- Home

- »

- Reports

- »

-

Digital Payment Services Sourcing Intelligence Report, 2030

![Digital Payment Services Sourcing Intelligence Report, 2030]()

Digital Payment Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Sep, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10537

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Digital Payment Services Category Overview

“The digital payment servicescategory’s growth is driven by rising internet penetration and the adoption of mobile payments.”

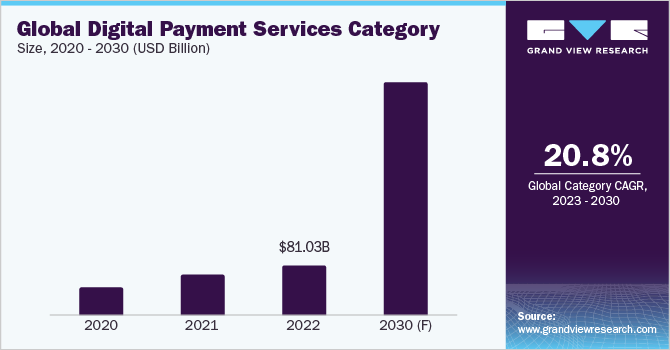

The digital payment services category is expected to grow at a CAGR of 20.8% from 2023 to 2030. The fast expansion of payments in real-time across the country can be attributed to the rising acceptance of mobile wallets. Suppliers of e-commerce services are moving away from traditional credit card and consumer finance solutions in an effort to acquire a competitive edge and toward client engagement tactics that make use of digital payments. The increasing popularity of online shopping is driving the demand for digital payment services, as online shoppers prefer convenience and security. Smartphones make it easy to make payments online and in-store, while contactless payments are becoming more popular due to their convenience and hygienic nature. The security of digital payment services is improving, making consumers more comfortable using these services. For instance, Civic is an e-KYC platform providing secure digital identity which provides secure digital identity at reduced costs, while cloud technology drives research and development in digital payment offerings.

The global digital payment category size was estimated at USD 81.03 billion in 2022. The rapid use of digital payment systems by young people, particularly Generation Z, is what is driving the trend in digital payments. This generation prefers online banking over other banking methods, and they seek personalized, adaptable, and relevant customer experiences. Because payment services are developing and delivering better customer experiences, there is a demand for improved user experiences that supports business growth. Banks and shops invest in providing reward points to users, and market players give rewards on digital transactions. For players in this sector, this trend is predicted to result in fierce rivalry and huge market potential. For instance, Amazon's net banking and credit card payment methods offer fare discounts, causing intense competition and significant market opportunities for market players. Procurement professionals must understand the various types of services available, such as mobile payments, and online payments.

Security is a critical factor in this category and there are many ways in which companies are offering it to their customers.Information is secured through cryptography by transforming it into a form that is difficult to interpret by unauthorized individuals. It is used in digital payments to protect sensitive information, such as credit card numbers and passwords. Secure sockets layer (SSL) is a security protocol used to encrypt data transmitted over the internet, while the Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect sensitive payment information. Two-factor authentication (2FA) is a security process that requires users to provide two pieces of identification to authenticate themselves, adding an extra layer of security against fraud. Biometric authentication uses biometric data, such as fingerprints or facial scans, to authenticate users, making it increasingly popular in digital payments. Blockchain is a distributed ledger technology used to record transactions securely and transparently, with the potential to revolutionize the way payments are made.

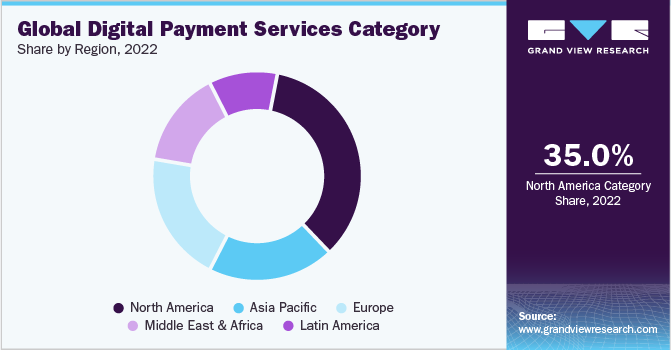

In North America, the United States is the largest market for digital payments, with leading providers including Visa and Mastercard. In Europe, the largest market is the United Kingdom, with PayPal, and Adyen. In Asia-Pacific, China has Alipay, WeChat Pay, and UnionPay, while Brazil has PagSeguro and Mercado Pago in Latin America. In the Middle East and Africa, the United Arab Emirates has Visa, Mastercard, and PayPal as its leading digital payment providers.

Supplier Intelligence

“How can the nature of the global digital payment services category be best described? Who are the key players in this category?”

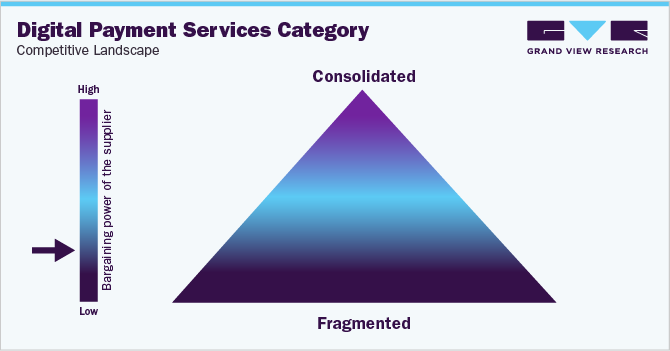

This category is highly fragmented due to various factors, including different payment methods, target markets, and regulatory requirements. These factors make it challenging for businesses to choose the right service for their needs. Different payment methods have their advantages and disadvantages, making it difficult for businesses to find the right one for their customers. Additionally, different market segments, such as businesses and consumers, can also impact the selection process. Furthermore, different countries have different regulatory requirements for digital payments, making it difficult for businesses to offer digital payments across multiple countries. Fragmentation in this category leads to increased competition, resulting in lower prices and better services for businesses and consumers. Innovation occurs as businesses develop new payment methods and services, providing more choices and better services. Customization is also possible, as businesses can tailor payment solutions to meet specific customer needs. Innovation has been driven by providers developing new payment solutions to meet their needs. Businesses now have a choice of providers and payment solutions, enabling them to select the best solution for their specific needs.

Demonetization brought a tectonic shift in the Indian digital payment services category. The rising footfall of digital payment platforms is testimony to the fact that the South Asian giant is spearheading a digital future.

Citing an NPCI report of June 2021, CompareRemit noted that PhonePe accounted for 46.04% of the Indian market share, while Google Pay contributed 34.63% (values are based on transaction volume). The trend is partly due to an exponential rise in smartphone penetration, internet access and robust government policies.

Key suppliers covered in the category:

-

Visa

-

Mastercard

-

PayPal

-

Alipay

-

China UnionPay

-

Amazon Pay

-

Stripe

-

PayU

-

Paytm

-

Adyen

Pricing and Cost Intelligence

“What are some of the key cost components or elements involved in the digital payment services category? Which factors influence the prices?”

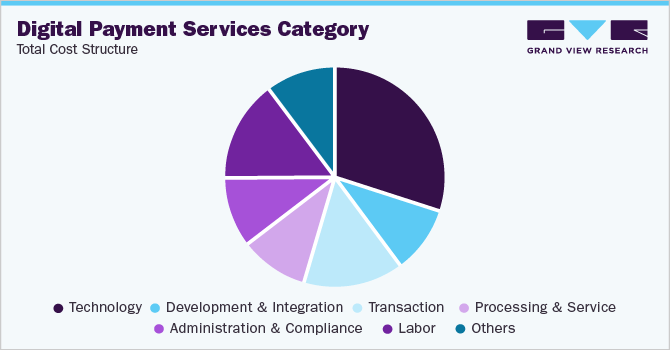

Technology cost is a significant expense in this category, requiring providers to invest in advanced technology and infrastructure to support their services. Technology can be further impacted by other costs such as payment processing, fraud prevention and detection, customer support, and marketing and sales. As the market matures and demand for this sector increases, the cost of technology will continue to rise. Transaction cost includes the fees for processing individual payments, including credit card processing, interchange, and network fees, as well as fraud prevention and detection. Labor cost includes salaries and benefits for employees in the digital payment service market, including customer service representatives, software developers, and security engineers. Development cost includes the cost of developing and maintaining infrastructure and software for digital payments, including servers, data centers, and payment processing software. Integration cost involves the complex and time-consuming process of integrating digital payment services with other systems, such as e-commerce platforms and point-of-sale systems. The PayPal fee for a USD 100 transaction is USD 3.98, making the total money received after fees USD 96.02. These providers charge monthly and annual fees for maintaining accounts and processing transactions, with the monthly fee varying based on the provider and service level, while the annual fee also varies based on the provider and service level.

The following chart provides various costs incurred in this category and the major cost heads are shown below:

Businesses generally use the subscription fees pricing model which is a popular choice for businesses processing a high volume of transactions. It offers predictable costs, no transaction fees, and access to additional features or functionality. Businesses can budget and plan their finances by knowing their monthly or annual fees, saving money, and enabling better financial management.

The Digital Payment Services Procurement Intelligence Report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries are the leading sourcing destinations for the digital payment services category?”

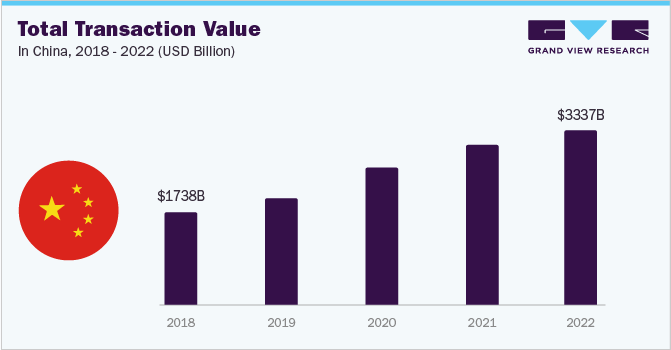

China is the world's largest e-commerce market, and the growth of e-commerce has led to the widespread adoption of digital payment services. Mobile payments are becoming increasingly popular in China, and this trend is being driven by the increasing penetration of smartphones. The government's support for this sector has helped to create a favorable environment for the growth of this category. China is home to some of the largest digital payment providers in the world, such as Alipay and WeChat Pay. These providers have helped to drive the growth of this category in China.

The United States is the world's largest economy, and the growth of the economy has led to the widespread adoption of digital payment services. Mobile payments are becoming increasingly popular in the United States, and this trend is being driven by the increasing penetration of smartphones. The United States is home to some of the largest digital payment providers in the world, such as PayPal, Venmo, and Square. These providers have helped to drive the growth of the digital payment market in the United States by making it easier and more convenient to pay online and in stores and by providing secure payment solutions. The U.S. government is supportive of the development of digital payments, and this has helped to create a favorable environment for the growth of this category.

The Indian government is promoting digital payments through initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) and the Unified Payments Interface (UPI), as e-commerce and mobile payments continue to grow in popularity. Customers are demanding more secure payment solutions, and digital payments offer a more secure option than cash or checks. This growth is a result of the growing demand for secure online transactions.

Security is a critical factor in this category, and procurement professionals should choose providers with strong measures to protect customer data. Scalability is also crucial, as the volume of transactions in this category is constantly growing. Procurement professionals should choose providers with a good reputation and a history of providing reliable services.

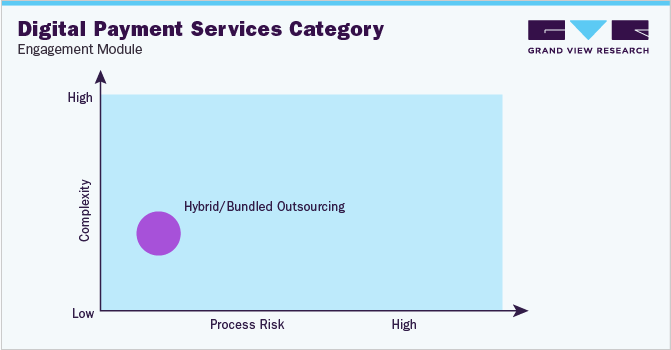

In terms of digital payment services sourcing intelligence, the hybrid model is a popular engagement model in the digital payment service category, combining in-house and full-service outsourcing. Companies handle some aspects of digital payment processing in-house, like payment gateway development and maintenance, while outsourcing others, like processing payments and customer support, to a third-party provider. This model offers several advantages, including maintaining control over digital payment processing, being more cost-effective, and being more scalable than in-house or full-service outsourcing. Companies can easily add or remove services as needed, making it a popular choice for companies looking to streamline their services.

This model offers several advantages, including cost savings, expertise, scalability, and security. Companies can benefit from third-party providers' expertise in specific areas, such as payment processing and fraud prevention, while still maintaining control over other aspects. Additionally, outsourcing some aspects of the process allows companies to scale their services to meet growing business needs while ensuring protection against fraud and other risks.

The digital payment services procurement intelligence report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Digital Payment Services Procurement Intelligence Report Scope

Report Attribute

Details

Digital Payment Services Category Growth Rate

CAGR of 20.8% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

8% - 10%(Annual)

Pricing Models

Subscription fee pricing model and transaction fees pricing model

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Sustainability, price, quality, reliability, flexibility, technical specifications, operational capabilities, regulatory standards and mandates, category innovations, and others.

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Visa, Mastercard, PayPal, Alipay, China UnionPay, Amazon Pay, Stripe, PayU, Paytm and Adyen

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 367.4 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global digital payment services category size was valued at approximately USD 81.03 billion in 2022 and is estimated to witness a CAGR of 20.8% from 2023 to 2030.

b. The increasing adoption of contactless payments, growth in internet penetration and the rise of mobile payments are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, China and India are the ideal destinations for sourcing digital payment services category.

b. This category is highly fragmented with the presence of many large players competing for the market share. Some of the key players are Visa, Mastercard, PayPal, Alipay, China UnionPay, Amazon Pay, Stripe, PayU, Paytm, and Adyen

b. Technology cost, transaction cost, and labor are the major key components of this category.

b. Security is a critical factor as procurement professionals should choose providers with strong measures to protect customer data. Scalability is important as the volume of transactions is constantly growing. Procurement professionals should choose providers with a good reputation and a history of providing reliable services. Therefore, scalability, data privacy, and security are some of the best sourcing practices in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified