- Home

- »

- Market Trend Reports

- »

-

Top 20 Multiple Sclerosis Drugs Market Analysis and Segment Forecasts To 2030

Report Overview

The global multiple sclerosis drugs market is expanding, driven by rising disease prevalence and sustained pharmaceutical innovation in disease-modifying therapies (DMTs). In 2024, the top 20 MS drugs generated USD 20.30 billion in sales, with the market projected to grow at a CAGR of 10.06% from 2025 to 2030. Key therapeutic classes include S1P receptor modulators, interferon betas, anti-CD20 monoclonal antibodies, fumarates, and selective adhesion molecule inhibitors. Pharma companies are advancing high-efficacy, targeted treatments aimed at reducing relapse rates, slowing progression, and improving long-term adherence across relapsing and progressive MS forms.

According to the World Health Organization (WHO, 2023), multiple sclerosis (MS) is a chronic autoimmune disorder in which the immune system attacks the brain and spinal cord, causing neurological symptoms such as vision problems, fatigue, and motor impairment. Over 1.8 million people globally are affected, with higher prevalence among young adults and females. MS can manifest in various forms, including relapsing-remitting, primary progressive, and secondary progressive types. Though incurable, early use of disease-modifying therapies (DMTs) can slow progression and improve quality of life. Access to treatment remains limited in low- and middle-income countries.

The demand for Ocrevus, one of the leading treatments in the MS market, is a key driver of market growth. Ocrevus has shown substantial effectiveness in managing both relapsing-remitting multiple sclerosis (RRMS) and primary progressive multiple sclerosis (PPMS). With its strong clinical efficacy, Ocrevus has become a preferred option for many patients, contributing to its strong sales performance. Its widespread adoption across major markets, especially in the United States, Europe, and international regions like Brazil, is significantly expanding the MS treatment landscape.

Another critical factor driving the growth of the MS therapeutic market is the ongoing advancements in disease-modifying therapies (DMTs). These treatments aim to slow the progression of MS and prevent relapses, improving patient outcomes and quality of life. As research continues, new therapies are emerging, offering more options for individualized treatment. These advancements are expected to fuel market growth, particularly as more patients gain access to innovative and personalized care. Additionally, the rising focus on early diagnosis and treatment is helping to improve patient management, driving demand for DMTs in regions with improved healthcare infrastructure. However, challenges persist in ensuring equitable access to these therapies in low- and middle-income countries, where access to MS treatments remains limited.

Roche’s Ocrevus Drives Growth in the Multiple Sclerosis Therapeutic Market

The Multiple Sclerosis (MS) Therapeutic Market saw significant growth in 2023, driven by strong demand for Ocrevus from Roche, which recorded global sales of USD 7.1 billion (CHF 6.38 billion), a 13% increase from 2022. The drug's success was fueled by a solid performance in the United States, where sales rose 11% to USD 5.1 billion (CHF 4.68 billion). The drug also saw strong sales growth in Europe and international markets, with increases of 12% and 31%, respectively.

The broader neuroscience therapeutic area grew by 16%, largely attributed to Ocrevus. It remains a leading treatment for both relapsing forms of multiple sclerosis (RMS) and primary progressive multiple sclerosis (PPMS), particularly in markets like Germany, Italy, and Brazil. In 2023, Roche's pharmaceutical division reported total sales of USD 48.1 billion (CHF 44.6 billion), with a 6% increase at constant exchange rates (CER). This growth was driven by Ocrevus, despite declines in sales from Ronapreve (USD 1.2 billion decrease) and Esbriet (70% decline due to generic competition).

The increase in net working capital by 6% reflects the higher demand for MS treatments. Trade receivables rose by 3% due to extended payment terms for Ocrevus in the United States, while trade payables decreased by 4% due to payments for a new R&D facility in Yokohama, Japan. Looking ahead, continued growth in the MS therapeutic market is expected, driven by sustained demand for Ocrevus and increased access to treatment in international markets.

Top 20 Multiple Sclerosis Drugs: Comparative Market Outlook Through 2030

The multiple sclerosis therapeutics landscape is led by a concentrated group of high-revenue drugs with established market presence and broad indications, especially in relapsing forms of MS and primary progressive MS (PPMS). The following table provides a comparative snapshot of the top-selling MS therapies, highlighting their current and projected revenues, year of first approval, approved indications, and annual treatment costs. This analysis underscores how biologics and oral disease-modifying therapies (DMTs) continue to drive growth. At the same time, competition from next-generation agents and emerging biosimilars is expected to reshape the competitive dynamics through 2030.

Top 20 Multiple Sclerosis Drugs Market, 2024 (USD Million)

Drug Name (Generic Name)

Company

2024 Revenue (USD Billion)

2030 Revenue (USD Billion)

Date of First Regulatory Approval

Approved Indications

Approximate Annual Cost (USD)

Generics/Biosimilars Available

OCREVUS

Roche

7.60

14.09

28-March-17 (U.S. FDA)

Multiple Sclerosis (MS) And Primary Progressive Multiple Sclerosis (PPMS)

~$150,000

No

TECFIDERA

*Similar analysis would be provided for the key 20 drugs

VUMERITY

AVONEX

PLEGRIDY

TYSABRI

FAMPYRA

KESIMPTA

GILENYA

COPAXONE

AUBAGIO

MAVENCLAD

Rebif

AMPYRA

BETASERON

ZEPOSIA

MAYZENT

Lemtrada

Acthar Gel

RAYOS

Pipeline & Innovation Spotlight

The multiple sclerosis (MS) therapeutics market continues to witness robust R&D activity, with numerous Phase 3 clinical trials underway targeting both relapsing and progressive forms of MS. Key players, including Novartis, Roche, Sanofi, Celgene, and Immunic AG, are advancing innovative candidates across diverse mechanisms of action such as S1P receptor modulators, anti-CD20 monoclonal antibodies, and novel immunomodulators. The pipeline reflects a strong industry focus on improving efficacy, safety, and patient adherence. Below is a summary of key late-stage clinical trials currently shaping the MS drug development landscape, highlighting primary interventions and drug classes involved.

Table: Selected Promising Pipeline Therapies in Multiple Sclerosis

NCT Number

Intervention

Drug Class

Company

Phases

NCT04926818

Fingolimod

S1P receptor modulator

Novartis Pharmaceuticals

PHASE3

NCT06675955

Ocrelizumab

Anti-CD20 monoclonal antibody

Hoffmann-La Roche

PHASE3

NCT04140305

RPC-1063

S1P receptor modulator

Celgene

PHASE3

NCT06141486

Frexalimab

Anti-CD40L monoclonal antibody

Sanofi

PHASE3

NCT06141473

Frexalimab

Anti-CD40L monoclonal antibody

Sanofi

PHASE3

NCT05134441

IMU-838

DHODH inhibitor

Immunic AG

PHASE3

NCT03599245

Ocrelizumab

Anti-CD20 monoclonal antibody

Hoffmann-La Roche

PHASE3

NCT04544436

Ocrelizumab

Anti-CD20 monoclonal antibody

Hoffmann-La Roche

PHASE3

Product Insights

Ocrevus (ocrelizumab), developed by Roche, dominates the multiple sclerosis market, holding the largest market share of 38.04% due to its dual indication in both relapsing forms of MS (RMS) and primary progressive MS (PPMS)-a unique positioning not shared by most competitors. As a humanized anti-CD20 monoclonal antibody, it offers strong efficacy in reducing relapse rates and slowing disability progression. Its biannual intravenous dosing enhances adherence compared to more frequent oral or injectable alternatives. Backed by robust clinical data and widespread physician acceptance, Ocrevus has achieved blockbuster status, generating over USD 7.5 billion in annual revenue. Its exclusivity through at least the late 2020s further secures market leadership.

Moreover, Kesimpta, a fully human anti-CD20 monoclonal antibody developed by Novartis, is gaining traction in the relapsing multiple sclerosis (RMS) market. Unlike Ocrevus, which requires intravenous administration, Kesimpta offers a patient-friendly, once-monthly subcutaneous self-injection, improving convenience and compliance. Approved in 2020, Kesimpta has demonstrated competitive efficacy in reducing relapses and MRI lesions, while maintaining a favorable safety profile. Novartis is leveraging strong commercial outreach and real-world evidence to expand its share in the MS space. Positioned as a first-line option for RMS, Kesimpta is expected to see continued revenue growth, potentially crossing USD 11 billion annually by the end of the decade.

In addition, Zeposia, a sphingosine-1-phosphate (S1P) receptor modulator by BMS, represents a second-generation oral therapy for relapsing multiple sclerosis (RMS). With a favorable cardiac safety profile and no genetic testing requirement, Zeposia addresses several limitations of first-generation S1P modulators like Gilenya. Approved in 2020, it offers once-daily oral dosing, contributing to strong patient adherence. BMS has been expanding Zeposia’s market presence through label extensions, including for ulcerative colitis, boosting its commercial prospects. However, it entered a competitive space, Zeposia’s safety, tolerability, and oral delivery position it well to capture greater market share, with projected revenues surpassing USD 2 billion by 2030.

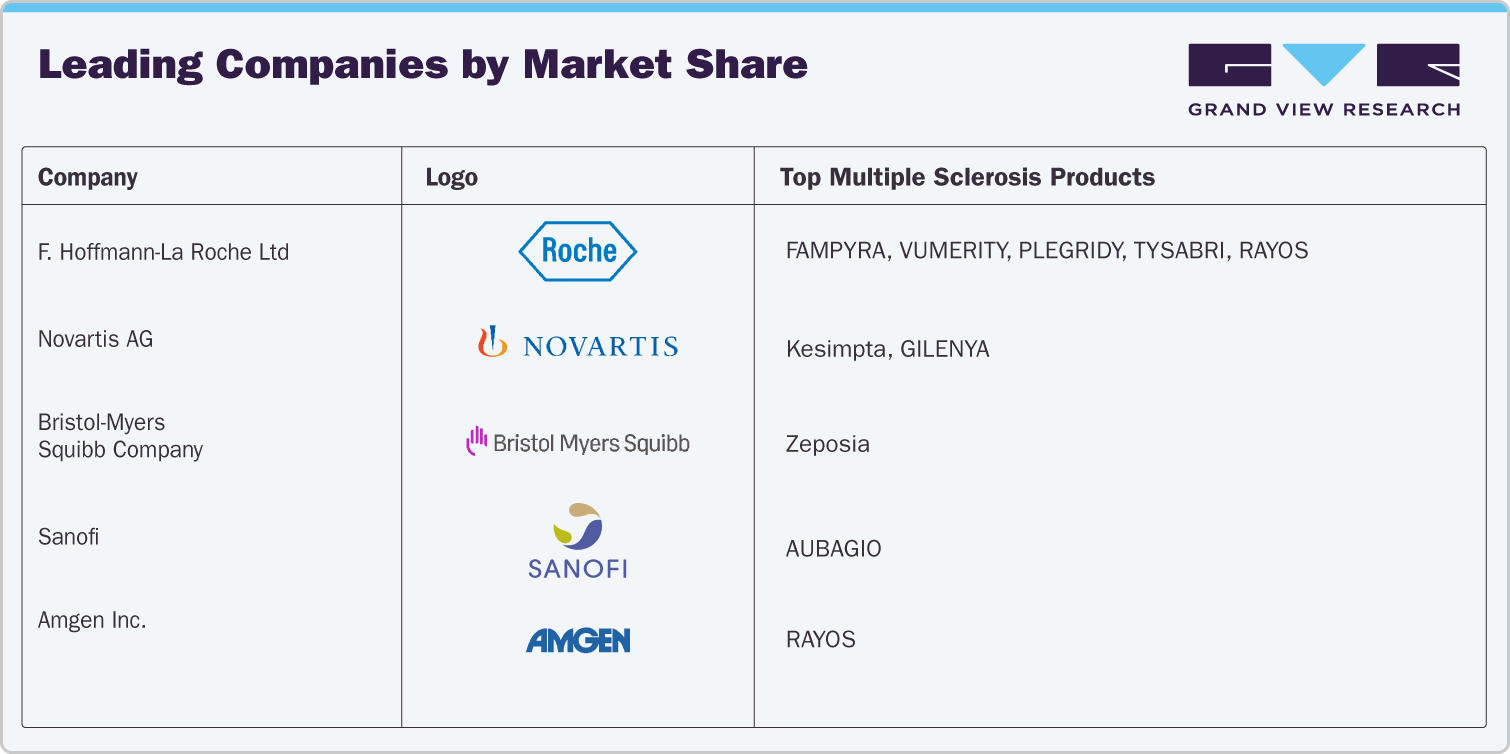

Key Companies & Market Share Insights

The multiple sclerosis (MS) drugs market is led by a group of multinational pharmaceutical companies with approved therapies including monoclonal antibodies, oral immunomodulators, and injectable interferons. Key drugs such as OCREVUS (Roche), TYSABRI, GILENYA (Novartis), TECFIDERA, and MAVENCLAD (Merck KGaA) are among the top-selling treatments globally. Companies maintain their positions through regulatory approvals, real-world evidence generation, and global distribution networks.

Market Share Insights

-

F. Hoffmann-La Roche Ltd continues to lead the global multiple sclerosis therapeutics market, driven by the performance of OCREVUS and the support portfolio of FAMPYRA, VUMERITY, and PLEGRIDY.

-

Merck & Co. and Bristol-Myers Squibb are actively expanding their presence in the MS segment through immunomodulatory and immunosuppressive therapies, including MAVENCLAD.

-

Amgen maintains targeted involvement in the MS therapeutics landscape, with niche adoption of select biologics and supportive care therapies.

Key Top 20 Multiple Sclerosis Drugs Market Companies:

The following are the leading companies in the top 20 multiple sclerosis drugs market market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Merck KGaA

- Bristol-Myers Squibb Company

- Sanofi

- Biogen

- Amgen Inc.

- Teva Pharmaceutical Industries Ltd.

- Merz Therapeutics

- Bayer AG

- Mallinckrodt Pharmaceuticals

Recent Developments

-

In September 2024, The U.S. FDA approved Genentech’s Ocrevus Zunovo (ocrelizumab & hyaluronidase-ocsq), a twice-yearly, 10-minute subcutaneous injection for relapsing and primary progressive multiple sclerosis. Based on OCARINA II trial results, it offers comparable efficacy to IV Ocrevus, providing a new treatment option for centers without infusion infrastructure and improving flexibility for patient care.

-

In February 2024, Roche Pharma India announced the launch of Ocrevus for the treatment of MS. It is expected to cater to the requirements of patients suffering from MS in India. Ocrevus is one of its leading products and is available in more than 100 countries, and India, where it is approved for primary progressive & relapsing forms of MS.

-

In February 2024, TG Therapeutics announced the European launch of BRIUMVI (ublituximab-xiiy) for relapsing multiple sclerosis, starting in Germany through partner Neuraxpharm. TG received a USD 12.5M milestone payment. BRIUMVI, an anti-CD20 monoclonal antibody, is approved in the US, EU, and UK for RMS with active disease. The drug is glycoengineered for efficient B-cell depletion and requires infusion-related precautions.

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global top 20 multiple sclerosis drugs market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

OCREVUS

-

TECFIDERA

-

VUMERITY

-

AVONEX

-

PLEGRIDY

-

TYSABRI

-

FAMPYRA

-

KESIMPTA

-

GILENYA

-

COPAXONE

-

AUBAGIO

-

MAVENCLAD

-

Rebif

-

AMPYRA

-

BETASERON

-

ZEPOSIA

-

MAYZENT

-

Lemtrada

-

Acthar Gel

-

RAYOS

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified