- Home

- »

- Next Generation Technologies

- »

-

Zero-Touch Provisioning Market Size & Share Report, 2030GVR Report cover

![Zero-Touch Provisioning Market Size, Share & Trends Report]()

Zero-Touch Provisioning Market (2022 - 2030) Size, Share & Trends Analysis Report By Component, Device Type, Network Complexity, Enterprise Size, Industry, By Regional Outlook, Competitive Strategies, And Segment Forecasts

- Report ID: GVR-4-68040-025-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global zero-touch provisioning market size was valued at USD 2,521.3 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.3% from 2022 to 2030. The rising number of connected consumer devices, Internet of Things (IoT), and industrial machines deployed across commercial, consumer, industrial, and infrastructure spaces is accelerating the adoption of zero-touch provisioning (ZTP) market globally. Moreover, the resultant increase in pivotal deployment of 5G networks and the large-scale emergence of network slicing has profoundly changed the orchestration and management of networks and networks related services. Lastly, many enterprise customers are updating their network infrastructure to improve the security of their networks and ensure more efficient data exchange is fueling the growth of the zero-touch provisioning market.

Zero Touch Provisioning (ZTP) enables the setting up or provisioning of the managed network devices within a network automatically with minimal to no manual intervention. It allows quick deployment of network devices & tools and automates the system advancement/updating process by utilizing scripts connecting the tools & devices, and configuration management platforms.

ZTP can be set up in software-defined wide area network (SD-WAN) routers, switches, firewalls, and wireless access points. Zero touch provisioning incorporates basic configuration, enabling the deployment of switches within custom configuration-altering environments. It is substantially beneficial for automating processes, such as fixing bugs, deploying patches, implementing additional features within a prior connection, and updating operating systems.

ZTP eliminates human errors, time spent on manual tasks, and operational costs, fueling the growth of the market. With the development of data centers from static legacy networks to dynamic cloud-computing, elimination of inaccuracies, and automation is indispensable. ZTP-enabled networking devices support ease of deployment and limit provisioning errors.

The integration of automation is essential for the cloud-based infrastructure designed to improve the efficiency of existing operations. It creates a configuration bridge between devices and networks streamlining and automating device management. Zero-touch provisioning configures settings, such as email and Wi-Fi on network equipment, enforces passwords, secures sensitive data, and centrally deploys applications and re-assigns licenses according to change in work.

The zero-touch provisioning market is consolidated, with a few players dominating and capturing a significant share of the overall market. These companies have invested an enormous sum of the amount, as the industry is anticipated to grow exponentially in the near future.

COVID-19 Impact on the Zero-Touch Provisioning Market

The COVID-19 outbreak significantly impacted the global economy and, subsequently, 5G infrastructure roll-out and deployment plans. According to the data released by the International Monetary Fund (IMF) in October 2021, the global GDP reduced by a rate of -3.1% in 2020 due to COVID-19. Governments across several countries implemented complete/strict lockdowns during the first two quarters of 2020 to stop the spread of the virus. The pandemic also forced organizations to abruptly shift to a work-from-home model, which led to the adoption of online platforms to ensure business continuity and enable distance learning, among other things.

This necessitated the establishment of efficient network services and solutions. Factors such as the advent of 5G technology, growing penetration of internet connectivity, rising adoption of smart devices, and technological advancements also positively impacted the demand for zero-touch provisioning. Distance learning and remote work culture boosted the rollout of 5G network services and propelled the adoption of 5G services. With the increasing number of connected devices and network services, the dire need for automating processes such as installation, configuration, and software up-gradation propelled the zero-touch provisioning market.

Component Insights

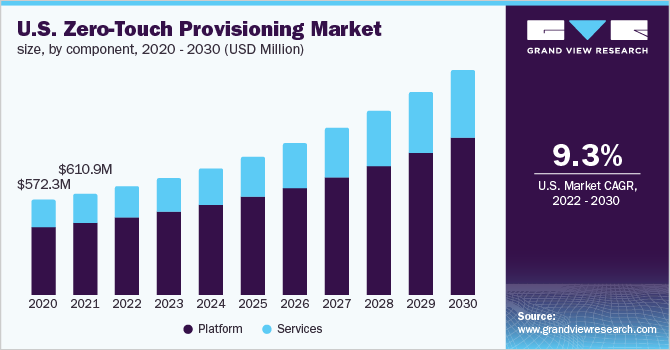

In terms of component, the market is classified into platforms and services. The platform segment dominated the overall market, gaining a market share of more than 71.0% in 2021 and witnessing a CAGR of 10.0% during the forecast period. The growth is attributed to the emerging adoption of ZTP platforms, which provides various advantages to enterprises including simplified deployment and configuration, increased reliability, reduced deployment costs, and improved network visibility and control.

Furthermore, ZTP platforms can simplify the deployment and configuration of network devices, especially in large-scale environments where the number of devices can be difficult to manage. By automating these processes, ZTP platforms can help organizations reduce the time and resources required for deploying and configuring new devices.

The services segment is anticipated to witness the fastest growth, expanding at a CAGR of 11.2% throughout the forecast period. The factors such as the growing need to save time and resources, high customization along with flexibility, and the requirement of ongoing support as well as maintenance is expected to drive the growth of the services segment.

ZTP services often include ongoing support and maintenance to help organizations manage and maintain their ZTP deployments. This can include technical support, software updates, and other resources to help organizations keep their ZTP deployments running smoothly.

Device Type Insights

In terms of device type, the market is classified into routers, switches, access points, firewalls, IoT devices, and others. The switches segment dominated the overall market, gaining a market share of more than 29.0% in 2021 and witnessing a CAGR of 9.3% during the forecast period. The growth is attributed to the emerging adoption of edge devices and increasing penetration of the internet & cloud by large enterprises to rapidly deploy and implement network elements.

The increasing adoption of switches by various industries such as smart cities, oil & gas, IT & telecom, among others for outdoor environments to improve communication between applications is propelling the growth of the market. Zero touch provisioning within a switch provides an option to auto-configure enabling the operators to mount and connect the switches, and easily initiate zero touch provisioning.

ZTP deployment by businesses and organizations within device types, such as switches simplifies network deployment and reduces the total cost of ownership. Moreover, the concept of network automation has fueled the network device configuration allowing enterprises to automate the whole process.

The Internet of Things (IoT) devices segment is anticipated to witness the fastest development, expanding at a CAGR of 11.9% throughout the forecast period. With the increasing adoption of IoT devices, device manufacturers and IoT service providers are facing issues in manually onboarding the devices, such as technological, security, device scalability, and interoperability.

The adoption of IoT devices has surged with the growing reliance on IoT & connected devices by several industries such as healthcare, agriculture, retail, transportation, manufacturing, and aerospace & defense. These industries incorporate IoT devices to improve production efficiency, customer experience, security, limit industrial wastage, and usage of fertilizers, among other use cases.

ZTP groups the IoT devices and provides access control as per the requirements, monitors the IoT device security, inventory, and health. It provides configuration and updates, assigned to each IoT device eliminating manual provisioning. ZTP allows network administrators to control and connect numerous IoT devices with little human intervention and effort.

Network Complexity Insights

In terms of network complexity, the market is classified into a multi-vendor environment, complex network architecture, and dynamic network environment. The complex network architecture segment dominated the overall market, gaining a market share of more than 45.0% in 2021 and witnessing a CAGR of 9.4% during the forecast period. Complex network environments are utilized by large enterprises/organizations comprising two domains, sub networks, multiple layers, and interdependencies between networking systems and devices with two host systems sharing a single network control protocol.

Zero touch provisioning automates the deployment of all the devices within the network system, manages heavy workloads, and eliminates human intervention by assigning controllers to various regions for region-based network management. The growth of the segment is attributed to the increasing adoption of ZTP to simplify network infrastructure management within large-scale complex network architecture.

The dynamic network environment segment is anticipated to witness the fastest development, expanding at a CAGR of 11.3% throughout the forecast period. With the constant evolution and frequent broadening of network requirements, organizations need to upgrade their network systems and devices according to transforming technologies. Organizations with dynamic network environments frequently face issues such as threat complexity, lack of agility, meeting compliance requirements, and secure data centers, among others.

The advent of ZTP has the potential to solve most of the issues faced by organizations with dynamic network environments. ZTP will enable seamless deployment of the network devices and systems; hassle-free software upgrades, and optimizes operational tasks. The elimination of human intervention and errors has also led to a reduction of operational and labor costs leading to the rapid adoption of ZTP and propelling the growth of the market.

Enterprise size Insights

In terms of enterprise size, the market is classified into large enterprises and small & medium enterprises. The large enterprises segment dominated the overall market, gaining a market share of more than 65% in 2021 and witnessing a CAGR of 9.9% during the forecast period. The growth is attributed to the increasing adoption of zero touch provisioning, network virtualization solutions, and network automation across large enterprises. These are expected to drive the segment's growth.

Additionally, large enterprises from various industries such as oil & gas, IT & Telecom, healthcare, and governments are the early adopters of advanced technologies such as ZTP and automation for building smart factories and smart cities which are driving the demand for zero touch provisioning. However, large enterprises require robust network infrastructure and devices to efficiently manage their resources and increase productivity without errors, propelling the growth of the market.

The small & medium enterprises segment is anticipated to witness the fastest development, expanding at a CAGR of 11.0% throughout the forecast period. Zero touch provisioning allows SMEs to deploy ZTP on-demand, perform network configuration tasks, and eliminates the requirement of on-site manual intervention in device configuration and deployment. SMEs focus on digital transformation to achieve reliable, fast, and secure networks, less time spent on manual tasks, automatic software up gradation, and eliminate human intervention and operational costs.

The adoption of zero touch provisioning is higher in SMEs as it improves the quality of services (QoS) and ensures device scalability and interoperability. Moreover, zero touch provisioning within devices such as routers, access points, IoT devices, and firewalls is higher in demand by SMEs owing to its affordability.

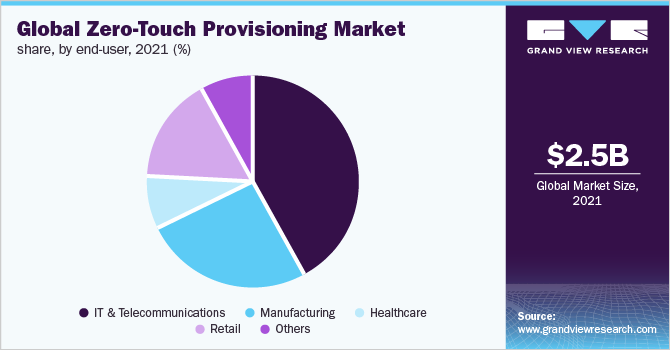

Industry Insights

In terms of industry, the market is classified into IT & telecommunications, manufacturing, healthcare, retail, and others. The IT & Telecommunications segment dominated the overall market, gaining a market share of more than 41.0% in 2021 and witnessing a CAGR of 9.2% during the forecast period. The growth is attributed to the increasing number of connected consumer devices, the adoption of advanced technologies, and the advent of network automation.

Zero-touch provisioning plays a significant role in the IT & telecommunication sector as it minimizes human errors, time spent on manual tasks, and operational costs, fueling the growth of the market. ZTP services are expected to revolutionize the entire IT sector by automating the process of software up gradation and system advancement. It enables basic configuration, allowing the deployment of switches within custom configuration-altering environments.

ZTP allows IT & telecommunication providers to automatically update scripts and configure new virtual functions. It also enables enterprises to cater to rising challenges emerging owing to the high usage of NFV.

The healthcare segment is anticipated to witness the fastest development, expanding at a CAGR of 12.1% throughout the forecast period. Zero-touch provisioning has gained traction in the healthcare sector as it automates processes, implements additional features within a prior connection, and updates operating systems, allowing healthcare organizations to gain a competitive advantage. The adoption of IoT-enabled connected medical devices & solutions surged post-pandemic creating reliable cellular connectivity, decentralized clinical trials, and remote patient monitoring.

ZTP-enabled networking devices support ease of network devices and infrastructure deployment and limit provisioning errors, due to which several hospitals and healthcare institutions are increasingly adopting zero-touch provisioning, propelling the growth of the market. ZTP has also enabled the automation of electronic medical records systems and patient monitoring systems propelling the growth of the market.

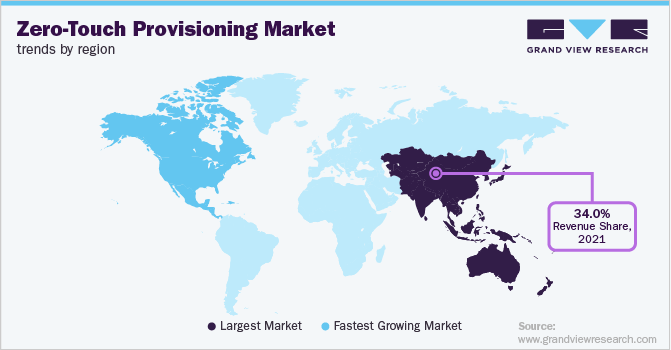

Regional Insights

Asia Pacific led the market with a market share of almost 34.0% throughout the forecast period. The growth is attributed to the increasing penetration of network automation solutions, large enterprises and SMEs adopting zero touch provisioning rapidly, and the growing number of connected devices in the region. The growth in the region can be attributed to the rising collaborations, partnerships, smart city infrastructure spending, and new product launches that are significantly contributing to the growth of the Asia Pacific market.

The rising adoption of zero touch provisioning can be attributed to their affordability and emerging network automation technology adopted by various industries, such as IT & Telecommunications, healthcare, manufacturing, and retail.

India and China have an extensive and distributed customer base driving the demand and creating new regional opportunities. The growth is prominently due to the improving network infrastructure and increasing requirements to reduce CAPEX across the region. Furthermore, the region's untapped potential is generating new investment opportunities for advanced ZTP. Multinational companies are expanding their presence across APAC, resulting in a broad customer base that provides lucrative opportunities for the market.

The market growth of Europe is driven by the high penetration of zero touch provisioning in the region.

North America is expected to develop substantially during the forecast period and expand at a CAGR of 9.2%. The region is equipped with a highly developed infrastructure and owns an extensive research and development base, allowing the region to be the top revenue contributor in the worldwide market during the projected period. A well-established infrastructure has allowed the speedier implementation of modern technologies, such as ZTP.

The significant presence of small and medium players in North America, which offer components and services to the giants such as Cisco Systems, Inc., Juniper Networks, Inc., and IBM Corporation, has also propelled the market growth. The prominent market players are also actively engaged in partnerships and collaborations to gain a competitive advantage.

For instance, in December 2022, Juniper Networks, Inc. announced a strategic partnership with Deutsche Telekom AG, a telecommunication provider. The partnership aims to leverage the company’s advanced technologies, such as AI-driven intelligence, zero touch deployments, and connected security for Deutsche Telekom AG’s SD-X, a virtualized and cloud-based platform.

Moreover, the U.S. is expected to retain its dominance during the forecast period owing to the inclination of adopting automation technologies, such as zero-touch provisioning and growing technological investments in the region.

Key Companies & Market Share Insights

The market is consolidated and is anticipated to witness increased competition due to the several players' presence. Major players are spending heavily on research and development activities to integrate advanced technologies in zero touch provisioning used within the network infrastructure which has intensified the competition among these players.

The companies are also collaborating with other market competitors and local & regional players to gain a competitive edge over their peers and capture a significant market share. Some of the key companies in the global zero-touch provisioning market include:

-

Cisco Systems, Inc.

-

Nokia Corporation

-

Telefonaktiebolaget LM Ericsson

-

Huawei Technologies Co., Ltd.

-

ZTE Corporation

-

Juniper Networks, Inc.

-

Hewlett Packard Enterprise Development LP

-

Arista Networks, Inc.

-

Extreme Networks

-

Riverbed Technology

Zero-Touch Provisioning Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2,726.6 million

Revenue forecast in 2030

USD 5,978.5 million

Growth rate

CAGR of 10.3 % from 2022 to 2030

Historic year

2017 - 2020

Base year for estimation

2021

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, device type, network complexity, enterprise size, industry, region

Regional scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil; Mexico

Key companies profiled

Cisco Systems, Inc.; Nokia Corporation; Telefonaktiebolaget LM Ericsson; Huawei Technologies Co., Ltd.; ZTE Corporation; Juniper Networks, Inc.; Hewlett Packard Enterprise Development LP; Arista Networks, Inc.; Extreme Networks; Riverbed Technology

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Zero-Touch Provisioning Market Segmentation

This report forecasts revenue growth at global, regional, and country levels in addition to provides an analysis of the industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global zero-touch provisioning market report based on component, device type, network complexity, enterprise size, industry, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Platform

-

Services

-

-

Device Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Routers

-

Switches

-

Access Points

-

Firewalls

-

IoT Devices

-

Others

-

-

Network Complexity Outlook (Revenue, USD Million, 2017 - 2030)

-

Multi-Vendor Environment

-

Complex Network Architecture

-

Dynamic Network Environment

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

IT & Telecommunications

-

Manufacturing

-

Healthcare

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global zero-touch provisioning market size was estimated at USD 2,521.3 million in 2021 and is expected to reach USD 2,726.6 million in 2022.

b. The global zero-touch provisioning market is expected to grow at a compound annual growth rate of 10.3% from 2022 to 2030 to reach USD 5,978.5 million by 2030.

b. Asia Pacific dominated the ZTP market with a share of over 30% in 2021. This is attributable to the growing demand and installation of network devices across the various countries such as India, Japan, China, South Korea and others.

b. Some key players operating in the zero-touch provisioning market include Telefonaktiebolaget LM Ericsson, Huawei Technologies Co. Ltd., Cisco Systems, Inc., Nokia Corporation, and Hewlett Packard Enterprise Company

b. The rising number of connected consumer devices, Internet of Things (IoT), and industrial machines deployed across commercial, consumer, industrial, and infrastructure spaces is accelerating the adoption of ZTP market globally

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.