- Home

- »

- Reports

- »

-

Disposable Medical Gloves Supplier Intelligence Report, 2030

![Disposable Medical Gloves Supplier Intelligence Report, 2030]()

Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Oct, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10557

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Category Overview

“Rising awareness of hygiene and safety are fueling the growth of the disposable medical gloves category.”

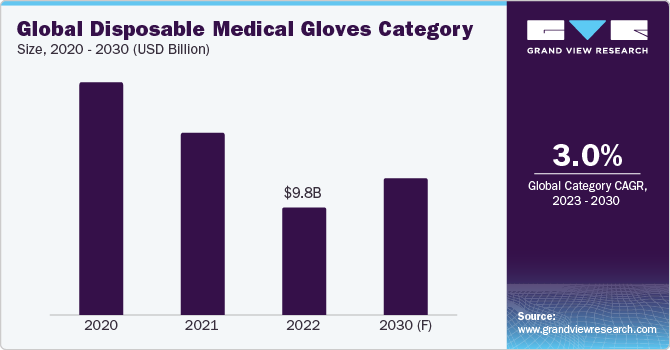

The global disposable medical gloves category is expected to grow at a CAGR of 3.0% from 2023 to 2030. The growth is significantly driven by increased awareness of hygiene & health, mass vaccinations to tackle various diseases, rising concern for safety & security at healthcare workplaces, and a rise in the number of surgical processes across the globe.

Technological developments coupled with an increased end-user base in the healthcare sector are also supplementing the expansion of the global category. The category is anticipated to witness continued growth in the coming years due to the major rise in epidemics and pandemics that are occurring more frequently around the world.

Natural rubber disposable medical gloves lead the global category, in terms of material, and account for over 37.4% of the product market share. Gloves made of natural rubber or latex are tactile and used in procedures like surgery and medicinal treatments. In addition, since they are so easy to wear, they are ideal for handling biological or water-based products. During the expected timeframe, it is anticipated that all of these factors will raise demand for them.

The demand for disposable medical gloves made of nitrile butadiene rubber (NBR), also called nitrile gloves, is anticipated to witness the fastest growth due to their durability, puncture resistance, and exceptional barrier protection characteristics. Nitrile gloves are used in applications where exposure to blood-borne pathogens and other pollutants is a major concern. They also offer outstanding comfort and fit because of memory and high elasticity.

In terms of product type, the examination gloves segment dominates the disposable medical gloves category, holding over 75.5% of the global category share. The product's demand in the medical industry is expected to rise as a result of rising hospital utilization, dental applications for routine examinations, and patient visits. To avoid staff and patient cross-contamination during non-invasive physical examinations, doctors, nurses, and other healthcare professionals utilize it.

The surgical gloves segment is anticipated to experience considerable expansion over the projected timeframe. The demand for products used in surgical applications is expected to increase due to the rising prevalence of chronic diseases including cancer and heart disease, the treatment of which commonly requires medical procedures and operations. Surgical gloves possess greater quality than examination gloves and are more frequently used by surgeons and nurses in operating rooms (ORs).

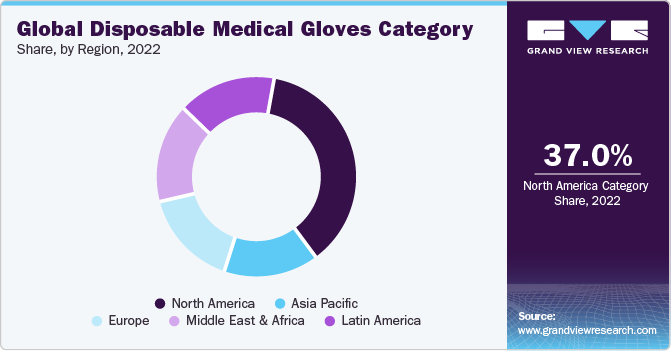

North America dominates the global disposable medical gloves category, holding 37.1% of the global share. The region is experiencing continuous advancements in the field of surgery, such as those in HRO (high-reliability organizing) and medical technology, which are predicted to promote the growth of the hospital sector and increase demand for medical gloves. It has a significant need for disposable medical gloves due to the numerous surgeries that are carried out there. Such treatments increase the value of disposable medical gloves by reducing direct skin-to-skin contact and the risk of bacterial infection during treatment, propelling the category’s growth.

Asia Pacific region is anticipated to witness the fastest growth over the projected timeframe. Key factors that drive the growth include rising medical tourism, increased preference for home-care services by the people, and development of healthcare infrastructure such as clinics & hospitals. In addition, a continuous rise in the population will lead to a higher demand for healthcare services, which consequently will boost the demand for disposable medical gloves in the region. The healthcare sector in India is witnessing a substantial rise owing to higher investments by private & public players, easy insurance access, and rising disposable income. This is anticipated to supplement the region’s growth.

Supplier Intelligence

“What best describes the nature of the disposable medical gloves category? Who are some of the main participants?”

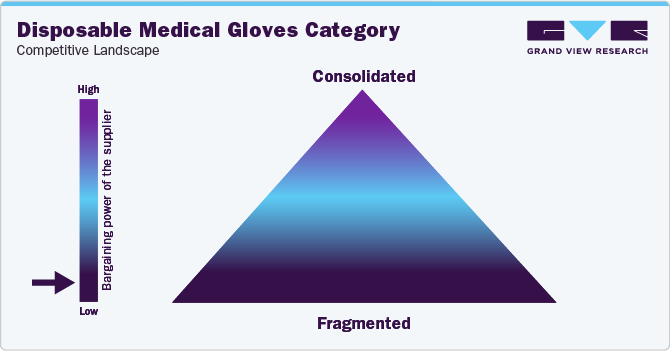

The category for disposable medical gloves is fragmented and highly competitive with the presence of a large number of regional and global industry players. The players operating in the industry at various stages of the value chain exhibit a high degree of integration. Players in the industry adopt a variety of tactics such as geographical expansions, new product developments, joint ventures, and mergers & acquisitions, to increase industry penetration and meet the varying needs of different end users, such as outpatient/primary care facilities, home healthcare providers, and hospitals. The threat of new entrants is anticipated to stay low since new industry participants are likely to face a high entry barrier in the form of initial capital investments.

Manufacturing of medical gloves is particularly capital-intensive because of the high costs of raw materials and the intricate manufacturing processes. Competition has increased as a result of significant raw material suppliers integrating along the value chain. Manufacturers sell products through both direct and indirect channels, including retail shops and distributors, as well as online sales and social media marketing. They use multi-brand merchants, exclusive distributors, and independent distributors to distribute their goods. However, few players deliver their products directly to consumers, commercial institutions, hospitals, and businesses to minimize additional expenditures.

Key suppliers covered in the category:

-

Ansell Limited

-

B. Braun SE

-

Cardinal Health, Inc.

-

Hartalega Holdings Berhad

-

Innovative Gloves Co., Ltd.

-

Kossan Rubber Industries Berhad

-

Mercator Medical S.A.

-

Rubberex Corporation (now Hextar Healthcare Berhad)

-

Semperit AG Holding

-

Supermax Corporation Berhad

-

Top Glove Corporation Berhad

-

UG Healthcare Corporation Limited

Pricing and Cost Intelligence

“What is the cost structure for disposable medical gloves? What variables affect the prices?”

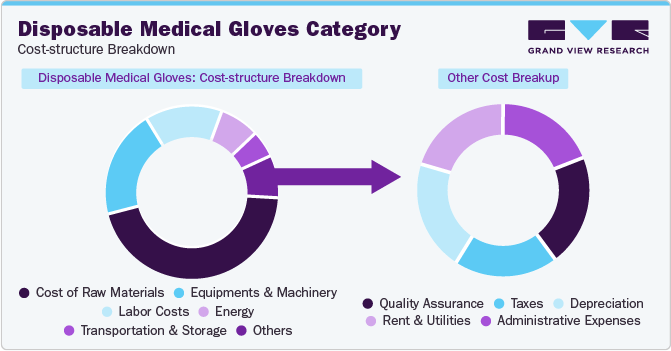

The cost structure of disposable medical gloves can be split into major categories such as cost of raw materials, equipment & machinery, labor costs, energy, transportation & storage, and other expenses. Other expenses can be further bifurcated into quality assurance, taxes, depreciation, rent & utilities, and administrative expenses.

Manufacturers generally use bulk pricing and competition-based pricing models. The gloves can be divided into a few categories such as type of product, sterile or non-sterile, powdered or without powder, color, and thickness. All are used uniformly. Consequently, suppliers have a limited portfolio of products to offer.

As demand for gloves can vary for several applications at the same location, businesses prefer to sell their products in bulk. Bulk pricing offers a range of products at a single price. It aids the business in turning a profit. Disposable gloves can cost more or less based on a number of variables, including the material, quantity, labor, and quality of the gloves.

Disposable gloves can generally be purchased for between USD 0.01 and USD 0.20 per pair. The total cost of gloves will be lower if the cost of the materials is lower. To cover their profit margins, manufacturers therefore use a bulk pricing strategy. In the previous two years, there was a greater demand for the category, but that demand has now subsided. Even after fluctuations in demand and prices of raw materials, the players are trying to grow in the global category.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

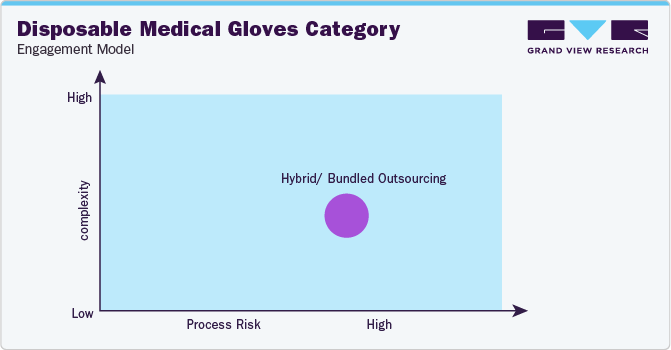

“How do disposable medical gloves manufacturers engage with their suppliers? What is the type of engagement model?”

Glove producers are more frequently employing a hybrid outsourcing model, where some services are kept in-house and others are outsourced. As a result, they are able to benefit from cheaper costs, scalability, improved productivity, and a high degree of flexibility. In addition, it helps with supplying products that follow environmental standards to healthcare systems.

It provides access to resources for everything from resilience building via the sourcing of raw materials to recycled packaging materials for enterprises. It also tackles how to meet operational needs in areas including contracts, distribution, product storage, logistics, data, and technology. The best way for glove makers to meet the manpower and volume demands is to outsource whenever there is a rise in demand.

The demand for allied services, like 3PL, is intimately correlated with the demand for gloves and will change as a result of how the glove makers respond. Industry 4.0, the latest technology, and access to raw resources during inflation must all be adopted inside the industry, whether internally or through outsourcing.

“In a hybrid/bundled outsourcing model, some part of the overall operation is outsourced to third parties. Generally, critical operations are retained in-house.”

To ensure that the final goods are more dependable, secure, and of higher quality, a quality provider of medical gloves must carefully monitor all areas of its production operations. Making gloves is a challenging undertaking. Producers need to be able to properly classify incoming raw materials by safety and regulatory compliance criteria to reduce human operator intervention and boost lab and plant productivity.

Cooperation is needed to understand the nature of production lead times, manufacturing diversity, buffer stock, change in consumption patterns, and clarity of information transmitted between each partner to ensure flexibility and contingency planning. Given the variety of gloves available from manufacturers, they need diverse vendors for various raw materials to conduct their business. The approved provider model with a reliable source would satisfy all of these requirements and advantages. They satisfy the prerequisite qualities or requirements.

Malaysia is the preferred low-cost/best-cost country for sourcing disposable medical gloves. The nation’s geographical proximity to numerous markets is a big benefit. In comparison to importing from China, importing goods from Malaysia might result in faster shipping times and less expensive logistics due to its better transportation, infrastructure, and well-connected ports. Due to a combination of high production costs from low utilization rates and narrow profit margins from low average selling prices, local glove makers in the nation have been losing money recently. As per a recent report, the utilization rate dropped from 34.9% to 39.9% in the Q4 of 2022 to 31.9% to 34.9% in the Q1 of 2023, which was hardly half the rate in 2019.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Disposable Medical Gloves Category Procurement Intelligence Report Scope

Report Attribute

Details

Disposable Medical Gloves Category Growth Rate

CAGR of 3.0% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Bulk-pricing, competition-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Years in service, geographic service provision, certifications, material used, end-user industries, type of gloves, features, sterilization, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Ansell Limited, B. Braun SE, Cardinal Health, Inc., Hartalega Holdings Berhad, Innovative Gloves Co., Ltd., Kossan Rubber Industries Berhad, Mercator Medical S.A., Rubberex Corporation (now Hextar Healthcare Berhad), Semperit AG Holding, Supermax Corporation Berhad, Top Glove Corporation Berhad, and UG Healthcare Corporation Limited

Regional Scope

Global

Revenue Forecast in 2030

USD 12.4 billion

Historical Data

2020 - 2021

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global disposable medical gloves category size was valued at USD 9.83 billion in 2022 and is estimated to witness a CAGR of 3.0% from 2023 to 2030.

b. Increased awareness regarding hygiene & health, mass vaccinations across the globe to tackle various diseases, rising concern for safety & security at healthcare workplaces, and rise in the number of surgical processes across the globe are driving the growth of the disposable medical gloves category.

b. According to the LCC/BCC sourcing analysis, Malaysia and Germany are the ideal destinations for sourcing disposable medical gloves.

b. The global disposable medical gloves category is fragmented, with a high level of competition among key players. Some of the key disposable medical gloves manufacturers are Ansell Limited, B. Braun SE, Cardinal Health, Inc., Hartalega Holdings Berhad, Innovative Gloves Co., Ltd., Kossan Rubber Industries Berhad, Mercator Medical S.A., Rubberex Corporation (now Hextar Healthcare Berhad), Semperit AG Holding, Supermax Corporation Berhad, Top Glove Corporation Berhad, and UG Healthcare Corporation Limited.

b. Cost of raw materials, equipment & machinery, labor costs, energy, transportation & storage, and other expenses (quality assurance, taxes, depreciation, rent & utilities, and administrative expenses) are key cost components associated with this category.

b. Assessing the quality and the lead times offered by the supplier, the range of glove options offered by the supplier by material, evaluating the features offered by the supplier for different glove type, and negotiating prices & terms with suppliers are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified