- Home

- »

- Reports

- »

-

Digital Procurement Systems Cost Intelligence Report, 2030

![Digital Procurement Systems Cost Intelligence Report, 2030]()

Digital Procurement Systems Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Sep, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10538

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Digital Procurement Systems Category Overview

“The digital procurement systems category’s growth is driven by the need to optimize the global supply chain.”

The digital procurement systems category is expected to grow at a CAGR of 10% from 2023 to 2030. The need for optimizing the global supply chain is driving category growth. Supply chain executives can use procurement management systems to keep track of the way their activities are performing, enabling companies to more accurately foresee potential problems in the future and redirect resources accordingly. Furthermore, it generates trustworthy data-driven solutions. This can be used to improve the efficiency of business processes. Purchase management systems offer exception-based process management systems to improve the management of steady-state operations and provide cross-functional visibility. As a result, an increasing number of consumers are investing in purchase management software. The increased desire for supply chain transparency and the sharing of order and shipment data further help drive category growth.

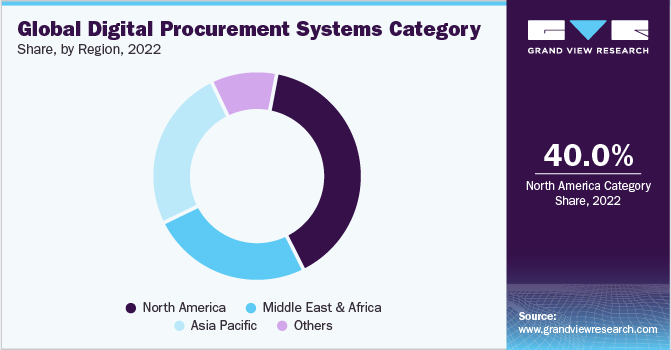

The global digital procurement systems category size was valued at USD 6.68 billion in 2022. Electronic procurement software helps to integrate and automate an organization's whole procurement cycle. When e-procurement technologies are coupled with ERP systems, ERP aids in managing suppliers by streamlining procurement procedures and freeing up staff to concentrate on other tasks, resulting in a more effective organization. Among other things, ERP solutions can improve business reporting, service to customers, inventory expenses, cash flow, data protection and secure cloud storage, business process enhancements, supply chain management, and reduce costs. These elements all contribute to category growth. For instance, in November 2022, management and strategy consulting firm Kearney bought Optano, a software company based in Germany, to streamline its supply chain planning using Optano's Al-driven software to optimize their supply chain processes, from manufacturing to scheduling and transportation.

Mobile procurement solutions are increasingly being implemented, resulting in category growth. Mobile procurement solutions allow purchase staff to oversee sourcing operations while on the go, which saves money and time. They improve procurement process efficiency by enabling procurement executives to examine and authorize purchase orders, payments, and contracts from their mobile devices. Furthermore, real-time access to procurement data allows for faster and more informed decision-making, driving the use of mobile procurement technology.

The complexity of integrating with current platforms and the onboarding of suppliers is a major impediment to category growth. The difficulty originates from the fact that each company has its own systems and suppliers, making it impossible to smoothly connect procurement software with all of them. The difficulty of compatibility issues is one of the primary concerns. Existing systems may be employing outdated technology, making it difficult to implement the most recent purchase software. This issue necessitates improvements to current systems, complicating the integration process even further. Further, the shortage of skilled individuals holds up the growth of the sourcing software category. Purchase software requires trained individuals to optimize the supply chain and manage costs. Several countries consider digital sourcing abilities to be less inventive. For example, 86% of UK firms face difficulties in developing digital purchasing skills. As a result, a shortage of trained individuals is impeding the growth of the procurement software category.

Supplier Intelligence

“How can the nature of the digital procurement systems category be best described? Who are some of the key players?”

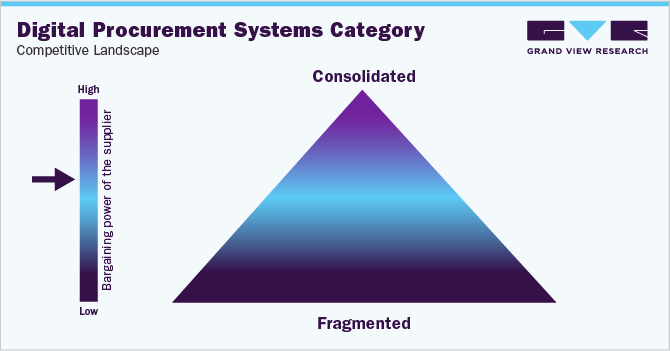

The digital procurement systems category is moderately consolidated because of the presence of a few large and minor companies operating both domestically and internationally. To strengthen their customer base presence, these businesses engage in collaborations, mergers and acquisitions, and new product releases. For instance:

-

In February 2022, Coupa Software announced a suite of the next step in spend management products called Community.ai. Community.ai integrates data-driven artificial intelligence to improve person-to-person connections and transform B2B communities.

-

In February 2022, ArcBlue, a procurement services company in the Asia Pacific area, was bought by Bain & Company. ArcBlue operates autonomously as Bain's special procurement implementation service line as a result of this transaction.

-

In September 2021, McCarthy Holdings, a construction corporation based in the United States, collaborated with GEP to deploy its smart procurement software. The company intended to use GEP procurement systems to transform its source-to-pay process.

-

In August 2021, Oracle enhanced its product range with the release of the Oracle Verrazzano Enterprise Container platform for multi-cloud and hybrid-cloud situations.

The bargaining power of suppliers of digital procurement systems is generally high. This is due to a number of factors, for example, The number of suppliers is relatively small. There are only a handful of major players in this category, such as SAP, Oracle, and Coupa. This gives suppliers a lot of power in negotiations with buyers. Further, it is a major undertaking to switch from one platform to another. This is because the system is often integrated with other systems in the organization, such as the ERP system and the CRM system. Switching systems can be disruptive and costly. The suppliers of this category have a deep understanding of the market and the needs of buyers. This gives them an advantage in negotiations. The suppliers are constantly innovating and adding new features and functionality to their products.

Key suppliers in this category:

-

SAP SE

-

Proactis Holdings PLC

-

Coupa Software Inc.

-

Microsoft Corporation

-

Oracle Corporation

-

Epicor Software Corporation

-

Ginesys

-

Zycus, Inc.

-

Ivalua Inc.

-

Infor Inc.

Pricing and Cost Intelligence

“What are the total costs associated with offering digital procurement systems? Which factors impact the price of digital procurement systems?”

The total cost associated with digital procurement systems can be broken down into the following components: License, support, software, and data server, implementation, maintenance, and training costs. License, support, implementation, and maintenance form the largest cost components of this category. Together, they account for roughly 75% of the total costs. However, it should be noted that the cost weightage of these components varies depending on the size of the firm. For example, maintenance cost for small firms is about 45%, but for large enterprises, it is reduced to just 15% of the total costs because of economies of scale. Similarly, license, support, and implementation costs vary between 10% and 20% of the total costs depending on the size of the firms.

The following chart shows a breakdown of the cost structure associated with digital procurement systems along with major cost components, as demonstrated below:

On-demand sourcing software is less expensive than on-premise software. However, it is not necessary to buy and install hardware or software, manage an implementation project, or provide internal system support. The only expenses associated with on-demand procurement software are subscription and training fees. On-demand software costs start at 15.9% of on-premise software costs and never exceed 50% of on-premise software costs. Subscription-based pricing models are becoming increasingly popular for digital procurement systems because they offer a number of benefits to both suppliers and businesses. For suppliers, subscription models provide a more predictable revenue stream, make it easier to scale their business, and allow them to easily update their software and security patches. For businesses, subscription models offer lower upfront costs, easy access to the software, and the ability to scale their procurement operations as their needs grow.

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries are the leading sourcing destination for digital procurement systems development?”

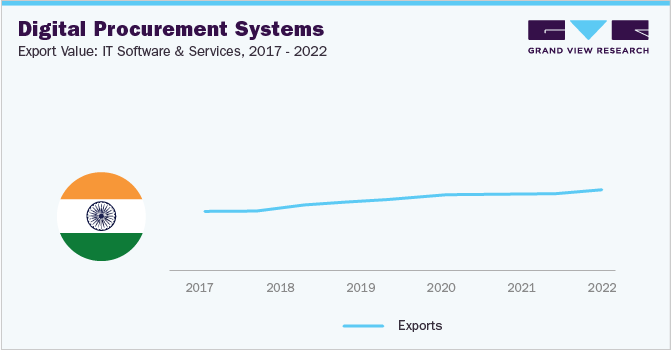

India and China are one of the most preferred destinations for digital procurement systems. Many major players in this category such as Oracle, SAP, and Epicor outsource their operations to these countries due to their large talent pool and low labor costs. The cost of developing digital procurement systems is significantly lower than in other developed countries, due to the country's large and skilled workforce and low cost of living. For example, the average salary for a software engineer in India is about USD 20,000 per year, while the average salary for a software engineer in the United States is about USD 100,000 per year. In fiscal year 2022, India's IT service exports were anticipated to be around USD 194 billion. Several changes have occurred in India's software as a service (SaaS) industry throughout the years. SaaS enterprises have become one of the fastest-growing businesses in the country, generating roughly USD 3.5 billion in revenue. All these factors have made them ideal destinations for digital procurement systems.

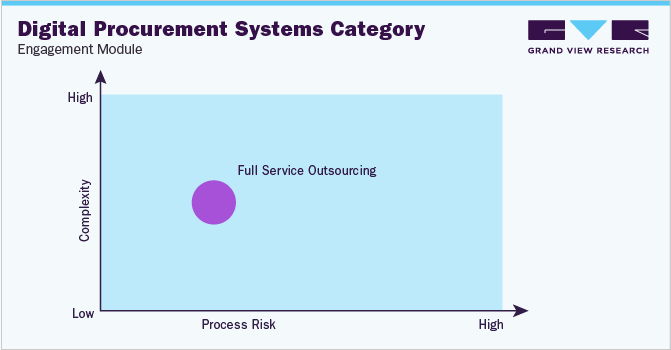

In terms of digital procurement systems sourcing intelligence, vendors opt for a hybrid/bundled or full outsourcing model. Employing an internal team would be advantageous, but businesses are confronted with substantial problems such as talent shortages, onboarding concerns, and infrastructure expenditures, all of which have a big financial impact. As a result, significant corporations prefer a full outsourcing model to obtain enhanced transparency, decreased risks and fraud, and increased protection against outside threats. It also allows them to acquire access to specialized teams, which can be advantageous in the long run. It has been discovered that implementing an offshore strategy can assist a corporation in reducing employment costs by more than 50% - 60%.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Digital Procurement Systems Procurement Intelligence Report Scope

Report Attribute

Details

Digital Procurement Systems Category Growth Rate

CAGR of 10% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

10% - 12% (annual)

Pricing Models

Subscription-based pricing model, cost-plus pricing model

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Procure-to-pay, sourcing, contract management, risk management, analytics, experience, solution type, scalability, support, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

SAP SE, Proactis Holdings PLC, Coupa Software Inc., Microsoft Corporation, Oracle Corporation, Epicor Software Corporation, Ginesys, Zycus, Inc., Ivalua Inc., Infor Inc.

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 14.32 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global digital procurement systems category size was valued at approximately USD 6.68 billion in 2022 and is estimated to witness a CAGR of 10% from 2023 to 2030.

b. The need for optimizing the global supply chain, growing adoption of mobile procurement solutions, and rising demand for supply chain transparency are driving the growth of this category.

b. According to the LCC/BCC sourcing analysis, China, and India are the ideal destinations for sourcing digital procurement systems.

b. This category is moderately consolidated with the presence of a few large players competing for the market share. Some of the key players are SAP SE, Proactis Holdings PLC, Coupa Software Inc., Microsoft Corporation, Oracle Corporation, Epicor Software Corporation, Ginesys, Zycus, Inc., Ivalua Inc., and Infor Inc.

b. License, support, implementation, and maintenance are the major cost components of this category. Other key costs include training, software, and data server.

b. Cost-saving measures such as complete service sourcing, verifying the performance of the service providers, and maintaining open communication with suppliers to address any issue are some of the best sourcing practices in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified