- Home

- »

- Market Trend Reports

- »

-

Sterile Injectable CDMOs: Competitive Landscape

Report Overview

The trend of outsourcing activities in the pharmaceutical domain is rising as companies find value in acquiring additional competencies essential for successful drug development and commercialization. Besides providing extended expertise & assisting in improved cash flow management, outsourcing brings significant manufacturing advantages, including reducing investment risks. Notably, in the context of early-stage technologies and products, establishing expensive in-house capabilities entails substantial risks across the product development phases. At the same time, outsourcing serves as a risk-averse alternative.

In addition, a limited understanding of the required scale for current and future product offerings or market penetration poses significant hurdles in designing and scaling manufacturing for in-house production. Consequently, the preference for outsourcing has grown as an effective strategy until market demand for products becomes well-established and understood. Moreover, the expansion of cell and gene therapies is significantly impacting the sterile injectable market. As these innovative treatments gain traction, there is a growing need for specialized manufacturing capabilities that comply with stringent regulatory requirements.

Overall, the sterile injectable contract development and manufacturing market is on an upward trajectory, fueled by rising demand for biologics, chronic disease management, outsourcing trends, technological advancements, and the emergence of innovative therapies. These factors collectively position CDMOs as critical players in meeting the evolving needs of the pharmaceutical industry.

Competitive Landscape: Sterile Injectable CDMOs Report Coverage

Market Outlook

Company Categorization

Service Heat Map Analysis

Competitive Assessment Analysis

List of Key CDMOs by Region

Company Overview

Service Benchmarking

Financial Reporting

Major Deals and Strategic Alliances Analysis

SWOT Analysis

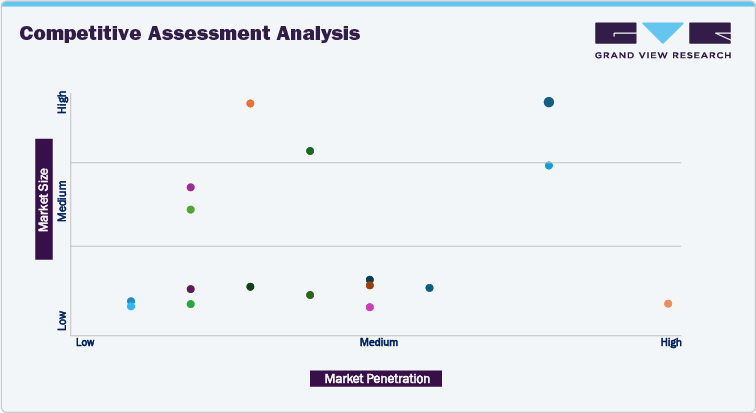

The Competitive Assessment Analysis

The competitive assessment analysis is based on company revenue size and service penetration of key service providers in the market. Players such as Baxter and Boehringer Ingelheim International GmbH secured high market size and service offerings. The medium segment covers Ajinomoto Bio-Pharma and Fresenius Kabi Contract Manufacturing (Fresenius Kabi AG), among others. Fareva Group, Vetter Pharma International GmbH, PCI Pharma Services, Siegfried AG, Recipharm AB, and others are in the low category owing to minimum revenue generation and service penetration.

Major Deals And Strategic Alliances Analysis

The sterile injectable contract development and manufacturing organization market is undergoing transformative changes driven by strategic initiatives aimed at enhancing operational efficiency and meeting the increasing demand for complex biologics and therapeutics. As pharmaceutical companies face mounting pressure to accelerate drug development timelines and navigate stringent regulatory environments, many are turning to CDMOs for their specialized manufacturing capabilities. This shift is characterized by a growing trend towards end-to-end service models, where CDMOs offer comprehensive solutions that encompass everything from active pharmaceutical ingredient development to final product manufacturing.

Company Name

Type of Development

Month

Year

Description

Vetter Pharma International GmbH

Expansion

June

2024

The company announced its plan to set up new facilities in the U.S. and Germany. This expansion is likely to leverage the company’s capacity for clinical manufacturing and related services.

Alcami Corporation

Partnership

March

2024

The company partnered with Tanvex CDMO, enhancing its capabilities in biologics manufacturing. Alcami would leverage its expertise in sterile filling, labeling, and packaging, while Tanvex would contribute its high-throughput bulk drug substance development services. The partnership aimed to expedite the delivery of sterile injectables, addressing the increasing demand for specialty therapeutics and complex biologics.

Kühne Holding AG

Acquisition

April

2024

The company signed an agreement to acquire Anova Group's pharmaceutical CDMO, further expanding its portfolio in healthcare and pharmaceuticals.

Partnerships, acquisitions, and expansions are becoming essential strategies for CDMOs to bolster their production capacities and expand their service offerings, ultimately positioning themselves as critical players in the evolving landscape of sterile injectables.

SWOT Analysis for Boehringer Ingelheim International GmbH

Boehringer Ingelheim's reputation, technological capabilities, and global reach position it as a strong player in the sterile injectables CDMO market. However, it must address challenges like competition, cost sensitivity, and evolving client needs while capitalizing on growth opportunities in biologics, emerging markets, and innovative delivery systems.

An in-depth analysis shall be provided for below listed 30 Sterile Injectable CDMOs:

-

ACS DOBFAR

-

Aenova Group

-

Alcami Corporation

-

Ajinomoto Bio-Pharma

-

Ardena Holding NV

-

Argonaut Manufacturing Services

-

Ascendia Pharmaceuticals

-

ASPEN

-

Aurigene Pharmaceutical Services

-

Axcellerate Pharma

-

Boehringer Ingelheim International GmbH

-

Baxter

-

BioConnection Bv

-

Bora Pharmaceuticals

-

Syngene International Ltd.

-

Terumo Europe NV

-

TAKATA SEIYAKU CO., LTD

-

WuXi Biologics

-

Piramal Pharma Solutions

-

Vetter Pharma International GmbH

-

Recipharm AB

-

Fresenius Kabi Contract Manufacturing (Fresenius Kabi AG)

-

Unither Pharmaceuticals

-

FAMAR Health Care Services

-

PCI Pharma Services

-

IDT Biologika GmbH

-

Fareva Group

-

Eurofins Scientific

-

Torbay Pharmaceuticals

-

Pfizer CentreOne (Pfizer Inc.)

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified