- Home

- »

- Market Trend Reports

- »

-

Australia Clinical Trials Landscape

Report Overview

Our healthcare portfolio has been developing since our inception in 2014, wherein we have tracked numerous sub-domains and their R&D activities. To help understand and highlight the clinical trials development journey, we have made this study by profiling the state of R&D funding and initiatives by the market players. This report accesses the trends in clinical trials which includes total number of initiated clinical trials and regulatory changes in Australia.

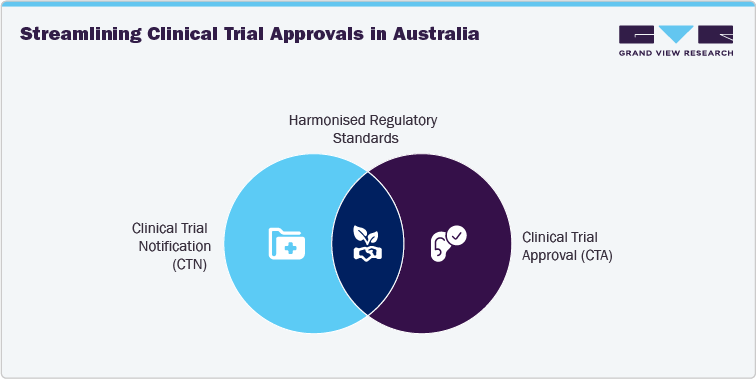

Australia’s clinical trials ecosystem continues to strengthen through streamlined regulatory pathways and national harmonization initiatives. The country primarily operates under two frameworks for trials involving unapproved medicines, devices, or biologicals: the Clinical Trial Notification (CTN) and Clinical Trial Approval (CTA) schemes. Under the CTN, Human Research Ethics Committees (HRECs) and institutions retain responsibility for trial approval, while the Therapeutic Goods Administration (TGA) is notified. In contrast, the CTA pathway involves direct assessment by the TGA for higher-risk interventions. Both routes operate under international Good Clinical Practice standards, ensuring global compatibility. The National Mutual Acceptance (NMA) scheme, now implemented across all states and territories, has reduced duplicate ethics reviews by allowing a single HREC approval to cover multi-site public-hospital trials. This system has been a key enabler of faster trial start-up across Australia.

Regulatory Landscape in Australia Clinical Trials

Therapeutic Goods Administration (TGA): The TGA, part of the Australian Government Department of Health, is the central regulatory body overseeing the safety, quality, and efficacy of therapeutic goods. It regulates investigational products (drugs, biologics, and medical devices) used in clinical trials.

The National Health and Medical Research Council (NHMRC) develops national guidelines and ethical standards for research involving humans. Its National Statement on Ethical Conduct in Human Research forms the backbone of trial ethics governance.

Human Research Ethics Committees (HRECs): These are institution-level ethics review boards that approve clinical trial protocols in accordance with NHMRC guidelines. Australia does not have a single national ethics board; rather, accredited HRECs operate under institutional frameworks.

Furthermore, Australia operates under two primary regulatory pathways for clinical trials involving investigational drugs or biologics:

A) Clinical Trial Notification (CTN) Scheme

-

The most widely used and streamlined route.

-

The sponsor notifies the TGA after receiving HREC approval.

-

TGA does not review the trial data itself but relies on the HREC’s evaluation.

-

Commonly used for early-phase trials, bioequivalence studies, and low-risk interventions.

-

Fast, cost-effective, and well-suited for multinational and first-in-human studies.

B) Clinical Trial Approval (CTA) Scheme

-

Involves a detailed review by the TGA of the trial protocol, manufacturing data, and safety information.

-

Required for high-risk or novel investigational products not previously evaluated.

-

Used less frequently than CTN, but essential for trials involving genetically modified organisms, high-risk biologics, or complex combination therapies.

R&D Funding Landscape

Australia ranks 7th globally for medical research excellence, supported by a vibrant ecosystem of over 1,200 biotechnology companies, 55 dedicated medical research institutes, and 40 universities with strong research programs in health and medicine. The Australian government has introduced a range of strategic initiatives aimed at strengthening the clinical trials ecosystem and positioning the country as a leading destination for global research investment. Below are some of the key initiatives:

- National One Stop Shop for Clinical Trials

This initiative is supported by government funding of USD 18.8 million, which aims to streamline clinical trial processes by harmonizing regulatory frameworks nationwide. The resulting platform will enhance accessibility and coordination, making it easier for patients, researchers, and industry stakeholders to locate, conduct, and engage in clinical trials across Australia.

-

Health Research for a Future Made in Australia

This initiative was launched in May 2024, this package marks a “once-in-a-generation” transformation in Australia’s health and medical research landscape, backed by a record investment of USD 1.89 billion. The initiative includes USD 1.4 billion in new funding through the Medical Research Future Fund (MRFF), alongside USD 411 million dedicated to supporting researchers addressing some of the country’s most pressing health challenges

Cost Analysis Model

Cost of Running a Phase 1 Clinical Trial in Australia

Running a Phase 1 clinical trial in Australia entails various expenses shaped by factors such as compliance with regulatory protocols, the structure and complexity of the trial, strategies for enrolling participants, and day-to-day operational costs. The average cost of conducting a Phase 1 clinical trial in Australia generally falls approximated between USD 1.2 million to USD 2.5 million (approximately AU USD2 million and AU USD4 million), with the exact amount varying based on factors such as the study’s scale, design complexity, and targeted therapeutic indication.

Below is the list of the largest cost components for a Phase 1 study in Australia:

-

Clinical Site Costs

-

Laboratory and Testing Costs

-

Patient Recruitment and Retention

-

Regulatory and Ethical Compliance

-

Manufacturing and Supply of Investigational Product

-

Clinical Research Organization (CRO) Fees

-

Data Management and Monitoring

-

Project Management

-

Technology and Infrastructure

-

Insurance and Liability

-

Miscellaneous Costs

Australia Healthcare Infrastructure and Capacity Analysis

Australia is home to over 200 clinical trial sites, spanning public and private hospitals, specialist clinics, general practices, and purpose-built research centers. These facilities are equipped with advanced infrastructure to support comprehensive testing, treatment, and data analysis. All trials are conducted within a robust regulatory environment, aligned with International Council for Harmonization Good Clinical Practice (ICH GCP) standards, ensuring both scientific rigor and participant safety.

Estimated Number of Phase 1 Clinical Trial Beds, 2024

Australia features a robust network of Phase 1 clinical trial units, primarily concentrated in major urban centers like Melbourne, Sydney, and Brisbane. These facilities are internationally regarded for their quality, efficiency, and regulatory compliance. Many units operate within hospitals or research institutions, offering seamless integration with healthcare services. Their infrastructure supports first-in-human studies and complex early-phase trials. Australia's expedited ethics approvals, cost efficiency, and experienced workforce make it an attractive location for global sponsors.

According to the data published by Australian Competition & Consumer Commission (ACCC) in November 2024, there are approximately 391 total Phase 1 beds across Australia.

Table 1 Estimated number of phase 1 clinical trial beds, by state, 2024

State

Estimated Number of Beds, 2024

Victoria (Melbourne)

161

New South Wales (Sydney/Newcastle)

60

Queensland (Brisbane)

60

Western Australia (Perth)

32

South Australia (Adelaide)

78

Total

391

Source: Australian Competition & Consumer Commission, Grand View Research

Australia Clinical Trial Volume Analysis

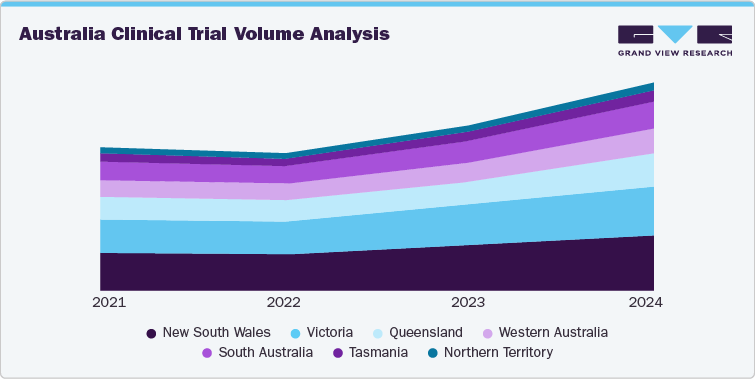

Clinical trial activity in Australia has expanded significantly in recent years, with volumes rising across nearly every state and territory. Between 2021 and 2024, the total number of registered clinical trials increased from 2,569 to 3,719, marking a notable uplift of nearly 45% in just three years. This surge underscores Australia’s growing attractiveness as a global hub for clinical research, supported by streamlined ethics processes, competitive R&D funding incentives, and government-backed initiatives such as the National Mutual Acceptance scheme and the Medical Research Future Fund.

New South Wales and Victoria have consistently led national trial activity, together accounting for more than half of all registrations. In New South Wales, trial numbers grew from 673 in 2021 to 996 in 2024, while Victoria advanced from 595 to 868 during the same period. These states benefit from world-class research hospitals, strong academic-industry linkages, and concentrated investment in medical precincts such as Sydney’s Westmead and Melbourne’s Parkville biomedical hubs. Queensland has also seen strong momentum, with trials climbing from 401 in 2021 to 602 in 2024, reflecting the state’s emphasis on oncology, rare diseases, and digital health-enabled trials.

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified