- Home

- »

- Reports

- »

-

Finance and Accounting Outsourcing Category Report, 2030

![Finance and Accounting Outsourcing Category Report, 2030]()

Finance and Accounting Outsourcing Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Oct, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10549

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Finance and Accounting Outsourcing Category Overview

“The finance and accounting outsourcing category’s growth is driven by increasing demand for automation and digital technologies.”

The finance and accounting outsourcing category is expected to grow at a CAGR of 6% from 2023 to 2030. The category is experiencing a steep decline because of growing economic uncertainties on a global level. An increase in inflation and interest rates has resulted in a decrease in investment volume in this category. Businesses have the potential to improve F&A processes through advancements in data analytics, intelligent automation, artificial intelligence (AI), and blockchain.

The global finance and accounting outsourcing category size was estimated at USD 43.1 billion in 2022. Companies are embracing digital technologies such as artificial intelligence, automation, and many more to improve operations, productivity, data accuracy, cost-cutting, and customer satisfaction experience. Businesses are leveraging AI-powered algorithms to improve their financial operations and gain a competitive edge, from automated invoice processing to AI-driven financial forecasts.

The introduction of cloud technology has changed the way that finance and accounting outsourcing is performed. Cloud-based accounting solutions improve collaboration, security, and scalability by providing real-time access to data. Enabling remote work options and giving a central platform for finance departments and outsourced partners to communicate effortlessly helps the companies eliminate the necessity to have conventional on-premises systems.

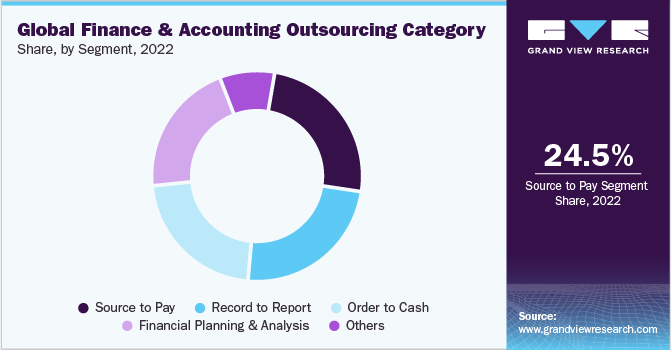

The source-to-pay outsourcing segment holds a 24.5% share of the global market for finance and accounting outsourcing. It includes all accounts payable procedures in their entirety. The nature of these transactions depends on the efficient use of automation and analytics in addition to a domain-specific understanding. The automation journey goes beyond robotic process automation (RPA) to facilitate better decision-making and financial management for businesses to minimize the risks in the supply chain. AI with machine learning and natural language processing (NLP) skills is offered by some service providers. They offer cutting-edge optical character recognition (OCR) technology to make it easier to process paper and digital bills electronically.

Supplier Intelligence

“What are the characteristics of the finance and accounting outsourcing category?

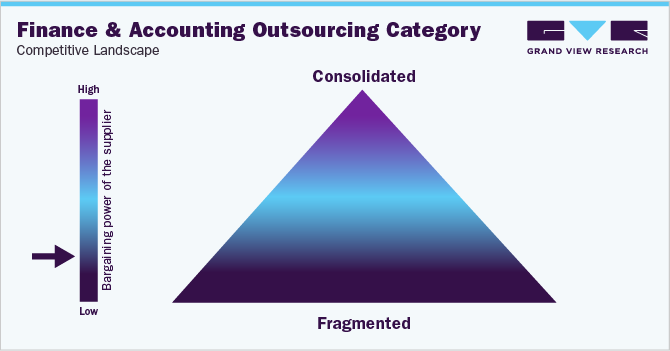

The global finance and accounting outsourcing category is fragmented. The industry encompasses a wide range of services, including accounting and bookkeeping, payroll processing, tax return preparation, auditing, and many more to small, medium, and large enterprises. The category is often driven by the major leading players like Accenture, Capgemini, Genpact, and IBM. There are limited to negligible service providers that can compete with them in terms of end-to-end service delivery capabilities and geographic reach for global/regional engagements. Thus, it limits the buyer’s bargaining power to a moderate level.

The supplier’s bargaining power is at a moderate level as the industry is driven by major players in terms of service providers and its serving industries some being FAO-specific categories. Leading companies like Accenture, IBM, Capgemini, and Genpact made up over 60% of the overall market share. The recent trend followed in this category is that medium-sized businesses tend to collaborate with niche firms to offer integrated services. All competitors compete on the same bases, such as technology and service delivery skills rather than just concentrating on pricing. Therefore, the intensity of rivalry is moderate.

The barriers for new entrants in finance and accounting outsourcing are high as existing players are stronger in terms of ability and reach. Customers tend to work with trusted service providers who are knowledgeable in their fields and can meet a variety of needs. The rising process complexity and huge investment costs are other significant obstacles for new entrants.

Key suppliers covered in the category

-

Accenture Ltd.

-

Capgemini SA

-

Conduent Inc.

-

Fusion Business Solutions (P) Limited.

-

Genpact Ltd.

-

Hewlett-Packard Development Company, L.P.

-

Infosys BPO Limited

-

Meru Accounting

-

International Business Machines Corporation

-

Steria Limited

-

Wipro BPO

-

WNS Global Services

Pricing and Cost Intelligence

“What are some of the major cost components in finance and accounting outsourcing? How are these components impacting the category?”

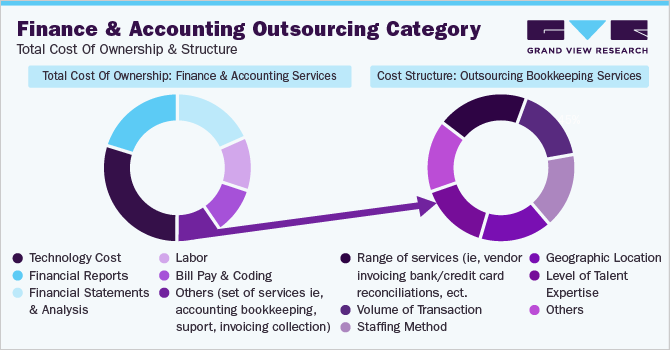

Labor cost, technology cost, financial reports, and financial statements & analysis are essential elements of the cost structure in outsourcing accounting services. Other elements involved are bill pay and coding, a set of other services such as accounting bookkeeping support, invoicing and collection, and budget & cash flow forecast reports. For instance, Ostrow Reisin Berk & Abrams, Ltd., a US-based accounting firm offering basic outsourcing accounting services. The price of the service ranges between USD 400 to USD 500 per month which consists of monthly financial reports and improved financial insights of their clients. The price varies depending upon the services that companies select over and above the basic accounting services. Therefore, for other services which include weekly check-ins with a dedicated team, payroll services, bill pay & general ledger/chart of accounts coding, they charge between USD 2,000 to USD 2,500 per month.

According to a press release by Gartner in 2021, it has been anticipated that 30% to 40% of finance companies are engaging with a single outsourcing company to fulfill their all finance and accounting operations. Companies are increasingly using automation tools to automate complex, dynamic processes that require human judgment for process automation. It will benefit the clients to integrate a single interconnected automation initiative. Buyers are urged to make use of the automation roadmaps that the supplier has built since there is a chance to move to a volume-based pricing model, which is competitively priced and offers more transparency concerning the way costs are calculated.

A fixed pricing method is frequently utilized for the price of the software and technology required to support and supply the services because the supplier typically has a better understanding of the expenses related to these items than the client. Customers usually prefer fixed prices or a volume-based pricing strategy because they want a secure assurance of savings. The supplier has a better understanding, control, and historical knowledge about the transformation and governance task which is considered for a fixed price that impacts the total pricing of services.

Suppliers provide a wide range of services such as end-to-end accounting and bookkeeping services, audit support, financial reporting, tax compliance management, financial planning and analysis, etc. This range of services affects the pricing of finance and accounting outsourcing and varies from supplier to supplier. For instance, the cost of bookkeeping outsourcing services is affected by various components such as recruitment method, geographic location, revenue and headcount, range of services, etc. The cost of outsourcing bookkeeping services ranges from USD 500 to USD 5,000 monthly which can vary depending on the above-mentioned factors.

The report provides a detailed analysis of the cost structure of finance and accounting outsourcing and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries are the leading sourcing destination for finance and accounting outsourcing?”

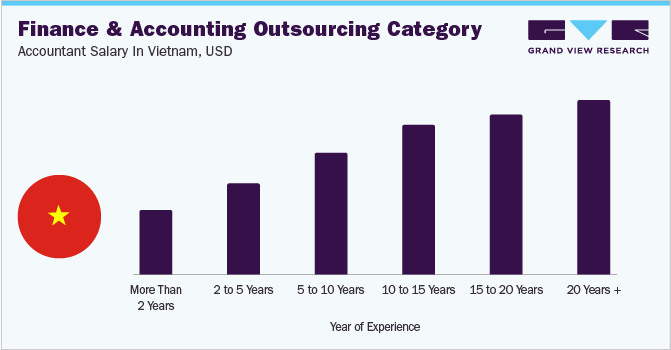

In terms of finance and accounting outsourcing sourcing intelligence, Vietnam, India, and the Philippines are the most preferred countries to source these services. According to the 2019 A.T. Kearney’s Global Services Location Index (GSLI), India and Vietnam are suitable for outsourcing as it has large labor availability, high financial attractiveness, and favorable business environments. This is the reason which made these two countries beneficial as compared to Malaysia and Thailand. Vietnam consists of a highly trained workforce with diplomas and certificates.

The factor that helped Vietnam to be considered as one of the ideal destinations for sourcing is labor availability. The employee in Vietnam is highly motivated to upskill and upgrade their employment condition which has helped them to rapidly increase their salary rates. For instance, the accountants who have 2 years of experience salary ranges from USD 271.6 which increases by 42% for accountants having 2 to 5 years of experience.

In March 2021, a PwC report on Vietnam's digital readiness indicated that approximately 90% to 93% of the workforce are learning new skills, which will further improve their employment options and ability to work in different kinds of roles. Outsourcing the service will help the companies to have a seamless recruitment and onboarding process, as well as save time and money on training labor as outsourcing consists of trained and experienced talents.

“The hybrid outsourcing model envisages the client outsourcing some part of the overall operation to third parties. Generally, suppliers tend to retain critical operations in-house.”

A hybrid/bundled outsourcing model is the most common form of the engagement model adopted by various companies. In some cases, finance and accounting outsourcing is classified as business process outsourcing and refers to managing the processes that enhance the day-to-day operations of a company. To examine the changes, difficulties, and advantages of outsourcing finance and accounting services, the majority of firms start with very repetitive, highly transactional tasks. For instance, Accounts Receivable and Accounts Payable are two of these transactional processes that are frequently outsourced. These manual procedures are usually given to entry-level accountants on the accounting team. As employees advance in their careers, new talent must be found to replace those jobs, which results in downtime, lost productivity, and increased costs for recruiting and training new team members. A normal bookkeeping process requires a significant amount of time and money under an in-house arrangement model. Because a third-party provider handles talent sourcing, training, and deployment, using an outsourced approach helps to lighten the load. A few other popular tasks that are frequently outsourced under this category are compliance, financial planning and analysis, debt management, and audit reporting.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Finance and Accounting Outsourcing Procurement Intelligence Report Scope

Report Attribute

Details

Finance and Accounting Outsourcing Category Growth Rate

CAGR of 6% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

4% - 5% (Annually)

Pricing Models

Fixed pricing model and volume-based pricing

Supplier Selection Scope

End-to-end service, cost and pricing, compliance, service reliability, and scalability

Supplier Selection Criteria

Range of services, technology usage, certification, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Accenture Ltd., Capgemini SA, Conduent Inc., Fusion Business Solutions (P) Limited., Genpact Ltd., Hewlett-Packard Development Company, L.P., Infosys BPO Limited, Meru Accounting, International Business Machines Corporation, Steria Limited, Wipro BPO, and WNS Global Services

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 68.7 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global finance and accounting outsourcing category size was valued at approximately USD 43.1 billion in 2022 and is estimated to witness a CAGR of 6% from 2023 to 2030.

b. The increasing demand for cloud-based accounting solutions, automation, and digital technologies such as data analytics, intelligent automation, artificial intelligence (AI), and blockchain are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, Vietnam, India, and the Philippines are the ideal destinations for sourcing finance and accounting outsourcing services.

b. This category is fragmented with a mix of global, regional and local players capable of providing wide range of services, including accounting and bookkeeping, payroll processing, tax return preparation, auditing, and many more. Some of the leading players are Accenture Ltd., Capgemini SA, Conduent Inc., Fusion Business Solutions (P) Limited., Genpact Ltd., Hewlett-Packard Development Company, L.P., Infosys BPO Limited, Meru Accounting, International Business Machines Corporation, Steria Limited, Wipro BPO, and WNS Global Services.

b. Technology cost, labor cost, financial reports, as well as financial statements and analysis are the major key cost components of this category. Other elements involved in cost include bill pay & coding, and others (a set of services selected such as accounting bookkeeping support, invoicing, and collection) as well as budget and cash flow forecast reports.

b. Identifying suppliers that are equipped with experienced teams, high-quality AI-powered technology, and capable of providing detailed financial reports are some of the best practices for sourcing this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified