- Home

- »

- Reports

- »

-

Blow Molding Plastic Packaging Procurement Intelligence Report, 2030

![Blow Molding Plastic Packaging Procurement Intelligence Report, 2030]()

Blow Molding Plastic Packaging Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10518

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Blow Molding Plastic Packaging Category Overview

“The blow molding plastic packaging category’s growth is driven by the increase in adoption of the automation and innovative technology in food, beverage, pharmaceutical, and personal care.”

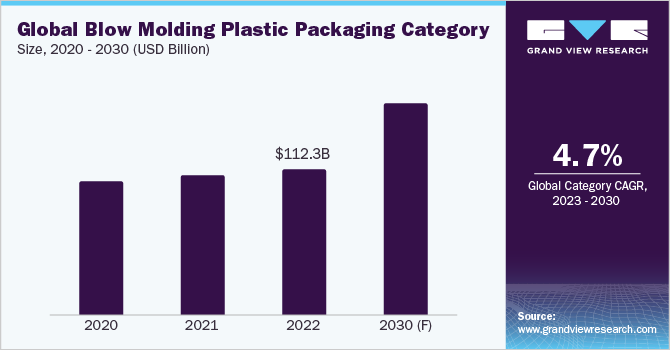

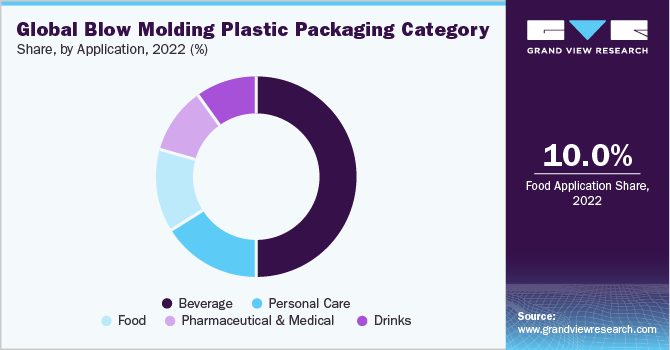

The blow molding plastic packaging category is expected to grow at a CAGR of 4.7% from 2023 to 2030. Factors such as high impact strength, custom manufacturing, and increased demand in varied industries such as construction, automobiles, and food & beverages are fueling the category growth. Beverage industries are heavily investing in this category which accounts for 40% - 50% of the market share. Technological innovation and R&D to develop sustainable materials for producing category materials is another factor driving the growth.

The global blow molding plastic packaging category size was estimated at USD 112.26 billion in 2022. One of the key trends is the increasing technological innovation and R&D in the category to develop more sustainable and eco-friendly products. It has resulted in the developing reduced weight of plastic containers which are weighing 8 to 12 grams lesser and contains 25% less plastic than before. This helps in reducing logistics costs, raw material costs, and carbon footprint.

After the outbreak of the COVID-19 pandemic, health and safety concerns drastically increased the usage of packed foods and beverages, which has increased manufacturing of various types of sizes and packaging of food packing materials to cater to the changing needs of the food & beverages industry. Food and beverages constitute 50% of the whole plastic packaging category.

Liquiform is an innovative technology that is rapidly emerging in the category. Through its cutting-edge technology, it uses consumable and pressurized liquid, alternating with compressed air to develop plastic containers. This process involves combining bottle forming and the filling process in one step which eliminates numerous steps involved in manufacturing, resulting in reduced cost and the wastage involved. The technology has been validated with a wide range of packaging substrates, and varied conditions for ambient, cold, and hot filled PET containers.

Within this category, companies are using Artificial Intelligence (AI), IoT, and big data as it helps automate repetitive tasks and also enables them to collect and analyze data that can be analyzed and shared in real time to improve efficiency and productivity by reducing errors. For instance, in 2022, Bekum Maschinenfabrik GmbH announced that it was using AI to automate the loading and unloading of molds.

In addition, the rising concerns toward cost-efficient and sustainable eco-friendly products are expected to aid blow molding plastic packaging category expansion.

Supplier Intelligence

“How is the nature of the blow molding plastic packaging category? What are the initiatives taken by the suppliers in this category?”

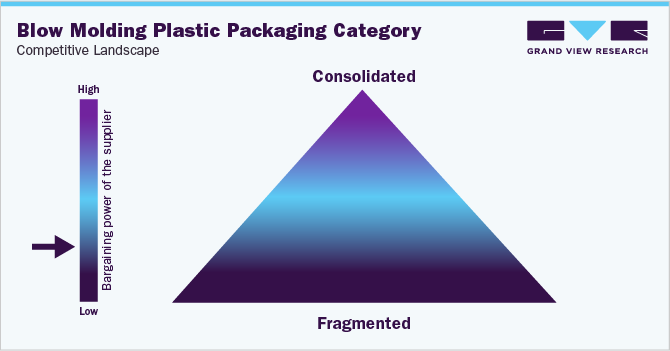

The global blow molding plastic packaging category is fragmented with the presence of several players in the market. Major players are collaborating with various organizations to develop materials or technologies such as 3D printing, and the use of biomaterials to provide innovative and sustainable packaging materials. For instance, in October 2021, Coca-Cola, UPM, and Changchun Meihe came forward to develop and commercialize the next-gen biomaterials to efficiently convert second-gen biomass to plant-based monoethylene glycol. This has helped them in reducing bio-waste, which is then converted to monoethylene glycol, a raw material for manufacturing packaging materials. For an eco-friendly sustainability drive, Coca-Cola and UPM, through their partnership, have developed a renewable solution to drive a shift from crude oil-based materials. UPM is the leader in the bio-based forest industry and has the vision to create solutions and technologies to develop sustainable raw materials used in the category.

The competition is intense between players as many large and small players offer a range of services. The suppliers of this category provide raw materials, designing and manufacturing, and collaborative technological solutions. Due to the increasingly growing large number of companies who require these materials/services, the suppliers of these materials/suppliers have high bargaining power which has reduced the marginal gap of the category. Large players must accumulate local players or sources from LCC countries to sustain profitability in the market.

Key suppliers covered in the category:

-

Niagara Bottling Llc

-

Petainer UK Holdings Ltd.

-

Nampak Plastics Europe Limited

-

Plastipak Packaging Inc.

-

Esterform Packaging

-

Plastic Technologies Inc.

-

Toyo Seikan Kaisha Ltd.

-

Graham Packaging Company Inc.

-

Logoplaste

-

Greiner Packaging International

-

Sailor Plastics

-

Artenius Pet Packaging Europe (Appe)

-

Amcor Rigid Plastics

-

Constar Plastics B.V

Pricing and Cost Intelligence

“What are some of the major cost components involved in blow molding plastic packaging? Which factors impact the cost of blow molding plastic packaging?”

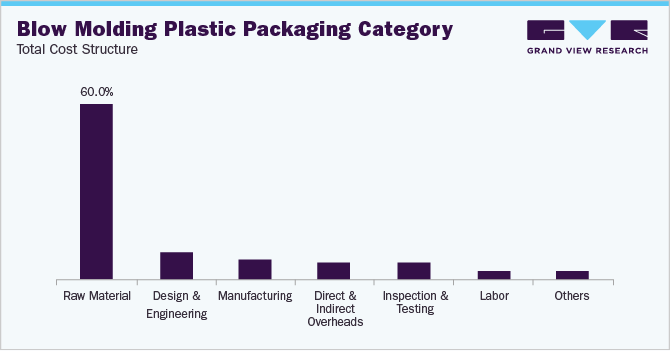

Raw material, design & engineering, and manufacturing form the major cost components when it comes to producing blow molding plastic packaging. There are a number of factors that can affect the cost of the category, including the type of plastic used, the size and complexity of the product being developed, and the volume of production. Businesses should carefully consider all these factors when producing packaging materials to ensure that they are competitive and profitable.

The following chart below provides various costs incurred during the production of the category. The major cost heads are shown below.

The cost of producing blow molding plastic packaging can be influenced by various factors. Firstly, the type of plastic used such as Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), and Polyvinyl Chloride (PVC) significantly affect the cost part. It constitutes about 50% - 60% of the total cost involved during production. Additionally, the type of production method creates an impact on product output varying from the size, nature, and complexity of the product. More complex product requires more powerful production method such as the injection molding technique which costs 50% - 60% more than the traditional molding technique, which in turn leads to higher upfront expenses. Furthermore, along with the complexity, the tonnage pressure, which helps in keeping the mold intact, constitutes around USD 3000 to 6000 for a single cavity and up to USD 90,000 depending upon the capacity of production.

Other costs include tooling, shipping, and overheads. Shipping costs will depend on the distance that the parts have to be shipped. Overhead costs include things like rent, utilities, and insurance. The total cost will vary depending on the specific factors involved, but a general estimate is that the cost of blow molding a plastic part will be between USD 0.50 and USD 5.00 per part.

The price depends on the type of blow molding used for packaging such as extrusion, injection, and injection stretch blow mold. Packaging done through extrusion type has comparatively low pricing than the one done through injection molding. Equipped technology has a higher impact on the pricing such as the use of 3D printing, miniaturization, light-weighting, and automation used during the packaging of the products.

The Blow Molding Plastic Packaging Procurement Intelligence report provides a detailed analysis of the cost structure of blow molding plastic packaging and the pricing models adopted by prominent suppliers in this category.

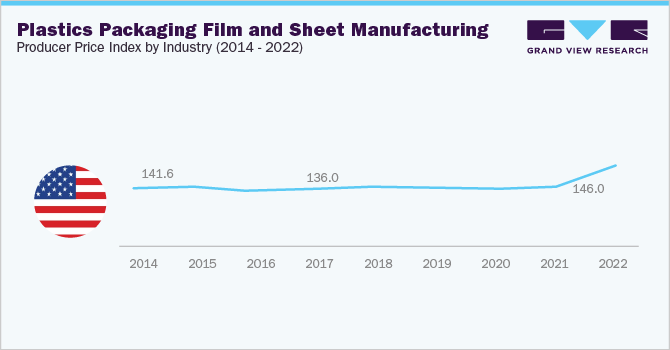

Raw materials constitute the majority cost part for the production with around 50-60% of the total production. With the wide availability of raw materials, suppliers have high bargaining power which in return decreases the profitability margin of the small players. The rise in the requirement for packaging substrate in various industries mainly due to health and safety concerns post-COVID-19 has caused a higher impact and rise in the PPI of the category to grow to 175 in 2022 from 141 in 2014.

Sourcing Intelligence

“Which countries are the leading sourcing destinations for blow molding plastic packaging production?”

Asia Pacific is the major region involved in the production of blow molding plastic packaging due to the availability of various raw materials, the latest technology, and cheap labor. China is considered to be the country with the largest production of HDPE, which is one of the major raw materials In this category. In 2023, China's production capacity of HDPE reached 4.16 million metric tons, the highest among all other countries after the US. In terms of blow molding packaging sourcing intelligence, the top six countries preferred for this category are China, Japan, the U.S., India, Brazil, and Germany.

In terms of engagement, suppliers of blow-molded plastic packaging adopt a hybrid model. Many industries are rushing to adopt the power that comes with cutting-edge technologies. Injection molding cost is one of the significant cost drivers determining the price of the product. China because of having low labor and production expenses than other countries, the majority of countries outsource their production to China due to its well-developed manufacturing infrastructure. Alongside, manufacturing in China provides players access to a global and expanded market.

In the hybrid outsourcing model, the suppliers outsource some parts of the overall operation to third parties. Generally, critical operations are carried out in-house by the client. Due to the certifications and complexity involved during production, many suppliers outsource critical operations to third-party vendors to have better productivity.

The Blow Molding Plastic Packaging Procurement Intelligence report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Blow Molding Plastic Packaging Procurement Intelligence Report Scope

Report Attribute

Details

Blow Molding Plastic Packaging Category Growth Rate

CAGR of 4.7% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

10% - 15% (Annually)

Pricing Models

Cost plus pricing model, volume-based pricing model

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

By type, operating capability, quality measures, technology, certifications, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Niagara Bottling Llc, Petainer UK Holdings Ltd., Nampak Plastics Europe Limited, Plastipak Packaging Inc., Esterform Packaging, Plastic Technologies Inc., Toyo Seikan Kaisha Ltd., Graham Packaging Company Inc., Logoplaste, Greiner Packaging International, Sailor Plastics, Artenius Pet Packaging Europe (Appe), Amcor Rigid Plastics, Constar Plastics B.V.

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 162.11 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global blow molding plastic packaging category size was valued at approximately USD 112.26 billion in 2022 and is estimated to witness a CAGR of 4.7% from 2023 to 2030.

b. The increasing technological advancement and rising demand by various industries are driving the growth of the category. Advancement in track and trace technology has also a major role in the growth of the category

b. According to the LCC/BCC sourcing analysis, China, Japan, the U.S., and India are the ideal destinations for sourcing the category items

b. This category is fragmented with the presence of many large players competing for market share. Some of the key players are Niagara Bottling Llc, Petainer UK Holdings Ltd., Nampak Plastics Europe Limited, Plastipak Packaging Inc., and Esterform Packaging.

b. Raw material, design & engineering, and manufacturing are the major key cost components of this category. Other key costs include inspection and testing, and direct and indirect overhead costs.

b. Acquiring or partnering with regional players to expand their distribution lines, sourcing from low-cost countries, and choosing suppliers that follow comprehensive standards and assurance policies, and quality certifications to support responsible sourcing of the category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified