- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Zinc Oxide Market Size, Share & Analysis Report, 2030GVR Report cover

![Zinc Oxide Market Size, Share & Trends Report]()

Zinc Oxide Market (2023 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Pellets), By Process (Indirect, Direct, Wet Chemical, Others), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-916-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Zinc Oxide Market Size & Trends

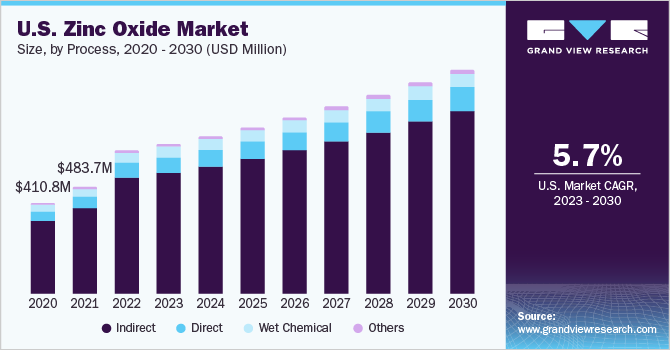

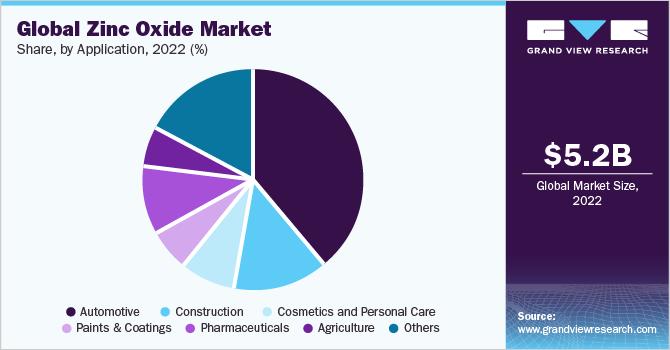

The global zinc oxide market size was valued at USD 5.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. This is attributable to its excessive use in rubber during the process of vulcanization, which is the prime component in tires for the automotive industry. The growth of the automotive industry is directly proportional to the growth of the tire industry as around 75% of the rubber produced across the globe is used in tire production. The tires, wiper blades, and engine mounts are usually manufactured from rubber.

Ceramics, particularly the tile industry, is the second largest application of zinc oxide. Both French (indirect) and American (direct) processes are suitable for these applications. The product finds its application in ceramics to reduce their melting temperature and energy and equipment requirements. Glass and ceramics have been used for manufacturing structural components for construction projects. Ceramic materials including porcelain, brick, and cement are commonly used to construct buildings. There has been an increasing trend to use nanomaterials in modern construction to improve the performance of construction materials.

According to Oxford Economics, the global construction industry was valued at USD 10.7 trillion in 2020 and is predicted to reach USD 13.3 trillion by 2025. Additionally, the output of the construction industry in Asia Pacific is expected to reach USD 7.4 trillion while North America is predicted to reach USD 2.4 trillion by 2030. The growing number of mega infrastructure projects in the emerging economies of Asia Pacific, such as India and China, is likely to boost the growth of the construction industry thereby driving the demand for the product market in the coming years.

The growing research and development activities to develop production technologies with low carbon and high output muffle furnace is likely to offer growth opportunities from the sustainability perspective. For instance, Zochem is using its expertise to install a new state-of-the-art French process technology with high output and low carbon footprint design. Furthermore, key manufacturers are actively involved in increasing the production capacities in order to cater to the increasing demand from end-use industries.

Form Insights

Powder form segment dominated the market with the highest revenue share of 76.9% in 2022. This is attributable to its increasing use in different applications such as batteries, lubricants, friction materials, gold extraction, silver extraction, spray galvanizing, and others.

Zinc oxide powder is primarily used to provide UV and corrosion protection in paints and as a catalyst in chemical processes. A very fine zinc oxide powder consists of irregular particles of around 4 to 10 microns. It is also used to manufacture zinc-rich paint formulations and chemicals such as sodium hydrosulfite, zinc phosphide, and others. Powdered ZnO is predominantly used across various industries.

ZnO pellets are made from high-purity (>99.995%) super high-grade zinc. They are an intermediate product between the dome and half ball in terms of size. These pellets can also be used in alkaline caustic potash or caustic soda baths without or with external dissolution tanks.

Liquid ZnO also finds applications in sun care and after-sun products, mineral makeup, and anti-aging skin care products. It has the ability to block wavelengths from 280 to 400 nm for UVB and UVA protection. Liquid product form helps formulators to create a high-performing anti-aging skin care and color cosmetic products.

Process Insights

Indirect or French process dominated the process segment with the highest revenue share of 80.5% in 2022. This is attributable to its properties as it is considered the fastest and most productive method of production. The quality of ZnO manufactured depends upon the type of zinc used in the process. For example, special high-grade with 99.99% zinc concentration is used for the production of gold seals or pharmaceutical-grade, whereas ordinary with 99.95% concentration is adequate to produce zinc for the rubber industry. The maximum yield of ZnO from 1 ton of special high-grade zinc is 1.2 tons.

The direct or the American process is less preferred by industry players and involves the use of feedstock containing oxidized zinc-containing raw material. This process involves the initial production of zinc by reduction of zinc ore by heating with coal followed by oxidation of zinc in a similar way used in the indirect process. This process provides a less purified form of ZnO and the high-grade requirement of pharmaceutical applications is a major challenge for this process.

Some of the other processes used in the production of products involve spray pyrolysis, hydrometallurgical method, mechanochemical method, and chemical synthesis method. In the spray pyrolysis, a solution of thermally decomposable zinc bearing salt is used. The mechanochemical process is an inexpensive and straightforward way to produce nanoparticles on a large scale, but a key challenge with this method is uniformly grinding the powder and reducing the grains to the necessary size. This process involves high-energy dry milling at lower temperatures followed by the addition of thinner to form the nano particles.

Application Insights

Automotive application dominated the product market with the highest revenue share of 39.5% in 2022. This is attributed to the growth of the tire industry as most of the rubber produced is used in automobiles of the manufacturing of the tire. ZnO is used in the vulcanization of rubber. It is also used as a cross-linking or curing agent for halogen-containing elastomers like polysulfides and neoprene.

Ceramics, particularly the tile industry, is the second largest application of the product. Properties such as low coefficient of expansion, high heat capacity, high-temperature stability, and thermal conductivity of ZnO are suitable for producing ceramics.

ZnO in small amounts provides a glossy surface to the ceramic while the addition of moderate amounts of zinc oxide provides a matte finish. ZnO improves the elasticity of glazes by lowering the change in viscosity as a function of temperature thereby preventing shivering and crazing.

Zinc oxide is widely used in the personal care & cosmetics industry as a broad-spectrum UV absorber. It is used in several cosmetic products including foundations, moisturizers, lip products, face powders, lotions & hand creams, and ointments. ZnO attenuates UV radiation effectively in both UVA (320–400 nm) and UVB range (290–320 nm). It can be used as an ingredient in dry deodorants for reducing wetness under the arm between a concentration of 0.05 and 10% by weight with average particle size ranging from 0.02 to 200 microns. Other applications of ZnO nanoparticles in the personal care & cosmetics industry include nappy rash creams, anti-dandruff shampoos, and others.

Regional Insights

Asia Pacific region dominated the product market with the highest revenue share of 52.3% in 2022. This is attributed to the advancing automobile, construction, and personal care & cosmetics industries in India, China, Japan, and South Korea. Moreover, the growing pharmaceutical industry is anticipated to drive the demand for ZnO owing to its anti-inflammatory, antiseptic, drying, and ultraviolet protection properties.

According to the India Brand Equity Foundation, the pharmaceuticals industry in India meets over 50% of the global demand for different vaccines making it the third-largest pharmaceuticals industry worldwide. According to the Indian Economic Survey, the domestic pharmaceuticals market in India stood at USD 42 billion in 2021 which is further anticipated to reach USD 65 billion by the end of 2024.

Key Companies & Market Share Insights

The global zinc oxide market is fragmented with domestic and international players operating globally. A few of the prominent players in the product market are EverZinc, Rubamin Zinc Nacional, Ace Chemie Zynk Energy Limited, Lanxess, and Tata Chemicals Ltd. These players accounted for around 12% of the market share whereas the other small and domestic manufacturers capture the remaining market.

Domestic companies such are Zochem are involved in increasing their production capacities in order to expand their product offerings and eventually increase their market share. Whereas, players like EverZinc are involved in merger and acquisition activities to meet the high demand for zinc oxide from the end-use industries. Some prominent players in the global zinc oxide market include:

-

Ace Chemie Zynk Energy Limited

-

AG CHEMI GROUP s.r.o.

-

CCL

-

EverZinc

-

Zinc Nacional

-

HAKUSUI TECH

-

LANXESS

-

IEQSA

-

Neo Zinc Oxide

-

Pan-Continental Chemical Co., Ltd.

-

Rubamin

-

Tata Chemicals Ltd.

-

TOHO ZINC CO., LTD.

-

TP Polymer Private Limited

-

Upper India

-

Weifang Longda Zinc Industry Co., Ltd.

-

Yongchang zinc industry Co., Ltd.

-

Zinc Oxide Australia

-

Zochem, Inc

Zinc Oxide Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.4 billion

Revenue forecast in 2030

USD 8.1 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, process, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Netherlands; Belgium; China; India; Japan; South Korea; Vietnam; Brazil; Argentina; Peru; Saudi Arabia; South Africa

Key companies profiled

Ace Chemie Zynk Energy Limited; AG CHEMI GROUP s.r.o.; CCL; EverZinc; Zinc Nacional; HAKUSUI TECH; LANXESS; IEQSA; Neo Zinc Oxide; Pan-Continental Chemical Co., Ltd.; Rubamin; Tata Chemicals Ltd.; TOHO ZINC CO., LTD.; TP Polymer Private Limited; Upper India; Weifang Longda Zinc Industry Co., Ltd.; Yongchang zinc industry Co., Ltd.; Zinc Oxide Australia; Zochem, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

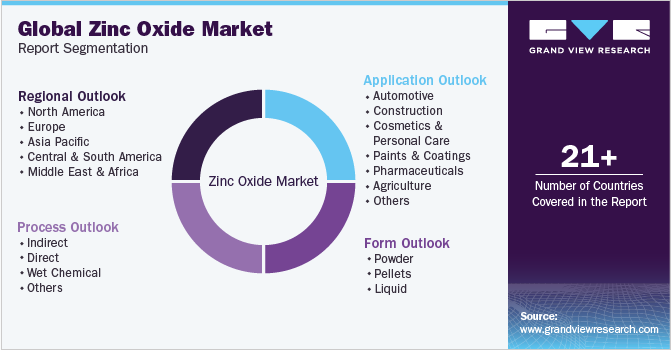

Global Zinc Oxide Market Report Segmentation

This report forecasts revenue growth at, global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global zinc oxide market report based on form, process, application, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Pellets

-

Liquid

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Indirect

-

Direct

-

Wet Chemical

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Cosmetics and Personal Care

-

Paints & Coatings

-

Pharmaceuticals

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

Belgium

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

Peru

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global zinc oxide market size was estimated at USD 5.2 billion in 2022 and is expected to reach USD 5.4 billion in 2023.

b. The global zinc oxide market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 8.1 billion by 2030.

b. Asia Pacific dominated the zinc oxide with a share of 52.26% in 2022. This is attributable to to the advancing automobile, construction, and personal care & cosmetics industries in India, China, Japan, and South Korea.

b. Some key players operating in the zinc oxide market include Ace Chemie Zynk Energy Limited, AG CHEMI GROUP s.r.o., CCL, EverZinc, Zinc Nacional, HAKUSUI TECH, LANXESS, IEQSA, Neo Zinc Oxide, Pan-Continental Chemical Co., Ltd., Rubamin, Tata Chemicals Ltd., TOHO ZINC CO., LTD., TP Polymer Private Limited, Upper India, Weifang Longda Zinc Industry Co., Ltd., Yongchang zinc industry Co., Ltd., Zinc Oxide Australia, Zochem, Inc

b. Key factors that are driving the zinc oxide market growth include its increasing use in the rubber industry during the process of vulcanization, which is the prime component in tires for the automotive industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.