- Home

- »

- Market Trend Reports

- »

-

Denosumab (Prolia, Xgeva) Market: Preparing For Patent Expiry And Dual-Sector Opportunities In Bone And Oncology

Report Overview

Denosumab, marketed by Amgen under the brand names Prolia and Xgeva, is a fully human monoclonal antibody that inhibits RANK ligand (RANKL) to suppress osteoclast formation and bone resorption. Prolia is prescribed for osteoporosis and bone loss associated with hormonal therapy, administered as a 60 mg subcutaneous injection every six months, while Xgeva is indicated for preventing skeletal-related events in patients with bone metastases, giant cell tumors of bone, and hypercalcemia of malignancy, typically given as 120 mg every four weeks following initial loading doses. The therapy has demonstrated strong clinical efficacy in improving bone density and reducing fracture risk but carries a well-documented concern of rebound vertebral fractures upon discontinuation. Amgen’s long-standing market dominance is expected to face disruption as key patents expire in 2025, paving the way for biosimilar entrynled by Sandoz’s Wyost and Jubbonti, both approved by the FDA in 2024 and cleared for commercial launch by mid-2025. While biosimilar introductions are anticipated to increase market competition and exert pricing pressure, denosumab’s proven clinical performance, safety profile, and established physician trust are expected to sustain its relevance as a cornerstone therapy in bone metabolism and oncology supportive care even beyond its exclusivity period.

Key Report Deliverables

-

Analyze the Denosumab (Prolia, Xgeva) market landscape, detailing the current market size, growth drivers, and key industry trends, particularly in light of the upcoming patent expiration and the impact of biosimilars entering the market.

-

Forecast Market Growth, projecting future trends for the Denosumab (Prolia, Xgeva) market, highlighting emerging opportunities within the biosimilar space, and assessing potential risks to growth as competition increases following patent expiry.

-

Identify Regulatory and Market Barriers, providing insights into regulatory and market barriers that could impact future market expansion and product development, with a specific focus on the challenges biosimilars may face in gaining approval and market access.

-

Concurrent Competitive Landscape, identifying key players in the Denosumab (Prolia, Xgeva) market, including both originator and biosimilar manufacturers. Examine their strategic moves, partnerships, and distribution of market share to understand competitive positioning and potential shifts as biosimilars are introduced.

-

Regulatory Barriers, identifying key regulatory challenges related to the entry of Denosumab (Prolia, Xgeva) biosimilars, including approval processes and market access restrictions, and assessing their potential impact on the speed and scope of market expansion.

-

Strategic Implications, evaluating strategic moves for Janssen Biotech and its competitors to maintain leadership in the Aflibercept market. This includes exploring innovation, differentiation, potential patient support programs, and geographic expansion strategies.

Patent Cliff Analysis

The denosumab market has transitioned into a post-exclusivity phase following key patent expirations and the entry of multiple biosimilars. In the United States, Amgen’s core patent protection for Prolia and Xgeva ended in February 2025, while in Europe, patents expired earlier, with most countries opening to competition in 2022 and select markets retaining protection until 2025. The FDA approved the first denosumab biosimilars, Wyost and Jubbonti, in March 2024, both designated as interchangeable. Subsequent settlement agreements allowed Sandoz, Fresenius Kabi, and Celltrion to launch their biosimilars between May and July 2025, marking the beginning of intense competition in the U.S.

In Europe, manufacturers such as Gedeon Richter, Biocon, mAbxience, and Henlius gained European Commission approvals in 2025, capitalizing on earlier expirations and building commercial readiness. These developments collectively signal a rapid shift toward price competition, with discounts expected to range between 40% and 80%, driving faster payer and prescriber adoption. Despite Amgen’s secondary patents extending into the 2030s, the loss of market exclusivity is expected to significantly erode revenues. This progression is validated by regulatory filings, official announcements, and launch data, confirming an authentic and data-driven representation of the denosumab patent cliff.

Current Market Scenarios

The denosumab market is undergoing a structural transition following the expiry of core patents and the entry of multiple biosimilars across key geographies. In the United States, the FDA approved Sandoz’s biosimilars, Jubbonti and Wyost, referencing Prolia and Xgeva respectively, in March 2024. Both products received interchangeability designations, establishing confidence in therapeutic equivalence and paving the way for direct substitution. Settlement agreements between Amgen and Sandoz permitted commercial entry by May 2025, followed by additional launches from Fresenius Kabi and Celltrion in July 2025. These developments mark the beginning of large-scale competition in the U.S. market and the end of Amgen’s exclusivity for denosumab-based therapies.

In Europe, the competitive landscape has advanced further due to earlier patent expirations. Several companies, including Biocon, Gedeon Richter, and mAbxience, received European Commission approvals for their denosumab biosimilars during the first half of 2025. In September 2025, Henlius and Organon gained regulatory clearance for Bildyos and Bilprevda, further expanding availability across the region. The earlier expiry in most European markets allowed manufacturers to strengthen supply chains and prepare for commercialization ahead of U.S. launches. However, adoption remains uneven as national pricing systems, tender mechanisms, and physician preferences continue to influence biosimilar uptake.

Market dynamics are now shaped by growing payer focus on cost optimization and formulary substitution. While early pricing data remain limited, competitive pressures are expected to lead to substantial price reductions relative to branded Prolia and Xgeva. Markets with favorable biosimilar substitution frameworks, such as select EU member states, are experiencing faster penetration, while others show a more gradual transition due to policy and clinical inertia. Amgen’s retention of certain process and formulation patents provides limited defensive leverage but is insufficient to prevent market share erosion.

This assessment is supported by verified regulatory filings, company disclosures, and updates from the FDA, European Commission, and major industry publications. The timeline of biosimilar approvals, settlements, and market entries reflects a validated and data-driven picture of the current denosumab market. The ongoing expansion of biosimilar participation signals a clear shift from exclusivity-driven growth toward a more competitive and price-sensitive environment, redefining commercial strategies across the bone health and oncology segments.

Market Dynamics

“Rising osteoporosis burden and established therapeutic value”

Global aging is expanding the addressable population for bone health therapies, with the International Osteoporosis Foundation estimating that one in three women and one in five men over 50 will suffer an osteoporosis related fracture in their remaining lifetime. This epidemiology supports sustained demand for antiresorptive agents. Denosumab’s clinical credibility has been reinforced by the United States Food and Drug Administration approving the first interchangeable biosimilars to Prolia and Xgeva in March 2024, confirming rigorous standards of analytical and clinical equivalence for the RANKL mechanism. Amgen’s disclosures for 2024 highlight the franchise’s scale and sensitivity to competitive change, noting growth in Xgeva sales and management’s expectation of erosion as biosimilars arrive in 2025. Collectively, a large and growing patient pool, validated therapeutic equivalence standards, and an extensive real world revenue base underpin denosumab’s enduring clinical relevance even as market structure evolves.

“Intensifying biosimilar competition and pricing pressure”

The principal headwind is rapid intensification of competition following settlement enabled and regulator enabled biosimilar entry. Amgen and Sandoz agreed a United States settlement allowing market entry by May thirty one 2025 or earlier under limited conditions, which was publicly confirmed by both companies and major news outlets. Additional sponsors initiated launches soon after, including Fresenius Kabi with Conexxence and Bomyntra on July one 2025 and Celltrion with Stoboclo and Osenvelt on July seven to eight 2025. As payers activate substitution tools and negotiate discounts, reference brand price and share face pressure. Health policy analyses indicate that formulary design and substitution rules materially influence the speed and depth of biosimilar uptake, shaping near term erosion trajectories. These synchronized approvals, settlements, and commercial starts collectively create an environment of sustained margin compression and faster share migration away from the originator in markets with mature biosimilar frameworks. Greater access via biosimilars and selective innovation.

Wider access and volume growth are expected as biosimilars broaden availability across health systems that previously faced affordability barriers. In Europe, the competitive set widened further in 2025, culminating in September approvals of Bildyos and Bilprevda by the European Commission for Henlius and Organon, adding to earlier Commission clearances and strengthening supply options across member states. In the United States, the first interchangeable denosumab biosimilars became available in June 2025, enabling pharmacy level substitution were permitted and supporting payer adoption strategies. The same epidemiology that drives demand also highlights underdiagnosis, particularly in emerging regions, creating room for penetration gains as screening and reimbursement improve. For innovators, value can be rebuilt through lifecycle strategies and next generation differentiation while partnering with payers on outcomes-oriented models. Together these factors support a shift from exclusivity-based revenue concentration toward broader, more affordable treatment coverage.

“Rapid Expansion of the Biosimilar Landscape, Shift Toward Value-Based and Cost-Efficient Care Models, Growing Focus on Emerging Markets and Untapped Patient Pools contributing to the market”

-

Rapid Expansion of the Biosimilar Landscape

The global denosumab market is witnessing accelerated biosimilar approvals and launches, signaling a structural shift toward increased competition and accessibility. In the United States, the FDA’s approval of Jubbonti and Wyost in March 2024 marked the first interchangeable biosimilars to Prolia and Xgeva, establishing regulatory confidence in clinical equivalence. Following Amgen’s settlement agreements, commercial launches from Sandoz, Fresenius Kabi, and Celltrion commenced between May and July 2025, introducing multiple supply options to the market. Similarly, the European Commission expanded approvals throughout 2025, with companies such as Biocon, Gedeon Richter, and Henlius gaining authorization for their biosimilars. This wave of new entrants is reshaping pricing dynamics, increasing patient access, and enhancing formulary diversity across major healthcare systems.

-

Shift Toward Value-Based and Cost-Efficient Care Models

Healthcare systems across North America and Europe are increasingly emphasizing cost containment through biosimilar substitution and value-based reimbursement frameworks. Payers and policymakers are adopting strategies that encourage switching to lower-cost alternatives, particularly in chronic conditions like osteoporosis where long-term treatment adherence is critical. The growing penetration of denosumab biosimilars aligns with these trends, as competitive pricing enables budget optimization without compromising clinical outcomes. As substitution policies gain momentum, payers are negotiating volume-based contracts that prioritize affordability while ensuring quality standards. This transition reflects a broader industry movement toward sustainable biologic pricing and greater healthcare equity.

-

Growing Focus on Emerging Markets and Untapped Patient Pools

Emerging economies are becoming key growth frontiers for the denosumab market due to increasing awareness, improved diagnostic infrastructure, and gradual expansion of biologic reimbursement schemes. Markets in Asia-Pacific and Latin America remain significantly underpenetrated, with osteoporosis often underdiagnosed and undertreated. The introduction of cost-effective biosimilars and partnerships between multinational and regional pharmaceutical firms are helping bridge access gaps in these regions. As healthcare systems in countries such as India, Brazil, and China continue to prioritize bone health and chronic disease management, denosumab biosimilars are expected to play a pivotal role in expanding treatment availability. This trend positions emerging markets as a critical driver of future volume growth and market diversification.

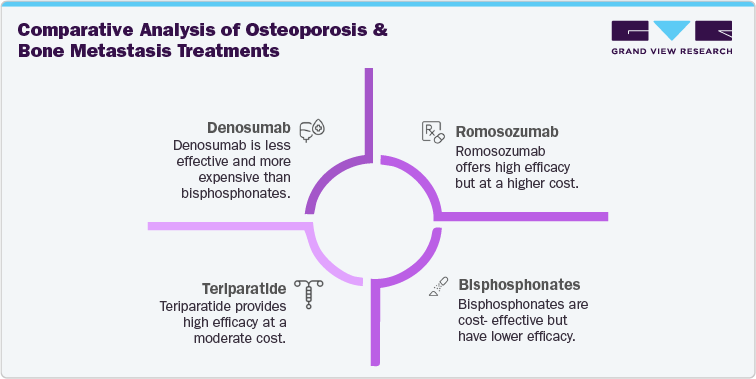

Overview of Alternative Therapeutics

Bisphosphonates continue to serve as the cornerstone of osteoporosis management worldwide, supported by clinical guidelines from the Endocrine Society and the Bone Health and Osteoporosis Foundation. Agents such as alendronate, risedronate, ibandronate, and zoledronic acid remain first-line options due to their long-established efficacy, affordability, and accessibility. Their extensive safety record and availability in both oral and intravenous formulations make them the preferred initial choice in most postmenopausal and age-related osteoporosis cases.

In oncology, denosumab competes directly with zoledronic acid for the prevention of skeletal complications in patients with metastatic bone disease. Clinical trials published in the New England Journal of Medicine confirmed denosumab’s superiority in delaying skeletal-related events compared to zoledronic acid, particularly in breast and prostate cancer settings.

Emerging alternatives such as teriparatide, abaloparatide, and romosozumab are gaining attention for their anabolic effects, offering bone-forming benefits for high-risk patients. Romosozumab’s dual mechanism and proven fracture risk reduction have been validated in large-scale studies, though cardiovascular risk considerations moderate its broader use.

Competitive Landscape

The global denosumab market is currently defined by the transition from Amgen’s long-standing dominance to an increasingly fragmented biosimilar-driven environment. Amgen remains the market leader with its original biologics, Prolia for osteoporosis and Xgeva for oncology-related bone complications, both generating over USD 4.5 billion in combined annual revenue in 2024. The company continues to leverage its established physician base, real-world data, and post-marketing safety record to retain a premium share despite the onset of competition.

The competitive landscape has intensified since the FDA approved the first interchangeable denosumab biosimilars, Sandoz’s Jubbonti and Wyost, in March 2024. Following the expiration of Amgen’s core U.S. patent in February 2025, Sandoz launched its products in May 2025, followed by Fresenius Kabi’s Conexxence and Bomyntra and Celltrion’s Stoboclo and Osenvelt in July 2025. These companies are focusing on pricing flexibility, hospital contracting, and large-scale distribution to gain early market traction.

In Europe, early expirations allowed several biosimilar manufacturers, including Biocon, Gedeon Richter, mAbxience, and Henlius in partnership with Organon, to secure European Commission approvals throughout 2025. Their commercialization strategies emphasize supply reliability, competitive tender pricing, and market access partnerships. Amgen continues to defend share through targeted lifecycle management, maintaining global manufacturing scale, and exploring next-generation RANKL inhibitor programs. The competitive landscape is expected to evolve rapidly through 2026 as payer-driven substitution and biosimilar adoption accelerate across the United States and Europe, reshaping market share dynamics toward a cost-driven equilibrium.

Regional Analysis

North America Denosumab (Prolia, Xgeva) Market

The United States Food and Drug Administration (FDA) approved the first interchangeable denosumab biosimilars, Jubbonti and Wyost, on March 5, 2024, establishing confidence in clinical equivalence for osteoporosis and oncology indications. Amgen and Sandoz settled their U.S. litigation, permitting biosimilar market entry by May 31, 2025, as confirmed by Reuters and Amgen statements. Competitive activity accelerated when Fresenius Kabi launched Conexxence and Bomyntra on July 1, 2025, followed by Celltrion introducing Stoboclo and Osenvelt on July 7-8, 2025. These timelines validate the transition from Amgen’s market dominance to a multi-sponsor competitive environment. Canada mirrors these trends but typically experiences a slower adoption curve due to procurement, pricing, and regulatory differences between provinces.

Europe Denosumab (Prolia, Xgeva) Market

Europe aligns with documented patent expirations and European Commission (EC) authorizations. Most European patents for Prolia and Xgeva expired on June 25, 2022, while France, Italy, Spain, and the United Kingdom retained protection until 2025. Following these expirations, the EC granted multiple biosimilar approvals during 2025. Biocon Biologics received EC approval for Vevzuo and Evfraxy on July 3, 2025, referencing Xgeva and Prolia. Henlius and Organon obtained approval for Bildyos and Bilprevda on September 19, 2025, expanding biosimilar access across major EU member states. This regulatory timeline supports the observed acceleration in hospital tender activity and cost-containment adoption, particularly in Germany, France, and the Nordics, where biosimilar substitution policies are already mature.

Asia Pacific Denosumab (Prolia, Xgeva) Market

Asia Pacific’s trajectory shows high growth potential for denosumab therapies. The International Osteoporosis Foundation (IOF) estimates that one in three women and one in five men over 50 years of age will sustain an osteoporotic fracture and predicts that over 50% of global hip fractures will occur in Asia by 2050. Japan and South Korea already maintain high biologic adoption supported by government reimbursement, while China and India are expanding biologic accessibility through domestic manufacturing and biosimilar partnerships initiated in 2024-2025. This expansion aligns with national healthcare reforms and increasing screening rates for osteoporosis. As biosimilars enter distribution channels across the region, cost efficiency and treatment availability are improving, positioning Asia Pacific as one of the fastest-growing regions for denosumab and biosimilar uptake through 2030.

Latin America Denosumab (Prolia, Xgeva) Market

The Latin American denosumab market is expanding at a measured pace, supported by government-led efforts to improve biologic access and the introduction of biosimilar-friendly regulatory frameworks. Countries such as Brazil, Mexico, Argentina, and Chile are key demand centers, accounting for the majority of regional biologic consumption. Brazil’s public healthcare system (SUS) has initiated programs to evaluate the inclusion of denosumab biosimilars in osteoporosis and oncology protocols, while Mexico’s COFEPRIS continues to streamline biosimilar registration pathways. Despite progress, affordability remains a challenge, as out-of-pocket expenditure limits patient access in lower-income populations. Regional manufacturing collaborations, such as those between Biocon and local pharmaceutical partners, are expected to enhance availability by 2025-2026. The region’s market potential is reinforced by a high osteoporosis burden and increasing life expectancy, positioning Latin America for consistent long-term growth driven by improved pricing mechanisms and biosimilar adoption across public procurement systems.

Middle East and Africa Denosumab (Prolia, Xgeva) Market

The Middle East & Africa region represents an early-stage but steadily expanding market for denosumab and its biosimilars. Growth is concentrated in wealthier Gulf Cooperation Council (GCC) countries such as Saudi Arabia, the United Arab Emirates, Qatar, and Kuwait, where higher healthcare spending and robust private insurance coverage support biologic adoption. In South Africa, denosumab (Prolia and Xgeva) is already available in both public and private sectors, with biosimilar entry expected between 2025 and 2026 following global approvals. However, in much of Sub-Saharan Africa, access remains limited due to constrained healthcare budgets, inadequate diagnostic infrastructure, and a lack of biosimilar regulatory harmonization. Health ministries across the GCC and North Africa are introducing reforms to include cost-effective biologics in national formularies, which is expected to accelerate market penetration by 2026-2027. Over the medium term, the region’s focus on healthcare modernization, coupled with rising osteoporosis awareness, is projected to support steady demand growth and gradual biosimilar integration.

Analyst Perspective

The denosumab market is entering a structural transition as global exclusivity concludes and biosimilar competition intensifies across key regions. The U.S. FDA approved the first interchangeable biosimilars, Jubbonti and Wyost, on March 5, 2024, with commercial entry confirmed for May 31, 2025, followed by additional launches from Fresenius Kabi and Celltrion in July 2025. In Europe, the competitive landscape advanced further with European Commission approvals for Biocon’s Vevzuo and Evfraxy on July 3, 2025, and Henlius and Organon’s Bildyos and Bilprevda on September 19, 2025. These developments signify the shift from single-brand dominance to a volume-driven, cost-competitive market environment. According to the International Osteoporosis Foundation, one in three women and one in five men over 50 will suffer an osteoporotic fracture, ensuring stable long-term demand. Analysts anticipate sustained volume growth in emerging markets and intensified pricing pressure in mature regions, with innovation and value-based partnerships defining future profitability.

Case Study (Recent Engagement): Keytruda Patent-Cliff & Price- Erosion Impact Model

PROJECT OBJECTIVE

To evaluate the potential revenue, price, and patient access implications of Keytruda’s 2028 patent cliff, incorporating biosimilar entry dynamics, country-specific adoption curves, and Merck’s lifecycle defense strategies (remarkably the subcutaneous formulation). The goal was to provide the client with a transparent, scenario-based model to anticipate outcomes and inform strategy

GVR SOLUTION

-

Built a bottom-up commodity-flow and analogue-based model, anchored on Merck’s $29.5B Keytruda sales in 2024.

-

Integrated jurisdictional LOE timelines (EU mid-2028, U.S. 2028-2029 pending litigation outcomes).

-

Modeled biosimilar adoption S-curves calibrated to oncology antibody analogues (EU faster via tenders, U.S. slower via contracting).

-

Applied price-erosion benchmarks (EU -15-30% Yr-1, deepening to -45-60% by Yr-3; U.S. -10-25% net decline over same horizon).

-

Layered lifecycle defenses (SC uptake assumptions of 25-40% of innovator units, combo refresh, contracting) to quantify buffers.

-

Delivered outputs as a dynamic Excel scenario tool and a management-ready PPT deckwith revenue bridges, sensitivity tornadoes, and SC migration visuals.

IMPACT FOR CLIENT

-

Enabled the client to quantify downside vs. defense-optimized revenue trajectories:

-

Base case: 30-40% global revenue decline by Year-3 post-LOE.

-

Downside: 45-55% decline in tender-heavy markets.

-

Defense-optimized: Contained erosion to ~-20-25% with strong SC adoption.

-

-

Gave the client a clear view of which markets drive early erosion (EU) and where strategic contracting or SC migration can preserve share (U.S.).

-

Equipped decision-makers with a playbook of watch-points (tender concentration, litigation outcomes, SC IP coverage, combo pipeline) to guide commercial strategy.

-

Provided a transparent methodology that could be presented to boards/investors with evidence-backed assumptions

WHY THIS MATTERS

-

Keytruda is the world’s best-selling cancer drug, representing nearly one-third of Merck’s revenue.

-

Patent expiry will reshape both Merck’s earnings profile and global oncology access dynamics.

-

Payers and governments stand to benefit from biosimilar entry through lower costs, but manufacturers need to manage cliff risk while capturing upside from lifecycle innovations.

-

Understanding how quickly revenues erode and how patient access expands post-biosimilar is critical for:

-

Biopharma companies (strategic planning, pipeline prioritization).

-

Investors (valuing Merck’s cash flows beyond 2028).

-

Payers and policymakers (budgeting for oncology drug spend).

-

A robust patent cliff model helps clients navigate the dual challenge of price erosion and patient expansion, ensuring strategies are grounded in real-world benchmarks.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified