- Home

- »

- Sector Reports

- »

-

Advanced Payment Cards Industry Analysis Data Book, 2030

Database Overview

Grand View Research’s advanced payment cards sector database is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The following data points will be included in the final product offering in 3 reports and one sector report overview:

Advanced Payment Cards Industry Data Book Scope

Attribute

Details

Research Areas

- Virtual Cards Market

- Dual Interface Payment Card Market

- Biometric Payment Cards Market

Details of Product

- 3 Individual Reports - PDFs

- 3 Individual Reports - Excel

- 1 Sector Report - PPT

- 1 Data Book - Excel

Cumulative Country Coverage

45+ Countries

Highlights of Datasets

- Type Revenue, by Countries

- End-use Revenue, by Countries

- Competitive Landscape

- Regulatory Landscape & Government Initiatives, by Key Countries

Cross-Segmentation Coverage

Each Type and End-use (Regional & Country Level)

Number of Tables (Excel) in the Bundle

~100

Advanced Payment Cards Industry Data Book Coverage Snapshot

Markets Covered

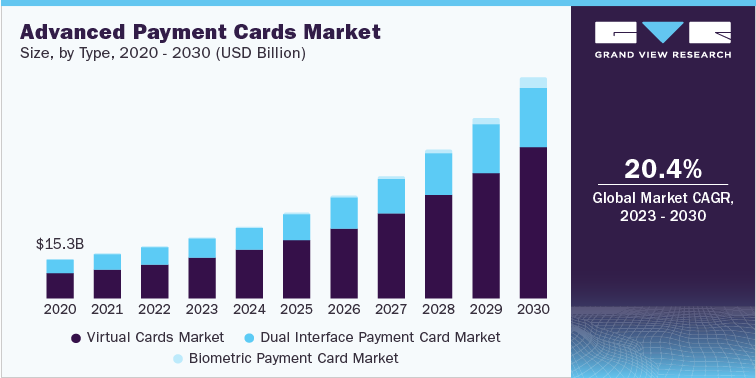

Advanced Payment Cards Industry

USD 20.50 billion in 2022

20.4% CAGR (2023-2030)

Virtual Cards Market Size

USD 13.31 billion in 2022

20.9% CAGR (2023-2030)

Dual Interface Payment Card Market Size

USD 7.10 billion in 2022

16.7% CAGR (2023-2030)

Biometric Payment Cards Market Size

USD 0.09 billion in 2022

68.3% CAGR (2023-2030)

Advanced Payment Cards Sector Outlook

The global market size for advanced payment cards was estimated at USD 20.50 billion in 2022 and is anticipated to increase at a CAGR of 20.4% from 2023 to 2030. The market continues to evolve as technological advancements, changing market dynamics, and the need for contactless payment shape its landscape. The advanced payment card industry is segmented into various types and end-uses. The type of segment includes card type and product type, further card type is divided into debit card, credit card, plastic, and metal. The end-use segment includes retail, transportation, healthcare, government, hospitality, consumer use, business use, and others.

The key elements driving the growth of the advanced payment cards industry is the increasing need for better transparency and high security in digital payment systems. Furthermore, a set of controls to enhance security while processing payments through advanced payment cards are also expected to drive the growth of the market. Additionally, the growing adoption of digital payment methods by several businesses and individuals worldwide bodes well for market growth. Moreover, the technological advancements in the areas including Artificial Intelligence (AI) & Machine Learning (ML), and the growing internet penetration are anticipated to propel the growth of the advanced cards market over the forecast period. Thales Group, Visa Inc, Mastercard, and IDEMIA are some of the key players spearheading the growth of these applications.

Virtual Cards Market Analysis And Forecast

The virtual cards market was estimated at USD 13.31 billion in 2022 and is anticipated to grow at a CAGR of 20.9% from 2023 to 2030. The market is projected to reach USD 60.06 billion by 2030. The growth can be attributed to the rising adoption of virtual cards by businesses for B2B payments. Furthermore, the rising investments by venture capital firms in virtual card providers is another major factor driving the market’s growth. For instance, in October 2021, Extend Enterprises, Inc., a digital card platform provider, announced that through a Series B funding round, it raised USD 40 million. The round was led by March Capital, along with participation from investors, including Fintech Collective, B Capital, Reciprocal Ventures, Point72 Ventures, Pacific Western Bank, and Wells Fargo. The company aimed to utilize these funds to offer virtual cards to assist banks in competing with other FinTechs.

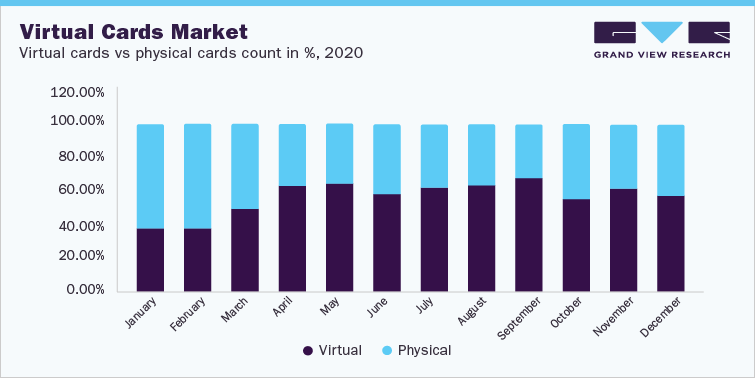

The virtual cards market is segmented based on card type, product type, and application. Based on card type, it is divided into debit card and credit card. The credit card segment held the highest share in 2022 and is anticipated to grow at the fastest CAGR of 21.6% over the forecast period. The growth of the credit card segment can be attributed to the increasing use of virtual credit cards by businesses and consumers for processing secure and contactless virtual payments. These cards generate random 16-digit numbers with expiry dates and CVV codes for each transaction. Payments made through virtual credit cards are routed back to the existing credit card using a current line of credit. Some of these virtual credit cards allow users to earn points on each purchase made, which users can use for benefits such as travel and employee incentives.

The product type segment is classified into B2B virtual cards, C2B POS virtual cards, and B2C remote payment virtual cards. In 2022, in terms of revenue share, the B2B virtual cards segment dominated the product type segment in the virtual cards market. The rising adoption of B2B virtual cards can be attributed to their benefits, such as better security than physical cards, which help businesses minimize exposure to potential fraud. Furthermore, payment network providers and fintech companies are increasingly entering into partnerships to enable enterprises to accept virtual card payments. The B2C remote payment virtual cards segment is expected to witness rapid growth from 2023 to 2030 owing to the increasing number of remote employees. Companies offer their employee virtual cards to enable them to access these cards remotely and allow spending. In such cases, the company can track and fund contactless employees' spending remotely.

The application segment includes consumer use and business use sub-segments. The business uses sub-segment holds the largest market share in the application segment due to the factors such as the increased adoption of virtual cards for business use. Furthermore, the benefits offered by the virtual card include high security, increased transparency, spending limit, and single and multi-use features, which bode well with the growth of the segment. The segment is also expected to benefit from the increasing adoption of virtual cards by businesses to pay their suppliers. Furthermore, the Europe regional market dominated the virtual cards market in 2022 due to factors such as the dominance of leading market players, including Skrill USA, Inc. and Adyen, among others. Furthermore, the increasing adoption of online payments and digital platforms across the region is also expected to drive the market’s growth over the forecast period.

Dual Interface Payment Card Market Analysis And Forecast

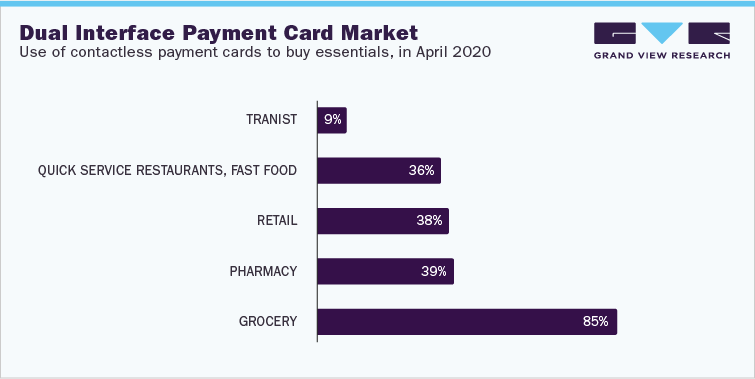

In 2022, the global dual interface payment card market was valued at USD 7.10 billion and is anticipated to witness a CAGR of 16.7% over the forecast period. The market is anticipated to grow due to the factors such as the rising adoption of contactless payments by consumers. For instance, according to the Mastercard Contactless Consumer Polling, nearly 51% of Americans use contactless payment, including tap-to-go credit cards and mobile wallets. Furthermore, the high acceptance of dual interface payment cards across various platforms owing to their ability to process payments in both contactless and contact modes also bodes well for the growth of the market.

The dual interface payment card market is segmented based on type and end-use. Based on type, it is divided into plastic and metal. The plastic segment held the maximum share in 2022 and is anticipated to grow significantly over the forecast period. Plastic cards enable issuing banks to offer their customers unique designs and create a brand identity through these designs. These cards come with customized prints, fonts, shines, and engraved letters, enabling banks to make their brand name and logo more prominent. Furthermore, dual interface payment cards are usually made of plastic owing to the cost-effectiveness and durability of the material, thereby anticipated to drive the segment’s growth over the forecast period.

Based on end-use, the market is divided into transportation, retail, hospitality, healthcare, and others. The retail sub-segment dominated the market in 2022 owing to the increasing adoption of contactless payment methods to pay for essentials. Many retailers have adopted the tap-and-go payment methods due to the wide range of benefits they offer. Tap-and-go payments decrease the time at checkouts and provide a secure way of payment. The transportation end-use segment is expected to witness a high growth rate over the forecast period, attributed to the companies resuming their work from office models post the COVID-19 pandemic. Furthermore, several cities across the globe are focused on delivering safe, reliable, and effective modes of transport to improve the connectivity and travel experience of the citizens. Furthermore, numerous public transport operators are investing in payment infrastructure to enable their customers for contactless payments.

North America dominated the global dual interface payment card market in 2022 and accounted for the maximum overall revenue share. The region's dominance is attributed to the rapid adoption of technology in the region. Consumers in the region have proven to be quick at adopting and implementing new technologies in their daily lives. Dual interface payment cards use technologies such as Near Field Communication (NFC) and Radio Frequency Identification (RFID) to make contactless payments within a few seconds. However, the Asia Pacific region is expected to register the highest CAGR over the forecast period. Several merchants across Asia Pacific have started accepting contactless payments based on the latest technologies, including NFC technology and QR code technology. The continued digitalization of banks and other financial institutions is also paving the way for the growth of the Asia Pacific dual interface payment card market.

Biometric Payment Cards Market Analysis And Forecast

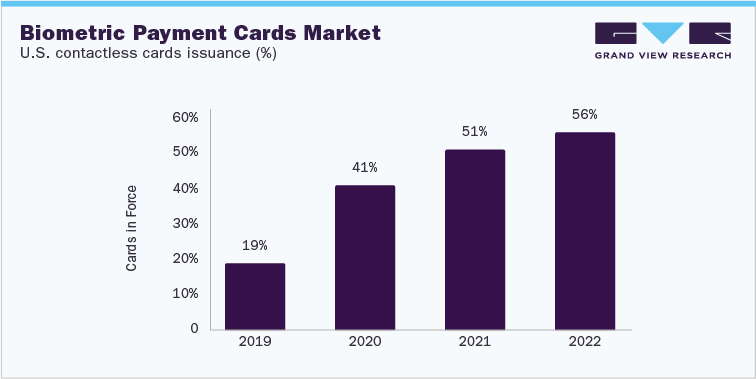

The global biometric payment cards market size was valued at USD 0.09 billion in 2022. It is projected to grow at a CAGR of 68.3% over the forecast period from 2023 to 2030. The growth can be attributed to the growing demand for biometric security. The rising fraud instances and cyberattacks have led to high consumer demand for biometric verification. For instance, in July 2021, according to a study by Fingerprint Cards, around 62% of consumers could switch banks to get a biometric card. Furthermore, the biometric payment card offers customers a quick and convenient payment authentication process without remembering the passcodes for processing transactions, which is anticipated to fuel the market's growth.

The global biometric payment cards market is segmented based on type and end-use. Based on type, it is divided into credit cards and debit cards. In 2022, the debit cards type segment dominated the market since numerous identity technology companies across the globe are partnering with fintech companies to enhance security for contactless payments made through debit cards. For instance, in December 2020, IDEMIA, a global identity company, and Rocker, a Swedish fintech company, announced their partnership to enhance the security of contactless payments by offering IDEMIA's F.CODE biometric payment card. The debit card utilizes biometric technology, which stores all the biometric credentials on the chip of the card.

The end-use segment is divided into retail, transportation, healthcare, hospitality, government, and others. The retail segment dominated the market in 2022 due to the factors such as the growing consumer preference for contactless payments. Retailers across the globe are likely to continue using contactless payments post the pandemic as it facilitates faster payment transactions with increased flexibility. However, the healthcare segment is expected to grow significantly during the forecast period. The growing preference among patients to pay bills using contactless credit or debit cards is propelling the demand for biometric payment cards in the healthcare industry.

North America dominated the biometric payment cards market in 2022. North America houses several key players in the market, including IDEX Biometrics ASA; Mastercard; and Visa Inc. Additionally, the region is known for being an early adopter of the technology. The Asia Pacific region is anticipated to emerge as the fastest-growing region over the forecast period. With the rising urban population and increasing purchasing power, the Asia Pacific region is expected to be one of the fastest-growing markets over the forecast period. The growth can be attributed to the initiatives pursued by various governments in the region to promote digitization and encourage the adoption of contactless payment technologies.

Competitive Insights

To endure the fierce competition, prominent market participants have formulated innovative concepts and ideas, improved their existing product lineup, and bolstered their profitability. The companies collaborated to leverage expertise and resources to fasten the launch and commercialization of the biometric payment cards. Partnerships often were focused on completing the pilot projects and the launch of new biometric payment cards with increased efficiency in usage and features. For instance, in January 2022, Thales Group, Mastercard, and Bank Pocztowy collaborated to launch biometric payment cards across Poland. Thales Group offered its corporate customers a fingerprint-scanning card through this launch, enabling them to authorize payments biometrically. Furthermore, several venture capital firms are raising funds to speed up the commercialization of advanced payment cards. For instance, in May 2023, IDEX Biometrics, a fingerprint biometrics firm, raised USD 11 million by selling 147 million new shares at USD .077 per share. The company aimed to raise funds to accelerate product commercialization, working capital, and general corporate purposes.

Prominent Market Players

-

American Express Company

-

JPMorgan Chase & Co.

-

Mastercard

-

Marqeta, Inc

-

Skrill USA, Inc.

-

Stripe, Inc.

-

Adyen

-

Wise Payments Limited

-

Valid Solucoes S.A.

-

Giesecke+Devrient GmbH

-

Eastcompeace Technology Co., Ltd

-

Wuhan Tianyu Information Industry Co., Ltd

-

BTRS Holdings, Inc.

-

WEX, Inc

-

Thales Group

-

IDEMIA

-

Zwipe

-

CPI Card Group Inc

-

Paragon Group Limited

-

bio-idz

-

IDEX Biometrics ASA

-

BNP Paribas

-

Goldpac Fintech

-

Infineon Technologies AG

-

NXP Semiconductors

-

Visa Inc

-

Watchdata Co., Ltd

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified