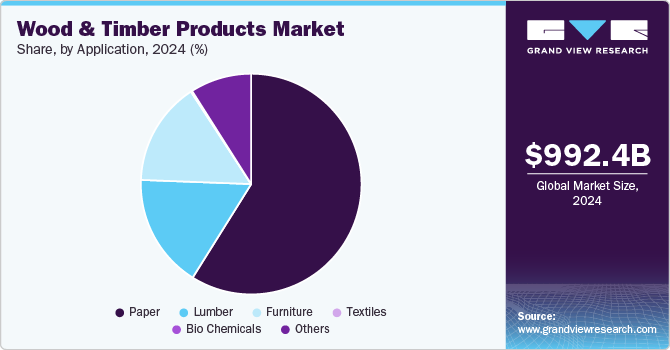

- Based on application, paper segment dominated the industry with a major revenue share of 58.9% in 2024 and is forecasted to grow rapidly from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 992.43 Billion

- 2030 Projected Market Size: USD 1,251.26 Billion

- CAGR (2025-2030): 4.7%

- Asia-Pacific: Largest Market in 2024

As populations grow, particularly in developing economies like China, India, and parts of Africa, the need for housing, commercial buildings, and infrastructure is surging. Timber is a preferred construction material due to its durability, affordability, and sustainability compared to steel and concrete. Innovations in engineered wood products, such as cross-laminated timber (CLT) and glulam, are also making wood a competitive option in high-rise buildings, further fueling demand.Wood remains a staple material in the furniture industry, where both traditional solid wood and engineered wood products are in high demand. As disposable incomes rise, particularly in emerging markets, consumers are willing to spend more on high-quality furniture and wooden interior elements such as flooring, wall panels, and doors. Additionally, the growth of e-commerce and modular furniture trends has boosted demand for plywood and MDF (medium-density fiberboard), which are cost-effective alternatives to solid wood.

The shift towards sustainable and biodegradable materials is increasing the demand for paper-based packaging solutions. With many governments and corporations pushing for eco-friendly alternatives to plastic, wood-derived products such as kraft paper, cardboard, and linerless labels are gaining traction. The direct thermal paper industry, for example, relies heavily on wood pulp, and growing logistics, e-commerce, and food packaging sectors are further driving its expansion.

Timber is seen as a renewable and carbon-friendly alternative to other building and packaging materials, provided it is sourced sustainably. Many companies are prioritizing FSC (Forest Stewardship Council) or PEFC (Programme for the Endorsement of Forest Certification) certified wood to meet environmental regulations and consumer preferences. This shift is particularly notable in developed markets where sustainability plays a critical role in purchasing decisions.

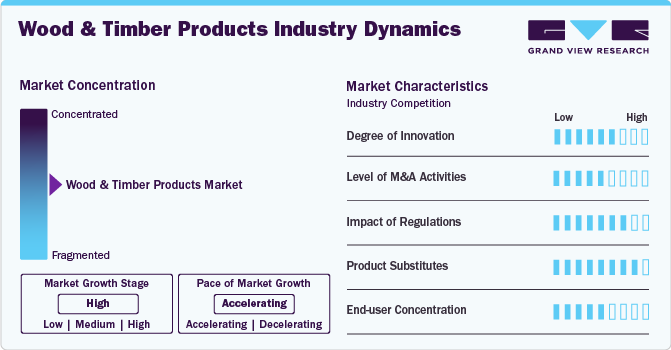

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The global wood and timber industry is highly diverse, encompassing several product categories that cater to different end-use industries. The largest segment is sawn timber and lumber, which is widely used in construction, furniture, and industrial applications. The level of market concentration varies across different wood and timber segments. The global sawn timber and engineered wood market is moderately fragmented, with both large multinational corporations and smaller regional players competing.

The timber industry is also benefiting from technological improvements that increase yield and efficiency. Precision forestry, AI-driven sawmills, and improved adhesives for engineered wood products are helping maximize wood utilization while reducing waste. These innovations enable companies to meet growing demand more sustainably.

The global trade of timber products is evolving with shifting supply chains. Countries like Canada, Russia, and Brazil are major suppliers, while China remains the largest importer and processor of timber. Trade restrictions, such as Russia’s recent ban on log exports, have disrupted supply, increasing prices and pushing manufacturers to look for alternative sources. In addition, illegal logging concerns and deforestation regulations are shaping global sourcing strategies, emphasizing certified and legally harvested wood.

Application Insights

Based on application, paper dominated the industry with a major revenue share of 58.9% in 2024 and is forecasted to grow rapidly from 2025 to 2030. The global demand for wood-based paper products is undergoing a transformation, with declining demand for traditional printing and writing paper but rising demand for packaging materials and hygiene products. With the digitization of media and office work, paper consumption for newspapers, books, and office supplies is shrinking. However, the rapid growth of e-commerce and sustainability-driven packaging regulations are fueling demand for kraft paper, carton board, and linerboard, which are derived from wood pulp.

Many companies are phasing out plastic packaging in favor of biodegradable and recyclable alternatives made from wood pulp. Additionally, the hygiene sector, which includes tissues, toilet paper, and disposable wipes, continues to grow, especially in Asia and developing markets. Major global players such as International Paper and Stora Enso are expanding their pulp production capacity to meet this growing demand.

Lumber remains a core building material, particularly in residential construction, commercial buildings, and infrastructure projects. The demand for lumber is driven by population growth, urban expansion, and a shift toward eco-friendly construction practices. In regions like North America and Scandinavia, wood-frame construction is widely used for housing due to its cost-effectiveness and sustainability compared to steel and concrete.

Innovations such as cross-laminated timber (CLT) and glulam (glued laminated timber) are further boosting lumber demand, as these materials allow for high-rise wooden buildings, reducing the carbon footprint of construction. Governments in many countries are promoting mass timber construction as part of their climate change mitigation strategies. Additionally, infrastructure projects, including bridges, railways, and public buildings, are increasingly incorporating engineered wood products due to their strength and durability.

Regional Insights

Asia Pacific wood and timber products market dominated the global market with a share of 31.8% in 2024. Asia-Pacific is the fastest-growing region for timber demand, driven by urbanization, industrial expansion, and rising incomes. Countries like China, India, and Indonesia are seeing a surge in construction activity, increasing the need for plywood, MDF, and solid timber. The demand for paper-based packaging is also expanding rapidly, fueled by e-commerce growth and government restrictions on plastic use.

The wood and timber products market in China is the world’s largest consumer and importer of wood and timber products, relying on international sources for raw materials. The country’s construction sector, particularly in urban housing and infrastructure, drives massive demand for softwood lumber, plywood, and engineered wood. The furniture industry is another key consumer, with China being both a major producer and exporter of wood-based furniture.

North America Wood And Timber Products Market Trends

The North American wood and timber market is driven by a strong construction sector, advanced forestry management, and increasing demand for engineered wood products. Canada and the U.S. are major global suppliers of softwood lumber, with vast forest resources and strict sustainability policies. North America is also a leader in mass timber construction, with innovations like cross-laminated timber (CLT) gaining popularity in urban housing projects.

U.S. Wood And Timber Products Market Trends

The wood and timber products in the U.S. is the largest consumer of wood products in North America, with demand coming primarily from the construction and furniture industries. The housing market boom, particularly in suburban and rural areas, has fueled a steady increase in lumber consumption. The push for affordable housing solutions has also driven demand for modular homes and prefabricated wood-based structures.

Europe Wood And Timber Products Market Trends

Europe wood and timber products market has one of the most advanced and sustainable timber industries, with strict environmental regulations and widespread adoption of FSC and PEFC-certified wood. The region is a global leader in engineered wood production, with companies developing high-performance materials such as laminated veneer lumber (LVL) and oriented strand board (OSB) for modern construction.

The wood and timber products market in Germany has one of the most advanced timber-processing industries, with state-of-the-art sawmills and automated production lines for engineered wood and high-end furniture. The country is also a leader in mass timber construction, with a growing number of high-rise buildings incorporating cross-laminated timber (CLT) and glulam beams.

Latin America Wood And Timber Products Market Trends

Latin America, particularly Brazil and Chile, is a major global supplier of timber, pulp, and wood-based products. Brazil has some of the world’s largest plantation forests, primarily producing eucalyptus and pine, which are used for pulp production, construction, and furniture manufacturing. The country’s paper industry is among the most competitive globally, supplying low-cost pulp to North America, Europe, and Asia.

Middle East & Africa Wood And Timber Products Market Trends

The wood and timber products market in the Middle East and Africa are emerging markets for wood products, with demand driven by the construction, furniture, and packaging industries. In the Middle East, countries like the UAE and Saudi Arabia are investing in luxury real estate projects, increasing demand for high-quality wood for interiors and furnishings. However, the region has limited natural forests, relying heavily on imports from Europe, North America, and Africa.

Key Wood And Timber Products Company Insights

Some key companies in the global wood and timber products market include Ogonek Custom Hardwoods, Inc., PotlatchDeltic Corporation, Resolute Forest Products, RSG Forest Products, Inc., Sierra Forest Products, Inc., Southern Pine Timber Products, Inc., Stora Enso Oyj, Timbeck Architecture, Timber Products Co. Limited Partnership, US LBM Holdings, LLC, West Fraser Timber Co. Ltd., Sterling Solutions LLC and Weyerhaeuser Company. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Stora Enso Oyj was incorporated in 1998 and is headquartered in Finland, Europe. The company is primarily engaged in developing and producing products based on wood and biomass in the form of biomaterials, wooden construction, and paper. It has organized its business into six operating divisions, namely, wood products & services, packaging materials, packaging solutions, biomaterials, forest, and paper. The company’s product portfolio includes formed fiber, bio-composites, wood products, bio-based chemicals, bio-based materials, intelligent packaging, corrugated packaging, and various others.

-

Sterling Solutions LLC was incorporated in 1998 and is headquartered in Illinois, U.S. The company offers matting and site access solutions to construction and industrial application industries. Its product segment includes TeraLam mats, terra cross bridge, clean exit mats, composite mats, timber mats, crane mats, and marine-barge floating mats.

Key Wood And Timber Products Companies:

The following are the leading companies in the wood and timber products market. These companies collectively hold the largest market share and dictate industry trends.

- Ogonek Custom Hardwoods, Inc.

- PotlatchDeltic Corporation

- Resolute Forest Products

- RSG Forest Products, Inc.

- Sierra Forest Products, Inc.

- Southern Pine Timber Products, Inc.

- Stora Enso Oyj

- Timbeck Architecture

- Timber Products Co. Limited Partnership

- Georgia-Pacific LLC

- West Fraser Timber Co. Ltd.,

- Sterling Solutions LLC

- Weyerhaeuser Company

Recent Developments

-

In September 2023, Lintec Europe introduced a new label stock solution at Labelexpo Europe 2023. This innovation enhances the recyclability of PET bottles and promotes the use of direct thermal paper as a sustainable substitute for synthetic paper products.

-

In July 2024, Georgia-Pacific launched production at its new cutting-edge Dixie plant, which specializes in manufacturing premium paper plates. This state-of-the-art facility is designed to enhance production efficiency and sustainability. The Dixie brand aims to meet the growing consumer demand for high-quality disposable tableware while implementing innovative practices that reduce waste and energy consumption.

Wood And Timber Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,025.92 billion

Revenue forecast in 2030

USD 1,251.26 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; China; India; Japan

Key companies profiled

Ogonek Custom Hardwoods, Inc.; PotlatchDeltic Corporation; Resolute Forest Products; RSG Forest Products, Inc.; Sierra Forest Products, Inc.; Southern Pine Timber Products, Inc.; Stora Enso Oyj; Timbeck Architecture; Timber Products Co. Limited Partnership; US LBM Holdings, LLC; West Fraser Timber Co. Ltd.; Sterling Solutions LLC; Weyerhaeuser Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

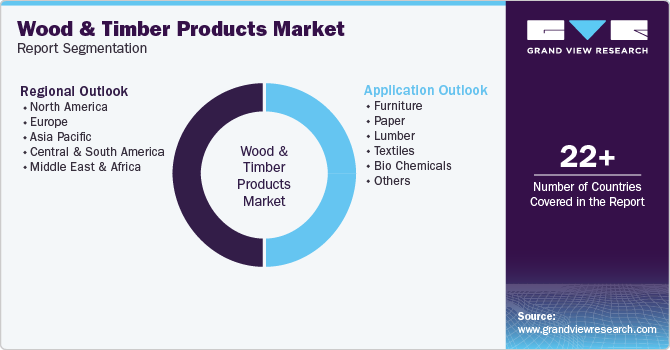

Global Wood And Timber Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wood and timber products market report based on application, and region.

-

Application Outlook (USD Million, 2018 - 2030)

-

Furniture

-

Paper

-

Lumber

-

Textiles

-

Bio Chemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global wood and timber products market size was estimated at USD 992.43 billion in 2024 and is expected to reach USD 1,025.92 billion in 2025.

b. The global wood and timber products market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 1,251.26 billion by 2030.

b. Based on application, paper segment dominated the global Wood & Timber Products market in 2024 by accounting for a revenue share of 58.9% of the market in the same year. The global demand for wood-based paper products is undergoing a transformation, with declining demand for traditional printing and writing paper but rising demand for packaging materials and hygiene products.

b. Key players operating in the market are Ogonek Custom Hardwoods, Inc., PotlatchDeltic Corporation, Resolute Forest Products, RSG Forest Products, Inc., Sierra Forest Products, Inc., Southern Pine Timber Products, Inc., Stora Enso Oyj, Timbeck Architecture, Timber Products Co. Limited Partnership, and US LBM Holdings, LLC.

b. The global demand for wood and timber products is growing due to several key factors, including urbanization, population growth, sustainability trends, and technological advancements in forestry and manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.