- Home

- »

- Reports

- »

-

Employee Background Screening Services Category Report, 2030

![Employee Background Screening Services Category Report, 2030]()

Employee Background Screening Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Sep, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10539

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Employee Background Screening Services Category Overview

“The employee background screening services category’s growth is driven by rising awareness of theimportance of background checks and globalization of the workforce.”

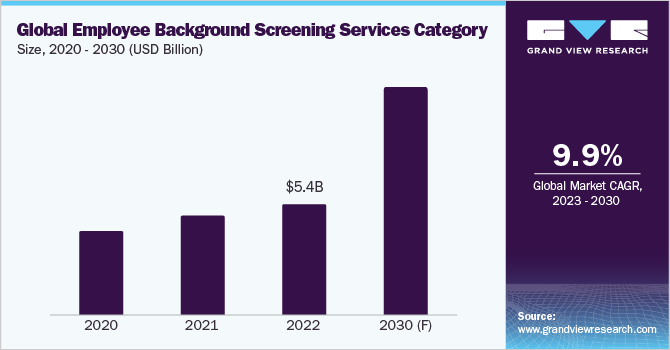

The employee background screening services category is expected to grow at a CAGR of 9.9% from 2023 to 2030. There is an increased requirement for regulatory compliance as governments around the world are increasingly enacting regulations that require employers to conduct background checks on their employees. The increasing number of businesses hiring remote workers is also driving the growth of this category which has led to the increased demand for background checks, as businesses need to ensure they are hiring safe and reliable employees. Background checks are crucial for employers to identify potential threats to workplace safety and fraud, as they can identify employees with a history of violence or criminal activity, as well as those with financial issues, and poor employment history.

The global employee background screening servicescategory size was valued at USD 5.36 billion in 2022. Governments worldwide are mandating employers to conduct background checks on employees, particularly in industries with high fraud or risks of harm, such as healthcare, finance, education, and others. Technologies such as artificial intelligence and biometrics have made background checks more affordable and accessible, leading to increased demand for these services. Globalization has made it more challenging for employers to verify employee backgrounds, but employment screening services help in overcoming this by providing access to global databases of legal, credit, and compliance verification databases and criminal records.

Employers are increasingly becoming aware of the importance of background checks due to the increasing number of fraud and violence cases linked to employees with criminal records. For instance, Matthew Branning, a 50-year-old man who disappeared in October 2021, was kidnapped, robbed, and killed by his colleague at work who ran away from the state after this incident. Michael Stark, 49, was charged in his presumed death. Both men were employees of Encholor, a water treatment system parts manufacturer.

AI is being utilized in background screening to automate tasks like data collection and analysis, making it more efficient and cost-effective for employers. AI can identify patterns and trends in data that are not visible to human analysts, enabling employers to make more informed hiring decisions. Machine learning, a type of AI, improves the accuracy and efficiency of background screening by learning and improving over time. Natural language processing (NLP) automates the extraction of information from documents, while cloud computing delivers computing services over the Internet, making it easier and more affordable for employers to conduct background checks without investing in their own infrastructure. Overall, AI and NLP are contributing to the advancements in background screening and hiring decisions.

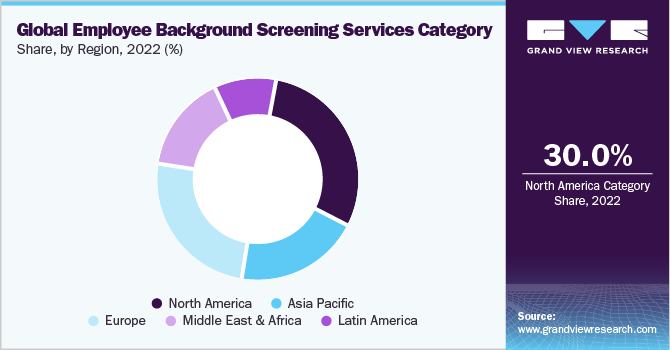

The North America employee background screening services market is the largest globally, with the United States accounting for the largest share. This can be attributed to the increasing size and complexity of organizations, the number of multinational companies operating in North America, and the growing awareness of the importance of background screening among employers. In Europe, the UK, Germany, and France are the major countries. The Asia Pacific market is the third largest, with its expansion driven by rapid economic growth and organizational size. Latin America is the fourth largest market, with Brazil accounting for the largest share, followed by Mexico and Argentina.

Supplier Intelligence

“How can the nature of the global employee background screening services category be best described? Who are the key players in this category?”

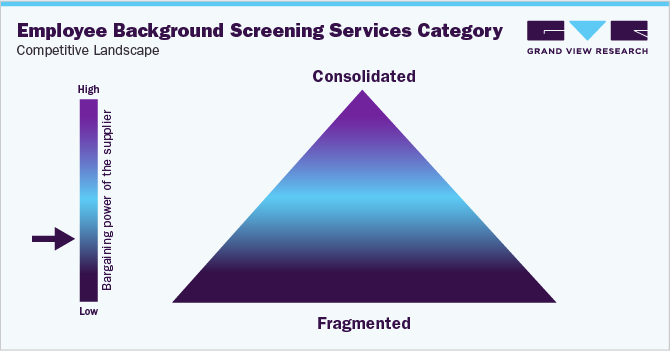

This category is highly fragmented with a large number of small and medium-sized providers and a few large providers. This fragmentation is due to factors such as low barriers to entry, lack of brand loyalty, and the growing demand for background checks. The fragmentation of the category can make it difficult for employers to choose the right provider, leading to price competition and reduced quality of background checks. Businesses face difficulties in obtaining quick background checks due to the time required to complete the necessary checks.

Key suppliers covered in the category:

-

Pinkerton Consulting & Investigations, Inc

-

HireRight, LLC

-

A-Check America Inc.

-

Verity Screening Solutions

-

Capita Plc

-

Triton

-

DataFlow Group

-

Sterling Talent Solutions

-

First Advantage Corporation

-

Accurate Background

Pricing and Cost Intelligence

“What are some of the key cost components or elements involved in the employee background screening services category? Which factors influence the prices?”

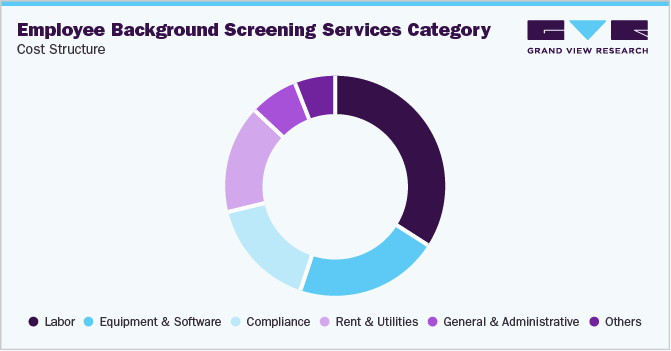

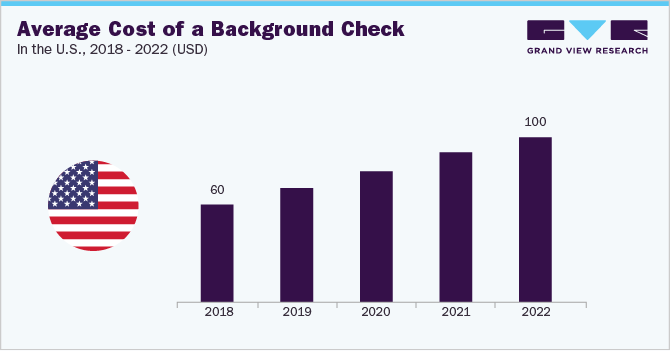

The industry is constituted by labor, equipment and software, compliance, rent and utilities, and general and administrative as the key cost components. Employee background screening services involve financial integrity and criminal record checks, and it is a labor-intensive category. Moreover, it has significant compliance costs due to the high expenses of accessing public records and noteworthy private databases. Public records are often free but may incur fees, while private databases, which are not publicly available, can be more expensive, with criminal background checks have rates ranging from USD 50 to USD 100. ID verification is another key function of employee background screening services. Factors influencing the costs of ID checks include accessing expensive databases, processing, and reporting results, all of which requires specialized skills and software, and compliance with various laws and regulations. The rates of ID verification vary depending on the specific services required and add to the overall cost of the service. Depending on the country and applicant, the rate may be as little as USD 1 or as high as USD 50. There is typically an access fee associated with state-wide criminal record searches in some countries such as the U.S. For instance, the Office of Court Administration in New York levies a USD 98 access fee per application. Agencies provide bundles of plans, from entry-level to premium. Basic plans cost between USD 15 and USD 30 per report which includes basic criminal and identification verification as well as searches of the national criminal database and the sex offender registry. Standard plans cost between USD 30 and USD 60 for each report which includes everything from basic plan along with domestic watch lists, and county criminal courts. Premium plans, which include verifications of employment and education, can range from USD 60 to USD 80 for each report. Depending on the supplier selected, the actual price and records sought will vary.

The following chart provides various costs incurred in this category and the major cost heads are shown below:

In light of the limited budgets allocated to SMEs, many suppliers employ a volume-based pricing model. Employers may find this model particularly useful because the price per background check declines as the number of checks increases based on the number or volume of screenings. This can reduce costs by spreading out fixed costs over a larger number of checks, such as software and databases. Additionally, a volume-based pricing model encourages businesses to conduct more background checks, even on non-high-risk positions, which can improve workplace safety. This model creates a more competitive market for background screening services, as lower prices make it harder for competitors to compete, leading to better prices and services for businesses needing background checks.

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries are the leading sourcing destinations for the employee background screening services category?”

India, Canada, and the United States are the leaders in the employee background screening service market due to their large number of businesses and strong regulatory environment. These countries require strong background checks on their employees, for instance, the Fair Credit Reporting Act (FCRA) in the U.S. They also have a large amount of data available on individuals, making it easier for background screening companies to conduct checks. Additionally, their strong technology infrastructure allows background screening companies to automate the process, making it more efficient and cost-effective. The relatively low cost of conducting background checks in countries such as India makes it more affordable for businesses to conduct background checks. Overall, these countries have a strong regulatory environment that mandates background checks for businesses.

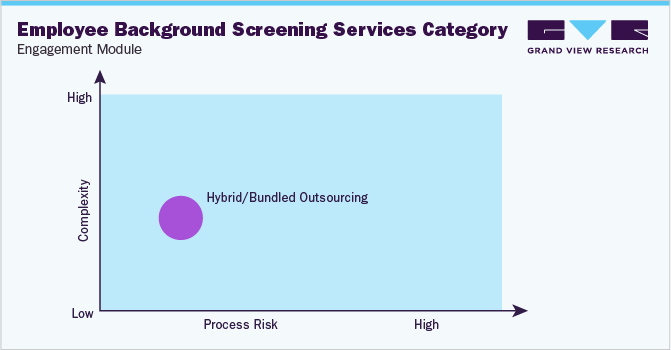

In terms of employee background screening services sourcing intelligence, the hybrid outsourcing engagement model is popular. This model offers numerous advantages for businesses as they can benefit from the expertise of a background screening vendor while maintaining control over the process which involves gathering information about a potential employee's criminal history, education, employment history, and other relevant information. This information is then used to assess the potential employee's suitability for the job. Other benefits include cost savings, increased efficiency, and improved quality. By outsourcing non-core tasks, businesses can free up internal resources, while ensuring accurate and fair checks conducted by a background screening vendor.

In the hybrid outsourcing model, the client outsources some parts of the overall operation to third parties. Generally, critical operations are carried out in-house by the client.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Employee Background Screening Services Procurement Intelligence Report Scope

Report Attribute

Details

Employee Background Screening Services Category Growth Rate

CAGR of 9.9% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

6% - 8% (Annual)

Pricing Models

Volume-based pricing model and flat rate pricing model

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Employment verification, reference check, education verification, criminal background checks, technical specifications, operational capabilities, regulatory standards and mandates, category innovations, and others.

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Pinkerton Corporate Risk Management, HireRight, A-Check America, Verity Screening Solutions, Capita Plc, Triton, DataFlow Group, Sterling Talent Solutions, First Advantage, and Accurate Background

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 11.41 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global employee background screening services category size was valued at approximately USD 5.36 billion in 2022 and is estimated to witness a CAGR of 9.9% from 2023 to 2030.

b. An increase in regulations governing background screening, globalization of the workforce, and growing awareness of the importance of background screening are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India and Canada are the ideal destinations for sourcing employee background screening services category.

b. This category is highly fragmented with the presence of many large players competing for the market share. Some of the key players are Pinkerton Corporate Risk Management, HireRight, A-Check America, Verity Screening Solutions, Capita Plc, Triton, DataFlow Group, Sterling Talent Solutions, First Advantage, and Accurate Background.

b. Labor, equipment and software, compliance, rent and utilities, and general and administrative are the major components of this category.

b. Identifying risk parameters, legal compliance and fairness in execution, and developing appropriate SOPs are some of the best sourcing practices in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified