- Home

- »

- Market Trend Reports

- »

-

PAP Devices Market - Size, Unit Volume, And ASP Trends, 2012 -2030, U.S. vs International Markets

Market Overview: Positive Airway Pressure Devices Market

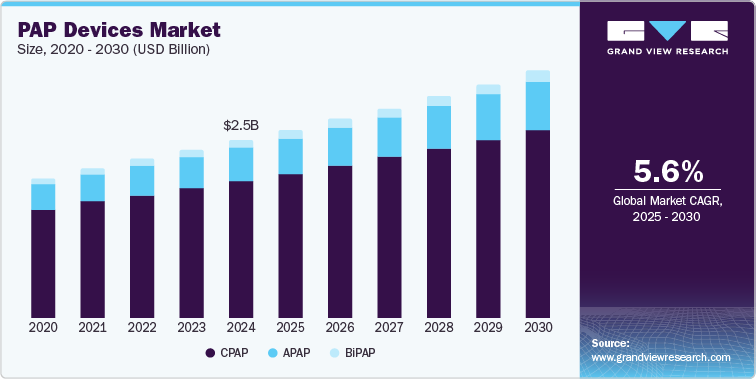

The positive airway pressure (PAP) devices market size was estimated at USD 2.48 billion in 2024 and is anticipated to grow at a CAGR of 5.61% over the forecast period to reach USD 3.44 billion by 2030. The rising prevalence of sleep apnea and the increase in awareness & diagnosis of sleep disorders are major factors driving the market. According to estimates published in 2023 by the Saudi Journal of Otorhinolaryngology-Head and Neck Surgery, approximately 936 million people worldwide suffer from mild to severe Obstructive Sleep Apnea (OSA), with 425 million individuals aged 30 to 69 experiencing moderate to severe forms of the disease.

1. PAP Devices Market: Company-wise Market Value, ASP & Unit Volume Trends (2012 - 2024)

The PAP devices market has witnessed dynamic shifts over the past decade, gradually moving toward consolidation. This trend has been primarily driven by competitive realignment, evolving consumer preferences, and advancements in sleep therapy technologies.

Global PAP Devices Market

Years

2012

2016

2020

2024

Global PAP Devices Market

Value ($ MM)

1430.42

2477.37

Volume (Units'000)

2093.81

2747.87

Similar Analysis Will be provided in the final deliverable at CPAP, APAP, and BiPAP levels (U.S. vs International Markets)

Below is the Overall List of Market Players:

-

ResMed

-

Philips

-

Fisher & Paykel

-

React Health (3B Medical)

-

Löwenstein Medical

-

BMC Medical

-

Wellell (Apex Medical)

-

Armstrong Medical

-

Breas Medical

-

SEFAM

-

Smiths Group PLC

-

Transcend Inc. (Somnetics International, Inc.)

-

Trudell Medical (Vyaire)

-

Drive DeVilbiss Healthcare Ltd.

-

Invacare Corporation

-

Others

Key Observations: (Based on GVR Proprietary Database - Referenced and Cited by Notable Industry Players)

-

ResMed

• Demonstrated the strongest growth trajectory across all players.

• Solidified its position as the market leader, especially after 2021, driven by product innovation and increased brand trust.

-

Fisher & Paykel

• Maintained moderate, steady growth, with market value increasing from an analyzed USD 26.8 million in 2012 to USD 105.7 million by 2024.

• Benefited from rising demand for non-invasive ventilation and sleep therapy solutions, supporting its expanding U.S. footprint.

-

React Health (3B Medical)

• A smaller but steadily growing market player, with a compound annual growth rate (CAGR) of ~0.07%.

• Gained traction following Philips’ market exit, meeting demand from DME (durable medical equipment) providers seeking alternative device suppliers.

-

Philips

• Formerly a leading player in the U.S. CPAP market.

• Experienced a decline post-2016, followed by a complete market exit after 2021 due to widespread product recalls, resulting in a loss of market share and brand trust.

Market Dynamics Driving Long-Term Growth:

-

Rising prevalence of sleep apnea and increased diagnosis rates

-

Integration of telehealth and remote monitoring capabilities

-

Shift toward home-based respiratory care and portable CPAP systems

-

Loss of consumer trust in legacy brands post-recalls, reshuffling loyalty

Market Players' Entry and Exit Strategies and Their Impact on Competitors

1. Medical Depot, Inc. Dba Drive Devilbiss Healthcare:

Medical Depot, Inc. Dba Drive Devilbiss Healthcare’s Exit Strategy Aims To Realign The Company With Its Mission And Vision

-

In September 2021, Medical Depot, Inc. dba Drive DeVilbiss Healthcare, announced its decision to discontinue its CPAP devices.

-

The company decided to shift its focus toward its market-leading oxygen products. This strategic move allowed the company to optimize its resources and manufacturing capacity to meet the heightened demand for oxygen therapy devices during the pandemic.

-

Following an extensive review process lasting almost a year, the decision demonstrates the company’s acknowledgment of unfavorable market conditions.

In accordance with the insights from secondary research, Drive DeVilbiss Healthcare has pivoted its mission focus toward the following key product lines:

2. Entry of React Health following Medical Depot, Inc. dba Drive DeVilbiss Healthcare’s exit and its anticipated impact:

The acquisition of Medical Depot, Inc. dba Drive DeVilbiss Healthcare’s IntelliPAP line of CPAP devices assets by React Health is likely to have significant implications for the CPAP devices market, including changes in competition, product availability, market dynamics, customer support, etc.

Analyst Insight: These additions to React Health’s portfolio broadens its offerings for sleep care, catering to various patient needs and providing comprehensive solutions for end-to-end patient care in the sleep space.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified