- Home

- »

- Market Trend Reports

- »

-

Cerliponase Alfa (Brineura) Market And Forecast, 2025-2033

Report Overview

Cerliponase alfa, marketed as Brineura by BioMarin Pharmaceutical, is an enzyme replacement therapy (ERT) developed for Neuronal Ceroid Lipofuscinosis Type 2 (CLN2), a rare lysosomal storage disorder. Since its approval in 2017, Brineura has represented a significant advancement in managing this fatal neurodegenerative condition by directly delivering recombinant human tripeptidyl-peptidase 1 (TPP1) to the central nervous system. The product’s market trajectory has been defined by its first-in-class status, high treatment cost, and complex delivery mechanism requiring intraventricular administration. With BioMarin’s orphan-drug exclusivity nearing maturity in the coming years, the Cerliponase alfa market faces a transitional phase. Key strategic considerations now revolve around expanding patient access, sustaining pricing models under payer scrutiny, and monitoring potential competition from next-generation therapies such as gene therapy and advanced delivery platforms.

Key Report Deliverables

-

Analyze the Cerliponase Alfa (Brineura) Market Landscape: Examine the current market size, growth drivers, and evolving dynamics for Cerliponase Alfa. Focus on how BioMarin’s orphan-drug exclusivity and the absence of competing therapies have shaped market stability. Evaluate the potential impact of future patent expiry and technological disruption, particularly from gene therapy programs targeting the same enzymatic pathway (TPP1 deficiency).

-

Forecast Market Growth: Project near- to mid-term trends in the Brineura market, assessing patient population growth through newborn screening programs, expanded indications for younger age groups, and geographic expansion into underpenetrated markets. Analyze long-term scenarios incorporating the potential market entry of gene therapies and other novel modalities, quantifying their impact on revenue trajectory and market share redistribution.

-

Identify Regulatory and Market Barriers: Provide an overview of regulatory frameworks governing enzyme replacement therapies in ultra-rare diseases, focusing on FDA and EMA orphan-drug regulations, approval extensions, and pricing negotiations. Assess the implications of high treatment costs and payer hesitancy on access and reimbursement. Identify operational barriers such as the need for neurosurgical infrastructure and specialized infusion centers.

-

Concurrent Competitive Landscape: Map the current competitive environment, noting that BioMarin holds a de facto monopoly in the CLN2 segment. Evaluate ongoing R&D efforts in adjacent or competing modalities, including gene therapy candidates under investigation by academic and biotech entities. Review BioMarin’s strategic initiatives-such as newborn screening advocacy and early-diagnosis programs-to sustain market leadership and preempt future threats.

-

Regulatory Barriers: Examine key challenges surrounding post-approval label expansions, manufacturing scalability, and market access in emerging geographies. Evaluate how varying reimbursement policies in North America, Europe, and Asia-Pacific influence treatment uptake and patient accessibility. Review ongoing regulatory revisions that may affect orphan-drug exclusivity duration and pricing flexibility.

-

Strategic Implications: Assess BioMarin’s strategic positioning and potential responses to exclusivity expiration and emerging competition. Explore initiatives in lifecycle management, pricing optimization, early-diagnosis collaborations, and geographic diversification. Evaluate how investment in companion diagnostics, screening technologies, and gene therapy partnerships could mitigate long-term market contraction and sustain revenue continuity.

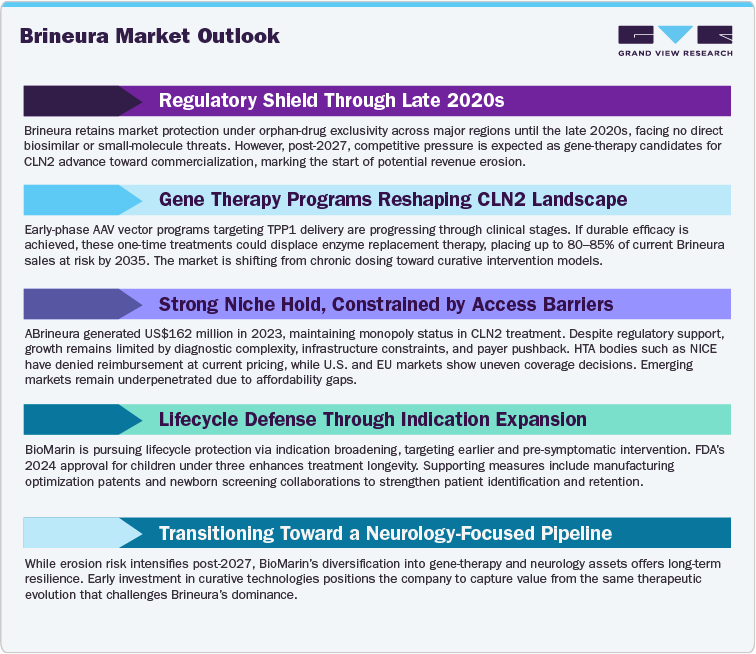

Patent Cliff Analysis

Current analysis indicates that Brineura’s regulatory exclusivity period in key markets extends into the late 2020s, with no confirmed small-molecule or biosimilar competition. However, revenue risk begins to rise post-2027, aligned with potential gene-therapy entrants in clinical development for CLN2. By 2035, up to 80-85% of Brineura’s current sales may be at risk if curative therapies achieve approval and reimbursement. The gradual shift reflects a transition from chronic ERT dependency to single-dose curative modalities. While direct biosimilar risk remains low due to complex protein engineering and intraventricular delivery requirements, technological substitution risk from gene therapy or next-generation enzyme delivery systems is substantial.

Mitigation strategies include extending product lifecycle through new indications (e.g., earlier intervention, pre-symptomatic treatment), process optimization patents, and supportive ecosystem development such as newborn screening programs. BioMarin’s diversification into gene-therapy portfolios and neurology assets could further hedge the revenue decline risk.

Current Market Scenarios

The Cerliponase Alfa (Brineura) market remains a highly specialized segment within the global rare-disease therapeutics industry. Since its launch, Brineura has established monopoly status in CLN2 treatment, with revenues of approximately US$162 million in 2023 (BioMarin annual reporting). Despite small patient volumes, high treatment sustain meaningful revenue contribution relative to addressable size.

The market’s stability is underpinned by orphan-drug exclusivity and absence of therapeutic substitutes, but its scalability is limited by diagnostic challenges and infrastructure requirements. In 2024, the FDA expanded Brineura’s indication to include children under three years, widening the eligible patient population. Concurrently, BioMarin has invested in newborn screening partnerships to identify pre-symptomatic patients earlier, extending treatment duration and improving clinical outcomes.

However, payer resistance remains a major barrier. Health Technology Assessment (HTA) agencies, including NICE in the UK, have rejected reimbursement at list price levels, citing cost-effectiveness concerns. In North America and the EU, reimbursement decisions continue to vary, reflecting differing budget impact thresholds. Emerging markets present potential expansion opportunities but face infrastructure and affordability constraints.

Meanwhile, R&D in gene therapy for CLN2 is gaining momentum, with preclinical and early-phase programs exploring adeno-associated viral (AAV) vectors for intracerebral TPP1 delivery. Should these therapies demonstrate durable efficacy, they may redefine the treatment paradigm, reducing long-term ERT dependency.

Market Dynamics

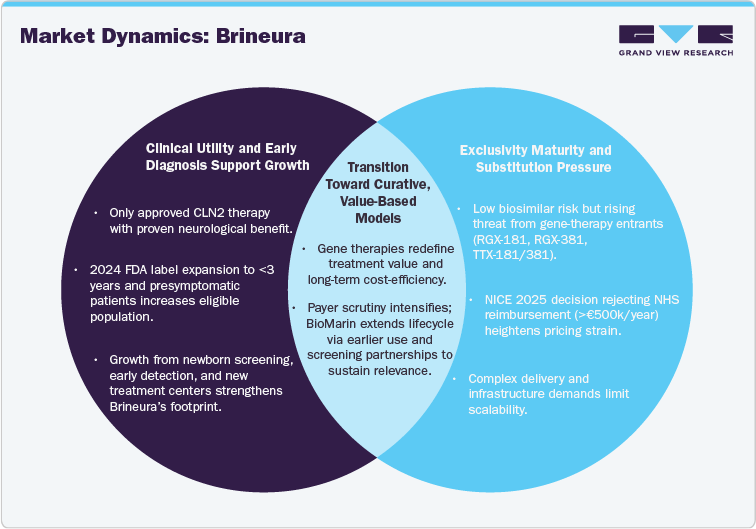

“Cerliponase alfa’s clinical utility in CLN2 sustains market presence”

Cerliponase alfa (Brineura) remains the only approved therapy for CLN2 disease. Bi-weekly intracerebroventricular administration slows loss of ambulation and modifies neurological decline. The FDA expanded the label on 24 July 2024 to include children under 3 years and presymptomatic patients, increasing eligible prevalence and treatment duration. Administration requires neurosurgical device placement and specialized centers, which constrains uptake but reinforces provider stickiness.

“Exclusivity maturity and substitution risk shape revenue trajectories”

Direct biosimilar pressure is limited given a complex protein, CNS delivery, and ultra-rare scale. Revenue risk stems from potential one-time or infrequently dosed gene therapies targeting TPP1 replacement, which could compress long-term ERT demand once durable benefit is proven and reimbursed. HTA decisions, notably NICE’s 2025-2025 draft and final guidance declining routine NHS use due to >EUR 500k annual cost, amplify access risk and price pressure.

“Screening expansion and geographic rollout create near-term growth options.”

Growth is driven by earlier identification and longer treatment windows following the U.S. label expansion, plus incremental penetration in under-served geographies that can establish neurosurgical and infusion infrastructure. Manufacturer guidance shows Brineura as a modest but durable contributor within BioMarin’s portfolio; 2023 company revenue was $2.42B with product-level disclosures indicating continued Brineura sales. Execution depends on newborn screening partnerships and center-of-excellence models.

“Gene therapy progress and payer scrutiny are redefining market dynamics”

-

Substitution risk and timelines: Active CLN2 gene-therapy programs (e.g., RGX-181, RGX-381/TTX-181/381) report early clinical activity; ocular and intracisternal approaches aim at durable TPP1 expression. Milestones through 2027-2030 will set the competitive curve and influence payer views on lifetime ERT value.

-

Access and pricing pressure: NICE’s 2025 guidance declined routine NHS coverage, citing budget impact; similar HTA positions would cap European volumes unless confidential discounts or MEAs are in place.

-

Operational constraints: Intraventricular delivery and device maintenance require trained teams and protocols; these barriers slow global uptake yet deter near-term imitators.

-

Lifecycle management: Label expansion to all ages in the U.S. extends treatable population and supports earlier, longer treatment courses while gene-therapy risk is unresolved.

Emerging alternative therapies are redefining the CLN2 treatment landscape

While Brineura remains the sole approved enzyme replacement therapy for CLN2 disease, emerging modalities-particularly gene therapies-are poised to reshape the therapeutic framework over the next decade. Multiple biotechnology firms and academic institutions are advancing adeno-associated virus (AAV)-based programs targeting TPP1 gene restoration, the same enzyme deficiency addressed by Cerliponase alfa. Early-phase candidates such as RGX-181, RGX-381, and other intracerebral or intravitreal vectors have shown encouraging preclinical efficacy in delivering sustained enzyme activity within neural tissues. These programs, if clinically validated, could offer one-time treatment solutions that significantly reduce or eliminate the need for lifelong biweekly enzyme infusions.

In parallel, advancements in neuro-targeted delivery systems and next-generation enzyme formulations may improve penetration and reduce surgical complexity associated with current intraventricular delivery methods. Additionally, symptomatic and adjunctive therapies focusing on neuroprotection, inflammation modulation, and seizure control continue to evolve, further diversifying the CLN2 care continuum. Collectively, these emerging treatments represent a structural shift from chronic enzyme replacement toward potentially curative or less invasive interventions, fundamentally altering Brineura’s long-term commercial outlook.

Competitive Landscape

The competitive environment for Cerliponase alfa (Brineura) remains highly specialized, with BioMarin Pharmaceutical currently holding a monopolistic position in the CLN2 treatment segment. Unlike markets where biosimilars rapidly follow patent expiry, Brineura’s competitive pressures are emerging primarily from technological substitution, not biosimilar replication. The complex intraventricular administration, small patient population, and manufacturing sophistication render near-term biosimilar entry economically unviable. Instead, the next competitive wave centers on gene therapies and next-generation delivery platforms aimed at restoring or augmenting TPP1 function more durably or less invasively.

Several academic and industry-sponsored gene therapy programs are in clinical or preclinical development, directly positioning themselves as future alternatives to Cerliponase alfa:

-

REGENXBIO’s RGX-181 and RGX-381 (AAV9-based gene therapies) target systemic and ocular CLN2 manifestations, with early data suggesting sustained TPP1 enzyme expression.

-

Taysha Gene Therapies’ TSHA-141 and Thermo Fisher’s research collaborations represent additional entrants exploring CNS-directed TPP1 gene restoration.

-

Spark Therapeutics and Lysogene have reported exploratory work in neuronal ceroid lipofuscinosis (NCL) subtypes, indicating a broader competitive convergence around lysosomal storage disorders.

Parallel innovation is also occurring in enzyme optimization and delivery refinement. Research into intrathecal or convection-enhanced delivery systems, stabilized enzyme variants, and nanocarrier-assisted formulations could reduce administration burden and improve CNS penetration, addressing key limitations of Brineura’s current regimen.

Adjacent competition may arise from symptomatic and supportive therapies-for instance, anti-inflammatory, seizure control, and neuroprotective agents that improve quality of life for CLN2 patients. While not direct substitutes, such interventions could shift payer and prescriber focus toward integrated multimodal care rather than chronic enzyme replacement.

Regional Analysis

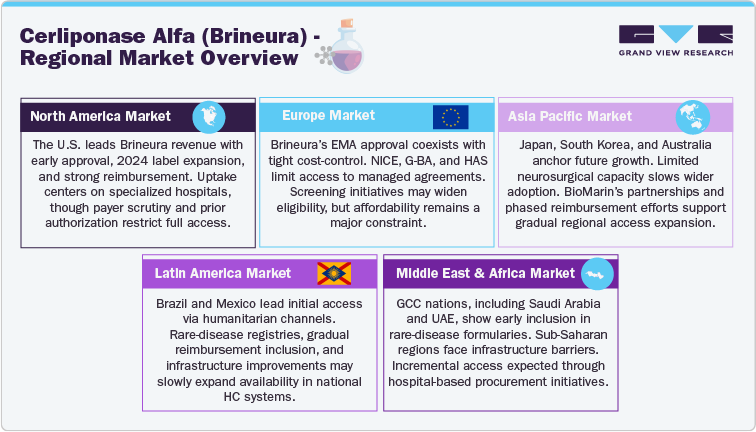

North America Cerliponase Alfa (Brineura) Market

The North American market represents the largest revenue contributor for Cerliponase alfa (Brineura), supported by early regulatory approval (FDA, 2017) and subsequent label expansion in 2024 to include all symptomatic and presymptomatic patients under three years of age. The U.S. market dominates due to established diagnostic networks, specialized neurosurgical centers, and strong orphan-drug reimbursement frameworks. Uptake is concentrated within tertiary hospitals and rare-disease centers of excellence capable of performing intraventricular infusions.

However, the region faces persistent payer resistance and budget-impact scrutiny due to the high per-patient annual treatment cost. Reimbursement typically depends on prior authorization and evidence of clinical response. Canada follows a similar pattern, with provincial variation in access reflecting differing orphan-drug funding mechanisms.

Europe Cerliponase Alfa (Brineura) Market

In Europe, Brineura maintains regulatory approval via the European Medicines Agency (EMA), but adoption remains limited by cost-effectiveness assessments. The NICE appraisal (UK) and other health-technology agencies, including G-BA (Germany) and HAS (France), have expressed reservations over the therapy’s cost-benefit profile. Access in Europe is therefore largely restricted to negotiated managed-access agreements or compassionate-use frameworks. Despite this, major reference centers in Germany, Italy, and the Nordics continue treatment for diagnosed CLN2 patients, reflecting consistent clinical acceptance where funding permits.

Future uptake may improve as pan-European newborn screening initiatives expand and early diagnosis increases treatable prevalence, though affordability remains a structural barrier.

Asia Pacific Cerliponase Alfa (Brineura) Market

The Asia-Pacific region represents an emerging growth opportunity for Brineura, though access remains highly uneven. Japan and South Korea have regulatory frameworks supporting orphan drugs, while China and India are in earlier stages of integrating rare-disease coverage into public insurance systems. Limited infrastructure for neurosurgical device implantation and CSF infusion remains the chief obstacle. BioMarin’s market strategy in the region focuses on early collaboration with local distributors and pediatric neurology networks to prepare the groundwork for eventual market entry. Regional economic diversity implies a gradual, tiered access rollout, with Japan and Australia likely to lead adoption once reimbursement mechanisms stabilize.

Latin America Cerliponase Alfa (Brineura) Market

Latin America presents a nascent but strategically relevant market for Cerliponase alfa. Brazil and Mexico have initiated rare-disease registries and inclusion of selected enzyme replacement therapies under national healthcare frameworks, although CLN2-specific funding is rare. The region’s adoption trajectory mirrors other high-cost rare-disease therapies: select early access via named-patient or humanitarian programs, followed by gradual inclusion in public reimbursement pathways after negotiation. Infrastructure and diagnostic delays continue to limit treatment eligibility.

Middle East and Africa Cerliponase Alfa (Brineura) Market

The Middle East and Africa (MEA) market for Brineura remains at an early developmental stage, constrained by diagnostic capacity and neurosurgical infrastructure. The Gulf Cooperation Council (GCC) markets-Saudi Arabia, the UAE, and Qatar-have begun including select ultra-rare therapies in their specialty formularies, making them potential early adopters. In contrast, Sub-Saharan Africa faces significant logistical and cost-related barriers to access. Improving rare-disease policy frameworks and increasing investment in tertiary pediatric care across the GCC may support incremental uptake through hospital-based procurement rather than broad.

Analyst Perspective

The Cerliponase alfa (Brineura) market stands at a pivotal point as its orphan-drug exclusivity approaches maturity. Unlike mass-market biologics that face biosimilar erosion post-patent expiry, Brineura’s challenges are defined by technological substitution rather than direct replication. The therapy’s commercial trajectory depends on how effectively BioMarin navigates the transition from chronic enzyme replacement toward curative gene-therapy paradigms emerging in the CLN2 landscape. The absence of immediate biosimilar threats provides short-term stability, yet mid- to long-term risks arise from AAV-based TPP1 gene therapies capable of offering one-time, durable correction. As these modalities advance through early-phase trials, payers and regulators are preparing for value-based reassessment of lifelong, high-cost treatments like Brineura. Consequently, BioMarin’s strategic imperative lies in lifecycle extension through diagnostic integration, early-age intervention, and partnership alignment with next-generation gene platforms.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deckwith revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified