- Home

- »

- Reports

- »

-

Customs Brokerage Service Cost Intelligence Report, 2030

![Customs Brokerage Service Cost Intelligence Report, 2030]()

Customs Brokerage Service Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Sep, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10536

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Customs Brokerage Service Category Overview

“The Customs Brokerage Service category’s growth is driven by the increasing international trade, technological advancements, and e-commerce expansion.”

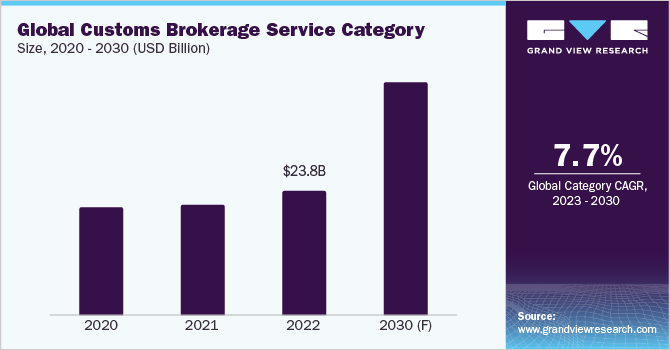

The customs brokerage service category is expected to grow at a CAGR of 7.7% from 2023 to 2030. This category is expanding due to digitization, automation, value-added services, trade facilitation initiatives, e-commerce growth, and emerging markets. Brokers can improve service quality, lower costs, and streamline operations. Supply chain management, trade advice, and risk assessment are examples of value-added services. Initiatives to facilitate trade make customs procedures simpler, and e-commerce is expanding to meet the needs of online customers and sellers.

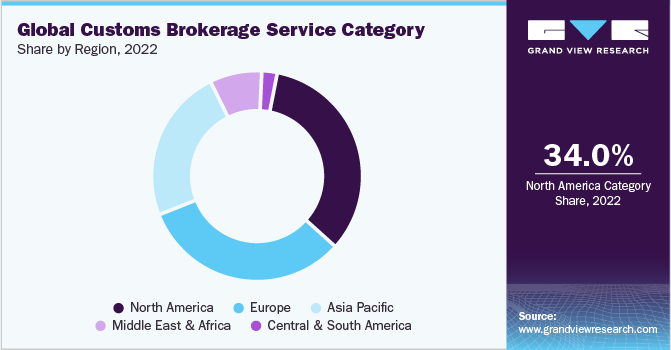

The category size was estimated at USD 23.78 billion in 2022. One of the key trends is the increase in international trade. Global trade volume is increasing, leading to a growing demand for customs brokerage services. These professionals assist businesses in navigating complex regulations, providing services such as customs clearance, documentation, compliance, and risk management. The demand for these services is expected to continue due to the increasing complexity of international trade.

E-commerce is a rapidly growing segment of the global retail market. A number of factors drive this growth, including the increasing availability of broadband internet, the growing popularity of mobile devices, and the convenience of shopping online. The growth of e-commerce is creating a significant demand for customs brokerage services, as businesses need to clear goods through customs to deliver them to their customers.

Technological advancements are also driving the growth of this category. New technologies are making it easier for brokers to process customs clearances and provide other services to their clients. For example, electronic data interchange (EDI) allows customs brokers to exchange data with customs authorities electronically, which can speed up the customs clearance process.

In addition, rising concerns like increased focus on personalized medicine and demand for specialized services are expected to aid customs brokerage service category expansion.

Supplier Intelligence

“What is the nature of the customs brokerage service category? What are the initiatives taken by the suppliers in this category?”

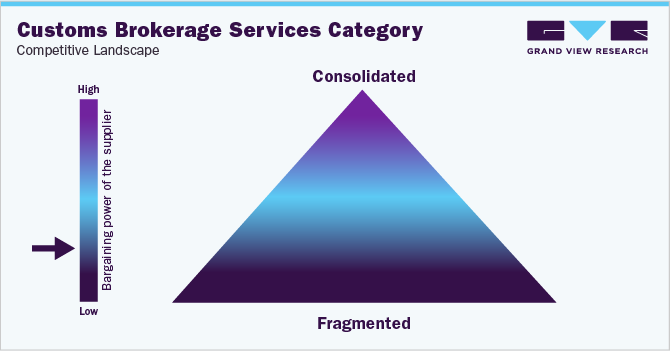

This category is highly fragmented with the presence of several players including multinational logistics companies, specialized customs brokerage firms, and freight forwarders. To grow their market share, firms in the industry are adopting crucial strategies like acquisitions, partnerships, and regional expansion. Specialized firms offer customs brokerage services and have strong relationships with customs officials, enabling them to expedite the clearance process. Freight forwarders, on the other hand, handle the transportation of goods and provide customs brokerage services. Buyers have more bargaining power where there are a large number of suppliers, it is easy and inexpensive to switch suppliers, and the customs brokerage service is not essential to the buyer's business. Suppliers have more bargaining power in markets where there are a small number of suppliers, it is difficult and expensive to switch suppliers, and the customs brokerage service is essential to the buyer's business.

-

In June 2022, Parade, a software provider for freight brokerage, integrated its truckload capacity management platform with Covenant Logistics Group, Inc. By bridging the technical gap and facilitating a more seamless shift from manual to digital freight bookings, this partnership will aid Covenant's freight brokerage operations. This will increase operational effectiveness and enable Covenant to adjust to the shifting business environment.

The regulatory environment also has an impact on the competitive landscape because these brokers are required to follow local customs laws and keep strong working relationships with customs authorities. Compliance with licensing laws, customs procedures, and industry certifications like Authorized Economic Operator (AEO) status can boost a business's reputation and competitiveness. Customs clearance is a complex and time-consuming process. However, automation, artificial intelligence, and blockchain can help to streamline the process, improve accuracy, and enhance transparency. Customs brokers that embrace these technologies will be able to provide superior services to their clients and gain a competitive edge. The category is expected to remain intense in the coming years, but also grow due to increasing international trade volume, creating opportunities for new players and existing players to expand their services.

Key suppliers covered in the category:

-

Kuehne+Nagel

-

United Parcel Service of America Inc

-

CEVA Logistics

-

APL Logistics Ltd

-

Expeditors International of Washington Inc

-

Nippon Express Holdings

-

Deutsche Post DHL Group

-

FedEx

-

CJ Logistics Corporation

-

DB Schenker

Pricing and Cost Intelligence

“What are some of the major cost components in customs brokerage service? Which factors impact the service cost?”

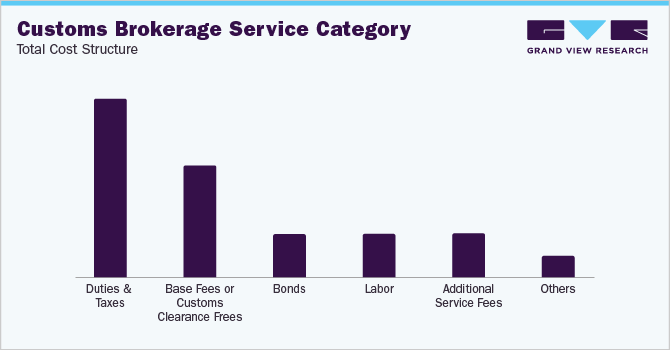

Customs brokerage services are essential for facilitating international trade by helping importers and exporters navigate complex customs regulations and procedures. The cost of these services is influenced by various factors, including the base fee, which covers fundamental services like filing paperwork, communicating with customs authorities, and monitoring shipment progress. Additional fees may apply for specific services tailored to each shipment's unique requirements. These fees may include reviewing documentation, arranging inspections, processing payments for duties and taxes, and handling unexpected delays or issues during customs clearance. The necessity for posting a bond is another critical aspect, as it guarantees importers' compliance with government duties and taxes. The amount of duties and taxes owed on imported goods is also a significant cost factor, affecting the total expenses incurred in availing customs brokerage services. The total cost of services will vary significantly depending on the specific circumstances of each shipment. Complex shipments or goods subject to stringent regulations may incur higher fees due to the additional effort and expertise required from the customs broker. Simpler and routine shipments may be subject to lower costs.

The following chart provides various costs incurred in this category. The major cost heads are shown below:

The cost of the services is subject to various factors that can significantly influence the overall expenses involved in facilitating international trade. One crucial determinant is the complexity of the shipment. Shipment complexity relates to the intricacy of the goods being imported or exported, with specialized or regulated items requiring more extensive documentation and handling, thus potentially increasing costs. The value of the goods also plays a pivotal role, as higher-value shipments often entail greater financial risk and may necessitate more comprehensive customs procedures. Moreover, the countries involved in the trade transaction, both the origin and destination, are critical factors affecting costs. Each country's unique customs regulations, tariffs, and duties can vary significantly, impacting brokerage fees. Additionally, the existing regulations in both the origin and destination countries can affect the level of scrutiny and processing time, potentially leading to adjustments in service costs.

Sourcing Intelligence

“Which countries are the leading sourcing destination for customs brokerage services?”

China, India, and the United States are the most preferred destinations for sourcing customs brokerage services. Indian customs infrastructure has significantly improved in recent years, with electronic customs clearance systems making imports faster and easier. Qualified customs brokers are available to help businesses navigate complex regulations. The Indian government is committed to improving business ease, while customs authorities are working to understand international trade regulations. The Federation of Customs Brokers' Association in India (FCBA) is raising standards in the industry by providing training and certification programs for brokers.

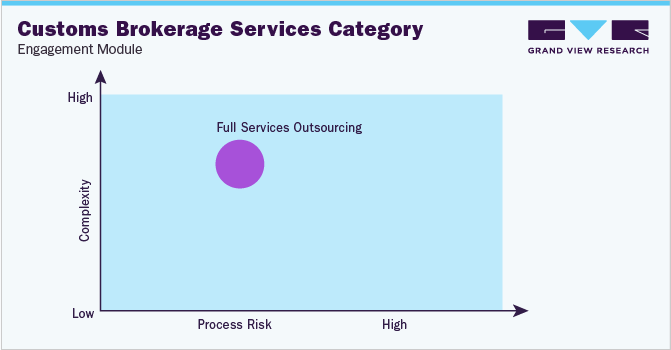

In terms of customs brokerage services sourcing intelligence, vendors typically use a full-service outsourcing model. The full-service outsourcing engagement model offers numerous benefits for businesses. Outsourcing expertise in customs regulations, cost savings, scalability, risk mitigation, time savings, integrated technology, global reach, and customer satisfaction provides businesses with a specialized team knowledgeable in international trade procedures. This approach prevents errors, ensures smooth customs clearance, reduces operational costs, and adapts to changing regulations. Scalability accommodates peak seasons, while integrated technology enhances visibility and reduces delays. Global reach aids international trade, ensuring compliance with regulations and minimizing disruptions. The full-service outsourcing model optimizes operations, cuts costs, and enhances compliance for businesses in international trade.

The performance-based operating model is used in this category focusing on efficient and accurate handling of documentation and clearance processes. This approach ensures smooth cross-border transactions and compliance with regulations and trade policies. The brokers must stay updated with changing regulations and trade policies to avoid delays and penalties during inspections. The performance-based model is incentivized to continually improve processes and adapt to global trade landscape changes, particularly during trade policy shifts. However, the industry is subject to evolving practices and regulations, such as trade policies, geopolitical dynamics, and technological advancements.

The Customs Brokerage Service Procurement Intelligence report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Customs Brokerage Service Procurement Intelligence Report Scope

Report Attribute

Details

Customs Brokerage Service Category Growth Rate

CAGR of 7.7% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

3% - 4% (Annually)

Pricing Models

Cost-plus pricing and value-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Technical expertise, experience, cost and quality of service, capabilities and reliability, customer service

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Kuehne+Nagel, United Parcel Service of America Inc, CEVA Logistics, APL Logistics Ltd, Expeditors International of Washington Inc, Nippon Express Holdings, Deutsche Post DHL Group, FedEx, CJ Logistics Corporation, DB Schenker

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 43.05 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global customs brokerage services category size was valued at approximately USD 23.78 billion in 2022 and is estimated to witness a CAGR of 7.7% from 2023 to 2030.

b. The increasing growth of digital transformation, blockchain adoption, increasing international trade, technological advancements, and e-commerce expansion are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis China, India, and the U.S. are the ideal destinations for sourcing customs brokerage services.

b. The global Customs Brokerage Service category is highly fragmented with the presence of several players in the market including multinational logistics companies, specialized customs brokerage firms, and freight forwarders. Some of the major suppliers are Kuehne+Nagel, United Parcel Service of America Inc, CEVA Logistics, APL Logistics Ltd, Expeditors International of Washington Inc, Nippon Express Holdings, Deutsche Post DHL Group, FedEx, CJ Logistics Corporation, and DB Schenker.

b. Base fees or customs clearance fees, duties and taxes, bonds, labor, and additional service fees are some of the cost components associated with this category.

b. Credentials and licenses, experience and track record, compliance expertise, customer service and communication, cost transparency, insurance coverage, service level agreement (SLA) are the best sourcing practices considered in the customs brokerage service category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified