- Home

- »

- Market Trend Reports

- »

-

Opportunities In The Bevacizumab (Avastin) Market: Navigating The Post-Patent Cliff Landscape

Report Overview

Bevacizumab, marketed as Avastin by Genentech (a Roche subsidiary), has become a cornerstone treatment for oncology indications, including metastatic colorectal cancer, non-small cell lung cancer, and glioblastoma. Its strong market performance has been driven by its anti-angiogenic efficacy and extensive clinical applications. As key patents continue to expire, the Bevacizumab market is poised for significant change. The evolving patent cliff creates both challenges and opportunities, particularly with the rise of biosimilars. The entry of biosimilars into the market will introduce competitive pressures, potentially reshaping treatment protocols and market share dynamics in the oncology space.

Key Report Deliverables

-

Analyze the Bevacizumab (Avastin) market landscape, detailing the current market size, growth drivers, and key industry trends, particularly in light of the upcoming patent expiration and the impact of biosimilars entering the market. Focus will be on how the patent expiration is affecting the market and how biosimilars like Mvasi, Zirabev, and Aybintio are shaping the competitive dynamics within oncology treatment.

-

Forecast Market Growth, projecting future trends for the Bevacizumab market, highlighting emerging opportunities within the biosimilar space, and assessing potential risks to growth as competition increases following patent expiry. Special attention will be given to how biosimilars will drive cost-effective alternatives and capture market share from the originator drug.

-

Identify Regulatory and Market Barriers, providing insights into regulatory and market barriers that could impact future market expansion and product development, with a specific focus on the challenges biosimilars may face in gaining approval and market access. This will cover the approval processes, pricing negotiations, and healthcare system dynamics that could delay or restrict biosimilar adoption.

-

Concurrent Competitive Landscape, identifying key players in the Bevacizumab market, including both originator and biosimilar manufacturers. Examine their strategic moves, partnerships, and distribution of market share to understand competitive positioning and potential shifts as biosimilars are introduced. Focus will be on how companies like Roche, Amgen, and Pfizer are navigating the post-patent landscape.

-

Regulatory Barriers, identifying key regulatory challenges related to the entry of Bevacizumab biosimilars, including approval processes and market access restrictions, and assessing their potential impact on the speed and scope of market expansion. Special focus will be on how FDA and EMA guidelines influence biosimilar market entry and the resulting impact on the market dynamics.

-

Strategic Implications, evaluating strategic moves for Roche and its competitors to maintain leadership in the Bevacizumab market. This includes exploring innovation, differentiation strategies, patient support programs, and geographic expansion to counter biosimilar competition and sustain market share in an increasingly crowded landscape.

Patent Cliff Analysis:

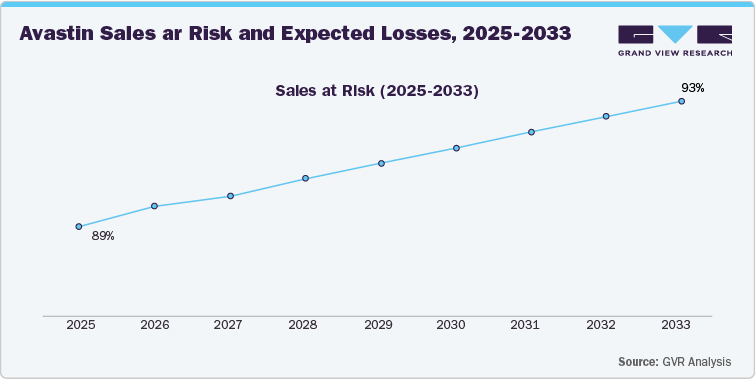

The data reveals a significant increase in Avastin’s sales at risk, escalating from 89% in 2025 to 93% by 2033. This trend highlights the imminent challenges associated with the expiration of Avastin’s patent protection and the anticipated entry of biosimilars and generic versions into the market. As exclusivity wanes, the company will face intensified competition, which is likely to result in a steep decline in Avastin’s market share and pricing power.

The gradual rise in sales at risk signifies an accelerating loss of revenue from Avastin's core indications, particularly in oncology, where patent expiration enables biosimilar manufacturers to introduce lower-cost alternatives. This market disruption is expected to affect both domestic and international markets, where Avastin has established a strong presence.

Given the high proportion of sales at risk, it is crucial for the company to adopt proactive measures to offset the anticipated losses. Strategies such as securing new indications for Avastin, pursuing supplementary patent protections, or expanding the drug’s lifecycle management through combination therapies could help mitigate the impact of biosimilar competition. Additionally, the company should focus on expanding its pipeline of innovative treatments to ensure a seamless transition as Avastin’s market dominance diminishes. Diversifying into emerging markets or developing complementary products could also serve as strategic responses to the patent cliff’s effects.

Current Market Scenarios

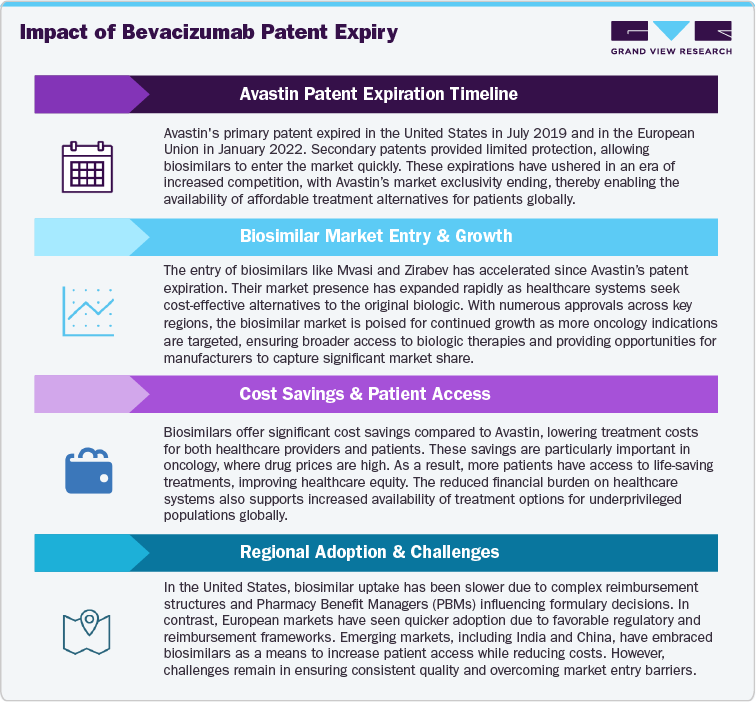

The Bevacizumab (Avastin) market is experiencing a significant shift due to the expiration of its patent in major regions like the United States and Europe, creating an opportunity for biosimilars to enter and disrupt the market. Avastin, a leading treatment for various cancers, has been a key revenue driver for Roche. However, with patent protection ending, biosimilars such as Mvasi (Amgen), Zirabev (Pfizer), and Aybintio (Samsung Bioepis) are emerging as cost-effective alternatives in oncology. This shift is driven by the increasing pressure on healthcare systems to control costs, particularly in oncology, where treatments are expensive.

Biosimilars offer a more affordable option for patients without compromising efficacy or safety, leading to their growing adoption in markets like North America and Europe, where regulatory frameworks support their entry. In the U.S., the FDA’s biosimilar approval process has become more streamlined, facilitating faster market access. In Europe, the biosimilar market is more mature, with multiple options already available, further increasing price competition. Additionally, the demand for affordable cancer therapies is driving biosimilar uptake in emerging markets like Asia-Pacific and Latin America, where rising cancer rates and healthcare budget constraints are prominent.

Despite the growing opportunity, the biosimilar market faces challenges. Development complexity and the need for extensive clinical trials to prove similarity to Avastin remain significant hurdles. Furthermore, physician and patient acceptance is crucial, as trust in biosimilars needs to be built through solid clinical evidence and post-market surveillance.

The entry of biosimilars is intensifying competition for Roche and other originator drug manufacturers, who must adapt by focusing on next-generation biologics or other treatment innovations to maintain market share. As the Bevacizumab market evolves, the success of biosimilars will depend on competitive pricing, regulatory compliance, and proving their clinical equivalence, along with overcoming market access barriers and gaining trust from healthcare providers.

Market Dynamics

“Bevacizumab’s strong clinical performance in cancer therapies sustains its market presence.”

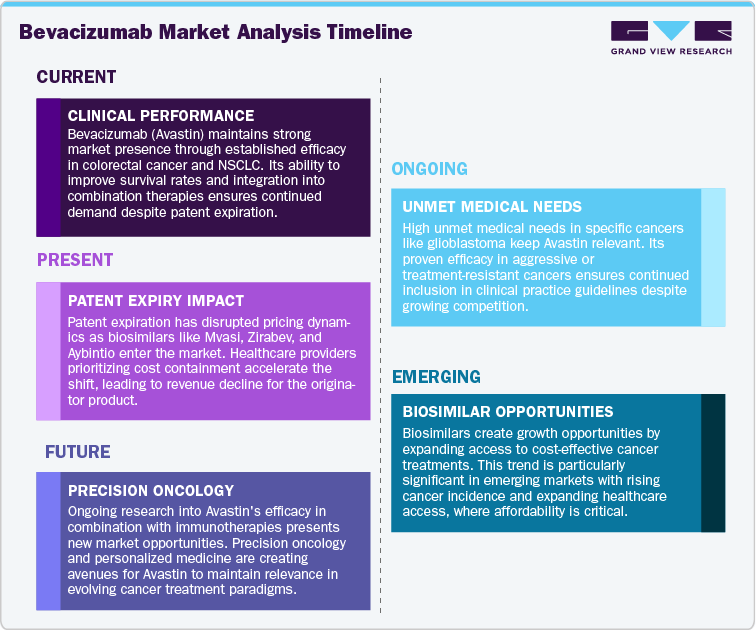

The Bevacizumab (Avastin) market continues to be driven by its widespread application in oncology, particularly in colorectal cancer and non-small cell lung cancer (NSCLC), where it has established itself as a standard-of-care therapy. Avastin has been pivotal in improving overall survival rates for patients with advanced cancer, driving its demand across both developed and emerging markets. Despite the patent expiry, the drug’s broad clinical utility and ability to be integrated into combination therapies remain key drivers of its ongoing use in oncology. The growing prevalence of cancer, particularly in the older population, further sustains the demand for Avastin, with the drug consistently included in updated clinical treatment protocols by oncologists.

Another key driver for the Avastin market is the high unmet medical need in certain cancer types, particularly glioblastoma, where limited effective treatments are available. Avastin remains one of the few drugs approved for this aggressive form of brain cancer, providing it with a strong niche in the oncology space. Furthermore, the robust clinical evidence supporting Avastin’s efficacy in prolonging survival in specific cancer types ensures its continued relevance, particularly in treatment-resistant or later-stage cancers. Despite competition from biosimilars, Avastin’s position in treatment regimens and clinical practice guidelines continues to support its steady demand in the oncology market.

“Patent expiry and the rise of biosimilars impact revenue streams.”

The patent expiration of Bevacizumab (Avastin) has a substantial impact on its revenue generation, as it opens the market to biosimilars-cost-effective alternatives that directly challenge the originator’s market share. Biosimilars like Mvasi, Zirabev, and Aybintio are already gaining ground, offering similar efficacy at a lower price, which significantly disrupts pricing dynamics. As healthcare providers and payers prioritize cost containment, the competitive pressure on Avastin intensifies, particularly in developed markets with strict reimbursement policies. This price erosion directly affects Avastin's ability to sustain its premium pricing, leading to a gradual revenue decline. Additionally, the rise of generic alternatives in regions with less stringent regulations exacerbates this trend, further compressing profit margins. From an analyst’s perspective, the shift towards biosimilars and generics is not just a temporary disruption but a structural change in the oncology market, forcing originator companies to refocus on pipeline innovation, new market entry, or next-generation biologics to mitigate the loss in revenue from blockbuster drugs like Avastin.

“Biosimilars and expansion into emerging markets create new growth prospects.”

The entry of biosimilars to the Avastin market represents a significant opportunity for both originator companies and new players. While biosimilars like Mvasi and Zirabev are challenging the market share of the originator product, they also create an opportunity for cost-effective treatments in oncology, especially in price-sensitive healthcare markets. With the increasing emphasis on reducing healthcare costs globally, biosimilars present an avenue for expanding access to high-quality oncology care without compromising therapeutic efficacy. As more healthcare systems move towards cost containment, the adoption of biosimilars is expected to grow, opening avenues for both new and existing companies to capture market share. The biosimilar market itself is expected to experience double-digit growth as it becomes increasingly entrenched in treatment protocols across key oncology indications.

In emerging markets, where the incidence of cancer is rising and healthcare access is expanding, there are considerable growth opportunities for both Avastin and its biosimilars. The growing oncology burden in regions such as Asia-Pacific, Latin America, and parts of Africa creates an urgent need for cost-effective cancer therapies, positioning biosimilars as essential treatment options. Moreover, the shift towards personalized medicine in oncology presents an opportunity for companies to further position Avastin in combination therapies or in new indications, including in the treatment of solid tumors and rare cancers. As precision oncology grows, there is an opportunity for Avastin to continue playing a pivotal role in combination regimens, ensuring its place in targeted cancer treatment regimens.

Additionally, with increased research into Avastin’s efficacy in combination with other biologics or in different treatment settings, there remains potential to expand its market. There are ongoing studies assessing its effectiveness in immunotherapy combinations, particularly for lung cancer and ovarian cancer, which could lead to new indications and an extended lifecycle for Avastin. These factors combine to present significant market opportunities, even as biosimilars erode some of the originator’s share.

“Increased biosimilar uptake and precision oncology are redefining market dynamics”

- Patent Expiry and the Impact of Biosimilar Competition on Bevacizumab Revenue

The patent expiration of Bevacizumab (Avastin) has opened the door for biosimilars such as Mvasi (Amgen) and Zirabev (Pfizer) to enter the market, causing a decline in pricing power for the originator. The growing presence of biosimilars is increasing competition and driving price reductions across developed markets like the United States and Europe. Despite this, Avastin remains a core drug in oncology treatment protocols, especially for first-line therapies in colorectal cancer and non-small cell lung cancer (NSCLC). However, the erosion of market share from biosimilars will force originator companies to find ways to adapt, either through innovation or cost-containment strategies.

- Rapid Adoption of Biosimilars in Developed and Emerging Markets

The increasing biosimilar adoption in both developed and emerging markets is a key trend reshaping the Bevacizumab market. In developed markets like the U.S., the FDA’s approval of more biosimilars has led to increased market fragmentation, offering cost-effective alternatives to the original drug without compromising efficacy. In emerging markets such as Asia-Pacific and Latin America, where healthcare access is expanding rapidly, affordability has accelerated the uptake of biosimilars. Healthcare systems in these regions are increasingly prioritizing cost-effective oncology treatments, which has further boosted the adoption of biosimilars. As the biosimilar market grows, regulatory agencies are streamlining approval processes to accelerate market entry and adoption, creating an even more competitive landscape for Avastin.

- Competitive Landscape and Cost Pressures

Personalized medicine and precision oncology are pivotal trends shaping the future of Bevacizumab’s role in treatment protocols. As more cancer therapies are developed with a focus on genetic targeting, Avastin is being explored in combination with immune checkpoint inhibitors and other biologics to enhance treatment outcomes in areas like immuno-oncology. These combination therapies are driving a shift in treatment paradigms, with Avastin continuing to play a significant role in multimodal cancer treatment regimens. This shift towards tailored therapies opens up new opportunities for Avastin while reinforcing the need for companies to adapt to these evolving treatment approaches in order to stay relevant in the changing oncology landscape.

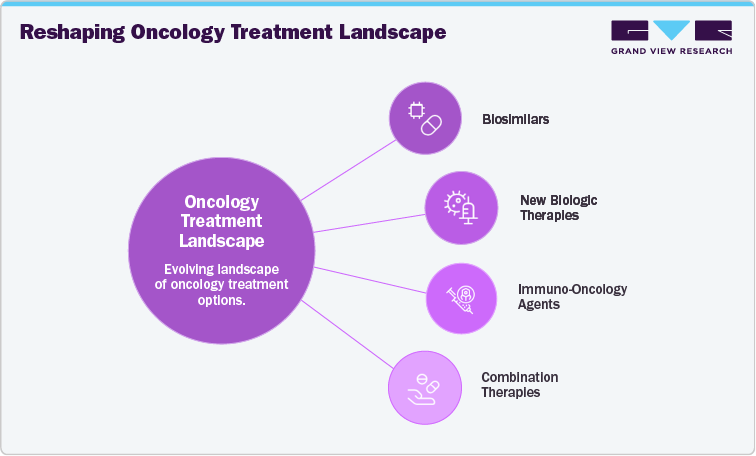

Overview of Alternative Therapeutics

The emergence of biosimilars and generic alternatives following the patent expiration of Bevacizumab (Avastin) is significantly reshaping the oncology treatment landscape. Biosimilars such as Mvasi (Amgen), Zirabev (Pfizer), and Aybintio (Samsung Bioepis) offer cost-effective alternatives that mirror the efficacy and safety profiles of the originator product. These alternatives are gaining traction as healthcare systems focus on reducing treatment costs, especially in oncology, where drug prices are a major concern. The increased adoption of biosimilars is contributing to market fragmentation, providing hospitals and physicians with more affordable treatment options, while simultaneously driving down the revenue for originator biologics like Avastin.

In addition to biosimilars, the rise of new biologic therapies and immuno-oncology agents is further diversifying the treatment options available to oncologists. These next-generation therapies are being increasingly integrated into personalized treatment regimens, offering tailored approaches that target specific cancer mechanisms. Innovations in combination therapies, particularly those involving immune checkpoint inhibitors, monoclonal antibodies, and targeted therapies, are also gaining momentum. As precision oncology continues to evolve, these alternative therapeutics are creating new competitive pressures for Avastin by offering more targeted, effective, and often less expensive treatment options. Companies in the oncology space must continue to innovate and adapt to these shifts in order to maintain their market position and address the growing demand for personalized cancer treatments.

Competitive Landscape

The competitive landscape for Bevacizumab (Avastin) has become more complex following the expiration of its patent, which has facilitated the entry of biosimilars and alternative therapies. Several biosimilars, including Mvasi (Amgen), Zirabev (Pfizer), and Aybintio (Samsung Bioepis), have already been launched and are gaining market share. These products are priced lower than the originator drug, creating significant pricing pressure and making them an attractive option for healthcare providers and payers, especially in cost-sensitive markets. As biosimilars continue to gain approval in various regions, including Asia-Pacific and Europe, they are likely to further erode Avastin’s market share, particularly in first-line oncology treatments such as non-small cell lung cancer and colorectal cancer.

In addition to biosimilars, alternative therapies targeting similar cancer pathways as Avastin are contributing to the competitive pressure. Regeneron Pharmaceuticals’ Eylea (aflibercept), primarily used in ocular indications but also effective in cancer treatment, is becoming a direct competitor. While Eylea’s primary focus remains on eye diseases, its use in colorectal cancer and non-small cell lung cancer places it in direct competition with Avastin, particularly given its similar mechanism of action targeting vascular endothelial growth factor (VEGF). Similarly, ramucirumab (Cyramza) from Eli Lilly is a VEGF receptor-2 antagonist approved for several oncology indications, including gastric cancer and non-small cell lung cancer, positioning it as an alternative to Avastin in those indications.

The rise of immuno-oncology agents further diversifies the competitive field. Keytruda (pembrolizumab) and Opdivo (nivolumab), PD-1 inhibitors, are becoming increasingly important in oncology treatment, especially in cancers such as melanoma, lung cancer, and renal cell carcinoma. These immunotherapies are often used in combination with chemotherapy or other biologics, offering new treatment regimens that indirectly compete with Avastin. Additionally, the growing use of targeted therapies and oral drugs like JAK inhibitors (e.g., Tofacitinib and Upadacitinib) is reshaping treatment paradigms. While these therapies are primarily indicated for autoimmune diseases, they are increasingly explored in oncology, offering a non-injection option that appeals to patients. The expanding variety of alternative treatment options places additional pressure on Avastin’s market position, especially as these therapies become more integrated into standard-of-care protocols in oncology.

North America Bevacizumab (Avastin) Market

In North America, the Bevacizumab (Avastin) market is predominantly driven by its established role in the treatment of colorectal cancer (CRC) and non-small cell lung cancer (NSCLC). The patent expiration of Avastin has accelerated the entry of biosimilars such as Mvasi and Zirabev, both of which have garnered regulatory approval in the U.S. and Canada. These biosimilars are poised to capture market share in oncology indications previously dominated by Avastin, particularly in settings where cost containment is a priority for payers and healthcare providers. Avastin continues to maintain relevance in first-line treatments for various cancers, especially in combination therapies. The ongoing preference for biologic treatments in cancer care, along with regulatory support for biosimilars, will continue to shape the competitive landscape. Despite growing biosimilar competition, Avastin remains integral to many clinical protocols and is likely to retain a significant presence in oncology, particularly in established markets with high levels of healthcare access.

Europe Bevacizumab (Avastin) Market

In Europe, Bevacizumab has a strong presence, with widespread use across multiple oncology indications. The market has been impacted by the approval and subsequent adoption of biosimilars such as Mvasi, Zirabev, and Byooviz. These biosimilars provide a cost-effective alternative to Avastin, aligning with Europe’s increasing focus on reducing healthcare costs while maintaining therapeutic efficacy. Regulatory frameworks in countries such as the U.K., Germany, and France have supported the rapid adoption of biosimilars, which are now becoming a central part of treatment regimens, particularly in public healthcare systems that prioritize cost containment. Avastin remains relevant in several clinical guidelines, especially for first-line therapies, but its market share is expected to face further erosion as biosimilars penetrate the market. Additionally, the preference for combination therapies in oncology, particularly those involving immune checkpoint inhibitors, is influencing treatment protocols and expanding competition in the oncology space.

Asia Pacific Bevacizumab (Avastin) Market

The Asia Pacific region represents a dynamic market for Bevacizumab, with significant opportunities arising from both the increasing cancer burden and the expanding use of biosimilars. In countries such as China and India, where the incidence of colorectal cancer and lung cancer is rising, Avastin’s clinical use remains substantial. However, the introduction of biosimilars like Mvasi and Zirabev has introduced cost-effective alternatives, which are being rapidly adopted due to the growing demand for affordable cancer treatments. The regulatory landscape in countries like Japan and South Korea has facilitated the swift approval and use of these biosimilars, positioning them as viable options in the oncology space. Although Avastin remains a core component in first-line treatments in some markets, the increasing preference for biosimilars and the expansion of personalized medicine are set to alter the competitive dynamics. The demand for biologic therapies in the region is rising, but the cost-conscious nature of healthcare systems, especially in emerging markets, is driving the adoption of more affordable options, further accelerating the growth of biosimilars.

Latin America Bevacizumab (Avastin) Market

In Latin America, the Bevacizumab market is shaped by the rising incidence of cancer, particularly in countries like Brazil and Mexico, where colorectal cancer and lung cancer are becoming more prevalent. Despite Avastin’s continued use in these indications, the introduction of biosimilars has shifted the market dynamics towards more affordable treatment options. Biosimilars such as Mvasi and Zirabev are gaining acceptance, especially in public healthcare systems, where cost-effective solutions are essential due to the limited healthcare budgets in several countries. Avastin remains an important therapy, but its market share is under pressure from biosimilars that are priced significantly lower, making them more accessible in resource-constrained environments. As healthcare infrastructure continues to improve and the demand for cancer treatments increases, the preference for biologic alternatives, particularly in oncology, is expected to further expand the biosimilar market and reduce Avastin’s dominance.

Middle East and Africa Bevacizumab (Avastin) Market

The Middle East and Africa (MEA) market for Bevacizumab is characterized by its nascent stage of development, though rapid improvements in healthcare infrastructure are creating growth opportunities. In countries like Saudi Arabia and South Africa, Bevacizumab continues to be used in oncology care, particularly in colorectal cancer and NSCLC, but its uptake is constrained by limited access to advanced biologic therapies. Biosimilars are beginning to enter the market, with increasing interest in more affordable treatment options, particularly in countries with significant cancer burdens but limited treatment options. The region’s growing healthcare investments are likely to increase access to biologics, including Avastin and its biosimilars, but competition from biosimilars is expected to intensify as affordability becomes a key priority. In regions with less advanced healthcare systems, access to Bevacizumab remains restricted, but the increasing focus on improving oncology care and expanding access to biosimilars presents an opportunity for market growth.

Analyst Perspective

The expiration of Bevacizumab’s (Avastin) patent has triggered a direct shift in the oncology market, creating a competitive environment dominated by biosimilars. With biosimilars like Mvasi and Zirabev now approved, they are capturing substantial market share, particularly in colorectal cancer and non-small cell lung cancer, where Avastin was a cornerstone therapy. This transition is accelerating price reductions and reshaping market dynamics as payers and providers shift towards more affordable options. The impact of the patent cliff is forcing originator companies to rethink their strategies, focusing on pipeline innovation, lifecycle management, and leveraging emerging therapies to counterbalance the erosion in revenue.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028–2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15–30% Yr-1, deepening to -45–60% by Yr-3; U.S. -10–25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25–40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deck with revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30–40% global revenue decline by Year-3 post-LOE.

-

Downside: 45–55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20–25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified