- Home

- »

- Market Trend Reports

- »

-

Middle East & Africa - Competitive Landscape Of Insulin Delivery Devices

Report Overview

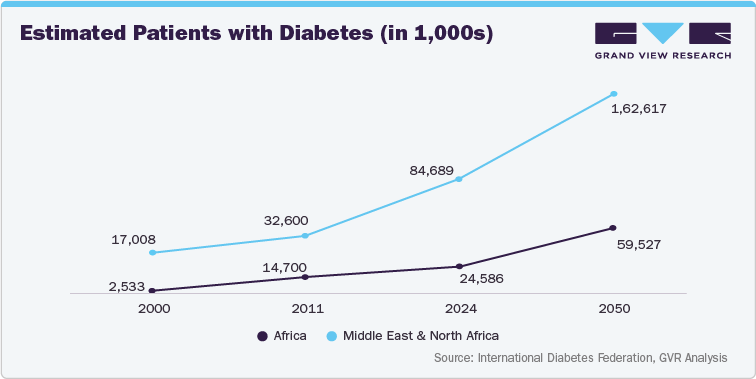

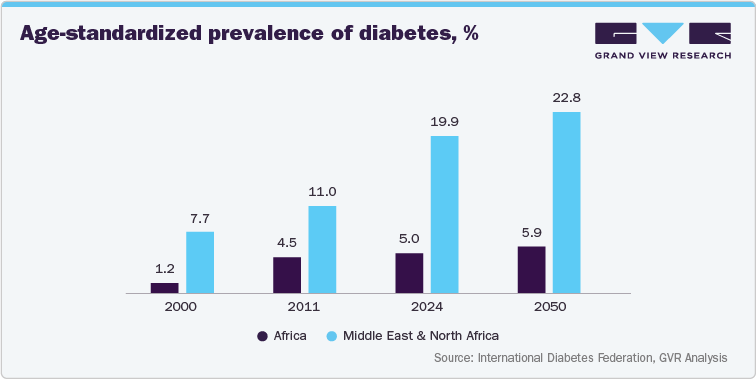

The insulin delivery devices market in the Middle East and Africa (MEA) is witnessing significant growth, driven by the escalating prevalence of diabetes, fueled by lifestyle changes, urbanization, and an aging population. Increased awareness about diabetes management and the benefits of advanced insulin delivery systems, such as insulin pens and pumps, are also contributing to market expansion. Furthermore, government initiatives and healthcare reforms aimed at improving diabetes care, coupled with rising healthcare expenditure, are creating a favorable environment for market growth. The growing presence of international medical device manufacturers and their strategic partnerships with local distributors are further enhancing market accessibility and driving adoption of innovative insulin delivery technologies.

The MEA region presents significant opportunities for insulin delivery device manufacturers. The rising disposable incomes in several countries within the region are enabling greater affordability of these devices. Moreover, the increasing prevalence of type 1 and type 2 diabetes, coupled with the limitations of traditional insulin delivery methods, is creating a significant demand for advanced devices. The market is also witnessing a shift towards patient-centric solutions, with a focus on user-friendly devices that improve patient adherence and quality of life.

Evolution Of Insulin Delivery

The insulin delivery systems have witnessed significant transformation, transitioning from manual methods to advanced, technology-integrated platforms that emphasize precision, usability, and patient adherence. The earliest delivery methods utilized reusable syringes that were invasive, required sterilization, and offered limited dosing accuracy. The subsequent shift to disposable syringes addressed infection control and improved patient convenience. This evolution was followed by the introduction of insulin pens, which enhanced dose accuracy, enhanced insulin administration, and supported improved portability.

The market further advanced with the adoption of insulin pumps, enabling continuous subcutaneous insulin infusion with programmable basal and bolus rates, particularly benefiting individuals requiring intensive insulin therapy. The integration of continuous glucose monitoring systems marked a significant advancement, allowing automated insulin modulation in near real-time and laying the foundation for hybrid closed-loop systems. Similarly, the introduction of smart insulin pens equipped with connectivity features for dose tracking and data synchronization with digital platforms contributed to market advancements. These advancements indicate a shift toward patient-centric, and data-driven insulin delivery technologies within the broader diabetes management ecosystem.

Technological Innovations and Leading Solutions in Insulin Delivery Devices

Automated Insulin Delivery (AID) Systems:

Automated Insulin Delivery (AID) systems, also known as "artificial pancreas," integrate continuous glucose monitoring (CGM) with an insulin pump, automating insulin delivery based on real-time glucose readings. This offers improved glycemic control and reduces the burden of manual insulin management for patients. The adoption rate is influenced by factors such as healthcare infrastructure, affordability, and regulatory approvals. The market is also seeing an increase in the use of smart insulin pens and digital dose tracking, which provide more accurate and convenient insulin delivery.

Recent developments in Automated Insulin Delivery (AID) systems:

-

In April 2025, Senseonics and Sequel Med Tech announced the creation of the first Automated Insulin Delivery (AID) system combining Sequel’s twiist pump with Senseonics’ Eversense 365 one‑year continuous glucose monitor. The integration targets a Q3 2025 launch, offering enhanced glucose control and user flexibility.

-

In January 2025, Tandem Diabetes Care and the University of Virginia’s Center for Diabetes Technology signed a multi‑year collaboration to advance research in fully automated insulin delivery. Leveraging UVA’s algorithm expertise and Tandem’s device systems, the partnership aims to improve patient quality of life through more advanced closed‑loop insulin systems.

Smart Insulin Pens and Digital Dose Tracking:

Smart insulin pens, which track insulin doses and provide data on injection times and dosages, are becoming increasingly popular. These pens can connect to mobile apps, allowing patients and healthcare providers to monitor insulin usage and make informed decisions. Digital dose tracking features are also being integrated into traditional insulin pens, offering similar benefits. The adoption of these technologies is facilitated by the increasing penetration of smartphones and the growing demand for user-friendly diabetes management tools.

Recent developments in Smart Insulin Pens and Digital Dose Tracking:

-

In November 2024, Medtronic received FDA clearance for its InPen smart insulin pen app, which now suggests corrective doses for missed meals. This paves the way for the Smart MDI system, integrating InPen with the smaller-size Simplera CGM. A limited launch will target current CGM and InPen users.

Tubeless and Wearable Patch Pumps:

Tubeless and wearable patch pumps offer a convenient alternative to traditional insulin pumps. These devices are attached directly to the skin and deliver insulin continuously, eliminating the need for tubing. This design enhances patient comfort and mobility, which is particularly appealing to active individuals. The demand for these pumps is increasing due to their ease of use and the growing preference for less intrusive diabetes management solutions.

Recent developments in Tubeless and Wearable Patch Pumps:

-

In February 2023, Gulf Drug, a major UAE pharmaceutical distributor, officially introduced EOFlow’s tubeless, disposable “EOPatch” wearable insulin pump in the United Arab Emirates. The device, designed to simplify insulin delivery, marks EOFlow’s first commercial venture into the Middle Eastern market

SWOT Analysis Of Maret Leaders

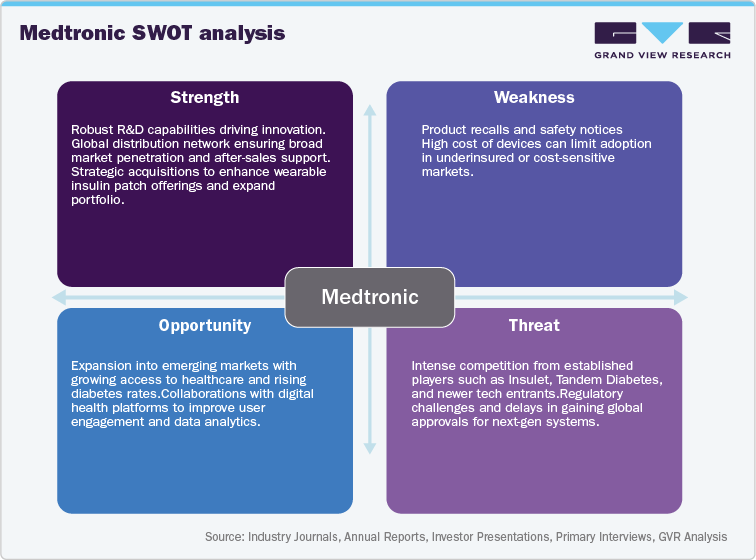

Medtronic:

Competitive Landscape:

Key Company Profiles:

MEDTRONIC:

Company Overview:

Headquarters: Ireland

Founded: 1949

Employee Strength: 95,000+

Overview: Medtronic is a major player in the insulin delivery devices market, offering a range of products designed to improve diabetes management. The company's offerings include insulin pumps and continuous glucose monitoring (CGM) systems, which are often integrated to create automated insulin delivery (AID) systems. Medtronic's strategy involves significant investments in research and development to develop new technologies and expand its market presence through strategic partnerships and acquisitions. The company's focus on innovation and customer-centric approaches has helped it maintain a strong position in the competitive insulin pump market.

Product Offered:

Product

Description

MiniMed 630G System

An insulin pump system with SmartGuard technology. Used for continuous glucose monitoring.

MiniMed 770G Insulin Pump System

It offers several features, including automatic adjustment of insulin delivery every 5 min, increased time with SmartGuard Auto Mode, and improved patient experience with MiniMed 770G.

MiniMed 780G System

The MiniMed 780G System is an advanced insulin pump system designed to provide personalized automated insulin delivery for improved glucose management in individuals with diabetes.

InPen Smart Insulin Pen

It aids Multiple Daily Injections (MDI). Helps patients take the right amount of insulin at the right time and reduces challenges associated with MDI patients.

i-Port Advance Injection Port

It is a built-in inserter made for MDI patients for direct delivery of insulin with a syringe or pen without puncturing the skin.

Financial Performance:

Name

Type

Revenue, 2023

(USD Million)

Revenue, 2024 (USD Million)

Medtronic plc

Public

31,227

32,364

Recent Developments:

Year

Month

Details

2025

April

Medtronic submitted its insulin pump for FDA approval, designed to interoperate with Abbott’s FreeStyle Libre CGMs. This marks a key step in advancing their strategic partnership and reflects Medtronic’s focus on flexible, patient-centered diabetes technology following plans to spin off its diabetes division.

2025

April

Medtronic received FDA clearance for Simplera Sync, a disposable CGM integrating with MiniMed 780G. This milestone supports Medtronic’s aim to offer a more user-friendly, streamlined diabetes management system, featuring automated insulin delivery with simplified sensor insertion and reduced calibration requirements.

2024

January

Medtronic revealed "MiniMed" as the name for its soon-to-be independent diabetes business. The new entity will focus on insulin delivery and glucose monitoring products, with the MiniMed 780G continuing as a flagship device, supporting Medtronic’s separation strategy to sharpen business focus.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified