- Home

- »

- Homecare & Decor

- »

-

Wrapping Tissue Market Size & Share, Industry Report, 2030GVR Report cover

![Wrapping Tissue Market Size, Share & Trends Report]()

Wrapping Tissue Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Virgin Pulp, De-inked Pulp), By Application (Commercial, Residential), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-157-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wrapping Tissue Market Size & Trends

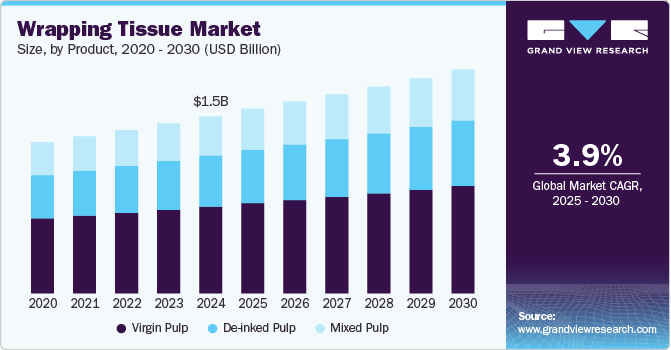

The global wrapping tissue market size was estimated at USD 1.53 billion in 2024 and is projected to grow at a CAGR of 3.9% from 2025 to 2030. The increasing demand for eco-friendly and sustainable packaging solutions is a significant contributor, as consumers and businesses alike become more environmentally conscious. Wrapping tissue, made from recycled and biodegradable materials, fits well into this trend. The booming e-commerce sector also plays a crucial role, with more businesses requiring wrapping tissue to protect and present their products attractively during shipping. In addition, the rise in gifting culture, influenced by social media and the growing popularity of personalized and luxury packaging, boosts demand for high-quality wrapping tissue.

With the rise of premium and personalized gift-giving, there is a greater demand for elegant wrapping solutions. The surge in the luxury goods market further boosts the need for sophisticated wrapping tissues that enhance the unboxing experience. In addition, the growth of small and medium-sized enterprises (SMEs) in the e-commerce sector contributes to market expansion, as these businesses seek cost-effective yet attractive packaging options. Innovations in wrapping tissue production, such as the use of advanced printing techniques and eco-friendly materials, also play a significant role in driving market growth.

In November 2024, KFC introduced Lickable Wrapping Paper infused with the flavors of the Stuffing Stacker Burger to celebrate the holiday season. Designed in collaboration with London-based artist SOLDIER, the red wrapping paper features a festive camo motif and depicts the taste of KFC’s Original Recipe Chicken with cranberry sauce and aromatic onion stuffing spices. The lickable areas have protective covers for safe sampling. This product was available exclusively online through the KFC Shop for a limited time, free of charge, while supplies last.

Consumer Survey & Insights

Environmental consciousness is profoundly reshaping consumer habits, influencing sectors from beauty to agriculture. According to Shorr's 2025 Sustainable Packaging Consumer Report, which surveyed 2,016 American consumers, over half (54%) have deliberately chosen products with sustainable packaging in the past six months. Remarkably, 90% of respondents indicated a higher likelihood of purchasing from brands with eco-friendly packaging. More than half of Millennials (59%) and Gen Z (56%) reported consciously buying products with sustainable packaging. In addition, 43% of consumers are willing to pay extra for such products, while over a third (39%) have switched to competing brands for their sustainable packaging. These findings underscore the significant impact of eco-friendly packaging on consumer decisions and highlight the growing need for brands to adopt sustainable practices to meet this increasing demand.

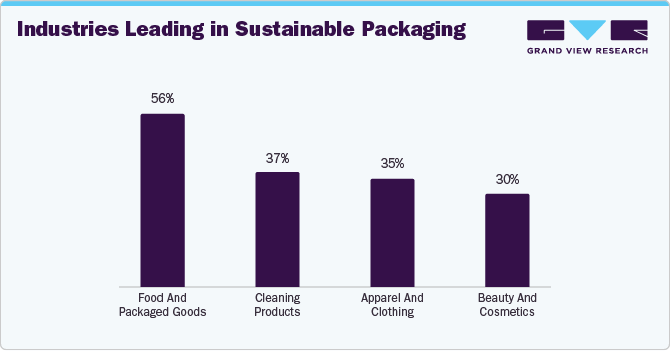

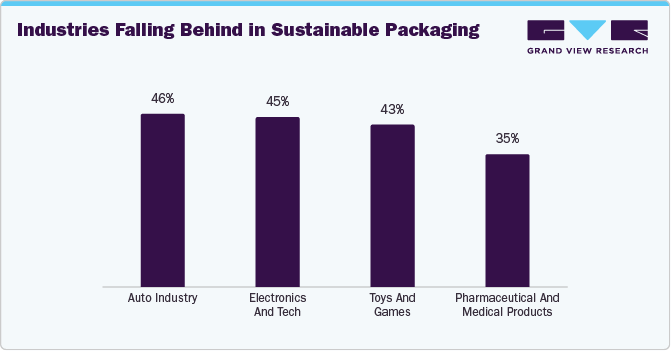

Consumers have identified leading and lagging industries in sustainable packaging efforts. The food and packaged goods sector is highly praised by 56% of respondents, followed by cleaning products at 37%, apparel and clothing at 35%, and beauty and cosmetics at 30%. Conversely, the auto industry is viewed as lagging by 46% of consumers, with electronics and tech at 45%, toys and games at 43%, and pharmaceutical and medical products at 35%. These insights underscore the varying degrees of progress across sectors, highlighting areas that require greater focus on sustainable packaging initiatives.

Product Insights

The virgin pulp wrapping tissues segment led the market with the largest revenue share of 48.97% in 2024. Virgin pulp, derived from freshly harvested trees, offers superior quality in terms of strength, softness, and brightness compared to recycled pulp. These qualities make it highly desirable for premium packaging solutions, especially in the luxury goods and gift-wrapping sectors. In addition, the consistent performance and appearance of virgin pulp products appeal to businesses seeking reliable and aesthetically pleasing packaging materials.

The mixed pulp wrapping tissues segment is anticipated to grow at the fastest CAGR of 4.3% from 2025 to 2030. This growth is driven by the increasing demand for a balanced approach to quality and sustainability in wrapping tissue. Mixed pulp, a blend of virgin and recycled fibers offers a desirable combination of strength, softness, and environmental benefits. This makes it an attractive option for businesses aiming to reduce their carbon footprint without compromising on product quality. The rising consumer preference for eco-friendly packaging solutions further supports the expansion of the mixed pulp segment.

Application Insights

Based on application, the commercial setting segment led the market with the largest revenue share of 58.81% in 2024. The commercial sector, including businesses such as retailers, e-commerce platforms, and packaging companies, relies heavily on wrapping tissue for packaging and presentation purposes. The demand for aesthetically pleasing and protective packaging solutions is high in this sector, particularly for products that require safe transit and attractive presentation. In addition, the growing trend of personalized and luxury packaging in the commercial market enhances the appeal of high-quality wrapping tissue.

The residential settings segment is expected to grow at the fastest CAGR of 4.1% over the forecast period, driven by increasing consumer interest in creating aesthetically pleasing and personalized packaging at home. With the rise in DIY culture and home-based businesses, more individuals are seeking quality wrapping tissue for personal and small-scale commercial use. The trend of gifting and home décor also boosts demand, as people invest in elegant wrapping solutions to enhance the presentation of their gifts and crafts.

Distribution Channel Insights

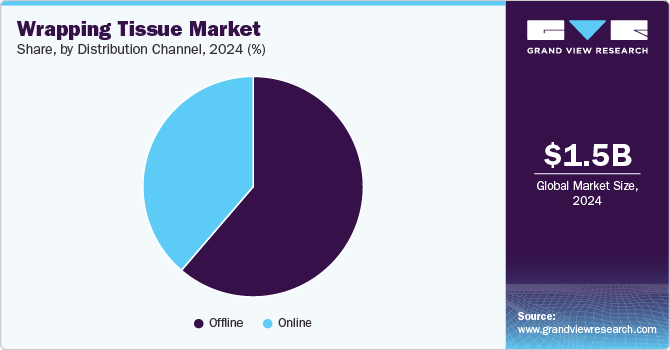

Based on distribution channel, the offline segment led the market with the largest revenue share of 61.29% in 2024. Physical retail stores, including specialty gift shops, supermarkets, and stationery stores, offer consumers the opportunity to see and feel the quality of wrapping tissue before making a purchase. The immediate availability of products and the personalized assistance provided by sales staff enhance the shopping experience, attracting a broad customer base. Promotional activities, such as discounts and in-store displays, further boost sales.

The online segment is expected to grow at the fastest CAGR of 4.2% over the forecast period. This surge is driven by the increasing convenience and accessibility of online shopping. Consumers can easily browse and purchase wrapping tissue from the comfort of their homes, with the added benefit of reading reviews and comparing products. The rise of e-commerce platforms and the growing trend of small businesses selling their products online further boost this segment. In addition, the availability of a wide range of wrapping tissue products online, often at competitive prices, enhances the shopping experience.

Regional Insights

North America dominated the wrapping tissue market with the largest revenue share of 40.75% in 2024. This strong market position is attributed to several factors. High consumer spending on premium and personalized packaging solutions, coupled with the popularity of online shopping, has significantly boosted demand. The region's well-established retail infrastructure and strong presence of key market players further support market expansion. In addition, the rising trend of eco-friendly and sustainable packaging solutions aligns with consumer preferences in North America, enhancing the appeal of high-quality wrapping tissue.

In August 2023, Ranpak launched its Geami Wrap ’n Go converter in North America, offering a sustainable alternative to plastic packaging. The converter transforms kraft paper into a 3D honeycomb structure that eliminates the need for adhesive tape and cutting. It is designed to be modular, lightweight, compact, portable, and easy to set up for in-store use. The solution is compatible with various environments and industries, ensuring smooth and even paper application. This innovation aims to enhance customer experience while providing cost-efficient protection.

U.S. Wrapping Tissue Market Trends

The wrapping tissue market in the U.S. is expected to grow at a significant CAGR over the forecast period. The increasing demand for premium and personalized packaging solutions among consumers plays a crucial role. As more people turn to online shopping and e-commerce, the need for attractive and protective wrapping tissue becomes even more critical. The trend of eco-friendly and sustainable packaging solutions also boosts market growth, with consumers and businesses seeking environmentally conscious options. For instance, in December 2024, According to the American Forest & Paper Association (AF&PA), 65-69% of paper available for recovery in the United States was recycled last year. DS Smith, a leader in sustainable fiber-based packaging, significantly contributed to this trend. Its Reading, PA, facility can recycle over 36,000 tons of used corrugated cardboard annually. The company's 14-day recycling process reduces fiber usage in its boxes by 30%. Consumers are encouraged to recycle wrapping paper and use sustainable options to reduce holiday waste.

Europe Wrapping Tissue Market Trends

The wrapping tissue market in Europe accounted for the second largest market revenue share of 25% in 2024. The region's strong emphasis on environmental consciousness and regulatory frameworks encouraging the use of biodegradable materials propel market growth. In addition, the rising trend of premium and personalized gift-giving has heightened the demand for aesthetically pleasing wrapping tissues. The well-established retail sector and the growing popularity of online shopping further contribute to the market's expansion. For instance, in May 2024, Mondi introduced ‘TrayWrap,’ a secondary paper packaging solution designed to replace plastic shrink film for bundling food and beverage products. Made from Mondi’s Advantage StretchWrap, TrayWrap is currently utilized by a Swedish coffee brand. It secures coffee packages with adhesive dots and prepunched folding points for stability and visibility. Crafted from 100% recyclable kraft paper, TrayWrap aligns with European regulatory requirements. Mondi collaborated with Meurer to adapt existing machinery for its production, ensuring a seamless transition for food and drink producers

Asia Pacific Wrapping Tissue Market Trends

The wrapping tissue market in Asia Pacific is expected to grow at a significant CAGR of 4.7% over the forecast period. The region's expanding middle-class population and rising disposable incomes lead to higher consumer spending on quality packaging materials. The increasing prevalence of e-commerce and the surge in online shopping drive demand for protective and attractive wrapping tissues. In addition, the growing awareness of eco-friendly packaging solutions aligns with the global trend towards sustainability. The cultural emphasis on gifting and celebrations further boosts market demand for premium wrapping tissues.

Key Wrapping Tissue Company Insights

Some key companies in the wrapping tissue industry include Flower City Tissue Mills Co, Innovative Packaging Group, Inc., Janhavi Enterprises, MPI PAPERMILLS Inc., NASHVILLE WRAPS, and others.

Key players in this market are innovating new products to enhance competition among manufacturers. The growing demand for eco-friendly products is further intensifying market rivalry. In a relatively fragmented competitive landscape, innovation and new product development are essential for companies to maintain consumer interest.

-

Flower City Tissue Mills Co. has been a prominent player in the wrapping tissue industry since 1906. Known for crafting fine gift-wrapping tissue papers, the company offers a wide variety of products, including 76 colors, 75 prints, and custom designs. Flower City Tissue Mills is committed to sustainability, producing all their tissue paper with 100% post-manufactured recycled materials. Their dedication to quality and customer service ensures a positive experience for customers, making them a trusted name in the industry.

-

Innovative Packaging Group, Inc. specializes in wholesale gift and retail packaging solutions that reinforce brand messages and inspire customer loyalty. Based in Dallas, Texas, the company offers a wide selection of gift boxes, wrapping paper, decorative tissue, and more from top brands. It provides sustainable and custom packaging options, catering to both small businesses and large enterprises. With over three decades of experience, Innovative Packaging Group supports local businesses by offering professional packaging solutions that are usually associated with larger brands.

Key Wrapping Tissue Companies:

The following are the leading companies in the wrapping tissue market. These companies collectively hold the largest market share and dictate industry trends.

- Flower City Tissue Mills Co

- Innovative Packaging Group, Inc.

- Janhavi Enterprises

- MPI PAPERMILLS Inc.

- NASHVILLE WRAPS

- Sakura Packaging Private Limited

- Seaman Paper Co.

- Shah Paperplast Industries Ltd.

- Twin Rivers Paper Company

- I.M.A. Industria Macchine Automatiche S.p.A.

Recent Developments

-

In August 2024, UK Greetings launched a paper tear strip for roll wrap products to eliminate plastic shrink wrap in gift wrapping. This innovative, 100% recyclable solution integrates seamlessly with existing designs, enhancing sustainability without sacrificing usability. CEO Ceri Stirland emphasized the company's commitment to reducing environmental impact, while Operations Director Richard Wilkinson highlighted significant investments in advanced machinery for large-scale production. The paper tear strip will be implemented across all domestically produced roll wraps, reinforcing UK Greetings' eco-friendly packaging portfolio.

-

In May 2024, Orlandi launched its innovative EcoPro Paper-Wrap, a groundbreaking solution in sustainable packaging. This high-barrier, recyclable paper-wrap material eliminates the need for plastic, film, or foil, providing an eco-friendly alternative to traditional packaging. EcoPro is designed for versatility, effectively wrapping various hard-good products, and is suitable for multiple applications, including e-commerce and retail. President and CEO Sven Dobler emphasized the product's alignment with consumer demands for sustainability, superior performance, and exceptional printing capabilities, ensuring brands can maintain their visual identity.

Wrapping Tissue Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.60 billion

Revenue forecast in 2030

USD 1.93 billion

Growth rate

CAGR of 3.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Flower City Tissue Mills Co; Innovative Packaging Group, Inc.; Janhavi Enterprises; MPI PAPERMILLS Inc.; NASHVILLE WRAPS; Sakura Packaging Private Limited; Seaman Paper Co.; Shah Paperplast Industries Ltd.; Twin Rivers Paper Company; I.M.A. Industria Macchine Automatiche S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wrapping Tissue Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wrapping tissue market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Virgin Pulp

-

De-inked Pulp

-

Mixed Pulp

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wrapping tissue market was estimated at USD 1.53 billion in 2024 and is expected to reach USD 1.60 billion in 2025.

b. The global wrapping tissues market is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2030 to reach USD 1.93 billion by 2030.

b. North America dominated the wrapping tissues market with a share of 40.7% in 2024. The regional growth is driven on high consumer spending on premium and personalized packaging solutions, coupled with the popularity of online shopping, has significantly boosted demand.

b. Some of the key players operating in the wrapping tissue market include Flower City Tissue Mills Co, Innovative Packaging Group, Inc., Janhavi Enterprises, MPI PAPERMILLS Inc., NASHVILLE WRAPS, Sakura Packaging Private Limited, Seaman Paper Co., Shah Paperplast Industries Ltd., Twin Rivers Paper Company, I.M.A. Industria Macchine Automatiche S.p.A.

b. Growth of the global wrapping tissue market is majorly driven on account of the increasing demand for eco-friendly and sustainable packaging solutions, as consumers and businesses alike become more environmentally conscious.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.