- Home

- »

- Sector Reports

- »

-

Long Steel Products Industry Trends Data Book, 2023-2030

Database Overview

Grand View Research’s long steel products sector database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with an agricultural statistics e-book.

Long Steel Products Industry Data Book Scope

Attribute

Details

Areas of Research

- Steel Rebar Market

- Wire Rod Market

- Steel Sections Market

- Steel Pipes and Tubes Market

Number of Reports/Presentations Covered in the buddle

1 Sector Outlook Report + 7 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Application

7 Product Categories

Highlights of Datasets

- Demand/Consumption, by Countries

- Competitive Analysis

- Markets, By Application

- Steel Rebar, By Application

- Wire Rod, By Application

- Steel Sections, By Application

- Steel Pipes & Tubes, By Technology

Long Steel Products Industry Data Book Coverage Snapshot

Markets Covered

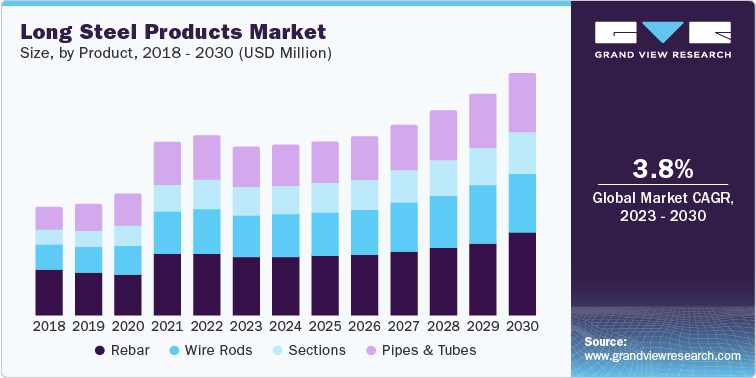

Long Steel Products Industry

USD 753.02 billion in 2022

3.8% CAGR (2023-2030)

Steel Rebar Market Size

USD 258.44 billion in 2022

2.9% CAGR (2023-2030)

Wire Rod Market Size

USD 186.00 billion in 2022

4.6% CAGR (2023-2030)

Steel Sections Market Size

USD 123.10 billion in 2022

4.5% CAGR (2023-2030)

Steel Pipes and Tubes Market Size

USD 185.47 billion in 2022

3.7% CAGR (2023-2030)

Long Steel Products Sector Outlook

Steel is a vital industry for global economic growth and long steel products play a crucial role in developing infrastructure across the globe. It is a key raw material used in producing long products for building & construction and various manufacturing activities. As per the World Steel Association, the total value contribution by the steel industry is USD 2.9 trillion, which is equivalent to 3.8% of the global GDP.

The rise in infrastructure projects globally, such as metro projects, railway bridges, highways, and mega city projects across the globe, has augmented the demand for long steel products in construction. For instance, in November 2021, the U.S. government signed a USD 1 trillion bipartisan infrastructure plan for the upgradation and construction of infrastructure in the country, such as roads, highways, bridges, airports, ports, and energy, from 2021 to 2026.

Long steel products are widely used in residential, non-residential, and infrastructure applications. Structural steel products, including beams, angles, sections, etc. are widely utilized in housing, residential, and commercial buildings owing to their lightweight and high-strength characteristics, which minimize the load on the foundation and reduce sub-structure costs.

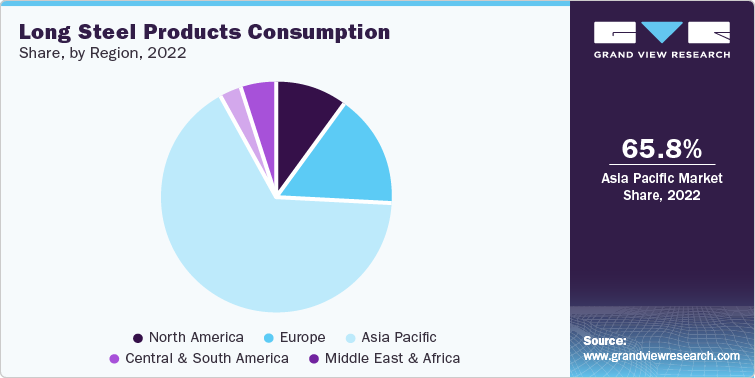

Due to growing populations and housing needs, Asia Pacific was the largest application segment and accounted for a revenue share of more than 65.0% in 2022. Countries such as India and China are witnessing an increasing number of residential construction projects, which is likely to create significant demand for long steel products. China consumes over 40% of the world’s long steel products, as the country has some of the top players operating in the steel industry.

China, India, Japan, and the U.S. remained the largest producers and exports of long steel products. The long steel products industry is mainly driven by the rising need for replacing structurally deficient infrastructure in the world, especially in developing countries, and the need to reconstruct bridges in developed countries remains the key focus area. Rebars are the largest segment that dominates the long steel products market. They are mainly used to provide resistance to construction loads and hold the concrete in tension. It also provides resistance to temperature-induced stresses and limits the cracking in structures.

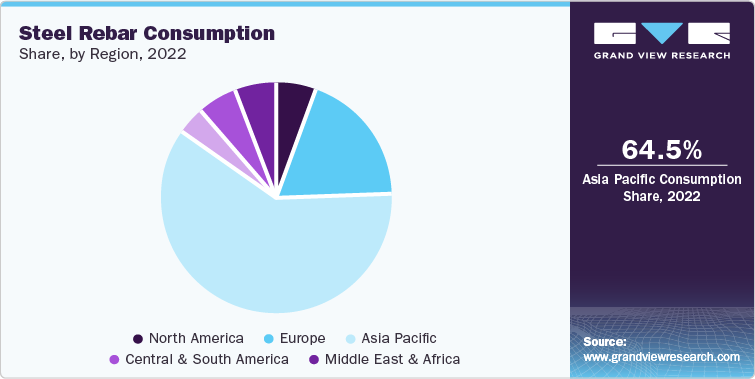

Steel Rebar Market Analysis And Forecast

The construction segment dominated the steel rebar market, with applications such as construction, infrastructure, and industrial purposes. Asia Pacific accounted for more than half of global steel rebar demand, owing to the easy availability of raw materials and investments in construction activities.

China ranked among the top producers and consumers of steel rebar globally. India follows suit after China, as the second largest consumer of steel rebar. The demand in these countries is primarily driven by investments in construction and infrastructure through government-aided policies to boost development in the region.

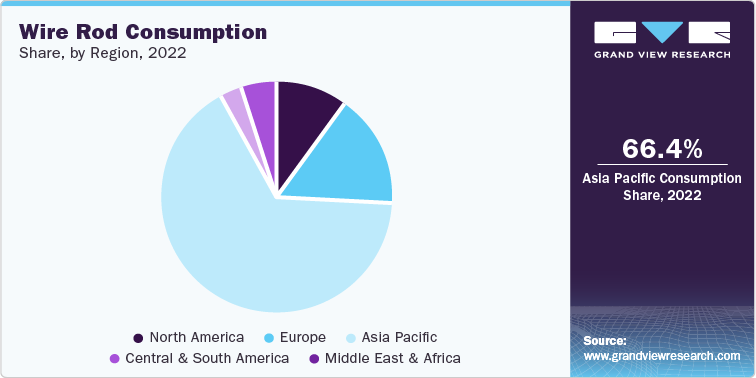

Wire Rods Market Analysis And Forecast

Wire rods are manufactured by drawing hot metals through shafts to develop wires with reduced diameters. Wire rods represent the most ductile form of long steel products owing to their high ductility and easy availability in different diameters. They are widely used in construction and fencing applications.

Increasing investments in infrastructure development projects and flourishing construction and automotive industries worldwide fuel the global consumption of wire rods. The demand for wire rods is closely linked to the construction sector, which tends to be cyclical and can be affected by factors such as interest rates, government policies, and economic growth.

Growing infrastructure investments in the North American region are anticipated to benefit the growth of the market. For instance, under the Infrastructure Development Act passed by the U.S. government, the authorities are estimating that California is likely to receive USD 14.00 billion for rebuilding infrastructures, including water supply, bridges, roads, and communication. Similar investments were announced for other states in the U.S.

Steel Pipes & Tubes Market Analysis And Forecast

Increasing oil & gas production owing to the demand from the transportation industry is one of the prominent growth drivers for the market. The oil & gas industry is the major consumer segment for steel pipes & tubes.

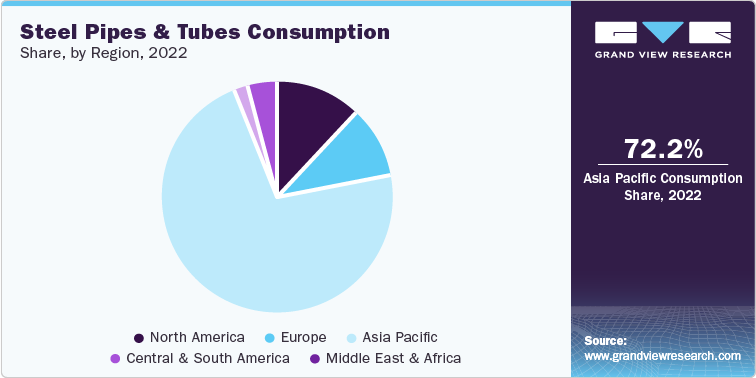

Asia Pacific emerged as the leading regional market in 2022 and accounted for a revenue share of over 64.7%, owing to the rising product consumption in the region. China, Japan, South Korea, Southeast Asia, and India are the major product consumers in the region owing to the presence of huge manufacturing, petroleum, and petrochemical sectors.

The Middle East & Africa are expected to register a growth rate of 1.8% in revenue in the said forecast period. Rising investment in the new oil & gas project is expected to propel the demand for pipes & tubes in the forecast period. Egypt has set its sights on increasing its oil production by 11% in 2023, aiming to reach a daily output of 650,000 barrels compared to the current 587,000 barrels daily. This expansion plan aligns with the commencement of operations in new oil fields and the expansion of existing fields in the Suez Canal region.

In an attempt to further increase its oil and gas sector, Egypt is planning to initiate two tenders for exploration activities. These tenders, scheduled to be launched by the end of 2023, are anticipated to encompass at least 16 blocks situated in the southern region of the country and across the Mediterranean. One of the tenders is expected to focus on exploring eight blocks affiliated with the Egyptian General Petroleum Corporation (EGPC). In comparison, the second tender is expected to target at least eight blocks associated with the South Valley Egyptian Petroleum Holding Company (Ganope).

Steel Section Market Analysis And Forecast

Steel sections are commonly used in the construction industry, they also have a significant role in the automotive industry. The demand for steel sections in the automotive industry is growing due to several factors, including safety requirements, lightweight, cost-effectiveness, design flexibility, durability, and corrosion resistance. The non-residential construction segment held the largest revenue share of over 54.0% of the global market in 2022. Growth in the non-residential construction industry, driven by urbanization, infrastructure development, and economic growth, has increased the demand for steel sections.

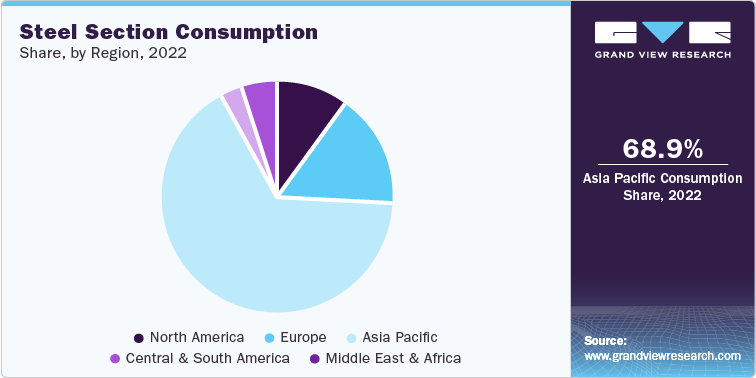

Asia Pacific dominated the global steel section market and is expected to continue over the forecast period. The stronghold of the region is attributable to the presence of raw material suppliers, manufacturers, and end-users. Asia-based manufacturers are expanding their production to cater not just to domestic customers but to international demand as well.

Competitive Insights

The outlook for the long steel products markets has weakened quickly in the last quarter of 2022. Factors responsible for weaker prospectus include higher energy prices, the global economic slowdown, rising inflation, the impacts of the Russia-Ukraine war, the sharp decline in the real estate sector, and the rising COVID-19 infections. Global crude steel production has declined significantly in 2022 as the demand has contracted at the global level.

The destruction of steel production facilities in Ukraine has led to a collapse in steel production along with rising energy prices and production stoppages, especially in Europe. However, the financial performance of steel companies showed improvement in 2022. Recently, steel prices have declined, putting pressure on steel producers' margins due to rising raw material and scrap prices.

-

In September 2022, Tata Steel decided to merge seven subsidiaries including four listed companies. This is projected to benefit the company by improving efficiency and reducing operations costs. The companies include Tata Steel Long Products, TRF, Tinplate Company of India, Tata Metaliks, The Indian Steel & Wire Products, Tata Steel Mining, and S&T Mining Company.

-

In September 2022, POSCO announced an investment of USD 14.1 billion to cut carbon emissions. The company constructed two electric furnaces, one in its Gwangyang factory and the other in its Pohang factory, to replace polluting old blast furnaces. In addition, the company installed cutting-edge equipment in electric furnaces to replace coking coal with cleaner hydrogen.

-

In February 2022, FABco, LLC, a leading provider of concrete construction material and supplier of steel rebars, acquired Volunteer Rebar. This acquisition is expected to help the company accelerate its growth and increase services to customers based in Tennessee, U.S.

-

In January 2022, Netherland-based VAN MERKSTEIJN INTERNATIONAL announced plans to build a new greenfield steel wire rod mill in Eemshaven by 2024, which is worth an investment of EUR 300 million (USD 305.4 million) and has a capacity of 580 kilotons. The company resumed this plan after obtaining all necessary approvals, which were initially put on hold in 2019 owing to problems with economic uncertainty and necessary permits.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified