- Home

- »

- Medical Devices

- »

-

Sterile Injectables CDMO Market Size, Industry Report, 2030GVR Report cover

![Sterile Injectables CDMO Market Size, Share & Trends Report]()

Sterile Injectables CDMO Market (2025 - 2030) Size, Share & Trends Analysis Report By Molecule Type (Small Molecule, Large Molecule), By Product, By Service, By Therapeutic Area, By Route Of Administration, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-363-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sterile Injectables CDMO Market Summary

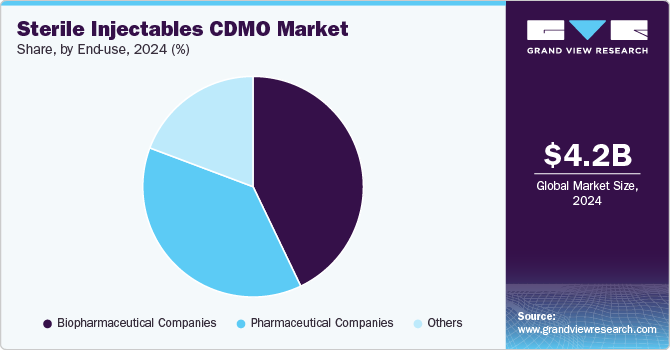

The global sterile injectables CDMO market size was estimated at USD 4.25 billion in 2024 and is projected to reach USD 7.29 billion by 2030, growing at a CAGR of 9.61% from 2025 to 2030. The market growth is primarily driven by increasing pipeline and approvals of injectable drugs.

Key Market Trends & Insights

- North America dominated the sterile injectables CDMO market with the largest revenue share of 40.64% in 2024.

- The sterile injectables CDMO market in Asia Pacific is anticipated to grow at the fastest CAGR of 10.91% during the forecast period.

- Based on molecule type, the large molecule segment led the market with the largest revenue share of 66.00% in 2024.

- Based on service, the formulation development segment led the market with the largest revenue share with 39.04% in 2024.

- Based on therapeutic area, the oncology segment led the market with the largest revenue share of 29.67% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.25 Billion

- 2030 Projected Market Size: USD 7.29 Billion

- CAGR (2025-2030): 9.61%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Pharmaceutical companies are proactively focusing on developing injectable medications due to their numerous benefits, such as quicker onset of action, precise dosing, and enhanced patient adherence.

For instance, as per the U.S. Food and Drug Administration (FDA) report published in January 2024, the Center for Drug Evaluation and Research (CDER) approved 55 novel drugs in 2023. These medications included injectables, indicating a robust pipeline that is anticipated to drive an increase in the demand for contract manufacturing services for both commercial and research purposes, hence contributing to overall market growth.

The increasing demand for cellular and genetic therapies is driving the market’s growth. With the expansion of therapy pipelines, there is a rising requirement for specialized manufacturing capabilities provided by contract manufacturing organizations (CMOs). For instance, according to the American Society of Gene & Cell Therapy (ASGCT), 3,866 therapies are currently in development, spanning from preclinical stages through preregistration. Within this landscape, 2,082 therapies are categorized as gene therapies, which include genetically modified cell therapies like CAR T-cell therapies, constituting 53% of gene, cell, and RNA therapies. In addition, 862 therapies are nongenetically modified cell therapies, making up 22% of the overall gene, cell, and RNA therapies in development. Thus, a strong product pipeline and growing demand for advanced therapeutics are likely to enhance overall market demand.

Strategic initiatives undertaken by market participants, such as expanding sterile manufacturing facilities and engaging in collaborations and partnerships, are anticipated to bolster market growth throughout the projected period. For instance, in March 2024, Alcami Corporation company partnered with Tanvex CDMO, enhancing its capabilities in biologics manufacturing. Alcami would leverage its expertise in sterile filling, labeling, and packaging, while Tanvex would contribute its high-throughput bulk drug substance development services. The partnership aimed to expedite the delivery of sterile injectables, addressing the increasing demand for specialty therapeutics and complex biologics.

The high demand for sterile injectables propels growth in outsourced agreements amongst contract manufacturers and biopharmaceutical companies, thereby boosting the growth of the sterile injectable CDMO industry. The growing need for faster drug action, rapid absorption, and less drug concentration are a few major aspects contributing to the adoption of sterile injectables CDMO industry. Further, pharmaceutical firms actively involved in sterile injectable development and manufacturing are gaining traction to support monoclonal antibody therapies, large-molecule injectable drugs, and infectious disease-treating drugs. Several factors, including reduced time and cost-affordable research and development cycles of generic injectables and the growing advancements in rare disease treatments, are accelerating the market growth.

Advanced manufacturing techniques are crucial for ensuring the stability and efficacy of cancer therapies. Contract manufacturers specializing in sterile injectables, particularly those experienced in handling complex formulations and biologics, are well-equipped to address the specific requirements of oncology drugs. Sterile injectables are essential for delivering complex biologics and innovative treatment methods in cancer treatment, driving the growth of the sterile injectable contract manufacturing sector. The growth in outsourcing practices is expected to drive the expansion of the segment over the forecast period. Pharmaceutical companies, particularly those specializing in oncology, are increasingly turning to outsourcing manufacturing operations to streamline processes, cut costs, and capitalize on the specialized expertise offered by contract manufacturers. This shift has notably boosted the cancer sector's sterile injectable contract development and manufacturing market.

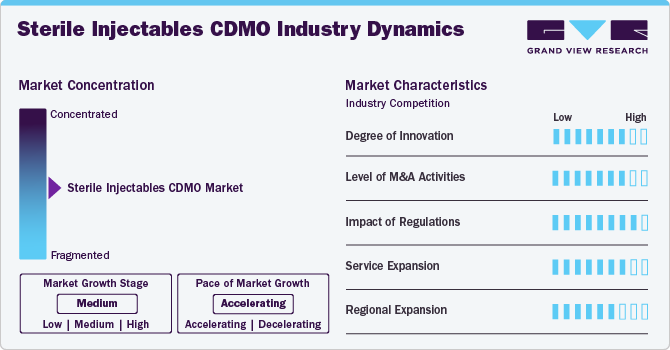

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market is characterized by a degree of innovation, Level of M&A activities, impact of regulations, service expansions, and regional expansions.

The sterile injectables CDMO industry fortifies a high degree of innovation. Increasing focus on the adoption of advanced aseptic processing techniques that ensure the sterility of injectable products throughout the manufacturing process. This includes the use of isolators and restricted access barrier systems (RABS) to maintain aseptic conditions during filling and finishing operations. In addition, advancements in lyophilization technology have improved the stability and shelf-life of injectable products, especially for biologics and complex molecules. High-containment manufacturing facilities have also emerged to address the growing demand for potent drug products, ensuring safe handling and production of hazardous substances.

Regulations have a high impact on the market, influencing compliance requirements, quality standards, and market entry barriers. Regulatory agencies impose rigorous guidelines to enhance safety, efficacy, and manufacturing processes, impacting the time and cost associated with novel biologics development and commercialization. Moreover, Continuous updates and amendments in regulatory guidelines require companies to stay informed and adaptable. Biopharmaceutical companies find it critical to track updated regulatory guidelines, so they outsource regulatory affairs services to comply with updated regulatory standards.

The level of M&A (mergers and acquisitions) activities in the market is high. Several companies are undertaking mergers and acquisitions strategies to expand biologics regulatory affairs portfolios, gain access to advanced technologies, and enhance their market presence. For instance, in April 2024, Kuhne Holding AG company signed an agreement to acquire Anova Group's pharmaceutical CDMO, further expanding its portfolio in healthcare and pharmaceuticals, which will drive the market over the estimated time.

Service expansion in the market is medium owing to increasing demand for specialized regulatory expertise and comprehensive support services in the biologics sector. Moreover, service providers are expanding their regulatory consulting, compliance services, and end-to-end support for biologics development to cater to customer demand and broaden revenue growth opportunities. For instance, in February 2024, Pharmascience announced a USD 120 million expansion of its sterile injectable manufacturing facility last fall at its Candiac site. This expansion marked a crucial milestone for the company, demonstrating its commitment to enhancing its manufacturing capabilities in the pharmaceutical sector.

The market is experiencing significant regional expansion, with service providers strategically expanding their presence to new geographic areas. Biologics companies are expanding into emerging markets in Asia-Pacific, Latin America, and MEA owing to growing healthcare needs and favorable regulatory environments. Thus, growing contract development and manufacturing organizations trend for regulatory affairs due to the rising need to navigate country-specific regulatory requirements and skilled expertise.

Molecule Type Insights

Based on molecule type, the large molecule segment led the market with the largest revenue share of 66.00% in 2024. The high segment growth is primarily attributable to the rising investments by contract manufacturers for large molecule-based therapeutics development, the increasing product pipeline of injectables, and market approvals for biosimilars. For instance, according to the U.S. FDA, biologics witnessed approximately 44% to 45% of the development pipeline from 2023 to 2024.

The growing demand for precision medicine has boosted the need for innovative treatments that target specific pathways or genetic markers associated with various conditions. Furthermore, constant advancements in biomanufacturing technologies are contributing to the segment growth. Innovations such as single-use technologies and continuous manufacturing processes have made it more feasible for CDMOs to produce large molecules at scale while ensuring compliance with stringent regulatory requirements. These technological improvements reduce production costs and timeframes, making it more attractive for pharmaceutical companies to invest in the development of large molecules.

The small molecule segment is projected to witness a considerable CAGR over the forecast period. The high segment growth is due to the increasing demand for generic injectables among small molecules. The increasing pipeline of small molecules is a major factor supporting the segment's stable growth during the forecast period. However, the growing adoption of advanced technologies has led to the growth of small molecule-based injectables in the past few years, thereby accelerating the segment’s growth.

Product Insights

The pre-filled syringes segment led the market with the largest revenue share of 41.26% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The growth is attributed to its enhanced safety and convenience offering for healthcare providers and patients by reducing the risk of medication errors and contamination. The user-friendly design of pre-filled syringes also improves dosing accuracy and reduces the need for manual handling of drugs, making them particularly suitable for self-administration by patients.

The growing prevalence of chronic diseases requiring long-term treatment, such as diabetes and autoimmune disorders, boosts the demand for pre-filled syringes as they provide a convenient and efficient delivery method for these therapies. For instance, in June 2023, The Lancet published its study involving 22 million individuals, revealing that approximately 1 in 10 people are affected by autoimmune disorders. This high prevalence emphasizes the significant impact on the adoption of pre-filled syringes for disease treatment.

Moreover, the shift towards biologics and biosimilars in pharmaceutical development has increased the need for specialized drug delivery systems like pre-filled syringes to ensure the stability and efficacy of these complex molecules. These factors are contributing to the rising adoption of pre-filled syringes in the sterile injectables CDMO industry.

The specialty injectables segment is anticipated to grow at a significant CAGR over the forecast period. Innovations in drug delivery systems such as the introduction of auto-injectors and wearable devices have enhanced patient compliance & convenience. These technologies enable the administration of specialty injectables, making them more acceptable to both healthcare providers and patients. The integration of smart technologies into injectables also supports better monitoring of treatment adherence. Moreover, the growing shift toward personalized medicine necessitates tailored therapeutic solutions that can be effectively delivered through injections. Specialty injectables allow for customization based on individual patient needs, thereby enhancing treatment efficacy and minimizing side effects. Thus, these factors are further contributing to the segment growth.

Service Insights

Based on service, the formulation development segment led the market with the largest revenue share with 39.04% in 2024. Injectable formulations include small-volume parenteral formulations such as vials & ampules and large-volume parenteral formulations such as glucose solutions and sodium chloride solutions. With the increasing demand for insulin, vaccines, and many other recent drug types administered via the parenteral route, the market is expected to grow considerably, especially for injectable formulations. Moreover, several companies are focusing on technological advancements in manufacturing injectables, including the formulation challenges of long-lasting, injectable device design and highly viscous & high-volume drug delivery.

The manufacturing segment is anticipated to grow at the fastest CAGR of 9.85% over the forecast period. The increasing geriatric population, coupled with the rising prevalence of chronic diseases, is driving pharmaceutical companies to invest in R&D activities and launch new drugs in the market to meet the growing demand. Therefore, to accelerate the launch and commercialization of their products in the market, companies are increasingly outsourcing their manufacturing processes to specialized CDMOs that can ensure compliance with stringent regulatory standards. These organizations leverage advanced technologies such as aseptic processing, isolators, and advanced filtration systems to maintain sterility across the manufacturing process. Moreover, the trend of personalized medicine has necessitated smaller batch sizes and more flexible manufacturing capabilities, further propelling the growth of CDMOs specializing in sterile injectables.

Therapeutic Area Insights

Based on therapeutic area, the oncology segment led the market with the largest revenue share of 29.67% in 2024. The increasing incidence of cancer globally is leading to a growing need for effective oncology treatments. The rise in cancer cases has fueled the demand for sterile injectables manufacturing services from CDMOs to meet the needs of pharmaceutical companies developing oncology drugs. Moreover, the complexity of oncology drug formulations often necessitates specialized manufacturing capabilities that CDMOs can provide. In addition, regulatory requirements encompassing sterile injectables production are stringent due to the critical nature of these drugs in treating patients. The expertise of CDMOs in navigating these regulatory hurdles while maintaining high-quality standards makes them valuable partners for pharmaceutical companies developing oncology drugs. Furthermore, the trend toward personalized medicine led to an increased demand for customized sterile injectable formulations tailored to individual patient needs.

The central nervous system diseases segment is anticipated to grow at the fastest CAGR of 10.26% over the forecast period. This can be attributed to increasing prevalence of CNS disorders across the globe, attributed to factors such as aging populations, lifestyle changes, and environmental influences led to a growing need for effective treatments delivered via sterile injectables. Moreover, the rise in R&D activities focused on discovering novel therapies for CNS diseases spurred the demand for specialized manufacturing services provided by CDMOs. Stringent regulatory requirements governing the production of sterile injectables for CNS indications necessitate expertise and infrastructure that CDMOs can offer. The complexity of formulating injectable drugs targeting the CNS, which often require precise dosing and delivery mechanisms to cross the blood-brain barrier effectively, further underlines the importance of CDMOs with advanced capabilities in this therapeutic area.

Route Of Administration Insights

Based on route of administration, the intravenous (IV) segment led the market with the largest revenue share of 29.56% in 2024. This is attributable to the large number of sterile injectables approval which required intravenous route administration. Further, a robust pipeline of IV sterile injectables is expected to be launched in the near future. The U.S. FDA stated that in 2021, the total volume of injectables launched majorly constituted IV infusion dosages accounted for approximately 30-35% of the total injectable volume. Hence, the aforementioned factors are driving the segment growth.

The subcutaneous segment is projected to grow at the fastest CAGR of 10.38% over the forecast period. This can be attributed to its high demand, due to its ability to administer various types of medications for several medical conditions owing to a sustained absorption rate. Thus, it is highly effective in vaccines, insulin, and growth hormone administration, requiring continuous delivery at a low dose rate. Hence, the above-mentioned advantages of the subcutaneous route of administration are some of the major factors driving the segment revenue growth.

End-use Insights

Based on end use, the biopharmaceutical companies segment led the market with the largest revenue share of 42.89% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This high segment growth is owing to the increasing trend of end-to-end outsourcing services, especially among small- and mid-size biopharmaceutical companies. Furthermore, the increasing number of biologics pipelines, coupled with the growing outsourcing trend among biopharmaceutical companies, is anticipated to drive growth of this segment over the forecast period. For instance, in May 2024, AGC Biologics entered into a collaboration agreement with BioConnection, a specialized CMO that focuses on the aseptic filling of syringes and vials for commercial and clinical production. The collaboration aims to offer end-to-end biopharmaceutical development and manufacturing capabilities for drug products.

The pharmaceutical company’s segment is anticipated to grow at a significant CAGR over the forecast period. The robust segment growth is due to the growing number of pharmaceutical companies penetrating the advanced therapy medicinal products industry. Moreover, rising R&D investments by major biopharmaceutical firms to develop innovative rare disease therapeutics is another factor propelling the segment’s growth. Moreover, outsourcing to CDMOs enables them to access specialized expertise and state-of-the-art facilities, resulting in improved efficiency and reduced costs. For instance, in March 2024, FUJIFILM Diosynth Biotechnologies expanded its manufacturing agreement with Argenx to offer drug products for the treatment of severe autoimmune diseases. Such factors are anticipated to drive the market growth.

Regional Insights

North America dominated the sterile injectables CDMO market with the largest revenue share of 40.64% in 2024. This can be attributed to the establishment of contract manufacturing facilities, the increase in chronic diseases, and the advancement of biology. The growth of the contract manufacturing market is significantly driven by the growing focus on biologics and biosimilars, which often necessitate sterile injectable formulations. For instance, according to the data published by NCBI in February 2024, the U.S. FDA approved around 55 new drugs in 2023, of which 17 were biologics. This signifies a significant advancement in the field of oncology and highlights the growing focus on developing targeted therapies for cancer patients. In addition, Strategic initiatives undertaken by market participants, such as expanding manufacturing facilities, forming collaborations, establishing partnerships, and engaging in acquisitions, are anticipated to drive the market’s growth throughout the projected period. For instance, in October 2023, Sharp Corporation acquired Berkshire Sterile Manufacturing (BSM). This acquisition expands Sharp’s capabilities in providing clinical and commercial sterile injectable products to its clients, hence, contributing to the overall market growth.

U.S. Sterile Injectables CDMO Market Trends

The sterile injectables CDMO market in the U.S. accounted for the largest revenue share in North America in 2024. Several biopharmaceutical companies outsource their complex development and manufacturing services to CDMOs. Moreover, stringent regulatory policies are anticipated to promote domestic CDMO services. Moreover, growing R&D investments by biopharmaceutical companies are anticipated to drive the demand for sterile injectable CDMOs in the region.

Europe Sterile Injectables CDMO Market Trends

The sterile injectables CDMO market in Europe is expected to grow at a significant CAGR during the forecast period, due to growing development and manufacturing facilities for sterile injectable drugs in the region Moreover, strong presence of biopharmaceutical companies in the region and high adoption of advanced therapeutics to treat several chronic ailments in the region are few factors propelling regional market revenue growth.

The Germany sterile injectables CDMO market accounted for the largest revenue share in Europe in 2024. In October 2023, Vetter Pharma invested around USD 249 million to expand commercial filling lines, aseptic manufacturing facilities, cold storage & warehouse facilities, and analytical testing laboratories at its Ravensburg plant in Germany. This increased investment is aimed at enhancing aseptic manufacturing capacity, which is crucial for sterile injectable products. By expanding their production capabilities,Vetter Pharma will be better equipped to cater to the increasing demand for sterile injectables from their global customer base. The strategic location of this new facility in Germany is anticipated to further strengthen the country’s position in the CDMO market for sterile injectables.

The sterile injectables CDMO market in UK is anticipated to grow at a significant CAGR over the forecast period. The grant received by Kindeva to expand its sterile injectables capabilities in Germany is expected to have a significant impact on the market in the country. In August 2023, Kindeva Drug Delivery, a global leader in pharmaceutical contract development and manufacturing organization (CDMO), received a grant from the German Federal Ministry for Economic Affairs and Energy. This grant is aimed at supporting Kindeva’s investment in expanding its sterile injectables capabilities at its site in Horselberg-Hainich, Germany. The investment will focus on enhancing Kindeva’s manufacturing capacity for sterile injectable products, including vials and pre-filled syringes.

Asia Pacific Sterile Injectables CDMO Market Trends

The sterile injectables CDMO market in Asia Pacific is anticipated to grow at the fastest CAGR of 10.91% during the forecast period. This is due to cost affordable services in Asian countries and supportive regulatory reforms, especially in India and China. FDA and EMA-approved R&D and manufacturing facilities in the region are also anticipated to surge foreign investments. For instance, around 92 healthcare contract service organizations are headquartered in Jiangsu, China, with over 72% of the facilities having FDA and EMA approval. Thus, the high number of FDA and EMA-approved facilities boosts the overall market growth.

The Japan sterile injectables CDMO market accounted for the largest revenue share in Asia Pacific in 2024. The market is driven by due to rising demand for new and cost-effective medicines, which may attract investments from biopharmaceutical companies in this region. For instance, in January 2022, Adragos, a pharmaceutical company, made a significant investment in the Japanese Kawagoe plant. This move aims to expand its operations and capabilities in producing sterile injectables. The investment signifies Adragos’ commitment to enhancing its presence in the pharmaceutical market, particularly in the field of Contract Development and Manufacturing Organization (CDMO) services for sterile injectables.

The sterile injectables CDMO market in China is expected to grow at the fastest CAGR over the forecast period, due to attractive destination for outsourcing activities due to its large population, diverse patient demographics, and cost-effectiveness. As a result, domestic and international pharmaceutical companies outsource their sterile testing manufacturing to CDMOs. In July 2023, WuXi STA, a leading CDMO in China, recently launched a new injectable manufacturing line. This development marks a significant advancement in the company’s capabilities to produce sterile injectable drugs. The launch of this injectable manufacturing line by WuXi STA is crucial for several reasons. Firstly, it enhances the company’s ability to cater to the growing demand for sterile injectables in the pharmaceutical industry. Sterile injectables are a vital component of modern healthcare, used for delivering critical medications directly into the bloodstream.

Latin America Sterile Injectables CDMO Market Trends

The sterile injectables CDMO market in Latin America is anticipated to grow at a substantial CAGR over the forecast period. The increasing M&A activity in the pharmaceutical industry and favorable environment for sterile injectables CDMOs to secure new contracts and expand their market presence in Latin America are driving market growth in the country. In addition, rising initiatives by regulatory bodies in countries including Brazil and Argentina have been implementing stringent regulations to ensure the quality and safety of pharmaceutical products.

The Brazil sterile injectables CDMO market is anticipated to grow at a significant CAGR over the forecast period, due to the increasing demand for healthcare services. In addition, increased spending has led to a greater demand for pharmaceutical products, including sterile injectables, which are used to treat a wide range of conditions, from cancer to autoimmune disorders. With the rise of various chronic diseases, there is a heightened need for specialized injectable medications that require complex manufacturing processes. Furthermore, the presence of several GMP-certified plants and lower manufacturing costs are attracting investors to establish their operations in this country. This shift enhances patient access to critical therapies and positions Brazil as a competitive player in the sterile injectables CDMO landscape.

MEA Sterile Injectables CDMO Market Trends

The sterile injectables CDMO market in MEA is expected to grow at a substantial CAGR over the forecast period. The regulatory environment in the MEA is evolving, with stricter regulations being implemented to ensure the quality and safety of pharmaceutical products. This has pushed pharmaceutical companies to outsource their manufacturing processes to specialized CDMOs that adhere to these stringent regulations. In addition, the cost-effectiveness of outsourcing production to CDMOs rather than investing in building their own manufacturing facilities is another driving factor for pharmaceutical companies in the region. Moreover, advancements in technology and expertise offered by CDMOs play a crucial role in driving the market growth, as companies seek access to state-of-the-art facilities and specialized knowledge for efficient production processes.

The South Africa sterile injectables CDMO market is anticipated to grow at the fastest CAGR over the forecast period, owing to increasing partnerships between international pharmaceutical companies and local CDMOs in South Africa. These partnerships are fostering innovation, technology transfer, and knowledge exchange, further boosting the market growth in the country.

Key Sterile Injectables CDMO Company Insights

The key market participants operating across the market focus on adopting several in-organic strategic initiatives such as mergers, partnerships, collaborations, acquisitions, etc. The key companies are implementing several strategies such as mergers & acquisitions/joint ventures, service launches, partnerships & agreements, mergers, expansions, and others to increase market presence & revenue and gain a competitive edge in driving market growth. Hence, increasing adoption of in-organic strategic initiatives is highly anticipated to boost the market share of prominent players.

For instance, in January 2024, Bora Pharmaceuticals acquired Emergent BioSolutions’ sterile manufacturing facility in Baltimore-Camden, Maryland. The acquisition, priced at approximately USD 30 million, includes the transfer of assets, equipment, and around 350 Emergent employees. This move is part of Emergent’s strategy to optimize its manufacturing network and focus on facilities in Lansing, Michigan, and Winnipeg, Canada.

Key Sterile Injectables CDMO Companies:

The following are the leading companies in the sterile injectables CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Baxter (Simtra BioPharma Solutions)

- Vetter Pharma International GmbH

- Recipharm AB

- Aenova Group

- Fresenius Kabi Contract Manufacturing (Fresenius Kabi AG)

- Unither Pharmaceuticals

- FAMAR Health Care Services

- Ajinomoto Bio-Pharma

- PCI Pharma Services

- IDT Biologika GmbH

- Alcami Corporation

- Fareva Group

- Eurofins Scientific

- Siegfried AG

- Torbay Pharmaceuticals

- Pfizer CentreOne (Pfizer Inc)

Recent Developments

-

In June 2024, PCI Pharma Services company announced the expansion of its packaging operations in Ireland. It invested in a new facility in Dublin, which would focus on secondary packaging, labeling, and serialization services. The expansion is part of PCI's ongoing commitment to providing comprehensive pharmaceutical packaging solutions to its clients across Europe.

-

In February 2024, Novo Holdings, under the Novo Nordisk Foundation, acquired Catalent for USD 16.5 billion. This acquisition is part of Novo Holdings’ strategy to utilize its Wegovy cash and expand its manufacturing capabilities. The deal includes Novo Nordisk acquiring three of Catalent’s fill-finish sites from Novo Holdings for USD 11 billion upfront. These sites specialize in sterile drug filling and are expected to enhance Novo Nordisk’s manufacturing network for current and future treatments for diabetes and obesity. The acquisition is set to increase Novo Nordisk’s filling capacity starting in 2026 gradually.

-

In December 2023, Cipla filed a patent for a stable, ready-to-use, extended-release injectable formulation of aripiprazole aimed at treating schizophrenia and related disorders. The patent outlined a formulation that maintains stability over 6 months in sealed, sterile conditions, with total impurities not exceeding 1.0% when stored at 25°C and 60% relative humidity.

Sterile Injectables CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.61 billion

Revenue forecast in 2030

USD 7.29 billion

Growth rate

CAGR of 9.61% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule type, product, service, therapeutic area, route of administration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Vietnam; Indonesia; Malaysia; Philippines; Singapore; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boehringer Ingelheim International GmbH; Baxter (Simtra BioPharma Solutions); Vetter Pharma International GmbH; Recipharm AB; Aenova Group; Fresenius Kabi Contract Manufacturing (Fresenius Kabi AG); Unither Pharmaceuticals; FAMAR Health Care Services; Ajinomoto Bio-Pharma; PCI Pharma Services; IDT Biologika GmbH; Alcami Corporation; Fareva Group; Eurofins Scientific; Siegfried AG; Torbay Pharmaceuticals; Pfizer CentreOne (Pfizer Inc) among others

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sterile Injectables CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sterile injectables CDMO market report based on molecule type, product, service, therapeutic area, route of administration, end-use, and region.

-

Molecule Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecule

-

Large Molecule

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-filled Syringes

-

Vials and Ampoules

-

Specialty Injectables

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Formulation Development

-

Analytical and Testing Services

-

Method Development and Validation

-

Stability Testing

-

Drug Substance

-

Stability Indicating Method Validation

-

Accelerated Stability Testing

-

Photostability Testing

-

Other Stability Testing Methods

-

-

Extractable & Leachable Testing

-

Others

-

-

Manufacturing

-

Clinical Trial Manufacturing

-

Commercial Manufacturing

-

Aseptic Fill-Finish Services

-

-

Packaging

-

Storage

-

Cold

-

Non-cold

-

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Diseases

-

Central Nervous System Diseases

-

Infectious Disorders

-

Musculoskeletal Diseases

-

Hormonal Diseases

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Subcutaneous (SC)

-

Intravenous (IV)

-

Intramuscular (IM)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Vietnam

-

Indonesia

-

Malaysia

-

Philippines

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sterile injectables CDMO market size was estimated at USD 4.25 billion in 2024 and is expected to reach USD 4.61 billion in 2025.

b. The global sterile injectables CDMO outsourcing market is expected to grow at a compound annual growth rate of 9.61% from 2025 to 2030 to reach USD 7.29 billion by 2030.

b. North America dominated the sterile injectables CDMO market with a share of 40.64% in 2024. This is attributable to growing product demand for sterile injectables, stringent regulatory framework, upsurge in clinical trials of high-potent drugs, advanced healthcare infrastructure, strong presence of biopharmaceutical organizations, and availability of skilled professionals, among other factors.

b. Some key players operating in the sterile injectables CDMO market include Ingelheim GmbH, Baxter BioPharma Solutions, Vetter Pharma, Recipharm AB; Aenova Group; Fresenius Kabi; Famar, NextPharma Technologies, Ajinomoto Bio-Pharma Services, PCI Pharma Services; IDT Biologika; Alcami Corporation; Fareva Group; Eurofins CDMO; Siegfried Holding AG.

b. Key factors that are driving the market growth include a growing focus on development of innovative therapeutics, and preference for personalized medicine, changing regulatory scenario, increasing outsourcing trends, adoption of one-stop-shop CDMOs, and growing R&D spending among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.