- Home

- »

- Medical Devices

- »

-

Wound Sealants Market Size & Share, Industry Report, 2030GVR Report cover

![Wound Sealants Market Size, Share & Trends Report]()

Wound Sealants Market (2025 - 2030) Size, Share & Trends Analysis Report By Sealants (Non-synthetic, Collagen Based, Synthetic), By Wound Type, By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-585-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wound Sealants Market Size & Trends

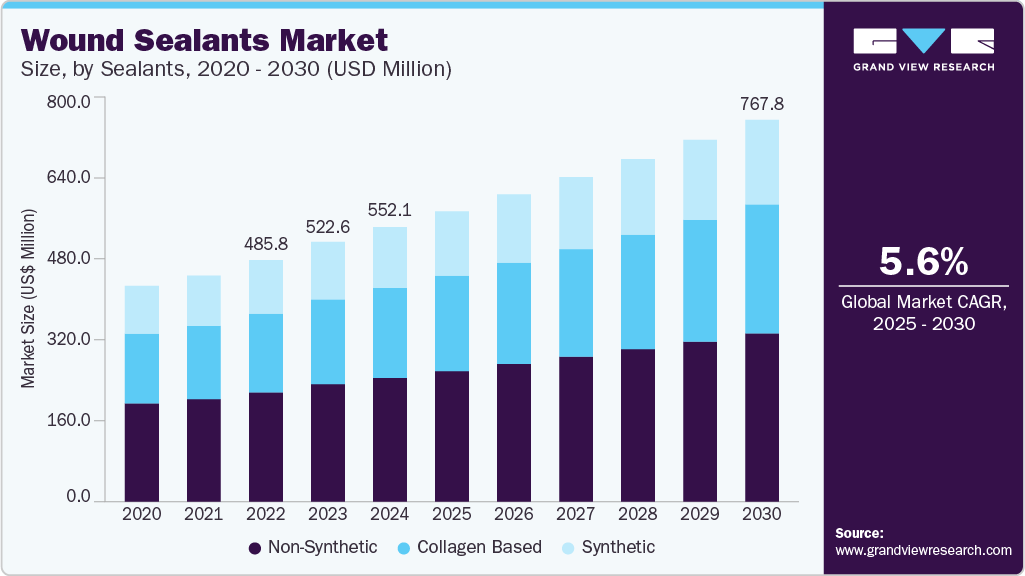

The global wound sealants market size was valued at USD 552.13 million in 2024 and is expected to expand at a CAGR of 5.63% from 2025 to 2030. The market's growth is attributed to the rising global volume of surgical procedures, fueled by an aging population and the increasing prevalence of chronic conditions such as diabetes and cardiovascular diseases.

Key Highlights:

- North America dominated the market and accounted for a 40.31% share in 2024.

- The U.S. held the largest share of North America wound sealants market in 2024.

- On the basis of sealants, the non-synthetic segment held the largest share of 45.08% in 2024.

- By wound type, acute wounds dominated the market in 2024 and is expected to expand at the highest CAGR during the forecast period.

- On the basis of end use, the acute care hospital segment dominated the market in 2024.

The growing demand for minimally invasive surgeries, which require efficient and reliable wound closure methods, further boosts the adoption of sealants. In addition, advancements in biomaterials and synthetic formulations are enhancing wound sealants' effectiveness, safety, and usability, making them a preferred choice in traditional and modern surgical practices.

The rising prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is anticipated to propel the market growth in the coming years. According to the article published by MDPI, in March 2025, diabetic foot is one of the most serious and challenging complications of diabetes, closely linked to high rates of lower limb amputation, as well as increased illness and mortality. Each year, around 18.6 million people globally are affected by diabetic foot ulcers, which are the leading cause of approximately 80% of diabetes-related lower limb amputations. It is estimated that up to 25% of individuals with diabetes are at risk of developing diabetic foot, and between 19% and 34% may experience foot ulcers at some point in their lifetime. Moreover, according to a study published by the American Medical Association in November 2023, around 33.33% of individuals with diabetes develop a foot ulcer during their lifetime. Diabetic foot ulcers impact about 1.6 million individuals in the U.S. each year. These factors are expected to drive the demand for wound sealants over the forecast period.

The growing number of surgical procedures, including cosmetic, orthopedic, and gynecologic, is anticipated to boost the market growth in the coming years. Wound sealants are widely used in various surgical procedures.

Number of worldwide surgical procedures performed by plastic surgeons

Rank

Surgical Procedure

Total Procedures (2023)

% of Total Surgical Procedures

Total Procedures (2022)

Total Procedures (2019)

% Change 2023 vs. 2022

% Change 2023 vs. 2019

1

Liposuction

2,237,966

14.2%

2,303,929

1,704,786

-2.9%

31.3%

2

Breast Augmentation

1,892,777

12.0%

2,174,616

1,795,551

-13.0%

5.4%

3

Eyelid Surgery

1,746,946

11.0%

1,409,103

1,259,839

24.0%

38.7%

4

Abdominoplasty

1,153,539

7.3%

1,180,623

924,031

-2.3%

24.8%

5

Rhinoplasty

1,148,559

7.3%

944,468

821,890

21.6%

39.7%

6

Breast Lift

903,266

5.7%

955,026

741,284

-5.4%

21.9%

7

Lip Enhancement/Perioral Procedure

901,991

5.7%

699,264

N/A

29.0%

N/A

8

Buttock Augmentation

771,333

4.9%

820,762

479,451

-6.0%

60.9%

9

Fat Grafting - Face

741,061

4.7%

648,894

598,823

14.2%

23.8%

10

Breast Reduction

686,125

4.3%

632,860

600,219

8.4%

14.3%

11

Face Lift

646,482

4.1%

541,491

448,485

19.4%

44.1%

12

Neck Lift

452,639

2.9%

400,593

260,747

13.0%

73.6%

13

Brow Lift

386,427

2.4%

352,324

270,917

9.7%

42.6%

14

Gynecomastia

352,302

2.2%

305,340

273,344

15.4%

28.9%

15

Breast Implant Removal

335,939

2.1%

320,765

229,680

4.7%

46.3%

16

Ear Surgery

327,990

2.1%

303,906

288,905

7.9%

13.5%

17

Upper Arm Lift

244,977

1.5%

204,011

168,289

20.1%

45.6%

18

Labiaplasty

189,058

1.2%

194,086

164,667

-2.6%

14.8%

19

Facial Bone Contouring

153,749

1.0%

138,115

108,536

11.3%

41.7%

20

Thigh Lift

146,264

0.9%

113,746

93,334

28.6%

56.7%

21

Lower Body Lift

128,998

0.8%

123,123

75,895

4.8%

70.0%

22

Buttock Lift

110,167

0.7%

95,174

54,894

15.8%

100.7%

23

Vaginal Rejuvenation

84,495

0.5%

70,645

N/A

19.6%

N/A

24

Upper Body Lift

70,306

0.4%

54,120

N/A

29.9%

N/A

TOTAL SURGICAL PROCEDURES

15,813,353

-

14,986,982

11,363,569

5.5%

39.2%

Source: International Society of Aesthetic Plastic Surgery, Grand View Research

Ongoing innovation in sealant technology, with the development of improved biomaterials, delivery methods, and functionalities, is expanding its applications and driving market growth. For instance, in November 2023, Ethicon, a Johnson & Johnson MedTech company, announced the approval of ETHIZIA. This adjunctive hemostat solution has been clinically proven to achieve sustained hemostasis in challenging bleeding scenarios. Utilizing unique synthetic polymer technology, the ETHIZIA Hemostatic Sealing Patch is the first and only hemostatic matrix designed to provide equally effective hemostatic action on both sides. Furthermore, the trend toward minimally invasive and robotic surgeries has strengthened the need for sealants, as these procedures require precision and controlled closure without excessive tissue manipulation.

Moreover, increasing awareness among healthcare professionals and patients about the advantages of advanced wound care products, including wound sealants, is driving their adoption and supporting market growth. This awareness is being fueled by educational campaigns, clinical evidence showcasing their effectiveness, and a strong focus on achieving better patient outcomes.

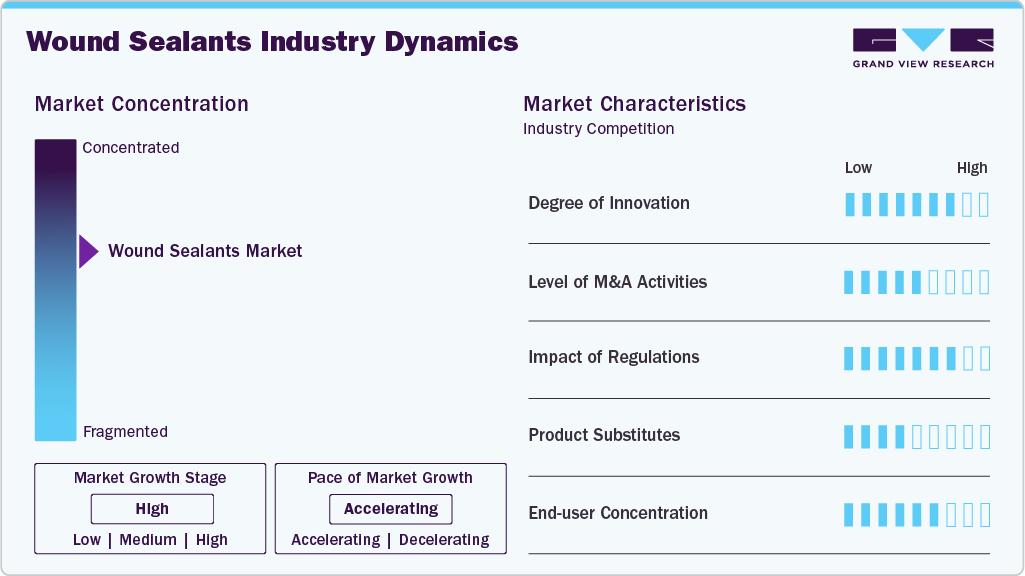

Market Concentration & Characteristics

The wound sealants industry is moderately innovative, with companies focusing on improving the effectiveness of their products. There is a growing trend to use advanced ingredients that help wounds heal faster, prevent infections, and make the healing process more comfortable for patients. In addition, these innovative products are also receiving increasing support from regulatory authorities.

Regulations play a significant role in shaping the market. Regulatory bodies like the FDA ensure that wound care products, including wound sealant products, meet high safety and quality standards before they reach consumers. Manufacturers must follow strict testing and approval processes, which can increase development costs and time, but ensure the safety and reliability of these products.

The wound sealant market is currently experiencing moderate merger and acquisition (M&A) activity, driven by several strategic objectives. Established players are acquiring smaller companies to expand their product portfolios, gain access to innovative technologies, and strengthen their market presence in specific geographies. This consolidation trend allows larger companies to enhance their competitive advantage and capitalize on the growing demand for advanced wound closure solutions in various surgical and wound care applications. For instance, in February 2023, Advanced Medical Solutions Group plc announced the acquisition of Connexicon Medical Limited. Connexicon specializes in tissue adhesive technologies, a strategic addition to bolster AMS’s product portfolio in advanced wound care and surgical adhesives. By integrating Connexicon's tissue adhesive technologies, AMS can expand its portfolio with innovative solutions for wound closure.

Product substitutes for wound sealants include traditional wound closure methods such as sutures, staples, adhesive strips, and surgical tapes. These alternatives are often preferred in certain procedures due to their lower cost, ease of use, or familiarity among surgeons. In addition, newer technologies like hemostatic agents, tissue glues, and advanced wound dressings also serve as substitutes depending on the clinical need.

End user concentration in the wound sealants industry is relatively high, with hospitals, ambulatory surgical centers (ASCs), and specialty clinics accounting for most product usage. These institutions conduct many surgical procedures, where wound sealants are frequently used to control bleeding, seal tissues, and improve surgical outcomes. Larger hospitals and surgical centers tend to establish long-term contracts with manufacturers or distributors, leading to bulk purchasing and more predictable demand patterns.

Sealants Insights

On the basis of sealants, the non-synthetic segment held the largest share of 45.08% in 2024. This growth can be attributed to these sealants, which facilitate hemostasis and tissue bonding with minimal immune response, making them ideal for sensitive procedures, such as cardiovascular and neurological surgeries. Their natural degradability within the body lowers the risk of postoperative complications and removes the need for removal.

The collagen-based segment is expected to witness the fastest growth over the forecast period. These sealants utilize the natural properties of collagen, a critical protein in the body that plays a significant role in tissue repair and regeneration. By forming a robust adhesive bond, collagen-based sealants not only effectively seal wounds but also create an optimal environment for cellular infiltration and tissue integration, which are among the major factors contributing to the segment's growth.

Wound Type

On the basis of wound type, acute wounds dominated the market in 2024 and is expected to expand at the highest CAGR during the forecast period. This growth can be attributed to the high volume of surgical procedures and traumatic injuries requiring immediate and effective wound management. Surgeries-ranging from cardiovascular and orthopedic to general and emergency procedures-often involve tissue incisions or bleeding that demand reliable sealing solutions to promote rapid healing and prevent complications. Additionally, trauma-related injuries, such as lacerations or burns, frequently occur in emergency settings where wound sealants are favored for their quick application and hemostatic properties.

End Use Insights

On the basis of end use, the acute care hospital segment dominated the market in 2024. This can be attributed to their central role in performing a wide range of high-risk and high-volume surgical procedures that require effective wound closure solutions. These hospitals handle complex surgeries, including cardiovascular, neurological, trauma, and transplant operations, where wound sealants are essential for controlling bleeding, sealing tissues, and reducing postoperative complications. With access to advanced medical technologies, trained surgical staff, and higher patient inflow, acute care hospitals are the largest consumers of wound sealants.

However, the home healthcare segment is projected to witness the fastest growth rate over the forecast period. This is due to the growing aging population, rising prevalence of chronic wounds, and increasing demand for cost-effective, at-home medical care. As more patients manage post-surgical recovery, diabetic ulcers, and pressure injuries outside of hospital settings, wound sealants offer a convenient, effective, and minimally invasive solution for wound closure and healing.

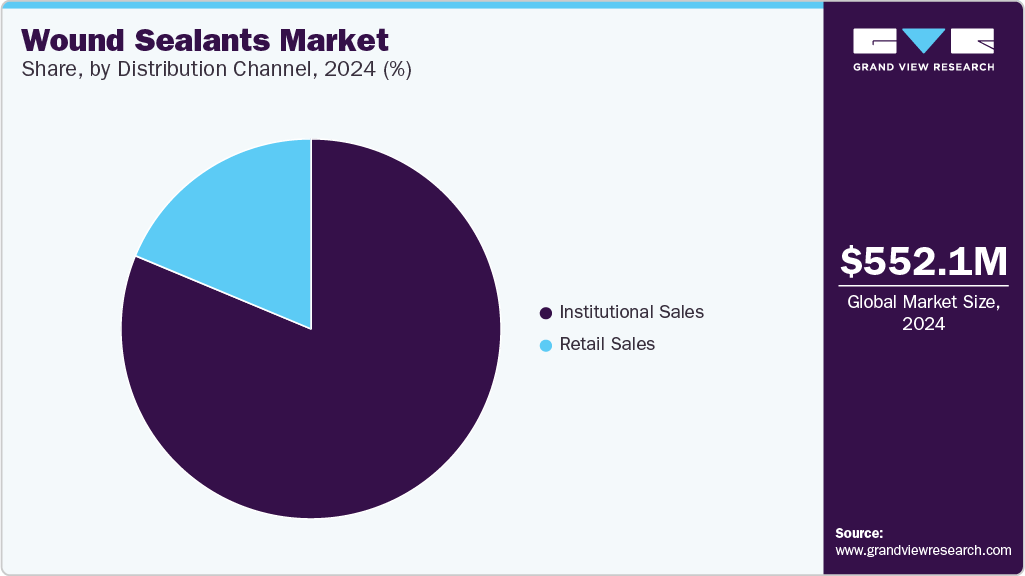

Distribution Channel Insights

The institutional sales segment dominated the market in 2024 based on distribution channel. This is because it caters directly to high-volume end users such as hospitals, ambulatory surgical centers, and specialized clinics, where most surgical procedures are performed. These institutions require a consistent supply of wound sealants for various surgical and emergency interventions, often purchasing in bulk through contracts or tenders. Manufacturers and distributors prioritize this segment due to its predictable demand, larger order sizes, and long-term procurement relationships.

However, the retail sales segment is projected to witness the fastest growth rate over the forecast period. This is due to the increasing consumer preference for over-the-counter (OTC) wound care solutions and the rising self-care trend. With the availability of wound sealants in pharmacies, supermarkets, and online platforms, consumers now have easy access to these products for managing minor injuries, cuts, and abrasions at home.

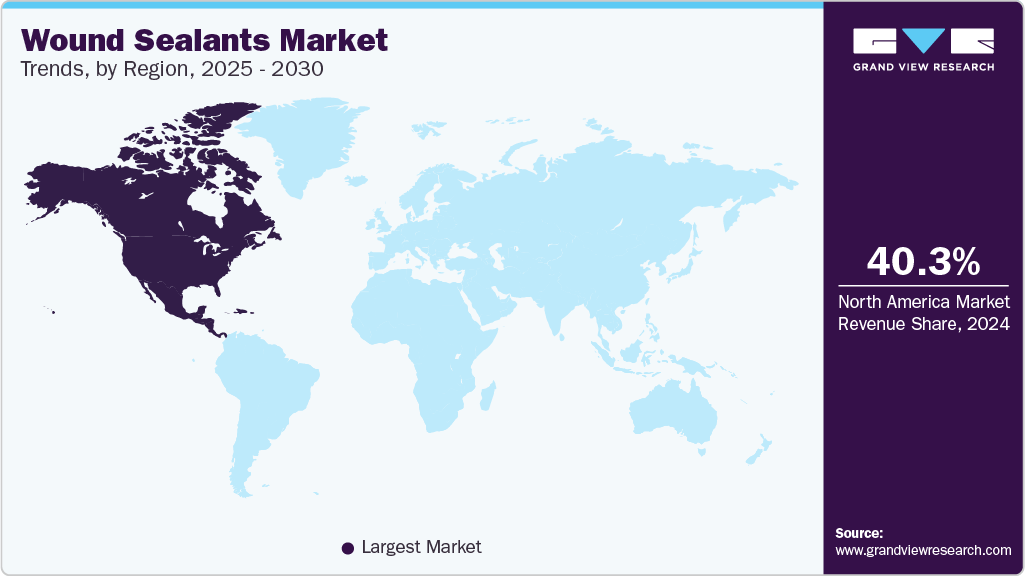

Regional Insights

North America dominated the market and accounted for a 40.31% share in 2024. The rapid adoption of advanced equipment in the U.S. has allowed the region to account for a larger market share. The presence of leading manufacturers and the quick adoption of advanced products are projected to further boost the region’s growth. The region continuously develops cost-efficient and advanced products for the patients to capture a huge market share. In addition, the rising prevalence of chronic diseases and the growing number of surgeries in the region are factors responsible for the regional market growth.

U.S. Wound Sealants Market Trends

The U.S. held the largest share of North America wound sealants market in 2024. The U.S. wound sealants market is experiencing growth, driven by combination of rising surgical volumes, increasing demand for minimally invasive procedures, and the growing aging population prone to chronic wounds and comorbidities. Technological advancements in synthetic and bio-based sealants, along with improved product efficacy and ease of use, are also contributing to wider adoption in hospitals, ambulatory surgical centers, and even home care settings.

Europe Wound Sealants Market Trends

Europe wound sealants market is growing with significant growth rate over the forecast period, owing to factors such as high disposable income, presence of a well-established healthcare infrastructure, and the availability of skilled professionals. Moreover, the presence of favorable reimbursement coverage has increased the adoption of surgical procedures. In addition, the increasing geriatric population and rising cases of chronic diseases are also anticipated to drive the market.

The UK wound sealants market is witnessing steady growth, primarily fueled by an aging population, a rising burden of chronic illnesses such as diabetes, and an increasing number of chronic wound cases. According to a March 2024 report by Diabetes UK (The British Diabetic Association), over five million people in the UK are currently living with diabetes, equivalent to more than one in every 14 individuals. This growing health challenge is driving demand for effective wound management solutions. The market also benefits from heightened awareness of advanced wound care, increased government support, and higher healthcare spending. As a result, there is greater adoption of innovative wound sealant products and technologies aimed at enhancing patient outcomes and lowering overall healthcare costs.

Asia Pacific Wound Sealants Market Trends

The Asia Pacific region is witnessing significant growth in the wound sealants market. This can be attributed to the region's growing diabetes population and rising healthcare expenditure. For instance, the Down to Earth organization estimates that India had 74.2 million diabetics between the ages of 20 and 79 as of December 2021. Furthermore, it is expected that this figure would rise to 124.8 million by 2045. Therefore, an increase in the diabetic population may help the wound sealants market growth in the Asia Pacific region. Furthermore, according to a report published by Insurance Asia, APAC’s healthcare spending is expected to surge 9.9% in 2024. These factors are expected to drive the segment’s growth over the forecast period

China wound sealants market is a key player in the Asia Pacific region, with significant growth anticipated over the forecast period. This expansion is primarily driven by the rising incidence of chronic diseases and a rapidly aging population. According to data from the State Council of the People's Republic of China in October 2024, nearly 297 million people in China were aged 60 or older in 2023, representing 21.1% of the total population. This significant demographic shift is contributing to increased demand for advanced wound care solutions, including wound sealants, to address age-related health issues and chronic wound management, thereby accelerating market growth.

Latin America Wound Sealants Market Trends

The Latin American wound sealants market is experiencing steady growth, driven by several key factors. The aging population across the region, coupled with a growing prevalence of chronic conditions like diabetes and obesity, is leading to a rise in chronic wounds such as diabetic foot ulcers and pressure ulcers. These health challenges drive demand for advanced wound care solutions, including wound sealants. Countries such as Brazil and Argentina are leading this growth trend, supported by their sizeable populations and ongoing improvements in healthcare infrastructure, which are enabling broader access to modern wound management technologies.

Middle East Africa Wound Sealants Market Trends

The growing geriatric population, increasing number of surgeries, and rising incidence of sports-related injuries are expected to propel the Middle East and Africa wound sealants market's growth. In addition, the increasing government initiatives to develop healthcare infrastructure are expected to increase the number of surgeries in the region, leading to an increase in demand for advanced wound sealant products.

Key Wound Sealants Company Insights

The wound sealants market is extremely fragmented, with major and local competitors. Due to the fact that the current market players are stepping up their efforts to grab the majority in the market, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, in an effort to gain a competitive edge over rivals. Thus, with various strategies adopted by the market players, the market is predicted to grow during the forecast period.

Key Wound Sealants Companies:

The following are the leading companies in the wound sealants market. These companies collectively hold the largest market share and dictate industry trends

- Terumo Corporation

- Baxter

- Advanced Medical Solutions Group plc

- Johnson & Johnson (Ethicon)

- BD

- Integra LifeSciences Corporation

- Cohera Medical, Inc.

- LifeBond Ltd.

Recent Developments

-

In November 2023, Ethicon, a Johnson & Johnson MedTech company, announced the approval of ETHIZIA, an adjunctive hemostat solution that has been clinically proven to achieve sustained hemostasis in challenging bleeding scenarios.

-

In February 2023, Advanced Medical Solutions Group plc announced the acquisition of Connexicon Medical Limited. Connexicon specializes in tissue adhesive technologies, a strategic addition to bolster AMS’s product portfolio in advanced wound care and surgical adhesives. By integrating Connexicon's tissue adhesive technologies, AMS can expand its portfolio with innovative solutions for wound closure.

Wound Sealants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 583.82 million

Revenue forecast in 2030

USD 767.76 million

Growth rate

CAGR of 5.63% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sealants, wound type, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India, Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Terumo Corporation; Baxter; Advanced Medical Solutions Group plc; Johnson & Johnson (Ethicon); BD; Integra LifeSciences Corporation; Cohera Medical, Inc.; LifeBond Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wound Sealants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wound sealants market report on the basis of sealants, wound type, end use, distribution channel, and region:

-

Sealants Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Synthetic

-

Collagen Based

-

Synthetic

-

-

Wound Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical/ Procedure

-

Obstetrics / Gynecology

-

Colorectal

-

Cardiovascular

-

Bariatric and Upper GI

-

Plastic and Reconstructive Surgery

-

Urology

-

Hepato-pancreato-biliary (HPB)

-

Dermatology

-

Others (ENT, Ortho trauma, Neuro, etc.)

-

-

Lacerations & Minor Cuts

-

Burns

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Care Hospital

-

Ambulatory Surgery Center (ASC)

-

Hospital Outpatient Wound Care Clinic

-

Home Healthcare

-

Skilled Nursing Facility (SNF)

-

Physician Office

-

Burn Center

-

Inpatient Rehabilitation Facility (IRF)

-

Long-term Acute Care Hospital (LTACH)

-

Long-term Care (residential living setting)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wound sealants market size was estimated at USD 552.13 million in 2024 and is expected to reach USD 583.82 million in 2025

b. The global wound sealants market is expected to grow at a compound annual growth rate of 5.63% from 2025 to 2030 to reach USD 767.76 million by 2030.

b. North America dominated the wound sealants market with a share of 40.31% in 2024. This is attributable to rapid adoption of advanced equipment in the U.S. has allowed the region to account for a larger market share. The presence of leading manufacturers and quick adoption of advanced products are projected to boost the region’s growth further.

b. Some key players operating in the wound sealants market include Terumo Corporation; Baxter; Advanced Medical Solutions Group plc; Johnson & Johnson (Ethicon); BD; Integra LifeSciences Corporation; Cohera Medical, Inc.; LifeBond Ltd.

b. Key factors that are driving the market growth include rising surgical volume worldwide due to aging populations and increasing prevalence of chronic diseases is fueling demand for advanced wound closure solutions like sealants. Moreover, growing preference for minimally invasive surgeries boosts the use of sealants for effective tissue sealing and reduced recovery time.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.