- Home

- »

- Market Trend Reports

- »

-

Central & South America Beer Market - Importers And Exporters Trade Data Analysis

Report Overview

Beer imports across Central and South America are on an upward trajectory, driven by a rising urban middle class and growing consumer interest in premium, imported products. Countries such as Brazil, Chile, Colombia, and Peru are leading this trend, with increasing demand for European craft beers, American IPAs, and Asian lagers. Retailers and hospitality operators are responding by expanding their premium offerings, targeting younger, globally influenced consumers who view imported beer as a lifestyle choice. While total import volumes remain moderate in many markets, the value per litre continues to rise, reflecting the shift toward higher-end positioning.

Exports from Central and South America, though still limited compared to more established beer-exporting regions, are gaining momentum. Brazil, the largest producer in the region, has begun exporting to neighboring countries and select global markets, leveraging both scale and improved product quality. Argentina’s craft beer sector is also making inroads, finding niche demand for artisanal and specialty brews abroad. These export efforts are supported by trade promotion bodies and a growing recognition of the region’s brewing innovation, though volumes remain relatively modest.

A key trend is the strengthening of intra-regional beer trade across Central and South America. Trade blocs such as MERCOSUR and the Andean Community have reduced barriers, enabling smoother cross-border flows of beer between countries like Argentina, Uruguay, Paraguay, and Bolivia. This has created opportunities for regional brewers to expand beyond their domestic markets, while multinational players increasingly use localized production hubs to serve multiple countries efficiently. The result is a more interconnected beer market, with increased competition, broader product availability, and the early foundations of a cohesive regional trade ecosystem.

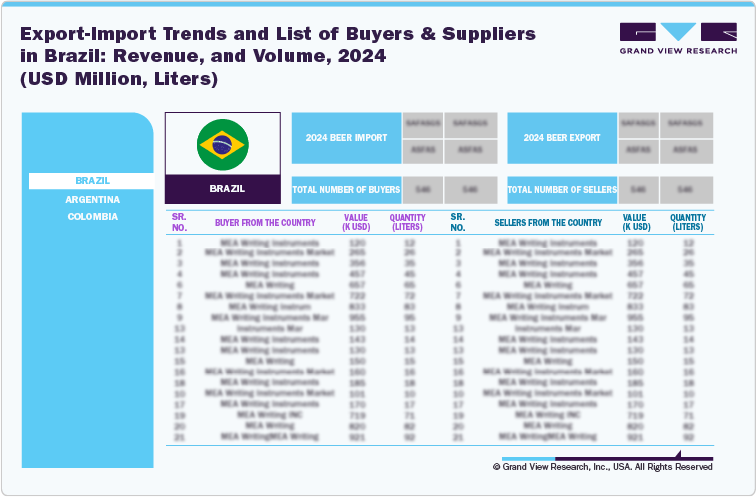

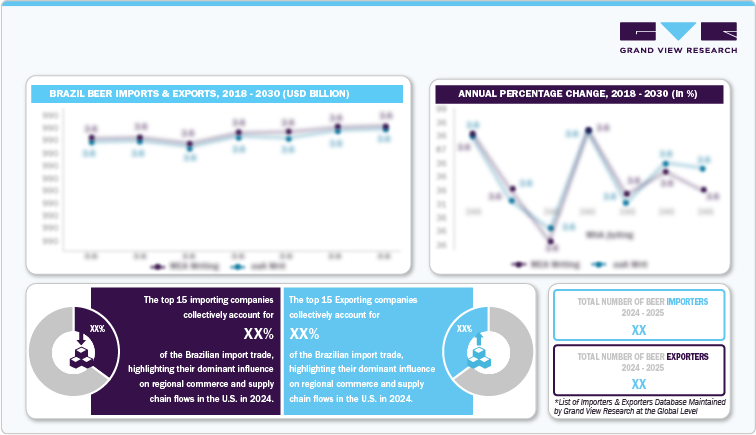

Brazil’s beer trade is marked by a strong domestic production focus, with imports and exports representing a small but strategically evolving share of the market.

Imports remain limited due to high tariffs and a dominant local brewing industry, yet demand for premium and niche international brands-particularly European and North American craft beers-is gradually expanding within urban centers. On the export front, Brazil is leveraging its scale, improving quality standards, and regional trade ties to expand modestly into neighboring South American markets and select global destinations.

While not a global beer export powerhouse, Brazil’s emerging craft segment and competitive production base position it as a potential contributor to premium and regional trade flows in the coming years.

Beer import trends in Brazil remain relatively modest due to high import duties, a strong domestic production base, and the dominance of major local players such as Ambev. However, there is a growing niche segment driven by demand for premium, foreign, and craft-style beers, particularly in affluent urban centers like São Paulo, Rio de Janeiro, and Porto Alegre. Consumers in these markets are increasingly seeking differentiated taste profiles and international experiences, prompting retailers and specialty distributors to import select European, American, and Asian brands. While still small in volume, this premium import segment is steadily expanding, reflecting broader shifts in consumer sophistication and lifestyle alignment.

On the export front, Brazil’s beer industry has shown gradual expansion, particularly within Latin America. The country’s vast production capacity, competitive pricing, and regional proximity have enabled it to export primarily to neighboring countries such as Paraguay, Uruguay, Bolivia, and Argentina. Additionally, Brazilian craft breweries are gaining visibility in international competitions and beginning to explore niche markets abroad, including parts of Europe and Asia. Although total export volumes remain limited compared to global leaders, the combination of scale and emerging quality makes Brazil a growing contributor to regional beer supply chains.

Brazil’s import and export dynamics significantly shape the beer landscape of Central and South America. As a dominant producer with rising outbound flows, Brazil enhances regional availability and affordability of beer, often crowding out smaller producers in price-sensitive markets. At the same time, its selective approach to premium imports signals evolving consumer expectations that influence neighboring markets. This dual role-as both a supply anchor and a consumer of global trends-positions Brazil as a central force in setting standards, shaping demand, and intensifying competitive pressures across the South American beer ecosystem.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified