- Home

- »

- Sector Reports

- »

-

Animal Feed Industry Overview & Growth (Data Book 2030)

Database Overview

Grand View Research’s animal feed sector data book is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Animal Feed Industry Data Book Scope

Attributes

Details

Areas of Research

- Poultry Feed Market

- Cattle Feed Market

- Swine Feed Market

- Aquafeed Market

- Pet Food Market

Number of Reports/Presentations in the Bundle

1 Sectoral Outlook Report + 5 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Additives

07 Additives Categories

Highlights of Datasets

- Trade Data, by Country

- Demand/Consumption, by Country

- Poultry Feed Enzymes

- Cattle Feed

- Swine Feed

- Aquafeed

- Pet Food

- Competitive Analysis

Animal Feed Industry Data Book Coverage Snapshot

Markets Covered

Animal Feed Industry

1,179 million tons in 2022

2.9% CAGR (2023-2030)

Poultry Feed Market

555.9 million tons in 2022

2.6% CAGR (2023-2030)

Cattle Feed Market

240.0 million tons in 2022

2.9% CAGR (2023-2030)

Swine Feed Market

310.1 million tons in 2022

3.3% CAGR (2023-2030)

Aquafeed Market

40.7 million tons in 2022

3.5% CAGR (2023-2030)

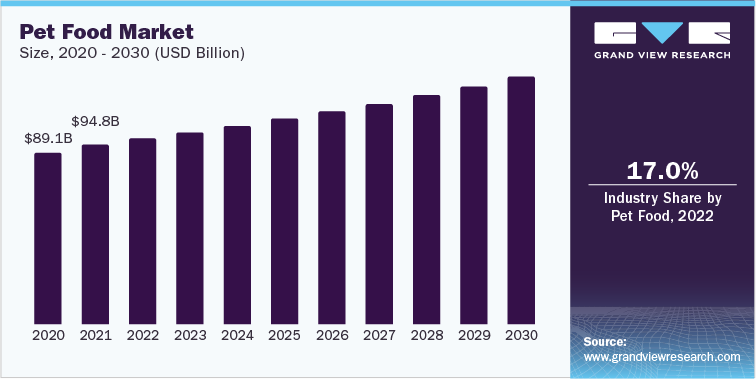

Pet Food Market

31.8 million tons in 2022

3.6% CAGR (2023-2030)

Animal Feed Sector Outlook

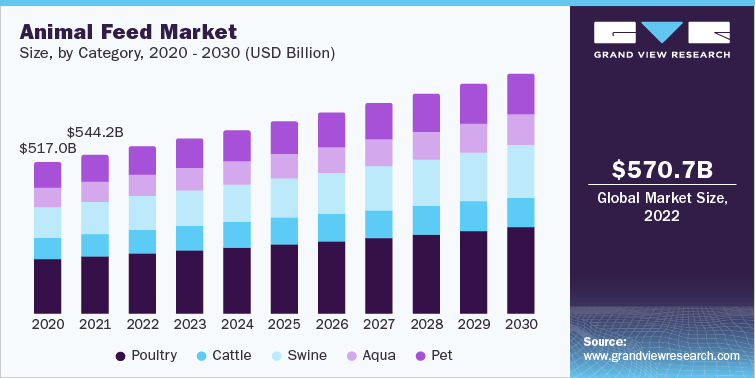

The economic value generated by the animal feed industry was estimated at approximately USD 570.72 billion in 2022. This economic output is an amalgamation of basic animal feed categories namely, poultry feed, cattle feed, swine feed, aquafeed, and pet food.

The global animal feed market has witnessed remarkable growth in the recent past due to increasing demand for quality meat and meat by-products. The outbreak of various diseases in livestock has increased concerns regarding the quality and safety of meat, which, in turn, is expected to boost the usage of animal feed. In addition, the rising consumption of processed aqua, dairy, and poultry products globally is likely to boost the market growth of animal feed.

Vitamins are extensively utilized as additives in animal feed formulations. They act as an effective protection against viruses, parasites, and bacteria. Some of the prominent vitamins used as feed additives include riboflavin, Vitamin D, Vitamin A, Vitamin K, and Vitamin E. Additional supplements infused with vitamins to provide optimal nutrition are also added to livestock feeds. Thus, the aforementioned factors are anticipated to fuel the demand for vitamin additives in the animal feed market.

Amino acids are widely used as animal feed additives. Different types of amino acids, such as methionine, lysine, tryptophan, and threonine, are primarily used as aquafeed additives. These nutrients play a vital role in protein building and promote growth in animals. This is projected to propel the demand for amino acid additives in the animal feed market over the forecast period.

The animal feed industry is highly fragmented in nature with the presence of a large number of participants. The key market players are focusing on mergers and acquisitions to bolster their presence throughout the value chain. Market players are engaged in various activities, including the production of poultry products, farming, and marketing, to reduce their operational costs and produce feeds with high nutritive value.

Prominent market participants such as BASF SE and Cargill, Incorporated are characterized by a high degree of integration throughout the value chain. Some of the key manufacturers of animal feed operating in the market are Nutreco N.V.; Kemin Industries Inc.; Evonik; DuPont; DSM; Cargill, Incorporated; Alltech; AFB International; and Archer Daniels Midland.

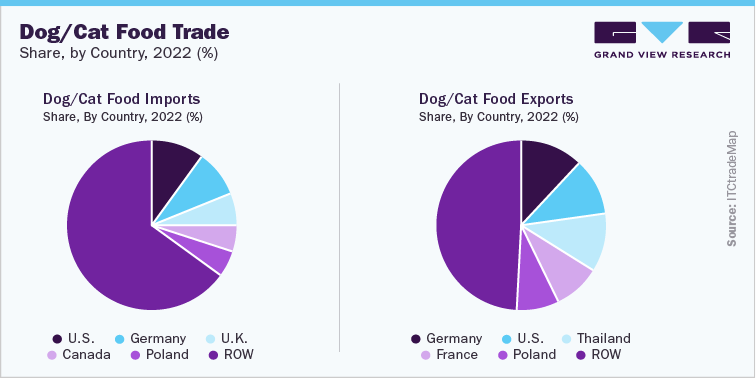

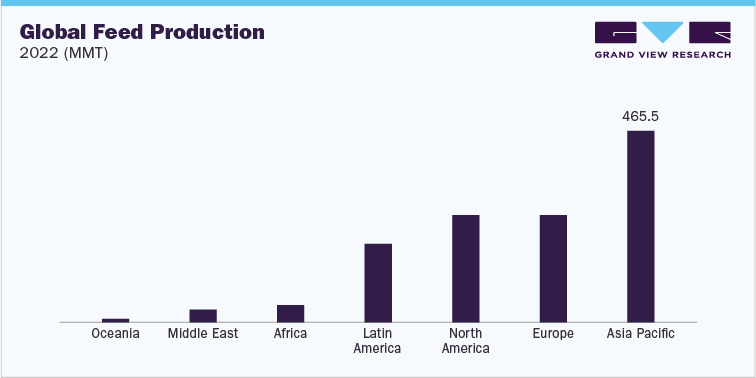

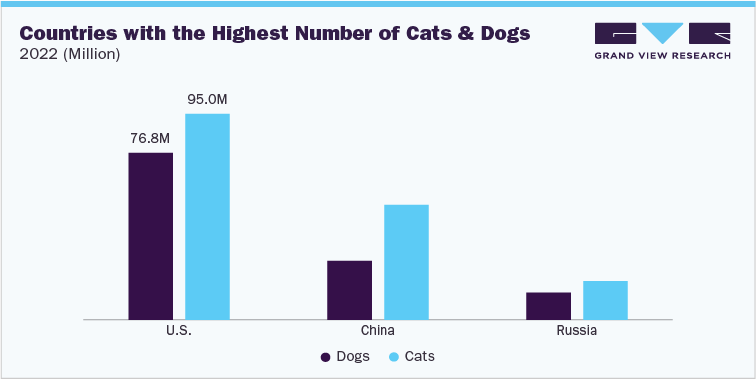

The figure above depicts the global feed production in 2022 in terms of Million Metric Tons. As depicted, Asia Pacific accounted for the highest feed production amounting to 465.5 MMT in 2022. According to the American Pet Products Association, Inc., 67% of the U.S. household population owns at least a single pet. The survey provided an estimation of the total amount, which is USD 99 billion spent on pets in the U.S. Among these, USD 38.4 billion is spent on pet food followed by USD 30.2 billion on vet care, USD 19.8 billion on supplies and OTC medicines, and USD 10.7 billion on services such as grooming, boarding, training, insurance, and pet sitting services. Online private channels such as Chewy.com and Amazon are endorsing their own brands to disrupt the market and eradicate middlemen margins.

According to European Pet Food Industry Federation (FEDIAF), Europe is one of the largest markets for the pet food industry, accounting for approximately 30% of the total pet care and pet food sales across the globe. Pet care sales in Eastern Europe are dominated by cat food (4% growth) compared to Western Europe, which is divided between pet products, cat food, and dog food (2% growth). Key factors that can be attributed to market growth include an increase in the demand for premium products, mainly organic, raw, and natural products, depending on the choice of owners.

The pet adoption rate in the Asia Pacific is likely to be primarily driven by growing urbanization, westernization, a growing number of nuclear families, and rising annual income in the developing countries of the region. These factors are expected to support the growth of pet ownership of both dogs and cats. Consumer concerns toward pet health, ensuring healthy skin and coat, digestion, and preventive teeth and gum issues have largely benefitted the sales of high-quality pet food. This trend can be illustrated by the fact that around 41% of pet owners in Thailand search for animal feed with added benefits for their health and body.

Organizations and individuals dedicated to promoting pet adoption have been actively educating the public about the benefits of adopting rather than buying pets. They highlight the overpopulation of animals in shelters and emphasize responsible pet ownership, spaying/neutering, and providing proper care. These efforts have played a crucial role in changing public attitudes toward adoption. Evolving lifestyles, such as smaller living spaces, delayed parenthood, and increased focus on work-life balance, have made adopting pets more appealing. People are opting for smaller or low-maintenance pets that fit their living situations and schedules better leading to an increase in the adoption of cats, small dogs, and other companion animals.

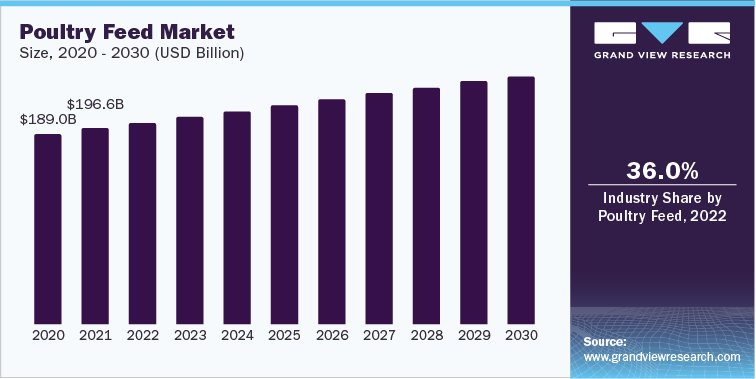

Poultry Feed Market Analysis And Forecast

Poultry feed accounted for a share of nearly 36% of the industry in 2022. Poultry is considered one of the most economical sources of protein owing to which poultry products such as egg and meat are consistently witnessing growth in demand. The demand has been primarily driven by the presence of abundant feed supply, low feed cost, absence of avian influenza, increasing poultry farming, and rising demand for meat and eggs globally.

The UN Food & Agriculture Organization predicts that the global population is likely to increase by more than 30% by 2050. To meet this projected demand, the livestock industry is focusing on increasing livestock production which is creating more requirements for feed ingredients. Increasing demand for feed ingredients is likely to provide significant growth potential to the global livestock as well as the poultry feed industry.

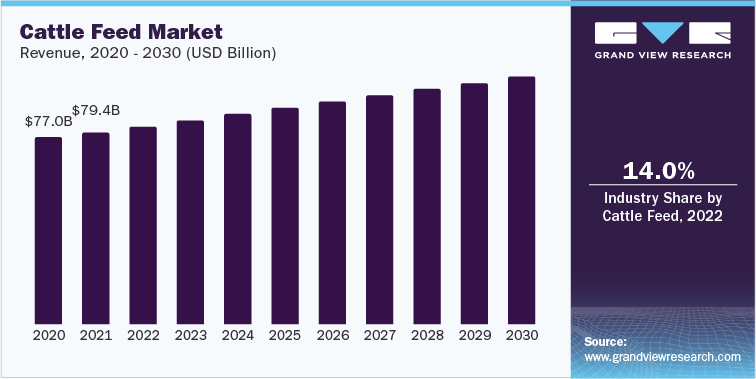

Cattle Feed Market Analysis And Forecast

Cattle feed accounted for a share of over 14% of the industry in 2022. There are different types of cattle feed that supply essential nutrients like protein and energy. The primary types of cattle feed include cattle cubes, pelleted cattle feed, and textured cattle feed. Cattle cubes are designed to supplement lower-quality forage, helping the herd maintain weight and condition. They provide the necessary protein, minerals, and vitamins that might be lacking in a cow's forage. Most cattle cubes contain around 20% crude protein, although higher protein options are also available.

Pelleted cattle feed is a combination of grains such as cottonseed meal, corn, wheat midds, and other energy sources. It is typically small in size, making it easier for digestion compared to other feed choices. The thermal process used in its manufacturing locks in amino acids and nutrients, resulting in improved nutritional benefits for the cattle.

Textured cattle feed consists of flaked corn, molasses, protein pellets, and other energy sources. It is fortified with essential macro and micronutrients, vitamins, and natural ingredients. Due to the inclusion of molasses, textured cattle feed is commonly referred to as sweet feed.

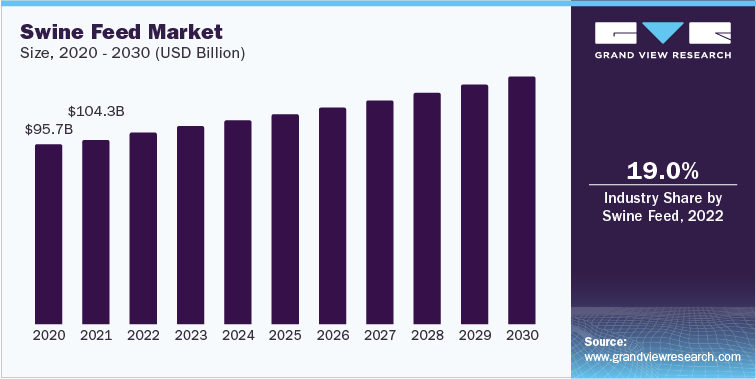

Swine Feed Market Analysis And Forecast

Swine feed accounted for a share of over 19% in the industry in 2022. Swine feed typically consists of a combination of ingredients carefully selected and blended to provide a balanced diet for pigs. The specific composition of swine feed may vary depending on factors such as the pig's age, weight, genetic potential, and the purpose of production (breeding, growth, or finishing). Common ingredients in swine feed include corn, wheat, barley, and sorghum, which provide carbohydrates and energy for the pigs.

The global demand for pork continues to increase due to population growth, rising disposable incomes, and changing dietary preferences. As a result, there is a greater need for swine feed to support the expansion of pig production and meet the demand for pork products.

Swine producers aim to maximize feed efficiency, which refers to the conversion of feed into body weight gain. Efficient feed utilization helps reduce production costs and improve profitability. The swine feed industry continuously works on developing feed formulations and technologies to enhance feed efficiency and optimize cost-effectiveness.

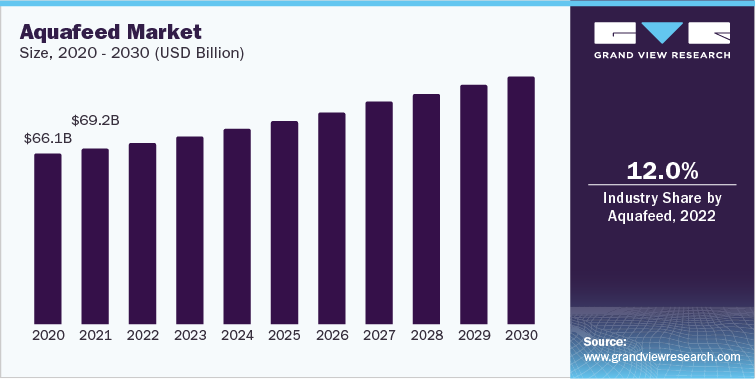

Aquafeed Market Analysis And Forecast

Aquafeed accounted for a share of over 12% in the industry in 2022. Aquafeed is a rich source of omega-3 fatty acids and proteins. It improves the nutritive value of feed and offers several benefits including increased digestibility of protein, improved growth rate, enhanced feed conversion, reduced mortality of aquatic species, and enhanced immunity system. Thus, increasing awareness among aquafeed manufacturers regarding its nutritional benefits, such as the presence of a high amount of protein content, is anticipated to trigger market growth.

The aquafeed market is expected to witness brisk growth on account of a rise in fish farming activities, especially in the emerging economies of the Asia Pacific region. The key players in the aquafeed market are involved in R&D activities to reduce costs and improve the quality of the final product. Increasing preference for natural and organic feed products among manufacturers has emerged as a market trend, which is anticipated to augment the use of plant-based aquafeed in the coming years.

Pet Food Market Analysis And Forecast

Pet food accounted for a share of over 17% of the industry in 2022. Organic pet food is a recent trend in the pet food market. Factors such as the increasing availability of organic pet food products in a variety of flavors and the inclusion of essential ingredients such as probiotics and antioxidants are likely to have a positive impact on the market growth. However, low product penetration owing to its slightly high price is likely to act as a restraining factor for organic pet food in the coming years.

The expenditure on high-quality pet foods by consumers has increased with growing concerns regarding pet health. As a result of this, pet owners are now focusing on purchasing quality food products containing high nutritional value.

Diseases, such as osteoarthritis, among cats and dogs, have considerably increased with over 50% of cats and dogs reportedly suffering from it globally. The demand for grain-free pet food has grown significantly over the past few years. Large companies manufacture high-quality products while others are attempting to market less expensive knockoffs. This is expected to act as a restraining factor for the growth of the pet food market in the coming years.

Competitive Insights

Manufacturers formulate animal feed as per the standard nutritional requirements of domesticated animals. The manufacturing process is similar to processed food, except for ingredients. Meat-based raw materials are processed/rendered to separate protein components, water, and fat. The manufacturing process also entails grinding, cooking, and mixing the aforementioned raw materials with other ingredients. The entire mixture is shaped into various forms depending on the requirements. Key manufacturers in the market comprise The J.M. Smucker Company; The Hartz Mountain Corporation; Mars, Incorporated; Hill’s Pet Nutrition, Inc.; Nestlé Purina; LUPUS Alimentos; Total Alimentos; General Mills Inc.; and WellPet LLC.

Murphy’s Premium Pet Food offers cat and dog food products under the brand names, Purina and Canidae. The products are designed to balance blood sugar levels and reduce inflammation. Organic and natural pet food is expected to gain popularity among consumers in the near future as households continue to view the diet of their pets as a means of improving their overall health.

Aquafeed manufacturers are engaged in constant R&D activities, which helps them with insights into product development and enhancement. In addition, key players are engaged in expanding their geographical reach by implementing various strategic plans such as mergers & acquisitions, joint ventures, disinvestments, long-term contracts & agreements, and partnerships to mark their presence in the aquafeed market.

The global aquafeed market is characterized by the presence of some of the major players such as Cargill, Incorporation, Aller Aqua, BioMar Group, BENEO, and Charoen Pokphand Foods. These companies are aquafeed manufacturers that cater their products to various companies engaged in fish farming, shrimp farming, aqua cultivation, and others.

Company Financial Performance, for Nutrition & Feed Business Portfolio, 2022 (USD Billion)

Company

Contact Details

Revenue

BASF SE

Carl-Bosch-Str. 38,

67056 Ludwigshafen,

Germany

Tel: +49 621 60-0

Nutrition & Care: 8.7 Billion

ADM

7 W Wacker Dr Ste 4600,

Chicago, Illinois, 60601,

Tel: (312) 634-8100

Animal Nutrition: 3.9 Billion

Nestlé

Rue Entre-deux-Villes 10 1814

La Tour-de-Peilz Switzerland

Tel: +41 21 924 51 11

Pet Care: 20.09 Billion

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified