- Home

- »

- Reports

- »

-

Patient Engagement Solutions Sourcing Intelligence Report, 2030

![Patient Engagement Solutions Sourcing Intelligence Report, 2030]()

Patient Engagement Solutions Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10504

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Patient Engagement Solutions-Procurement Trends

“Swift adoption of mobile healthcare platforms and applications by the healthcare sector with the availability of reliable internet connectivity is fueling the market growth.”

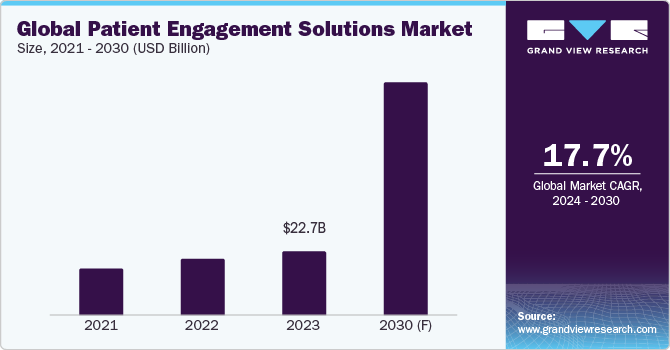

Procurement of patient engagement solutions has received an impetus with the prevalence of mobile healthcare platforms and the trend for patient-centered care. The global market is anticipated to grow at a CAGR of 17.7% from 2024 to 2030. Some factors, including robust internet connectivity, favorable policies to boost patient care, growing preference for transparency in treatments and traction for the healthcare delivery process, have fueled market growth. In addition, an increase in stakeholder alliances and collaborations, and the rising popularity of solutions offered in the category among the elderly population are further expected to drive its growth. Meanwhile, concerns about the security of patient health information are restricting data exchange among stakeholders in the sector, thus hampering patient engagement initiatives.

The internet has made it possible for doctors and patients to communicate with one another, increasing interest and improving diagnostic precision. They are now able to communicate much more easily and effectively due to the adoption of patient engagement technologies. As the prevalence of chronic illnesses such as diabetes and cancer rises, IT firms are developing ways to interact with and oversee patients in hospitals and other healthcare settings. For instance, the Apollo Hospitals Group (India) has developed a system that provides physicians and patients with real-time updates on their records and data. In an emergency, these technologies also allow patients to communicate with doctors. In addition, the patients do not have to wait in line to see doctors directly for health-related issues. The advanced solution enables governments and healthcare providers to monitor patient information, which helps them comprehend patient histories and recommend the best course of action.

The global patient engagement solutions market size was valued at USD 22.7 billion in 2023. Based on the component, the industry is dominated by the software segment. Deploying and utilizing software is easy, and it supports obtaining precise drug information. It facilitates effective digital prescription transfer and is utilized in the management of healthcare both at home and in other establishments as well. In addition, it helps with the implementation of cloud-based or on-premises augmented analytics, enabling the prediction and implementation of solutions using live training techniques. On the other hand, the services segment is anticipated to witness the fastest growth rate since it is among the most crucial elements for functioning patient engagement solutions. Based on delivery mode, the web/cloud-based mode dominates the industry. Rapid growth in the popularity of these portals can be attributed to easy data backup, low cost of handling, integrated features, fast accessibility, and real-time data tracking.

Key technologies that are driving the growth include artificial intelligence (AI) and machine learning (ML), remote monitoring devices, wearables, optimized online touchpoints, personalized health and predictive medicine. AI and ML technologies offer analysis of massive patient data sets to anticipate future health problems and offer personalized health advice.

According to a recent study, AI can reduce treatment costs by up to 49.5% while improving results by 29.5% to 39.5%. In addition, AI and ML can free up healthcare workers to focus on more complex patient care by automating repetitive chores. In healthcare, remote monitoring devices communicate data back to the care team and electronic health record (EHR). Through digital patient engagement tools, such as SMS text messaging and mobile apps, they offer a point of contact that allows patients and their clinicians to communicate outside of the office. In addition to providing new tools for managing chronic diseases, remote technologies strengthen ties between healthcare providers and patients.

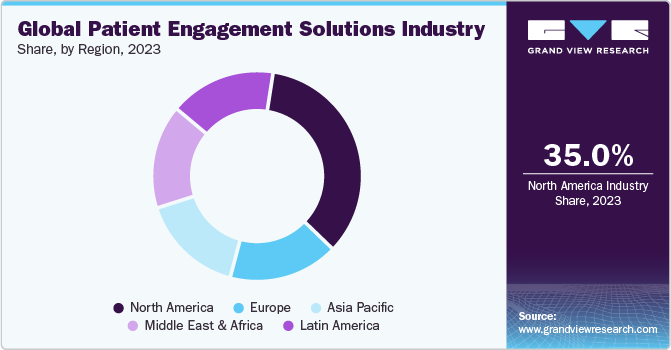

North America dominates the global landscape, accounting for a substantial market share attributed to the increased incidences of chronic disease, the need to reduce healthcare costs, and favorable government efforts and regulations. The region puts a high emphasis on patient-centered care, has advanced technological capabilities, and possesses a developed healthcare system which all contribute to the industry’s growth.

The U.S. leads the regional demand for the solutions and is anticipated to witness growth of over 7.5% over the next few years. The nation has a complicated healthcare system with a ton of paperwork and a set of procedures for the commercialization of medical devices and treatments. Inconsistencies and delays are being caused by manually managing every step of the healthcare process utilizing each person's data. As a result, the providers in the nation are quickly adopting these solutions to enable effective patient and hospital data management.

Supplier Intelligence

“What best describes the nature of the patient engagement solutions industry? Who are some of the main participants?”

The industry exhibits a fragmented landscape, with intense competition among the suppliers operating in the industry. A large number of players are based out of developing nations as a result of advancements in technology, alluding to the procurement landscape. However, they have also entered undeveloped nations and are attempting to create a market there as modern times have made connectivity quite easier. Since this is a rather new market, some new players are entering the industry as well. In addition, a plethora of fresh startups has surfaced to rival the well-established firms. The key players utilize a variety of tactics in an effort to increase their market share, such as new product launches, mergers and acquisitions, investments, and collaborations. They are investing heavily in the development of better products as well.

In order to improve patient engagement, CipherHealth and SADA teamed up in January 2023 to incorporate socioeconomic data into its platform using Google Cloud. Currently, a large number of major, mid-sized, and small organizations offer patient engagement solutions. It is noteworthy that over 74.9% of the solution providers offer cloud-based deployment options, and over 97.9% of the solution providers offer solutions for home health management. Buyers in the market possess a high capability to negotiate, as the industry comprises the presence of a large number of players. This enables the buyers to compare multiple suppliers to find the best deal in terms of software development or support services. In addition, the buyers can easily look for a better alternative just in case they are not satisfied with any respective supplier in terms of the solutions offered, pricing, or any other terms of business.

Key suppliers covered in the industry:

-

Athenahealth, Inc.

-

GetWellNetwork, Inc.

-

Infomedia Group, Inc. (d.b.a Carenet Healthcare Services)

-

Innovaccer Inc.

-

International Business Machines Corp. (IBM Phytel)

-

IQVIA Inc.

-

Lincor, Inc.

-

McKesson Corporation

-

Medisys, Inc.

-

Oracle Corporation (Oracle Cerner)

-

Orion Health Group Limited

-

PatientPoint Network Solutions, LLC

-

Veradigm LLC

-

Vivify Health, Inc.

-

MEDHOST

Pricing and Cost Intelligence

“What is the total cost of ownership for patient engagement solutions? What variables affect the prices?”

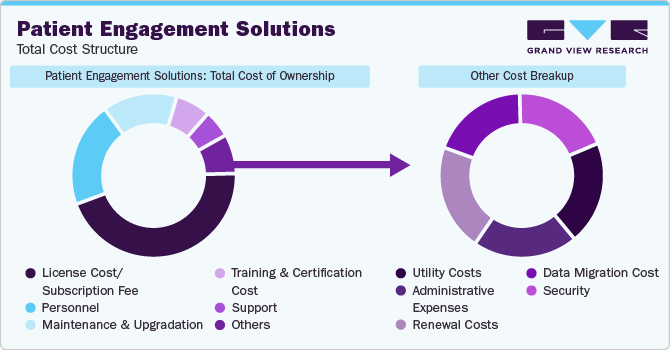

The total cost of ownership for the global patient engagement solutions industry is constituted by license cost/subscription fee, personnel, maintenance & upgradation, training and certification costs, support, and others. Other costs include utility costs, administrative expenses, renewal costs, data migration costs, and security. Pricing models that are commonly used for the platform solutions include subscription pricing, perpetual pricing, usage-based pricing, per-user pricing, and freemium pricing.

A healthcare provider has the option of selecting either an off-the-shelf solution, content management systems (CMS)-based or custom-built solution while entering the industry. Hospitals have a variety of feature sets and price options to choose from. Regarding revenue generation, certain software providers offer users pre-established functionality and subscription options, but other software vendors allow them to select the capabilities they require. The monthly subscription fees for off-the-shelf solutions range from USD 18.5 for simple feature sets to over USD 498.5 for sophisticated solutions. In addition, a healthcare provider ought to raise the price point to include support, license, and customization.

With the procurement of a content management system (CMS)-based solution, a business gets a platform with features such as EMR/EHR integration, patient-provider communications, doctor appointment scheduling, and patient registration. The price of content management systems (CMS)-based solution might range between USD 39,500 to USD 49,500 for software that includes basic features like secure patient-provider communication, appointment scheduling, and digital payment processing. The price of a custom-built solution with features such as analytics, chatbots driven by other businesses, patient feedback, payment processing, and appointment scheduling starts at USD 49,500.

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

Sourcing Intelligence

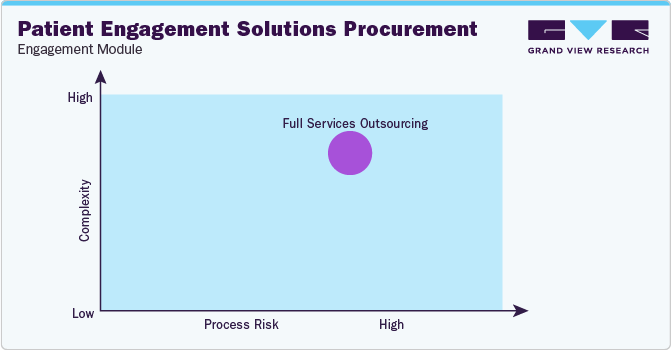

“How do patient engagement solutions engage? What is the type of engagement model?”

In terms of global patient engagement solutions procurement sourcing intelligence, healthcare providers ideally follow a full-service outsourcing model to engage with their suppliers. Healthcare providers (hospitals/ambulatory care centers/home-healthcare providers) require either a software / mobile application or hardware to support their patients. Since developing a software/application is very expensive and requires a team of specialists to do so in-house, the providers rely on third-party software developers to design and develop a platform for them based on their requirements, such as telehealth, document management, e-prescribing, billings & payments, and patient education. Likewise, the providers depend on the OEMs for hardware solutions such as tablets and assisted devices. The demand for patient support services varies often. Outsourcing enables providers with flexibility and scalability to use resources efficiently by scaling up or down support services in response to patient needs. In addition, it lowers their overhead expenses.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

Key factors that healthcare providers need to consider while looking to outsource their patient support services include compliance, data security, and collaborations and partnerships. Collaborating with trustworthy outsourcing companies that put data security first is essential. The suppliers to safeguard patient data use strong security measures, including strict access controls, secure data transmission protocols, and encryption. In addition, working with a trustworthy supplier that complies with industry standards is crucial. For instance, Health Information Technology for Economic & Clinical Health Act (HITECH) and Health Insurance Portability & Accountability Act (HIPAA) in the U.S., or comparable data protection laws in other nations. Selecting a supplier who shares the values, objectives, and communication preferences of the healthcare organization promotes cooperation, smooth integration, and the provision of excellent patient support services.

India is the preferred low-cost/best-cost country for sourcing patient engagement solutions. The nation is one of the most well-known for its affordable software development costs for healthcare. To date, the Indian software market has progressed fairly well and it is still having a significant effect on the country's entire economic system. Reaching out to a variety of software engineers with different skill sets to handle the duties may be beneficial. Numerous businesses from all over the world have established operations in India to benefit from the nation’s enormous talent pool and technological know-how. In addition, the nation has acquired a vast range of technological specializations in comparison to other regions. India, more intriguingly though, is shifting away from MySQL / PHP and towards more modern technology. Furthermore, western nations and Asia have different pay levels; thus, outsourcing the labor to India can result in a cost savings of over 69.9%.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). Similarly, the supply chain practices under sourcing are also covered. One such instance is the operating or engagement model which encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Patient Engagement Solutions Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 17.7% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Subscription-based pricing, perpetual pricing, usage-based pricing, and freemium pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Years in service, industries served, employee strength, revenue generated, geographical service provision, key clientele, certifications, software type, hardware type, services offered, deployment mode, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Athenahealth, Inc.; GetWellNetwork, Inc.; Infomedia Group, Inc. (d.b.a Carenet Healthcare Services); Innovaccer Inc.; International Business Machines Corp. (IBM Phytel); IQVIA Inc.; Lincor, Inc.; McKesson Corporation; Medisys, Inc.; Oracle Corporation (Oracle Cerner); Orion Health Group Limited; PatientPoint Network Solutions, LLC; Veradigm LLC; and Vivify Health, Inc.

Regional Scope

Global

Revenue Forecast in 2030

USD 71.0 billion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global patient engagement solutions category size was valued at approximately USD 22.7 billion in 2023 and is estimated to witness a CAGR of 17.7% from 2024 to 2030.

b. Swift adoption of mobile healthcare platforms and applications by the healthcare sector with the availability of reliable internet connectivity, execution of laws and programs designed to promote patient-centered care, and growing popularity of keeping all treatments transparent and actively involving people in the healthcare delivery process are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India and Philippines are the ideal destinations for sourcing patient engagement solutions.

b. This category exhibits a fragmented landscape with intense competition. Some of the key players are Athenahealth, Inc., GetWellNetwork, Inc., Infomedia Group, Inc. (d.b.a Carenet Healthcare Services), Innovaccer Inc., International Business Machines Corp. (IBM Phytel), IQVIA Inc., Lincor Inc., McKesson Corporation, Medisys, Inc., Oracle Corporation (Oracle Cerner), Orion Health Group Limited, PatientPoint Network Solutions, LLC, Veradigm LLC, and Vivify Health, Inc.

b. License cost/subscription fee, personnel, maintenance & upgradation, training & certification costs, and support forms the total cost of ownership for this category. Other costs can be further bifurcated into utility costs, administrative expenses, renewal costs, data migration costs, and security.

b. Selecting a platform which supports EHR integration, assessing the security & privacy policies (HIPAA compliance, data breach response, patient consent, data encryption) of the platform, selecting a supplier which can customize the entire platform to align it with business needs, and reviewing if a platform can offer accessibility to disable patients are some of the best sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified