- Home

- »

- Market Trend Reports

- »

-

Aducanumab (Aduhelm) Market: Outlook Amid Controversy And Commercial Limitations In Alzheimer’s Care

Overview

Aducanumab, marketed as Aduhelm, is an amyloid-beta-targeting monoclonal antibody developed by Biogen Inc. in partnership with Eisai Co., Ltd. for the treatment of Alzheimer’s disease. It works by binding to aggregated amyloid-beta proteins and facilitating their removal from the brain, aiming to slow disease progression rather than simply alleviate symptoms. The U.S. FDA granted accelerated approval on June 7, 2021, marking a significant milestone as the first therapy to address the underlying amyloid pathology of Alzheimer’s disease. Despite this achievement, its approval was highly debated following inconsistent results in the EMERGE and ENGAGE clinical studies, where only one trial demonstrated clinical benefit. Market uptake was minimal due to the Centers for Medicare & Medicaid Services (CMS) decision in April 2022 to restrict coverage to patients enrolled in clinical studies. The European Medicines Agency (EMA) later issued an unfavorable opinion, prompting Biogen to withdraw its European application in April 2022. In January 2024, Biogen announced it would discontinue Aduhelm’s development and commercialization by November 2024, redirecting focus to next-generation Alzheimer’s candidates such as lecanemab (Leqembi). Despite its commercial withdrawal, Aducanumab remains a landmark therapy that established the first regulatory precedent for disease-modifying Alzheimer’s treatments targeting amyloid pathology.

Key Report Deliverables

-

Analyze the Aducanumab (Aduhelm) Market landscape, detailing the current market size, growth drivers, and key industry trends, particularly in light of the upcoming patent expiration and the impact of biosimilars entering the market.

-

Forecast Market Growth, projecting future trends for the Aducanumab (Aduhelm) Market, highlighting emerging opportunities within the biosimilar space, and assessing potential risks to growth as competition increases following patent expiry.

-

Identify Regulatory and Market Barriers, providing insights into regulatory and market barriers that could impact future market expansion and product development, with a specific focus on the challenges biosimilars may face in gaining approval and market access.

-

Concurrent Competitive Landscape, identifying key players in the Aducanumab (Aduhelm) Market, including both originator and biosimilar manufacturers. Examine their strategic moves, partnerships, and distribution of market share to understand competitive positioning and potential shifts as biosimilars are introduced.

-

Regulatory Barriers, identifying key regulatory challenges related to the entry of Remdesivir (Veklury) biosimilars, including approval processes and market access restrictions, and assessing their potential impact on the speed and scope of market expansion.

-

Strategic Implications, evaluating strategic moves for Janssen Biotech and its competitors to maintain leadership in the Aflibercept market. This includes exploring innovation, differentiation, potential patient support programs, and geographic expansion strategies.

Patent Cliff Analysis

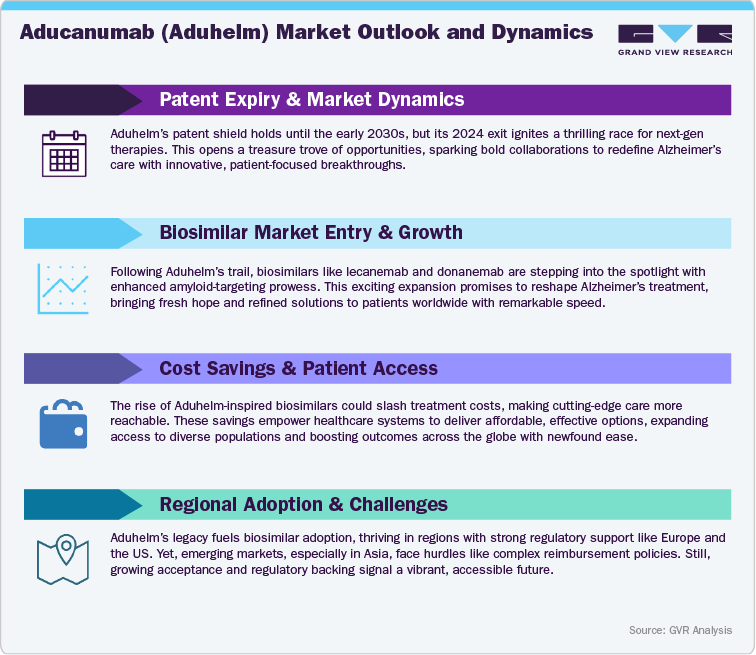

Aducanumab, developed by Biogen Inc. in partnership with Eisai Co., Ltd., holds intellectual property protection through a combination of composition, formulation, and manufacturing process patents, with key filings such as WO2014089500 and related family patents extending protection until 2032-2034 across major markets. In addition to patent protection, the therapy benefits from 12 years of biologic exclusivity under the Biologics Price Competition and Innovation Act (BPCIA) in the United States, ensuring reference product exclusivity until June 2033. Despite this, Aducanumab’s commercial relevance has significantly diminished following Biogen’s decision in January 2024 to discontinue its development and commercialization, driven by limited clinical adoption and restricted reimbursement.

Consequently, the patent expiry timeline is expected to have minimal financial or competitive impact, as the Alzheimer’s monoclonal antibody market is now dominated by lecanemab (Leqembi) and donanemab, both supported by more favorable efficacy data and extended intellectual property protection. In the current market environment, Aducanumab’s patent cliff is viewed as non-material, reflecting a strategic shift in Biogen’s R&D focus toward next-generation, disease-modifying Alzheimer’s therapies.

Current Market Scenarios

As of 2025, Aducanumab (Aduhelm) has effectively exited the commercial Alzheimer’s disease market following Biogen Inc.’s strategic decision in January 2024 to discontinue its development and commercialization. The decision was driven by limited clinical adoption, high post-marketing costs, and the burden of completing confirmatory studies that were mandated by regulatory authorities. The company confirmed that existing patients would continue receiving Aduhelm until November 2024, while clinical trial participants were supported through May 2024. This discontinuation marked the end of Aduhelm’s commercial lifecycle, less than three years after its U.S. FDA accelerated approval in June 2021, which had positioned it as the first amyloid-targeting Alzheimer’s therapy.

The therapy’s market performance remained severely constrained due to limited payer coverage and regulatory controversy. The Centers for Medicare & Medicaid Services (CMS) decision in April 2022 to restrict coverage to patients enrolled in clinical trials effectively eliminated broad market access among the primary Alzheimer’s patient base. Moreover, skepticism from clinicians and payers regarding Aduhelm’s clinical benefit led to low prescription rates and minimal hospital adoption. Despite an initial pricing strategy of approximately USD 56,000 per year, Biogen was forced to cut the price by nearly half due to mounting public and institutional criticism. The combination of regulatory scrutiny, payer resistance, and operational costs rendered Aduhelm commercially unsustainable.

Following the discontinuation, Biogen terminated its licensing agreement with Neurimmune, transferring intellectual property rights and halting ongoing production. The company redirected its Alzheimer’s disease strategy toward next-generation monoclonal antibodies, most notably lecanemab (Leqembi), which demonstrated stronger clinical outcomes and received full FDA approval in July 2023. In the current market, Aduhelm no longer contributes to Biogen’s Alzheimer’s portfolio revenue, and its exit has reinforced the shift in competitive focus toward therapies with proven cognitive benefits and broader reimbursement potential. While Aducanumab served as a pioneering product in disease-modifying Alzheimer’s research, its limited real-world adoption and short commercial tenure have positioned it as a developmental milestone rather than a sustainable therapeutic franchise.

Market Dynamics

Driver: Regulatory Milestone and Scientific Advancement

Aducanumab, developed by Biogen Inc. and Eisai Co., Ltd., achieved a pivotal milestone in Alzheimer’s therapeutics when it received accelerated approval from the U.S. FDA in June 2021. The approval marked the first time a therapy targeting amyloid-beta plaques was authorized for Alzheimer’s disease, symbolizing a significant shift from symptomatic treatment to a disease-modifying approach. This scientific breakthrough strengthened industry confidence in biologic-based precision medicine and opened regulatory pathways for subsequent anti-amyloid antibodies. Aduhelm’s introduction also catalyzed investment across the neurodegenerative research sector, leading to advancements in biomarker-driven trials and amyloid imaging techniques. Although its commercial impact was limited, the approval served as a foundation for regulatory innovation and set a precedent for accelerated pathways in high unmet-need conditions. Aduhelm’s pioneering status continues to influence future research in Alzheimer’s and related neurodegenerative disorders, establishing its legacy as a scientific turning point in modern neurology.

Restraint: Clinical Ambiguity and Commercial Setbacks

Aducanumab’s market trajectory was hindered by inconsistent clinical efficacy, coverage limitations, and pricing challenges. The pivotal EMERGE and ENGAGE phase 3 trials produced divergent results, raising uncertainty about the drug’s cognitive benefit and clinical value. This ambiguity triggered skepticism among clinicians, payers, and regulatory bodies. In April 2022, the Centers for Medicare & Medicaid Services (CMS) limited Aduhelm’s coverage to patients enrolled in clinical studies, eliminating widespread reimbursement and access. Furthermore, safety concerns related to amyloid-related imaging abnormalities (ARIA) and an initial annual price of USD 56,000 fueled negative public perception, leading Biogen to halve the price later that year. Combined with the excessive cost of confirmatory studies, these factors eroded market potential. Ultimately, Biogen discontinued Aduhelm’s commercialization in January 2024, acknowledging limited uptake and financial viability. The case underscored the critical importance of clinical clarity and payer alignment for novel biologics.

Opportunities: Strategic Foundation for Future Therapies

While Aduhelm’s commercial journey ended, its scientific and regulatory groundwork created substantial opportunities for next-generation Alzheimer’s therapies. The experience established a regulatory and developmental blueprint for future anti-amyloid drugs, validating the feasibility of disease-modifying approaches. The lessons from Aduhelm’s launch guided improvements in clinical trial design, patient selection, and biomarker utilization, leading to more effective therapies such as lecanemab and donanemab, both demonstrating superior cognitive outcomes. Aduhelm’s early challenges prompted a more data-driven framework for pricing and reimbursement negotiations, strengthening industry alignment with regulators and payers. Its legacy continues to drive pipeline diversification in neurodegenerative disease research, fostering innovation in both amyloid and tau-directed therapies. By shaping scientific standards and policy discussions, Aduhelm has transitioned from a short-lived product to a strategic inflection point that continues to define the direction of Alzheimer’s R&D and commercial strategy worldwide.

Trends: Shift Toward Disease-Modifying Alzheimer’s Therapies, Regulatory Evolution and Conditional Approvals, Repurposing and Growing Emphasis on Biomarker-Driven Clinical Development contributing to the market

-

Shift Toward Disease-Modifying Alzheimer’s Therapies

The approval and subsequent discontinuation of Aducanumab (Aduhelm) have accelerated the industry’s transition from symptomatic treatments to disease-modifying approaches. Drug developers now prioritize therapies that target core pathological drivers of Alzheimer’s, such as amyloid-beta and tau proteins. Aduhelm’s regulatory journey validated the feasibility of such mechanisms, paving the way for newer, clinically proven antibodies like lecanemab and donanemab. This marks a structural shift in R&D strategies, with focus moving toward long-term efficacy and cognitive preservation rather than short-term symptom management.

-

Regulatory Evolution and Conditional Approvals

Aduhelm’s accelerated approval under the U.S. FDA’s pathway for serious conditions established a precedent for conditional authorizations based on surrogate biomarkers. Although controversial, this model has influenced how global regulators evaluate therapies targeting complex neurodegenerative pathways. Agencies now emphasize post-marketing confirmatory trials and biomarker validation, shaping the framework for future Alzheimer’s drug approvals. This trend continues to strengthen regulatory-industry collaboration on evidentiary standards.

-

Growing Emphasis on Biomarker-Driven Clinical Development

Following Aduhelm, Alzheimer’s R&D has increasingly adopted biomarker-based patient selection using PET imaging and cerebrospinal fluid analysis to identify amyloid or tau accumulation. This precision-driven approach enhances trial efficiency, improves success rates, and supports targeted dosing strategies. The FDA and EMA now recognize biomarkers as key decision tools in clinical development, a direct outcome of Aduhelm’s legacy in adaptive trial design.

Overview of Alternative Therapeutics

The discontinuation of Aducanumab (Aduhelm) has reshaped the competitive dynamics of the Alzheimer’s disease therapeutics market, accelerating the transition toward next-generation, disease-modifying therapies with stronger clinical validation and broader market acceptance. The market is now led by Lecanemab (Leqembi), developed by Eisai Co., Ltd. and Biogen Inc., which achieved full FDA approval in July 2023 following positive results from the CLARITY-AD Phase 3 trial, demonstrating a 27% reduction in cognitive decline. Leqembi’s regulatory success, combined with favorable Medicare coverage, has established it as the benchmark therapy in the anti-amyloid segment.

Donanemab, developed by Eli Lilly and Company, represents another major advancement. Approved by the FDA in July 2024, it showed substantial improvement in early Alzheimer’s patients in the TRAILBLAZER-ALZ 2 study, outperforming earlier antibody therapies in both efficacy and amyloid clearance. Its streamlined dosing and shorter treatment duration enhance patient adherence and cost efficiency, positioning it as a key competitor in the disease-modifying treatment space.

Beyond amyloid-targeted agents, several companies are diversifying into tau aggregation inhibitors, neuroprotective biologics, and multimodal combination therapies. Notable candidates include Roche’s gantenerumab, AbbVie’s ABBV-8E12, and Alzheon’s ALZ-801, which aim to address the broader neurodegenerative mechanisms associated with Alzheimer’s progression. Additionally, novel approaches such as plasma exchange therapy and neuroinflammation modulators are under evaluation for complementary use with monoclonal antibodies.

Competitive Landscape

The competitive landscape following Aducanumab’s withdrawal is defined by a new generation of clinically validated monoclonal antibodies and diversified mechanistic approaches targeting Alzheimer’s disease. The market has evolved from early exploratory biologics to evidence-based therapies demonstrating measurable impact on disease progression, amyloid clearance, and cognitive outcomes. Leading players now compete through a combination of robust clinical data, global regulatory engagement, and strategic commercialization alliances.

Eisai Co., Ltd. and Biogen Inc. currently hold the dominant market position with Lecanemab (Leqembi), which secured full FDA approval in July 2023 and broad Medicare reimbursement. Leqembi’s Phase 3 CLARITY-AD results demonstrated clinically meaningful slowing of cognitive decline, setting a new efficacy benchmark. Its commercial success has reinforced Eisai’s leadership in the amyloid-directed therapy space and reestablished Biogen’s presence after the discontinuation of Aduhelm. Eisai’s global strategy emphasizes early-stage patient targeting, data transparency, and payer engagement, supporting steady adoption in the U.S., Japan, and select EU markets.

Eli Lilly and Company is positioned as the closest competitor with Donanemab, approved by the FDA in July 2024. The therapy’s TRAILBLAZER-ALZ 2 trial results demonstrated superior plaque clearance and significant slowing in early symptomatic Alzheimer’s patients. Lilly’s commercial model focuses on streamlined dosing, real-world evidence generation, and payer-aligned pricing strategies, which have enhanced physician confidence and accelerated uptake in major markets.

In addition, AbbVie, Eli Lilly, Roche, and several emerging biotech firms are expanding into tau-targeting, synaptic restoration, and neuroinflammation-modulating candidates, reflecting a broadening of the Alzheimer’s therapeutic landscape beyond amyloid pathology. Strategic collaborations and co-development partnerships remain key to accelerating clinical validation and managing R&D costs.

Overall, the competitive environment post-Aduhelm is characterized by intensifying innovation, data-driven regulatory advancement, and payer-centered commercialization models. The market trajectory increasingly favors companies capable of combining clinical efficacy, safety, and access strategy, reinforcing a long-term shift toward sustainable, biomarker-validated Alzheimer’s disease management.

Regional Analysis

North America Aducanumab (Aduhelm) Market

North America remains the largest and most advanced market for Alzheimer’s disease therapeutics, driven by strong regulatory infrastructure, high disease prevalence, and early adoption of biologic therapies. The U.S. market dominates due to the FDA’s progressive approval framework and Medicare’s role in coverage decisions. Following Aduhelm’s discontinuation, Leqembi’s full FDA approval in July 2023 and Medicare coverage expansion have significantly reshaped treatment access. Eli Lilly’s Donanemab, approved in July 2024, is gaining rapid uptake among early-stage Alzheimer’s patients. Ongoing collaborations between Eisai, Biogen, and major U.S. healthcare networks have enhanced diagnostic infrastructure through amyloid PET imaging and biomarker testing. The regional focus is now on value-based access models and real-world outcome validation, positioning North America as the commercial and clinical epicenter of Alzheimer’s innovation.

Europe Aducanumab (Aduhelm) Market

Europe presents a cautious but evolving landscape influenced by regulatory scrutiny, payer conservatism, and national-level reimbursement frameworks. While the European Medicines Agency (EMA) rejected Aducanumab’s application in 2022, the agency has demonstrated greater openness to newer anti-amyloid drugs supported by robust data. Eisai’s Leqembi and Lilly’s Donanemab are currently undergoing centralized review processes for conditional authorization in key markets such as Germany, France, and the U.K.. Adoption is expected to be gradual, as European health systems emphasize cost-effectiveness and evidence-based pricing. Significant growth potential lies in public-private partnerships to enhance diagnostic access, improve patient stratification, and integrate early intervention programs through national dementia strategies.

Asia Pacific Aducanumab (Aduhelm) Market

The Asia Pacific region is emerging as a high-potential growth market due to the rapidly aging population and increasing awareness of neurodegenerative disorders. Japan leads the region with early approval and reimbursement of Leqembi, reflecting its commitment to early-stage Alzheimer’s care. Countries such as South Korea, China, and Australia are expanding investments in biomarker testing, clinical trial participation, and biologics manufacturing. The presence of Eisai’s R&D and production base in Japan provides a competitive advantage, while regional partnerships are enhancing supply chain efficiency and affordability. Market expansion in Asia Pacific will be driven by policy incentives, domestic R&D collaborations, and growing accessibility to neurodiagnostic technologies.

Latin America Aducanumab (Aduhelm) Market

In Latin America, market adoption for advanced Alzheimer’s biologics remains limited due to pricing constraints, reimbursement barriers, and low diagnostic penetration. However, countries such as Brazil, Mexico, and Argentina are expanding healthcare investments and improving clinical trial participation in collaboration with multinational pharmaceutical companies. Governments are increasingly focusing on public health awareness programs and neurology training, which could create medium-term opportunities for anti-amyloid therapies once pricing alignment is achieved. Strategic partnerships with local distributors and regional manufacturing facilities may further improve affordability and access.

Middle East and Africa Aducanumab (Aduhelm) Market

The Middle East and Africa region remains in an early adoption phase, with Alzheimer’s diagnosis and treatment infrastructure still developing. Wealthier Gulf countries such as Saudi Arabia and the United Arab Emirates are investing in neurology centers of excellence and biomarker diagnostic capabilities, which may facilitate early market entry for next-generation biologics in the longer term. Broader regional growth will depend on policy support, pricing alignment, and multinational collaborations to build treatment capacity.

Analyst Perspective

Aducanumab’s journey represents a strategic inflection point in Alzheimer’s therapeutics. Its accelerated FDA approval in 2021 validated the amyloid-targeting approach, establishing a regulatory precedent for disease-modifying therapies. However, limited efficacy data, pricing controversies, and restricted reimbursement led to its discontinuation in 2024, highlighting the need for stronger alignment between clinical evidence and payer expectations.

Despite its commercial setback, Aduhelm’s development paved the way for more effective alternatives such as Leqembi (Eisai/Biogen) and Donanemab (Eli Lilly), both demonstrating superior outcomes and broader market acceptance. The experience has driven the industry toward biomarker-based development, value-driven pricing, and evidence-led commercialization strategies.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified