- Home

- »

- Reports

- »

-

Management Consulting Sourcing Intelligence Report, 2030

![Management Consulting Sourcing Intelligence Report, 2030]()

Management Consulting Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Nov, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10559

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Management Consulting Category Overview

“Changing business landscape due to technological advancements and increasing demand for specialized expertise are accelerating the growth of the management consulting category.”

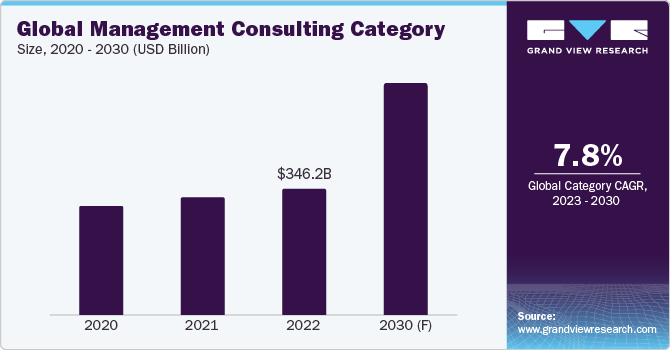

The management consulting category is expected to grow at a CAGR of 7.8% from 2023 to 2030. The consulting industry has revolutionized with automation and technological advancements in the process. As companies continue to adopt digital transformation, there will be an increased demand for technology-driven consulting. Technology such as artificial intelligence (AI), data analytics, and machine learning (ML) are driving category growth to help clients solve complex business problems. Technology-driven services help businesses automate manual processes, make better data-driven decisions, and improve overall performance.

In today's business landscape, there is a growing demand for consultants who specialize in balancing profitability with a strong sense of purpose and ethical values. This emerging trend of purpose-driven consulting has become a key focal point for firms. Purpose-driven consulting service involves guiding clients on aligning their corporate strategies with their fundamental values and mission, and on how to make a positive impact on both society and the environment. Purpose-driven consulting also equips businesses to adeptly address complex social and environmental challenges, including climate change and social inequality, while concurrently creating value for all stakeholders.

The global management consulting category size was valued at USD 346.2 billion in 2022. As the ESG issues are rising, Businesses need consultants to tackle these the rising ESG issues. As a result, firms are now expanding their offerings to include ESG services, aiding clients in evaluating and managing the effects of their operations in these areas. These services encompass the development of sustainability strategies, ESG reporting, engaging with stakeholders, and conducting impact assessments.

The growing importance of ESG in consulting is rooted in the increasing awareness of how business practices can affect the environment, society, and governance. Companies following ESG standards are expected to promote environmental sustainability by enhancing energy efficiency, reducing carbon footprint, and waste generation. However, companies not following standards can face legal and regulatory risks, penalties, reputational damage, and other challenges. As a result, clients are actively seeking consultants capable of helping them incorporate ESG considerations into their business strategies, recognizing the potential impact of ESG performance on their business.

The pandemic accelerated remote work, prompting firms to adapt and offer remote services to meet client needs. The significance of remote consulting lies in its capacity to grant clients access to a broader spectrum of services, regardless of their location. Additionally, it enables firms to extend their services to new geographic areas while cutting down on expenses linked to travel and on-site consulting. Remote services offer clients enhanced flexibility and convenience by allowing them to access services from the convenience of their office or home and reducing disruptions to their operations.

Supplier Intelligence

“What are the characteristics of the management consulting category?”

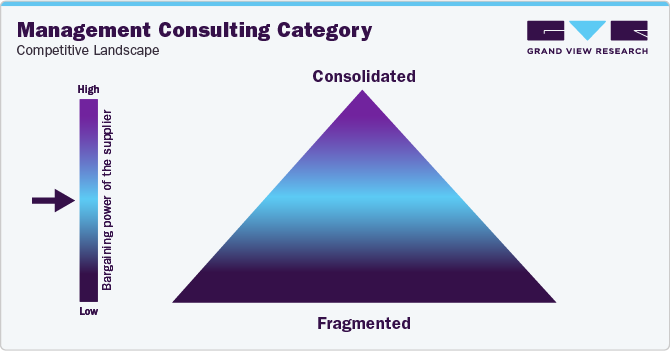

The global management consulting category is moderately consolidated. Most of the tier 1 and tier 2 firms are competing among themselves by offering specialized services to meet the needs of their clients. Additionally, due to rising technological advancements, companies are partnering with tech companies to provide clients with technology-driven services. For instance, in October 2023 Boston Consulting Group (BCG) entered a strategic partnership with Anthropic, an artificial intelligence startup. The partnership with Anthropic will help the BCG and its clients access Claude, Anthropic’s competitive AI assistant product to Open AI. BCG’s client team can utilize Claude to combine long-form documents and research.

Suppliers having highly skilled consultants with specialized knowledge hold substantial bargaining power. Consulting firms must retain and attract top talent to maintain their competitive edge, leading to intense competition for skilled professionals. The bargaining power of suppliers is moderate to high as tier 1 and tier 2 firms account for more than 60% of the market share.

Key suppliers covered in the category:

-

Boston Consulting Group

-

Bain & Company

-

McKinsey & Company

-

KPMG

-

PWC

-

Alvarez & Marsal

-

Oliver Wyman

-

A.T. Kearney

-

L.E.K. Consulting

-

Accenture

Pricing and Cost Intelligence

“What are some of the major cost components in management consulting? How are these components impacting the category?”

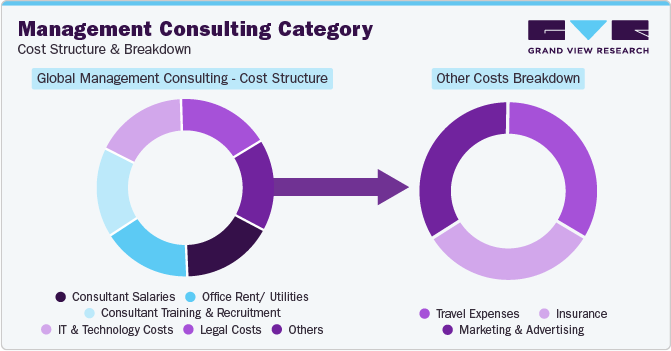

Consultant salaries, office rent/utilities, consultant training, and recruitment, IT & technology costs, and legal costs are some of the costs incurred in providing the services. The other costs include travel expenses, marketing & advertising, and insurance. Consultant salaries, office rent/utilities, consultant training & recruitment, and IT costs are the major cost components. Office rent and utilities can cost around USD 2,000 - USD 5,000 per month depending on the location of the firm. As compared to large corporations, IT costs for startups which include computers, software, and servers can be significantly high. According to the FINMODELSLAB 2023 report, IT costs can range from USD 10,000 to USD 50,000 for small firms. Firms can also incur technology-related costs such as cloud-based subscription fees, website development, and cybersecurity measures.

The cost of recruiting and training a consultant can vary depending on factors such as level of expertise, scope of work, and location. The training cost also depends on the length, complexity, and type of training. According to FINMODELSLAB Report 2023, training a consultant in the U.S. can cost around USD 7,500 - USD 12,000 per consultant. It is necessary to select an appropriate training program that aligns with the consulting firm’s objective. Firms in the category need to comply with legal requirements and regulations governing the industry. Generally, in the U.S. legal costs for setting up a firm can be between USD 2,000 - USD 7,000.

The following chart below indicates the annual base salaries of top consulting firms in 2023:

According to the Management Consulted 2023 report, 2023 was a big year for firms in the category as they increased starting salaries for undergraduate, and master’s students substantially as compared to 2022 due to increasing hiring by consulting firms. The average base salary of the top consulting firms such as Alvarez & Marsal, Bain & Co., and Mckinsey & Co., is around USD 112,000 to USD 129,000 per year.

The different ways the firm charges their clients can be on an hourly basis, daily basis, project-based, flat charges, retainer-based, performance-based, or value-based pricing. Value-based pricing is the price charged by the firm based on the value that the firm brings to the client’s business. Some companies also use the hourly fee method as it is simple and common. They charge a fixed amount for each hour the firm works on the project.

The report provides a detailed analysis of the cost structure of management consulting and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What are some of the best sourcing practices considered for management consulting?”

North America and Europe region dominated the consulting industry accounting for more than 80% of the market in 2022. According to the IBIS World 2023 report, in the U.S. the number of firms in the category has grown by 2.6% each year from 2018 to 2023. According to a trendstatistics.com report, more than 1.12 billion companies in the U.S. offered management consulting services in 2022. The rising number of companies in the country is driving the demand for services to manage complex problems.

India, China, and Canada are the preferred countries for sourcing consulting services due to offshoring by developed countries. These countries have competitive edges such as strong skills, huge talent pools, and significant cost advantages. The sector in India is rapidly expanding and has been achieving unprecedented success. Over the past few years, there has been a significant increase in the demand for specialized services from both Indian and international clients. As of 2023, there are over 47,000 Indian firms offering services in IT, healthcare, and manufacturing consulting. The industry has witnessed the fastest growth due to increasing investment activities and the relaxation of FDI restrictions.

Additionally, Hong Kong stands as a prominent hub for the category in China, drawing in globally acclaimed consulting firms due to its esteemed position as one of the world's top business centers. Mainland China is seen as having the greatest growth prospects for Hong Kong's services. There is an anticipated high demand for consultancy services related to operations and process management, as well as corporate and business strategy.

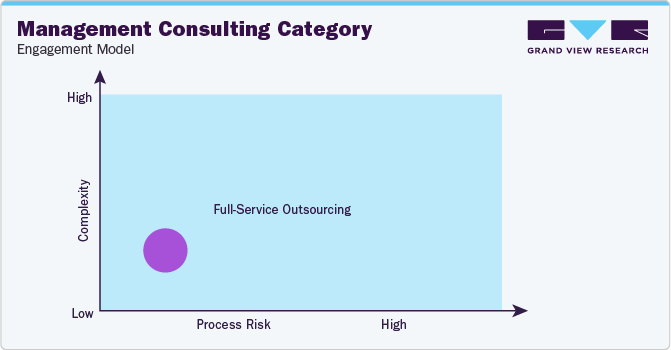

“The full services outsourcing model envisages the client outsourcing the complete operations/manufacturing to single or multiple companies.”

The full services outsourcing model is the most common management consulting sourcing intelligence practice rather than relying on the in-house team. Outsourcing provides industry expertise, a fresh perspective, and cost-effectiveness. Companies usually outsource functions like HR, IT, finance, taxation, and even company operations. Management consultants help in filling the gap that their clients face due to business-related shortcomings. They can provide tactical solutions and advisory services to their clients, relying on authentic data, and advanced statistical tools. These solutions demand investments in manpower, infrastructure, and proprietary software, which can be financially challenging for the companies. Outsourcing data collection and research tasks to a specialized team enables firms to gain valuable insights without the need to hire permanent staff or invest extensive time and resources in the process.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Management Consulting Procurement Intelligence Report Scope

Report Attribute

Details

Management Consulting Category Growth Rate

CAGR of 7.8% from 2023 to 2030

Base Year for Estimation

2022

Pricing growth Growth Outlook

5% - 15% (Annually)

Pricing Models

Value-based pricing, service-based pricing, competition-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Services provided, end-to-end services, project timeline, global reach, regulatory compliance, operational capabilities, quality measures, certifications, data privacy regulations, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Boston Consulting Group, Bain & Company, McKinsey & Company, KPMG, PWC, Alvarez & Marsal, Oliver Wyman, A.T. Kearney, L.E.K. Consulting, Accenture.

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 631.4 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global management consulting category size was valued at approximately USD 346.2 billion in 2022 and is estimated to witness a CAGR of 7.8% from 2023 to 2030.

b. The changing business landscape due to rising complex regulations and business practices and the increasing adoption of technology such as artificial intelligence, and data analytics in consulting processes are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis India, China, and Canada are the ideal destinations for sourcing management consulting.

b. This category is moderately consolidated as tier 1 and tier 2 consulting firms account for almost 60% of the market share. Some of the key players are Boston Consulting Group, Bain & Company, McKinsey & Company, KPMG, PWC, Alvarez & Marsal, Oliver Wyman, A.T. Kearney, L.E.K. Consulting, and Accenture.

b. Consultant salaries, office rent/utilities, consultant training, and recruitment, IT & technology costs, and legal costs are some of the key cost components of this category. The other costs include travel expenses, marketing & advertising, and insurance.

b. While procuring management consulting services, companies evaluate suppliers based on their ability to offer various types of consulting services, and whether they can offer end-to-end services. Other considerations include the time taken to research and provide solutions to the problem, the firm’s reputation, and experience in the field. Clients also seek how much data transparency the firm keeps with the clients, and whether firms adhere to thorough standards and guidelines.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified