- Home

- »

- Reports

- »

-

Corrugated Board Sourcing & Supplier Intelligence Report, 2030

![Corrugated Board Sourcing & Supplier Intelligence Report, 2030]()

Corrugated Board Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10521

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Corrugated Board Category Overview

“The corrugated board category’s growth is driven by the increase in demand from personal care, food and beverages, and the e-commerce industry.”

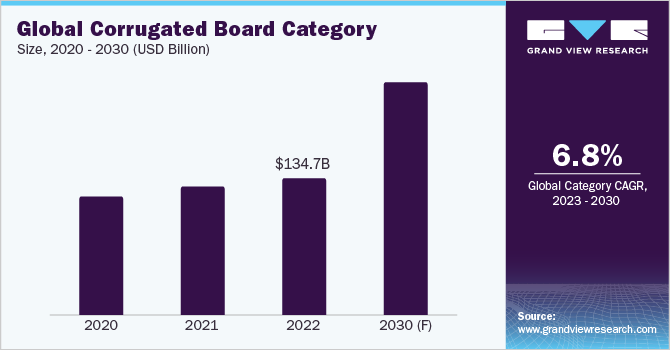

The corrugated boards category is expected to grow at a CAGR of 6.8% from 2023 to 2030. Factors such as growing demand for sustainable packaging, growing environmental concerns, increasing demand for food and beverage industries, and global expansion of the e-commerce market are fueling category growth. Corrugated boards are an appropriate replacement for plastic packaging. According to the United Nations data, around 300 million tons of plastic waste is generated globally every year which is close to the weight of the human population globally.

The global corrugated board category size was valued at USD 134.7 billion in 2022. One of the key trends is the growth of digitalization, automation, and sustainability in the category. For instance, in June 2022, Bobst, a Swiss-based company, launched a new suite of services and solutions aimed to assist brand owners and organizations with sustainability and digitization. The packaging and printing machinery has been promoting its 4 pillars of sustainability, digitization, automation, and connectivity. With the help of this, the company has been promoting its products to various organizations for mergers and collaborations.

The wide acceptance of corrugated boards as the Government of India calls for a ban on plastic-based packaging amid rising awareness for greener packaging solutions. FDIs and local investors are putting forward a lot of investments in Asian countries which are rapidly growing the market share.

Digitalization and technological advancements such as AI, blockchain technology, IoT, and digital printing are shaping the category with innovations. Ireland-based company, Smurfit Kappa is creating a variety of innovative products and introducing them to the market. One of their kind is the launch of multifunction printers that can do both digital printings as well as flexographic and also allows printing alongside the packaging material. This has resulted in increased sales and flexibility to alter as per client’s requirements.

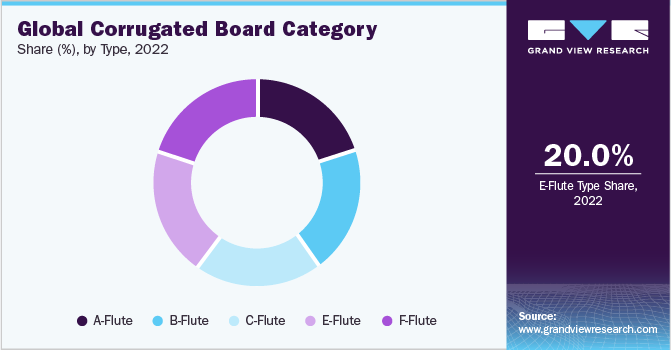

The flute has a major role in strengthening the corrugated board and is categorized as A, B, and C flute types. C-flute holds the largest market share among all other types. It offers great compression and stacking strength for the lightweighting of products. Acme Box Co. supplies such types for the packaging of pharmaceuticals, food products, and pet supplies. A type is prominently used for thicker packaging types for transit-related activities.

Supplier Intelligence

“How is the nature of the corrugated board category? What are the initiatives taken by the suppliers in this category?”

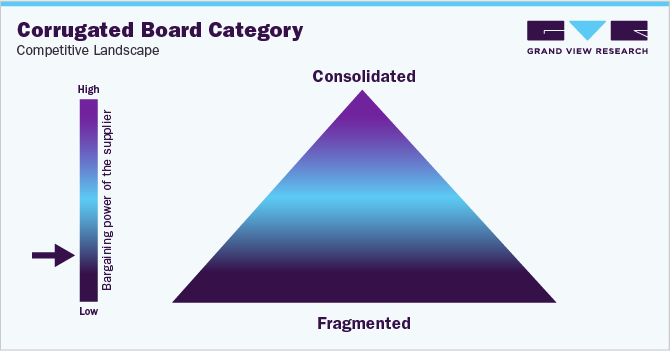

The global corrugated category is fragmented with the presence of several players in the market. Major industry players are investing a lot of money in R&D to expand their product offerings to drive category growth such as launching new products, acquiring companies, increasing investments, entering into contracts, and collaborating with other organizations to expand their global presence. To sustain and compete in the competitive climate, category participants have to develop strategies to remain profitable. One of the key business strategies used by the manufacturers in the category to benefit their clients and to expand their business portfolio is to manufacture locally to reduce operating costs. For instance, to expand its presence in the market, UFP Packaging, a division of UFP Industries, a holding company located in the United States, purchased Titan Corrugated and its subsidiary All Boxed Up.

In May 2022, to boost the manufacturing of the category, UK-based company Mondi announced an investment of USD 305.3 million. This will help increase the efficiency and expand the capacity in Poland, the Czech Republic, Turkey, and Germany.

Players are focusing on distinguishing their products to offer distinctive value propositions to secure a foothold in the market. Suppliers of this category are taking advantage of present growth prospects in rapidly growing categories while safeguarding their positions in sectors with slower growth. Startups are also making a significant difference with some of their endeavors, and it is anticipated that they will eventually establish a solid market presence in the future. In April 2022, a UK-based sustainable packaging provider, DS Smith launched an innovative corrugated board for making e-commerce shipments of medical devices. It features a single-material solution despite glued packaging with single-use plastic inert.

The competition is intense between players as many large and small players offer a range of services. The market is characterized by the existence of several well-known, century-old public enterprises. However, in a number of cases, manufacturing firms also compete with other businesses that make comparable goods that serve as corrugated board alternatives. By offering consumer value-added services, and distinctive solutions, the enterprises compete in the areas of services and linked machinery solutions. For instance, the WestRock Company provides automated packaging equipment that is tailored to the logistics and distribution challenges of the clients' products.

Key suppliers covered in the category:

-

DS Smith

-

Smurfit Kappa

-

WestRock Company

-

Mondi

-

Packaging Corporation of America

-

Stora Enso

-

International Paper

-

Georgia-Pacific

-

Oji Holdings Corporation

-

Port Townsend Paper Company

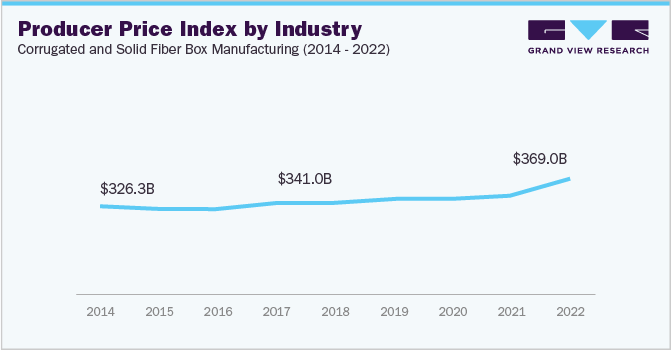

Pricing and Cost Intelligence

“What are some of the major cost components involved in a corrugated board? Which factors impact the prices?”

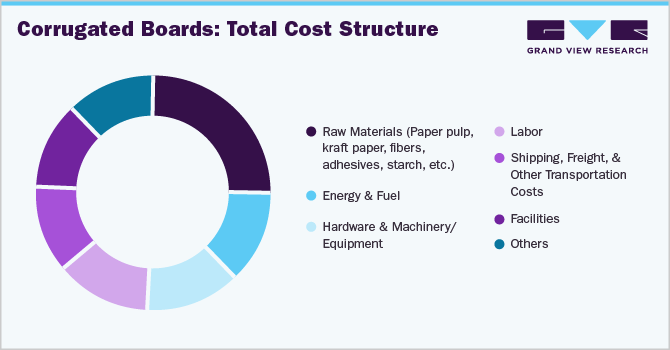

Kraft paper, corn starch used for making glue, and labor form the major cost components when it comes to producing corrugated boards. There are a number of factors that can affect the pricing of these raw materials, including import duties, logistics costs, waste paper prices, and fuel costs. Businesses should carefully consider all these factors when pricing their products to ensure that they are competitive and profitable.

Kraft paper which acts as a principal raw material for producing corrugated boards has doubled in the last 2 years to surge about 65% increase i.e., since 2020. Prices have gone up by almost 25% itself in the beginning months of 2022. The sudden rise in the prices is due to the ban on the export of waste cuttings from the European Union which generally outsourced cheaper raw materials. Amid the COVID-19 recovery, the import of materials has been affected the most due to a disrupted logistics & supply chain. These have compounded in an increase in the prices of waste papers, fuel and starch, and input costs. With the rise in cornstarch by about 35%, the conversion costs have jumped besides stitching wires and steel pins alongside ink prices.

The following pie chart provides various costs incurred in this category. The major cost heads are shown below:

Amid the COVID-19 pandemic, freight costs surged to reach USD 3,600 per 40 feet container, double the usual amount of USD 1,500 - USD 1,800. Owing to the price of waste paper, the cost of freight in exporting them is very high. Therefore, there is a sudden decline in imports of these materials since importing costs bears too high. Before covid-19, prices of wastepaper and cuttings were quoted to be below USD 100 per tonne, which after recovery have reached USD 400 a tonne. With the ban on the export of waste papers from many countries such as Europe, manufacturers have to look for different sources to gather material such as from Australia where freight costs were as high as USD 8000 per 40 feet container. Prices of coal, the main energy source for paper mills have surged nearly 190% globally. All these factors have allowed manufacturers to hike at least 25% of the prices of the category to run operations and remain profitable.

The Corrugated Board Procurement Intelligence report provides a detailed analysis of the cost structure of corrugated boards and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries are the leading sourcing destination for the category?”

China, Vietnam, and India are the major suppliers of corrugated boards globally having around 13,980 suppliers in China itself. It exports around USD 158 million of Kraft papers around to South Korea, Vietnam, Australia, and Malaysia. In China, the largest player in the corrugated board market is Asia Pulp and Paper, and UPM group. In 2022, the share of the APAC market rose to reach over 40% accounting for urbanization and increasing spending power in the country like India and China. In terms of corrugated board sourcing intelligence, the top five countries preferred are China, Vietnam, India, the U.S., and the UK.

The COVID-19 pandemic drastically affected logistics and supply chains. Europe's ban on the export of its cheapest source of raw material of corrugated board i.e., waste paper has also majorly affected the supply globally. The majority of countries have to source raw materials from different countries, making them pay on the higher side as compared to sourcing them from Europe. This has got them to increase the price of the category significantly to make up for the cost.

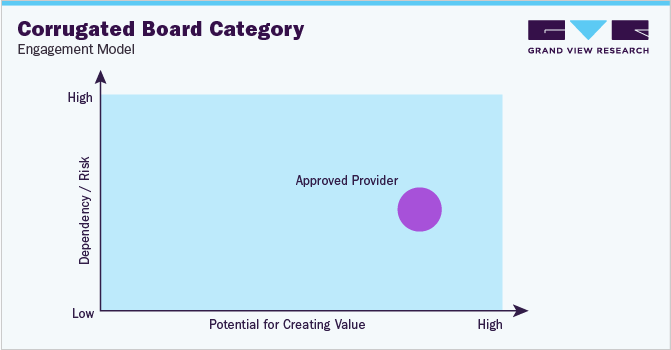

In terms of engagement, large-scale companies opt for either a partial or a full outsourcing model. Many industries are rushing to adopt the power that comes with cutting-edge technologies. Employing in-house technologies would be beneficial, however, companies are facing significant challenges such as talent shortages, infrastructure costs, and cost of running, all of which cause significant budgetary impact. Hence, to achieve more efficient production and to save costs, companies are outsourcing some operations to other third-party companies.

“In the approved provider model, the supplier meets the predefined set of qualifications, quality standards, and other criteria.”

An approved provider model is the most common form of the operating model due to its potential for higher value creation. In this model, the supplier of corrugated boards must meet the predefined set of qualifications, such as specific quality requirements, on-time delivery of raw materials, and various other criteria.

In the food and beverages industry, providers are readily distributing high-quality and hygienic boards to food companies for ready-to-eat meals, ready-to-make meals, and convenience meals. With the hygiene factor amid rising health concerns related to COVID-19, there is an increased demand for out-of-home food owing to the convenience factor and busy work schedule.

The Corrugated Board Procurement Intelligence report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Corrugated Board Procurement Intelligence Report Scope

Report Attribute

Details

Corrugated Board Category Growth Rate

CAGR of 6.8% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

20% - 25% (Annually)

Pricing Models

Cost plus pricing model, and market-based pricing model

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

By type, operating capability, quality measures, technology, certifications, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

DS Smith, Smurfit Kappa, WestRock Company, Mondi, Packaging Corporation of America, Stora Enso, International Paper, Georgia-Pacific, Oji Holdings Corporation, Port Townsend Paper Company

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 227.8 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global corrugated board category size was valued at approximately USD 134.7 billion in 2022 and is estimated to witness a CAGR of 6.8% from 2023 to 2030.

b. Factors such as growing demand for sustainable packaging, growing environmental concerns, increasing demand for food and beverages industries, and global expansion of the e-commerce market are fueling category growth.

b. According to the LCC/BCC sourcing analysis, China, Vietnam, and India are the ideal destinations for sourcing corrugated board.

b. This category is fragmented with the presence of many large players competing for market share. Some of the key players are DS Smith, Smurfit Kappa, WestRock Company, Mondi, and Packaging Corporation of America.

b. Kraft paper, corn starch used for glue, and labor form the major cost components when it comes to producing corrugated boards. Other key costs include logistics costs, import duties, and fuel costs.

b. Acquiring or partnering with regional players to expand their distribution lines, sourcing from low-cost countries, and choosing suppliers that follow comprehensive standards and assurance policies, and certifications to support responsible corrugated board sourcing.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified