- Home

- »

- Advanced Interior Materials

- »

-

Zero Liquid Discharge System Market Size Report, 2033GVR Report cover

![Zero Liquid Discharge System Market Size, Share & Trends Report]()

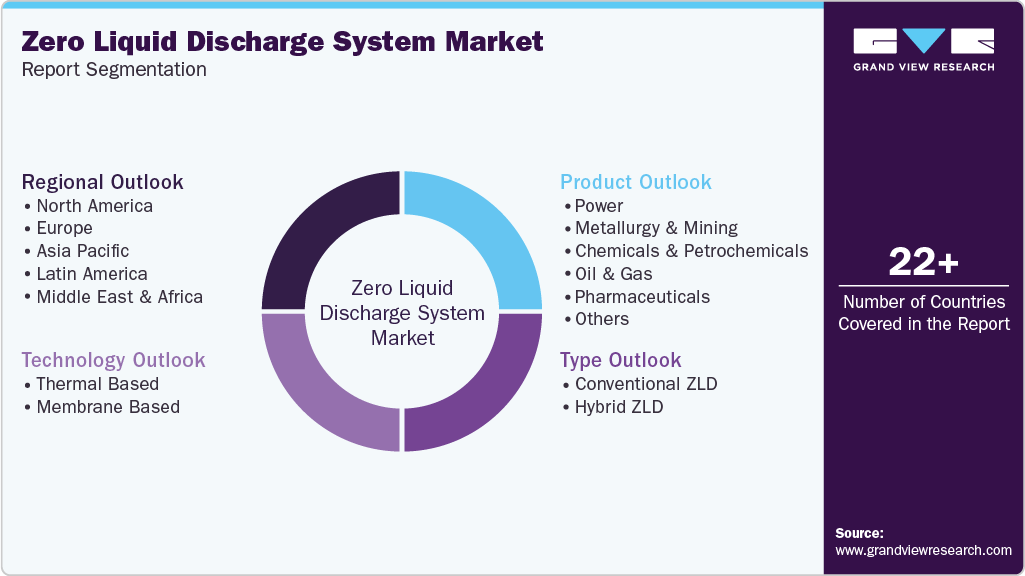

Zero Liquid Discharge System Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Conventional ZLD, Hybrid ZLD), By Technology (Thermal Based, Membrane Based), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-787-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Zero Liquid Discharge System Market Summary

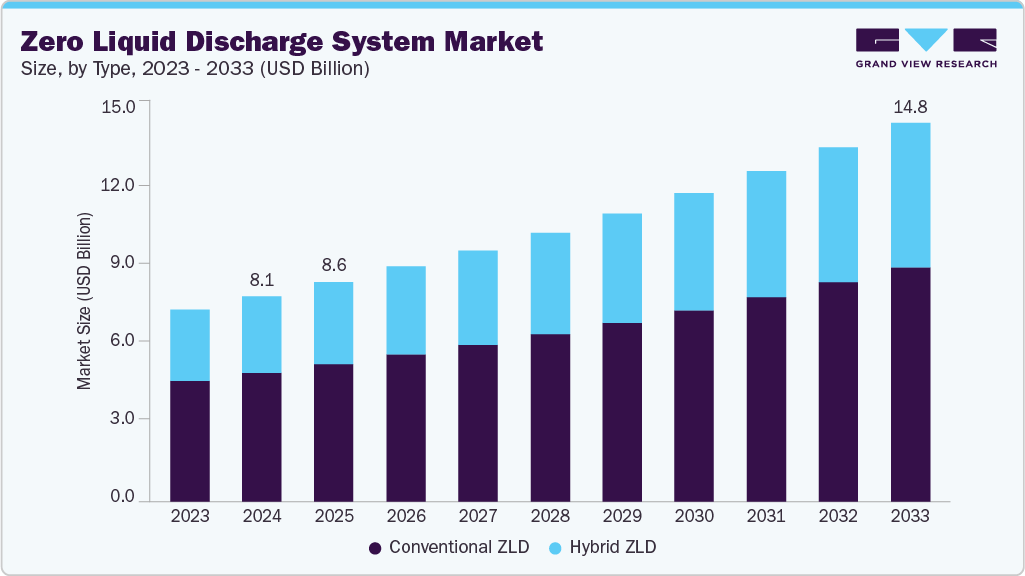

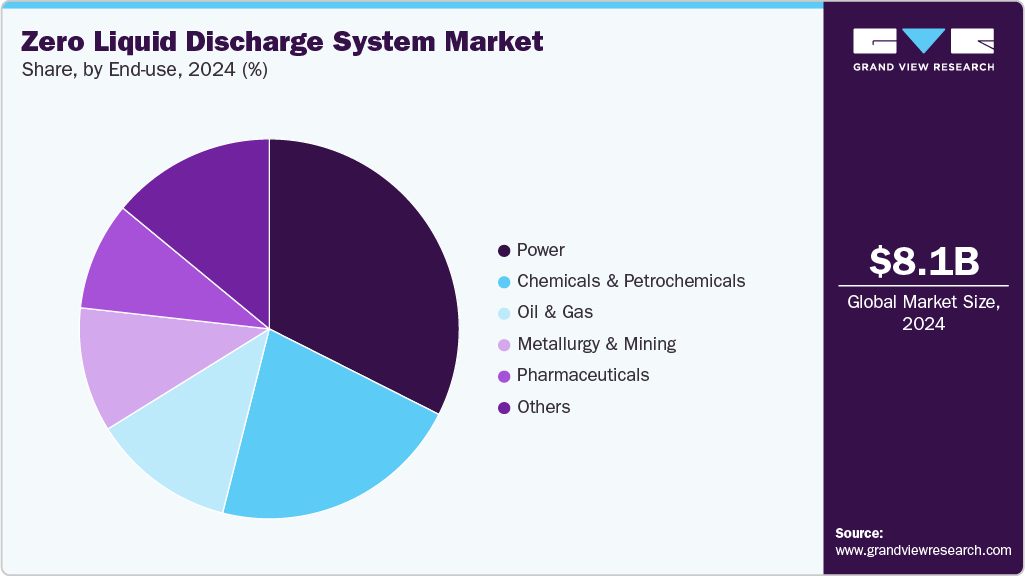

The global zero liquid discharge system market size was estimated at USD 8,045.0 million in 2024 and is projected to reach USD 14,847.8 million by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The industry is primarily driven as industries worldwide prioritize sustainable wastewater management and stricter environmental regulations come into force.

Key Market Trends & Insights

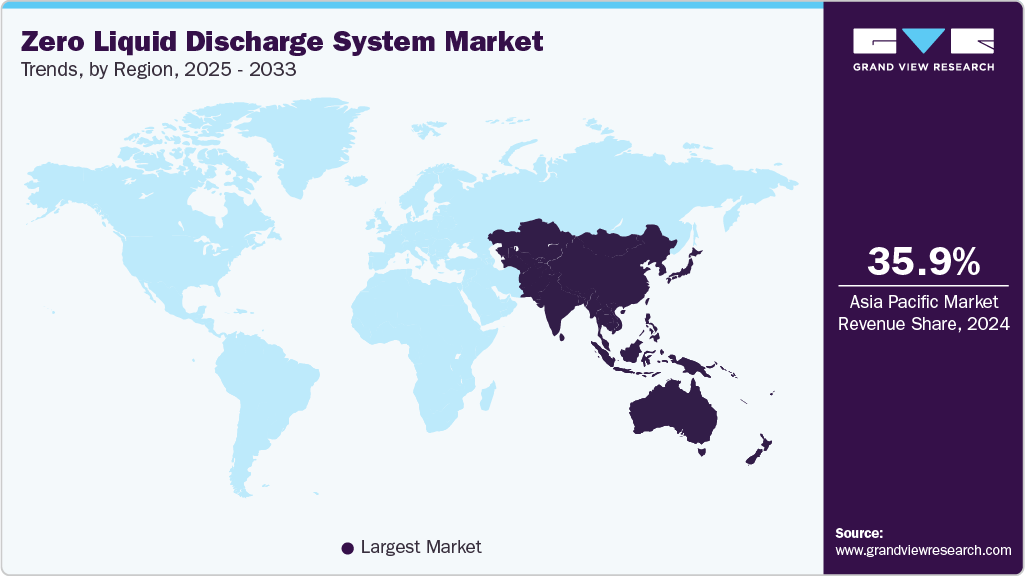

- Asia Pacific dominated the zero liquid discharge system market with the largest revenue share of 35.9% in 2024.

- By type, the hybrid ZLD segment is expected to grow at a considerable CAGR of 7.4% from 2025 to 2033 in terms of revenue.

- By technology, the thermal based segment is expected to depict a notable CAGR of 7.2% from 2025 to 2033 in terms of revenue.

- By end use, the power segment is expected to grow at a significant CAGR of 7.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 8,045.0 Million

- 2033 Projected Market Size: USD 14,847.8 Million

- CAGR (2025-2033): 7.1%

- Asia Pacific: Largest market in 2024

Increasing industrialization and the need to minimize water pollution are driving the adoption of zero liquid discharge (ZLD) technologies that recover and recycle water while eliminating liquid waste discharge. Sectors such as power generation, chemicals, and pharmaceuticals are increasingly implementing these systems to reduce environmental impact and ensure regulatory compliance.

In addition, advancements in membrane filtration, evaporation, and crystallization technologies are improving system efficiency and lowering operational costs, making ZLD solutions more feasible for a broader range of industries. Growing awareness of water scarcity and the economic benefits of water reuse further support market expansion. As governments and industries emphasize circular water management and sustainability, the demand for reliable, cost-effective ZLD systems is projected to continue increasing globally.

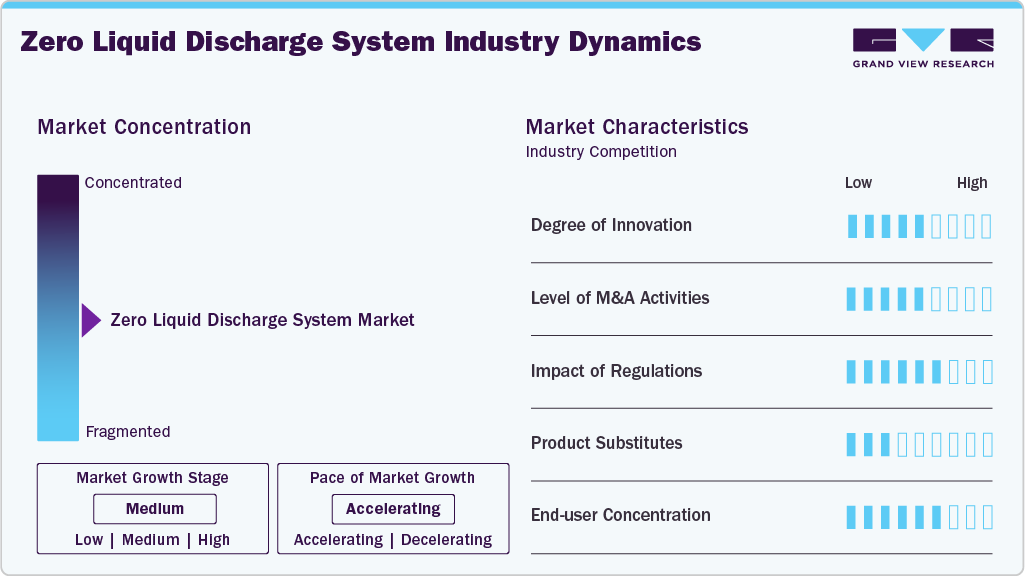

Market Concentration & Characteristics

The zero liquid discharge (ZLD) system industry is moderately fragmented, with a mix of global engineering firms and regional solution providers competing for market share. Large companies focus on comprehensive turnkey solutions and advanced technologies, while smaller players specialize in customized or cost-effective systems. Competition is driven by innovation, efficiency, and compliance with environmental standards. The diverse range of applications across industries and varying regional regulations allows both established and emerging companies to maintain a significant presence in the market.

The global market is witnessing strong innovation driven by advancements in membrane filtration, evaporation, and crystallization technologies. Companies are developing energy-efficient, modular, and automated ZLD systems to reduce operational costs and enhance performance. Integration of digital monitoring and control systems further improves process optimization, making ZLD solutions more sustainable, cost-effective, and adaptable for industries focused on environmental compliance and water reuse.

Mergers and acquisitions in the industry are driven by the need to expand technological capabilities, geographic reach, and service portfolios. Major players are acquiring smaller firms specializing in advanced treatment technologies and regional markets. These collaborations enhance R&D strength, improve system efficiency, and enable companies to offer integrated, end-to-end water treatment solutions, strengthening their competitive positioning in the growing sustainability-focused industrial landscape.

Strict environmental and wastewater discharge regulations are key factors shaping the ZLD system market. Governments are enforcing policies that limit industrial effluent discharge and promote water recycling. Compliance with sustainability standards and resource recovery goals encourages industries to adopt ZLD technologies. Regulatory pressure across sectors such as power, textiles, and chemicals continues to drive investment in advanced, eco-friendly water treatment systems.

Drivers, Opportunities & Restraints

A major driver for the zero liquid discharge system market is the increasing enforcement of stringent environmental regulations on wastewater disposal. Industries are adopting ZLD systems to eliminate liquid waste and recycle water for reuse, reducing environmental impact. Growing awareness of water scarcity and the need for sustainable resource management further accelerates the adoption of ZLD technologies across various industrial sectors.

An emerging opportunity in the industry lies in technological advancements that improve energy efficiency and reduce operational costs. Innovations in membrane filtration, hybrid evaporation, and crystallization systems are making ZLD solutions more feasible for diverse industries. Furthermore, expanding industrialization in developing economies and growing investment in sustainable water management create strong potential for market growth and new solution development.

High capital and operational costs associated with installation and maintenance are being challenge in the market. The energy-intensive nature of evaporation and crystallization processes limits adoption, especially among small and medium-sized industries. Complex system integration, skilled labor requirements, and management of solid waste byproducts also pose operational and financial challenges for end users.

Type Insights

The conventional ZLD segment held the dominant share in the market with a share of 62.8% in 2024, mainly associated with the reliance on established evaporation and crystallization processes for complete wastewater elimination. These systems are widely used in sectors such as power generation, textiles, and chemicals due to their proven reliability and regulatory compliance.

The hybrid ZLD segment is projected to grow rapidly as industries seek more energy-efficient and cost-effective solutions. Combining membrane-based pre-concentration with thermal evaporation, hybrid systems reduce power consumption and improve recovery efficiency. Their flexibility, scalability, and lower operational costs make them ideal for diverse industrial applications. As environmental regulations tighten and water reuse goals expand, hybrid ZLD systems are gaining traction as a sustainable and technologically advanced alternative.

Technology Insights

The thermal segment continues to dominate the market as it accounted for a share of 61.6% in 2024, as industries adopt evaporation and crystallization technologies to achieve complete wastewater elimination. These systems are well-suited for handling high-salinity and complex effluents common in power, chemical, and mining sectors. Despite being energy-intensive, thermal ZLD solutions remain preferred for their effectiveness, reliability, and ability to meet strict environmental discharge regulations, ensuring full recovery and reuse of water in industrial operations.

The membrane based segment is projected to grow rapidly, due to rising demand for energy-efficient and cost-effective ZLD solutions. Technologies such as reverse osmosis, ultrafiltration, and nanofiltration are increasingly used for pre-concentration before thermal treatment. These systems reduce energy consumption, operational costs, and environmental impact. Their modular design and scalability make them ideal for diverse industries seeking sustainable wastewater management and compliance with tightening environmental standards.

End Use Insights

The power sector dominated the market with a share of 32.4% in 2024, as power plants seek to minimize water discharge and comply with stringent environmental regulations. ZLD systems help recover and reuse water from cooling and boiler blowdown processes, reducing freshwater dependency. Growing emphasis on sustainable power generation and efficient resource management is encouraging utilities to adopt advanced ZLD technologies for better operational efficiency and environmental compliance.

The metallurgy & mining segment is projected to grow due to increasing environmental concerns and stricter wastewater discharge norms. ZLD systems help treat and recover water from tailings, process effluents, and metal extraction operations, reducing contamination and water consumption. The adoption of hybrid ZLD technologies enhances recovery efficiency while minimizing waste. As global demand for metals rises, mining companies are prioritizing sustainable water management and regulatory compliance through advanced ZLD solutions.

Regional Insights

The North America zero liquid discharge system industry is poised to grow at CAGR of 7.2% over the forecast period on the back of strict environmental regulations and a focus on sustainable industrial practices. Industries are adopting ZLD technologies to minimize wastewater generation and promote water reuse. Increasing investment in industrial modernization and advancements in treatment technologies are further supporting the adoption of efficient ZLD systems across various sectors.

U.S. Zero Liquid Discharge System Market Trends

The zero liquid discharge system industry in the U.S. is experiencing strong growth as industries prioritize sustainability and regulatory compliance. Stricter environmental policies are encouraging manufacturers and energy producers to adopt advanced wastewater treatment solutions. The integration of membrane and hybrid ZLD technologies is improving efficiency, while rising awareness about water conservation is driving investments in water recovery and recycling initiatives across multiple industrial sectors.

The Mexico zero liquid discharge system industry is growing as the country strengthens its environmental regulations and industrial water management policies. Rapid industrial expansion in manufacturing, mining, and energy sectors is driving the adoption of ZLD systems to reduce pollution and promote water reuse. Increasing awareness of water scarcity and sustainable production practices is further accelerating market growth and technological adoption across industries.

Europe Zero Liquid Discharge System Market Trends

The Europe zero liquid discharge system industry is growing rapidly, due to strict wastewater discharge standards and environmental sustainability goals. Industries across the region are implementing ZLD systems to achieve compliance and minimize environmental impact. Continuous technological innovation, strong government initiatives, and the focus on circular water management are further boosting the adoption of advanced ZLD solutions in key industrial sectors.

The zero liquid discharge system industry in Germany is rising due to its strong industrial base and commitment to sustainability. Industrial sectors such as chemicals, power, and manufacturing are increasingly adopting ZLD systems to reduce wastewater generation and promote resource recovery. Technological advancements and government support for eco-efficient infrastructure are further strengthening the market’s development in the country.

The UK zero liquid discharge system industry has gained impetus against the backdrop of its broader focus on environmental protection and water management. Industrial facilities are implementing ZLD solutions to meet stringent discharge regulations and enhance water reuse. The country’s increasing investment in clean technologies and sustainable manufacturing practices is driving steady growth in the ZLD market.

Asia Pacific Zero Liquid Discharge System Market Trends

The zero liquid discharge system industry in the Asia Pacific is a dominant market, as it accounted for a 35.9% share in 2024. The growth is attributed to expanding industrialization and stricter environmental norms. Countries across the region are focusing on water reuse and pollution control to address rising water scarcity. Growing adoption of hybrid and energy-efficient ZLD technologies is enabling industries to manage wastewater sustainably while supporting long-term environmental goals.

The China zero liquid discharge system industry is growing swiftly, as the government enforces stricter wastewater regulations and promotes sustainable industrial practices. Rapid growth in manufacturing, power, and chemical industries is driving demand for efficient ZLD systems. Continuous technological innovation and government initiatives focused on water recycling and pollution reduction are further accelerating market adoption nationwide.

The zero liquid discharge system industry in India has gained ground as industrial sectors face increasing pressure to reduce water pollution and conserve resources. Government initiatives promoting sustainable water management and stricter environmental policies are encouraging industries to adopt ZLD systems. Expanding manufacturing, textile, and energy sectors are further driving the deployment of cost-effective and efficient wastewater treatment solutions.

Middle East & Africa Zero Liquid Discharge System Market Trends

The Middle East and Africa zero liquid discharge system industry has observed an increased adoption of ZLD systems due to water scarcity and the need for sustainable industrial operations. Energy, petrochemical, and manufacturing sectors are key drivers of demand. Governments are promoting advanced wastewater treatment technologies to reduce environmental impact and enhance water reuse efficiency across industrial facilities.

The zero liquid discharge system industry in Saudi Arabia is experiencing significant growth as part of its efforts to conserve water and achieve sustainability goals. Expanding industrial and desalination projects are driving the need for advanced wastewater treatment systems. The country’s focus on reducing freshwater dependency and environmental impact supports rising adoption of ZLD technologies across major industries.

Latin America Zero Liquid Discharge System Market Trends

The zero liquid discharge system industry in Latin America is supported by rising industrial activities and environmental awareness. Governments are introducing stricter water discharge norms, prompting industries to adopt ZLD technologies. Growing investment in mining, oil and gas, and manufacturing sectors, along with increasing focus on sustainable operations, is driving regional market expansion.

The Brazil zero liquid discharge system industry is growing as industries seek to manage wastewater efficiently amid tightening environmental regulations. The mining, chemical, and power sectors are key adopters, focusing on water recovery and pollution control. Rising awareness of water scarcity and sustainability initiatives is encouraging greater investment in advanced ZLD technologies across the country.

Key Zero Liquid Discharge System Company Insights

Some of the key players operating in the market include Alfa Laval, GEA Group Aktiengesellschaft, Aquatech International LLC

-

Alfa Laval designs and manufactures specialized products and solutions for heat transfer, separation, and fluid handling across industries such as food processing, energy, water treatment, and marine. The company provides technologies that improve process efficiency, reduce energy consumption, and support sustainable operations. In the zero liquid discharge market, Alfa Laval offers advanced evaporation and separation systems that help industries minimize wastewater, recover valuable resources, and comply with stringent environmental standards through efficient, reliable process engineering.

-

GEA Group Aktiengesellschaft provides process technology, equipment, and solutions for various industries including food, chemicals, pharmaceuticals, and energy. The company focuses on optimizing production efficiency and sustainability through its separation, filtration, and evaporation technologies. In the zero liquid discharge systems market, GEA offers advanced thermal and mechanical treatment solutions that enable efficient water recovery and waste minimization. Its engineering expertise supports industries in achieving compliance, resource efficiency, and environmentally responsible operations.

Key Zero Liquid Discharge System Companies:

The following are the leading companies in the zero liquid discharge system market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Laval

- GEA Group Aktiengesellschaft

- Aquatech International LLC

- Aquarion AG

- Doosan Corporation

- H2O GmbH

- Mitsubishi Heavy Industries, Ltd.

- Praj Industries

- Siemens

- Veolia Water Technologies

- Ion Exchange (India) Ltd.

- Toshiba Infrastructure Systems & Solutions Corporation

- Green Pebble Technologies

- SUEZ Water Technologies & Solutions

- IDE Technologies

Recent Developments

-

In July 2025, Alfa Laval acquired the business unit Fives Cryogenics, adding advanced heat transfer and pump technologies to its portfolio. This strengthens Alfa Laval’s capabilities in thermal management for zero liquid discharge systems, enabling more efficient and innovative water treatment solutions, which will drive growth and enhance competitiveness in the ZLD market.

-

In July 2024, UCC Environmental and Vacom Systems formed a strategic partnership to provide advanced wastewater treatment solutions for zero liquid discharge in North American coal-fired power plants.

Zero Liquid Discharge System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8,603.1 million

Revenue forecast in 2033

USD 14,847.8 million

Growth rate

CAGR of 7.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end use, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Alfa Laval; GEA Group Aktiengesellschaft; Aquatech International LLC; Aquarion AG; Doosan Corporation; H2O GmbH; Mitsubishi Heavy Industries, Ltd.; Praj Industries; Siemens; Veolia Water Technologies; Ion Exchange (India) Ltd.; Toshiba Infrastructure Systems & Solutions Corporation; Green Pebble Technologies; SUEZ Water Technologies & Solutions; IDE Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Zero Liquid Discharge System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global zero liquid discharge system market report based on type, technology, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional ZLD

-

Hybrid ZLD

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Thermal Based

-

Membrane Based

-

-

End use Outlook (Revenue, USD Million, 2021 - 2033)

-

Power

-

Metallurgy & Mining

-

Chemicals & Petrochemicals

-

Oil & Gas

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global zero liquid discharge system market size was estimated at USD 8,045.0 million in 2024 and is expected to be USD 8,603.1 million in 2025.

b. The global zero liquid discharge system market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2033 to reach USD 14,847.8 million by 2033.

b. Conventional ZLD segment continues to dominate the market and accounted for a share of 62.8% in 2024, as industries continue to rely on established evaporation and crystallization processes for complete wastewater elimination. These systems are widely used in sectors such as power generation, textiles, and chemicals due to their proven reliability and regulatory compliance.

b. Some of the key players operating in the global zero liquid discharge system market include Alfa Laval, GEA Group Aktiengesellschaft, Okuma Corporation, Aquarion AG, Doosan Corporation, H2O GmbH, Mitsubishi Heavy Industries, Ltd., Praj Industries, Siemens, Veolia Water Technologies, Ion Exchange (India) Ltd., Toshiba Infrastructure Systems & Solutions Corporation, Green Pebble Technologies, SUEZ Water Technologies & Solutions, IDE Technologies.

b. The global zero liquid discharge (ZLD) system market is driven by stricter environmental regulations, growing water scarcity, and industrial sustainability initiatives. Technological advancements in membrane-based and hybrid ZLD systems enhance efficiency, while supportive government policies encourage adoption. Industries are increasingly implementing ZLD solutions to recycle water, reduce environmental impact, and comply with regulatory standards, fueling overall market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.