- Home

- »

- Reports

- »

-

Global HVAC Systems Procurement Intelligence Report, 2030

![Global HVAC Systems Procurement Intelligence Report, 2030]()

HVAC Systems Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Oct, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10548

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Global HVAC Systems Category Overview

“The global HVAC systems category’s growth is driven by increasing demand for energy efficiency systems and growing construction activities due to industrialization and urbanization.”

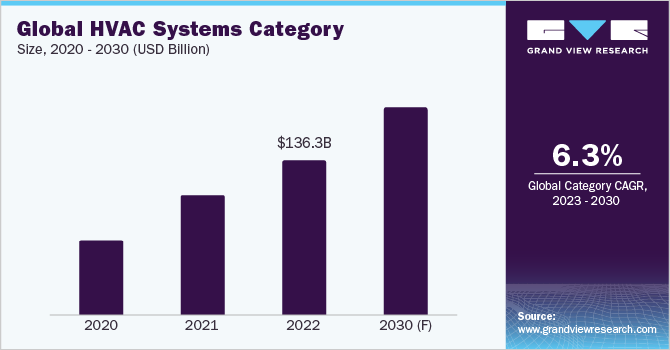

The global HVAC systems category is expected to grow at a CAGR of 6.3% from 2023 to 2030. There is a growing need for sustainable and energy-efficient buildings that utilize HVAC systems, which is in turn driving the growth in this category. The HVAC systems are designed to reduce the carbon footprints of buildings and mitigate the effects of global warming, enabled by energy-efficient and programmable thermostat components. The growing construction activities in industrial and residential sectors are also fueling the growth due to increasing population, industrialization, and urbanization. The HVAC system plays a vital role in building construction because of its heating and cooling solution as well as capability to preserve indoor air quality which is one of the major focus areas demanded by the companies.

The global HVAC systems category size was estimated at USD 136.3 billion in 2022. The category’s growth is boosted owing to the adoption of various innovative trends and advancements in technology such as smart HVAC technology, IoT, automation software to enhance operation, geothermal and ductless HVAC systems, zoning systems, and others. For instance,

-

Smart HVAC technology minimizes operation and energy costs and enables greater cover over building systems. This technology is equipped with sensors in the thermostat, compressor, and other locations. These sensors can help to adjust temperature, humidity, and airflow in different zones (depending on data from the sensors) to maximize comfort while reducing the usage of energy. For instance, in February 2023, Hitachi, a Japan-based company introduced air365 Max solutions for architects, HVAC specialists, and building proprietors combined with its original technology SmoothDrive 2.0 to lower CO2 emissions.

-

Ductless HVAC Systems are quickly replacing traditional systems because of their high efficiency, zoning capability, and ease of installation. In May 2023, the Toshiba Carrier Corporation (TCC), another Japan-based company launched its new Digital Invertor (DI) series in China. The series is created for commercial use which is an energy-efficient and ductless split air conditioning system.

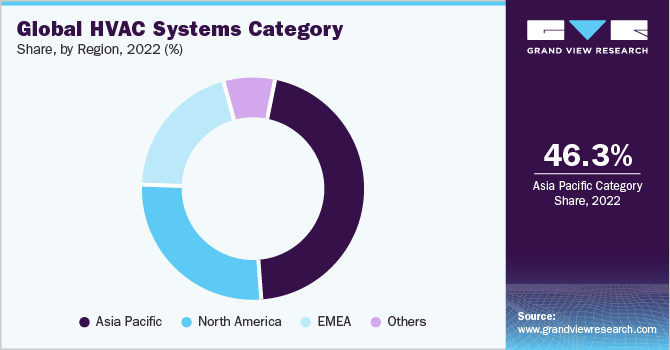

In 2022, Asia Pacific held a 46.3% revenue share and led the HVAC systems market. The region has experienced enormous growth throughout the years due to growing population, urbanization, and rising consumer disposable income to spend on advanced technology.

Supplier Intelligence

“What are the characteristics of the global HVAC systems category?”

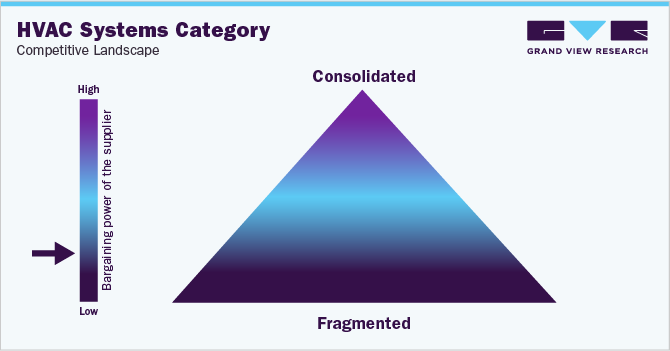

The global HVAC systems category is highly fragmented. The industry encompasses several major players such as Carrier Corporation, Daikin Industries, Ltd., Johnson Controls International plc, and Trane Technologies. This fragmentation is often driven by technological advancement focusing on energy-efficient, smart connected systems, smart homes, and sustainable HVAC systems. The bargaining power of suppliers is limited as supplier concentration is high and product/service differentiation is low. Therefore, the suppliers compete on prices to gain business.

The threat of new entrants in HVAC systems is low as the category is highly capital-intensive which requires substantial investment for various activities such as marketing, distribution, manufacturing, as well as for research and development purposes. Also, leading players in this category tend to create difficulty for new firms to enter as major players already benefit from intellectual property, economies of scale, and customer loyalty.

Key suppliers covered in the category:

-

Arkema Group

-

Carrier Corporation

-

Daikin Industries, Ltd.

-

Emerson Electric Co.

-

Hitachi Ltd.

-

Honeywell International Inc.

-

Johnson Controls International Plc

-

Lennox International, Inc.

-

Mitsubishi Electric Corporation

-

Trane Technologies

Pricing and Cost Intelligence

“What are some of the major cost components in global HVAC systems? How are these components impacting the category?”

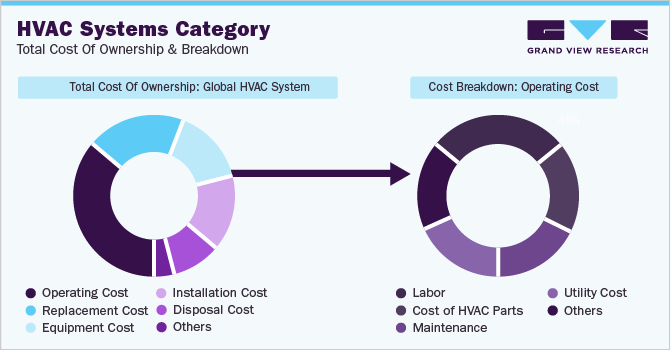

Operating cost, equipment cost, replacement cost, installation cost, and disposal cost are some of the cost components involved in HVAC systems. Other additional costs involved are insulation, asbestos removal, location of systems, seasonal energy efficiency ratings (SEER), annual fuel utilization efficiency (AFUE) rating, and permit cost. The operating cost consists of labor, maintenance, utility costs, cost of HVAC parts, and others.

According to the U.S. Census Bureau, more than 44% of existing housing in the United States was constructed before 1970. Home and business owners will eventually need to think about replacing their heating and cooling systems by installing new systems because most of them have a functioning lifespan of around 20 years in residential and commercial buildings. The installation depends on various factors such as the type of AC system, system installation locations i.e., zoning, equipment size, and cooling capacity. For instance, labor is highly required for installing the system and equipment. The labor cost for installing a new HVAC system is between USD 75 and USD 150 per hour. The cost will vary based on the cost of living in the client's area, the demand for HVAC installers, and the cost of specialists for trenching or working on old houses.

The Seasonal Energy Efficiency Ratio (SEER) is one of the most crucial characteristics used to differentiate HVAC systems. The SEER rating system, developed by the Air Conditioning, Heating, and Refrigeration Institute (AHRI), measures the effectiveness of air conditioning systems by taking into account both the cooling output of a unit and the total electrical energy used throughout a season. The greater the SEER rating, the unit is highly energy efficient. The cost of the unit increases with an increase in the SEER rating. However, the operating costs of the units that deliver more energy savings and operational efficiency are often lower. The federal government of the United States mandates that air conditioners maintain a minimum 13 SEER rating and a maximum 28 SEER rating.

The report provides a detailed analysis of the cost structure of global HVAC systems and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which countries are the leading sourcing destination for the global HVAC Systems category?”

Asia-Pacific is the major region that dominated the category due to urbanization and industrialization in this region. In terms of HVAC systems sourcing intelligence, China, Japan, and India are the most preferred countries to source these systems. The increasing population and rapid urbanization in these countries have increased the demand for residential and commercial spaces which require these systems to be installed. This necessity to install these systems in new buildings has boosted the demand for smart and environmentally friendly HVAC solutions. Suppliers are concentrating on offering energy-efficient air conditioning and ventilation systems in small packages to further enhance their market share in fast-growing countries. It increased the integration of air conditioning systems in the medium and small residential and non-residential segments.

Regulations programs and efficiency norms such as Energy Conservation building codes in India, the Commercial Building Disclosure (CBD) Program, and the Indian Society of Heating, Refrigerating, and Air-Conditioning Engineers (ISHRAE) are also enhancing the HVAC system category in these countries.

China witnessed the greatest worldwide growth in energy consumption for space cooling due to rising income levels and an increase in demand for thermal comfort. China dominated the air conditioner (AC) market worldwide. China had a positive trade balance of $2.01 billion in June 2023 with air conditioner exports amounting to $2.06 billion and imports amounting to $49.6 million. China’s major exports to Japan, the U.S., Iraq, Saudi Arabia, and South Korea whereas air conditioners are mostly imported from Germany, Japan, Thailand, South Korea, and the U.S.

The growing demand for HVAC system models such as mini-split ACs and more energy-efficient variable-speed inverter technology has led China to hold a dominant position in the global market for air conditioners (ACs). China is the market leader in this sector due to factors including rising population, urbanization, and consumer disposable income. Further, affordability, climate change, and altered tenant behavior will lead to an increase in cooling energy demand. Improved building design and system management combined with energy-efficient air conditioning can stabilize the amount of power used for cooling while also having positive effects on the economy, human health, and the environment. Driving energy-efficient cooling in buildings requires effective government regulation. China can save a lot of money and energy by implementing a comprehensive national policy guidance that includes legislation and business incentives.

“The hybrid services outsourcing model envisages the client outsourcing some part of the overall operation to third parties. Generally, suppliers tend to retain critical operations in-house.”

A hybrid outsourcing model is the most common form of the operating model due to its potential for higher value creation. Companies tend to outsource some parts such as raw materials/equipment to external vendors and keep the HVAC system operation, installation, or disposal process in-house. It will help to reduce cost, optimal operational efficiency, scalability of on-demand labor, flexible pricing, standardized processes, and increased effectiveness as well as productivity. In this model, HVAC service providers must have certificates such as R-410A Certification, Indoor Air Quality certification (IAQ), and EPA Certifications for HVAC Technicians, and should meet various other predefined sets of qualifications.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Global HVAC Systems Procurement Intelligence Report Scope

Report Attribute

Details

Global HVAC Systems Category Growth Rate

CAGR of 6.3% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

3% - 5% (Annually)

Pricing Models

Flat-rate pricing

Supplier Selection Scope

End-to-end service, cost and pricing, compliance, service reliability, and scalability

Supplier Selection Criteria

Equipment, implementation, HVAC technology, certification, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Arkema Group, Carrier Corporation, Daikin Industries, Ltd., Emerson Electric Co., Hitachi Ltd., Honeywell International Inc., Johnson Controls International plc, Lennox International, Inc., Mitsubishi Electric Corporation, and Trane Technologies

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 234.94 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global HVAC systems category size was valued at approximately USD 136.3 billion in 2022 and is estimated to witness a CAGR of 6.3% from 2023 to 2030.

b. The increasing demand for energy efficiency systems and growing construction activities, urbanization and technology advancements such as smart HVAC technology, and IoT are driving the growth of this category.

b. According to the LCC/BCC sourcing analysis, China, Japan, and India are the ideal destinations for sourcing global HVAC systems.

b. This category is highly fragmented with the presence of large players such as Arkema Group, Carrier Corporation, Daikin Industries, Ltd., Emerson Electric Co., Hitachi Ltd., Honeywell International Inc., Johnson Controls International plc, Lennox International, Inc., Mitsubishi Electric Corporation, and Trane Technologies. This fragmentation is often driven by technological advancement focusing on energy-efficient, smart connected systems, smart homes, and sustainable HVAC systems.

b. Operating cost, equipment cost, replacement cost, installation cost, and disposal cost are some of the cost components involved in HVAC systems. Other additional costs involved are insulation, asbestos removal, location of systems, SEER (seasonal energy efficiency ratings), AFUE (annual fuel utilization efficiency) rating, and permit cost.

b. Identifying suppliers equipped with smart technologies, increasingly stringent sustainability regulations, and fastener-managed inventory are some of the best practices for sourcing this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified