- Home

- »

- Reports

- »

-

Mobility - Voice and Data Sourcing Intelligence Report, 2030

![Mobility - Voice and Data Sourcing Intelligence Report, 2030]()

Mobility - Voice and Data Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Mar, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10579

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Mobility - Voice and Data Category Overview

“Rising deployment of 5G and surge in the number of mobile subscribers are fueling the category’s growth.”

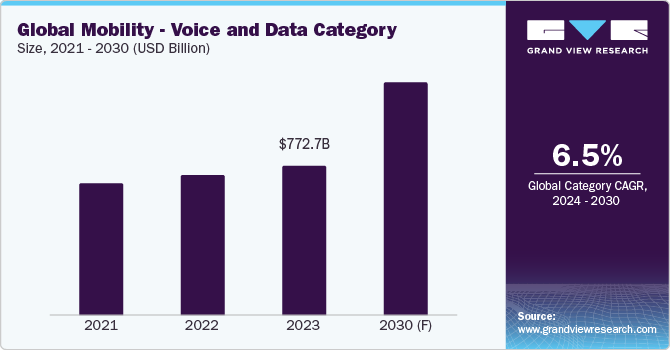

The global mobility - voice and data category is anticipated to grow at a CAGR of 6.5% from 2024 to 2030. This growth is attributed to factors such as the rising expenditure on deployment of 5G infrastructure, surge in the number of mobile subscribers, elevated demand for high-speed voice and data connectivity, and adoption of managed mobility services. A few of the key challenges being faced by the category are complex regulatory framework, high capital investments and license fees, and difficulties in maintaining network security.

Business customers are implementing these services via cloud or on-premise platforms as managed or enterprise services wherein end-to-end management is outsourced. Moreover, a shift towards virtualization and software-defined networking (SDN) is streamlining network management and enhancing flexibility in the telecom sector, paving the way for more agile and scalable infrastructures.

In terms of commercial end-use, these services are utilized by various industries such as BFSI, retail and e-commerce, healthcare, education, and hospitality & tourism. For instance, mobility in healthcare is essential for patient communication and accessing electronic health records. Mobility in retail and e-commerce is required for customer interaction, inventory management, and mobile payments.

The global mobility - voice and data category was valued at USD 772.7 billion in 2023. The demand in the category surged during the COVID-19 pandemic, wherein voice and data requirements increased substantially due to remote working environments, travel restrictions, and government-imposed lockdowns. Key players are currently focusing on 5G deployment which uses VoNR (Voice over New Radio) technology. Key benefits of 5G include lower latency, increased bandwidth, and higher capacity. Services such as enterprise mobility and managed mobility are currently witnessing robust growth due to increased demand for outsourcing/management of services from various commercial entities.

Key technologies driving the growth of this category include Artificial Intelligence (AI) and Machine Learning (ML), quantum computing, edge computing, cloud computing and virtualization, and Internet of Things (IoT) integration. AI and ML enable users to enhance operations and user experience by predicting network congestion, automatically rerouting traffic, and maintaining seamless connectivity. It also provides users with personalized experiences by leveraging data analytics to understand the behaviors and preferences of consumers. Quantum computing ensures ultra-secure data transmission and enhances encryption for consumers. It also plays a key role in optimizing data security and improving network performance by processing large amounts of data per second. Moreover, it enables predictive maintenance which enables a reduction in operational costs. Additionally, it performs simulations for network design and capacity planning.

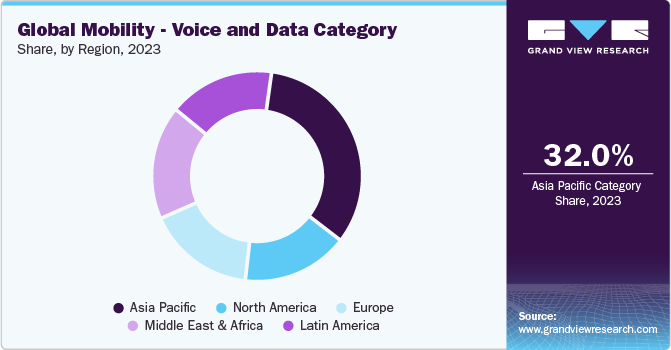

Asia Pacific dominates the global category, accounting for 32% of the global market share. This growth is attributed to a large number of mobile subscribers, rising adoption of the 5G network, demand for enterprise mobility services, and adoption of cloud-based mobility services. North America holds the second-largest share of the global market. Key growth drivers for this region include high adoption of 5G networks, increasing deployment of IoT and cloud-based services, and large-scale mobile connectivity. Asia Pacific is anticipated to witness the fastest growth rate during the forecast period, due to rapid digitalization, surge in mobile usage, and high demand from commercial end-users.

Supplier Intelligence

“What best describes the nature of the Mobility - voice and data category? Who are some of the main participants?”

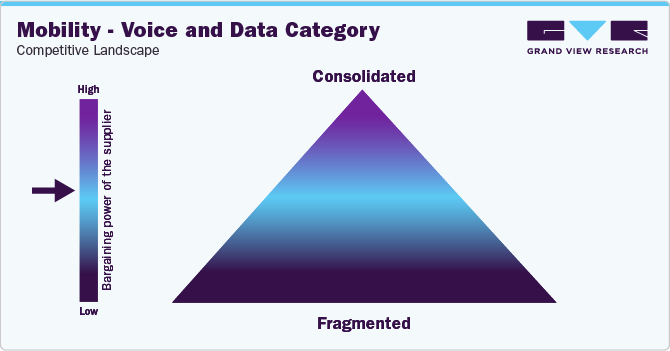

The global mobility - voice and data category is moderately consolidated, with a few top competitors accounting for a significant portion of the market share. The market can also be said to be oligopolistic. Top players in this category are expanding their market share by service diversification and strategic acquisitions. For instance, top players are offering integrated services by combining traditional mobility - voice and data services with emerging services such as cloud computing, cybersecurity, and artificial intelligence. Key players compete based on pricing, technological innovations, customer experience, and data security.

Specifically, mobility - voice and data service providers are prioritizing the development of edge computing infrastructure to support the growing demand for high-bandwidth and low-latency applications and services, facilitating more efficient data processing and delivery at the network edge. Moreover, service providers are intensifying their focus on sustainability and environmental measures by deploying initiatives to reduce carbon emissions, minimize electronic waste, and enhance energy efficiency throughout their operations and supply chains. Customers who are buying these services offered in the category are focusing on quality of service, reliability and uptime, speed and bandwidth, and network coverage. Additionally, customers are looking for personalized experiences from service providers, consisting of customized speed requirements, scalable bandwidth capacity, add-on features, collaboration tools, and dedicated customer support.

A few of the key metrics used by business customers to measure the performance of mobility - voice and data service providers include Average Revenue Per User (ARPU), churn rate, and subscriber growth. Commercial end-users usually require various features such as call routing, data integration linking, caller identification, call monitoring, automatic call attendant, and usage reporting under the spectrum of mobility - voice and data services. Additionally, business customers may require features such as LAN (local area network), WAN (wide area network), advanced networking applications, and voice & data cabling to link remote sites. Accordingly, business customers may select an appropriate service provider, while also considering aspects such as voice and data quality, pricing, flexibility, and customer support.

Key suppliers covered in the category:

-

AT&T Inc.

-

Broadcom Inc.

-

Charter Communications, Inc.

-

Cisco Systems, Inc.

-

Comcast Corporation

-

Deutsche Telekom AG

-

Huawei Technologies Co., Ltd.

-

Lumen Technologies, Inc.

-

Orange S.A.

-

Telefónica S.A.

-

Verizon Communications Inc.

-

Vodafone Group Plc.

Pricing and Cost Intelligence

“What is the cost structure for Mobility - voice and data Services? What variables affect the prices?”

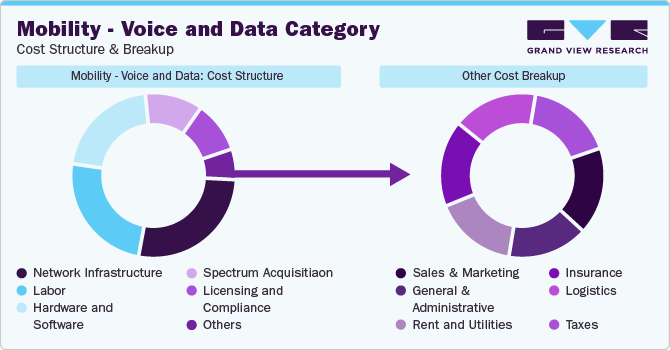

The cost structure of the global mobility - voice and data category is constituted by network infrastructure, labor, hardware and software, spectrum acquisition, licensing and compliance, and other costs as the key components. Other costs are further bifurcated into sales and marketing, general and administrative, rent and utilities, insurance, logistics, and taxes. Network infrastructure costs constitute the major chunk in the cost structure, followed by labor costs.

The prices of mobility - voice and data services are influenced by several variables. Key factors affecting the pricing include network infrastructure costs (such as installation costs of towers), investments in the upgrades of technologies, costs of acquiring spectrum, and licensing and compliance expenses. Significant costs are incurred by mobility - voice and data service providers in upgradation of hardware and software. For instance, upgrades from VoLTE (4G) to VoNR (5G) requires considerable investment. Moreover, technologies such as AI and ML, quantum computing, and cloud computing involve significant deployment costs. Spectrum prices directly affect the overall costs and investments of these service providers. When Governments levy excessive rates for spectrum acquisition, it drains the capital of service providers and may drive up service fees. Moreover, this factor can also affect service quality and consumer impact.

Service providers of mobility - voice and data may use several pricing structures. A key pricing structure being used is penetration pricing. In this pricing model, service providers initially charge lower rates to interest customers and gain market share. It is used to create brand loyalty and to differentiate from other service providers. Penetration pricing is a quick way to gain new customers and drive out competition. However, this pricing model may result in short-term losses for service providers. Moreover, it may lead to price wars among key service providers and customers may leave once prices are increased. Prices of mobility - voice and data vary according to geographic location. In 2023, the average prices per GB of datain the U.S. were in the range of USD 5.5 - USD 6.5. The average prices in the U.K. were in the range of USD 0.5 - USD 0.7. The average prices in India were in the range of USD 0.1 - USD 0.2.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“How do Mobility - voice and data service providers engage? What is the type of engagement model?”

In terms of global mobility - voice and data category sourcing intelligence, customers commonly follow a full services outsourcing model to engage with service providers. In this model, customers outsource the complete service scope to single or multiple service providers. Full services outsourcing helps customers to minimize operational costs, improve operational efficiency, and gain access to an expert team. Moreover, it also helps customers leverage advanced technologies and ensure flexibility and scalability in services. Additionally, it also enables customers to optimize risk management, obtain round-the-clock customer support, ensure regulatory compliance, and increase focus on core activities. Clients prefer signing long-term contracts with service providers for increased security, stability, dedicated support, and reinforcement of partnerships. Moreover, long-term contracts also assure suppliers of revenue stability, customer retention, and reduction in costs of sales. However, in a few instances, clients may opt for medium-term or short-term contracts with service providers for ad-hoc requirements.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

Customers in the mobility - voice and data category prefer to source services locally to comply with regulatory requirements and simplify logistical challenges. Within Asia Pacific, Israel is the most cost-effective country for this category. Israel is a low-cost destination due to its high smartphone adoption, intense market competition, deployment of penetration pricing, robust government initiatives, and low technology costs. Moreover, Israel is anticipated to witness significant market expansions and innovations in this category during the forecasted period. The mobility - data market in Israel was valued at USD 2 billion in 2023 and is anticipated to rise to USD 2.6 billion in 2028. Service providers in Israel are continuously improving their network coverage capacity and upgrading their technological expertise to meet the growing demand.

Within Asia Pacific, India, China, Malaysia, and Vietnam are among the other cost-effective countries for business customers. These countries provide low-cost voice and data business plans and have adequate infrastructure investments and government initiatives to support a wide customer base at economical rates. Moreover, these countries also have low labor, technology, and spectrum acquisition costs. In 2023, the average cost per GB of data in these countries was in the range of USD 0.1 - USD 0.4 (considering data costs for business customers). Within the European region, Italy and France are the low-cost countries due to supportive legislation and policies. In the South American region, Brazil, Peru, and Uruguay are the low-cost countries, due to a favorable regulatory environment and robust infrastructure.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Mobility - voice and data Category Procurement Intelligence Report Scope

Report Attribute

Details

Mobility - Voice and Data Category Growth Rate

CAGR of 6.5% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Penetration pricing, subscription-based pricing, usage-based pricing, tiered pricing, cost-plus pricing, and competition-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Geographical service provision, industries served, years in service, employee strength, revenue generated, key clientele, regulatory certifications, voice services, data services, cloud and hosting services, managed network services, unified communication services, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

AT&T Inc.; Broadcom Inc.; Charter Communications, Inc.; Cisco Systems, Inc.; Comcast Corporation, Inc.; Deutsche Telekom AG; Huawei Technologies Co., Ltd.; Lumen Technologies, Inc.; Orange S.A.; Telefónica S.A.; Verizon Communications Inc.; and Vodafone Group Plc.

Regional Scope

Global

Revenue Forecast in 2030

USD 1,200.8 billion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global mobility – voice and data category size was valued at approximately USD 772.7 billion in 2023 and is estimated to witness a CAGR of 6.5% from 2024 to 2030.

b. Rising expenditure on deployment of 5G infrastructure, surge in the number of mobile subscribers, elevated demand for high-speed voice and data connectivity, and growing adoption of managed mobility services are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, Israel and Italy are the countries that offer these services at low-cost.

b. This category is moderately consolidated, with a few top competitors accounting for a significant portion of the market share. Some of the key players are AT&T Inc., Broadcom Inc., Charter Communications, Inc., Cisco Systems, Inc., Comcast Corporation, Inc., Deutsche Telekom AG, Huawei Technologies Co., Ltd., Lumen Technologies, Inc., Orange S.A., Telefónica S.A., Verizon Communications Inc., and Vodafone Group Plc.

b. Network infrastructure, labor, hardware and software, spectrum acquisition, licensing and compliance, and other costs are the major cost components of mobility – voice and data. Other costs include sales and marketing, general and administrative, rent and utilities, insurance, logistics, and taxes.

b. Comparing the prices quoted by various service providers, assessing the range of services offered, evaluating the experience level, comparing references and testimonials of key clients, and evaluating the network coverage capabilities are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified