- Home

- »

- Sector Reports

- »

-

Pumps Industry Trends, Growth & Analysis Data Book, 2030

Database Overview

Grand View Research’s pumps sector database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook report and summary presentations on individual areas of research.

Pumps Industry Data Book Scope

Attribute

Details

Areas of Research

- Centrifugal Pump Market

- Positive Displacement Pump Market

Number of Reports/Presentations in the Bundle

1 Sector Outlook Report + 3 Summary Presentations for Individual Areas of Research + 1 Statistic ebook

Cumulative Coverage of Countries

50+ countries

Cumulative Coverage of Products

10+ Products

Highlights of Datasets

- Demand/Consumption, by Counties

- Competitive Analysis

- Trade Analysis

- Centrifugal Pump Market, by Design

- Centrifugal Pump Market, by Configuration

- Positive Displacement Pump Market, by Type

- Pumps Market By End-use

Pumps Industry Data Book Coverage Snapshot

Markets Covered

Pumps Industry

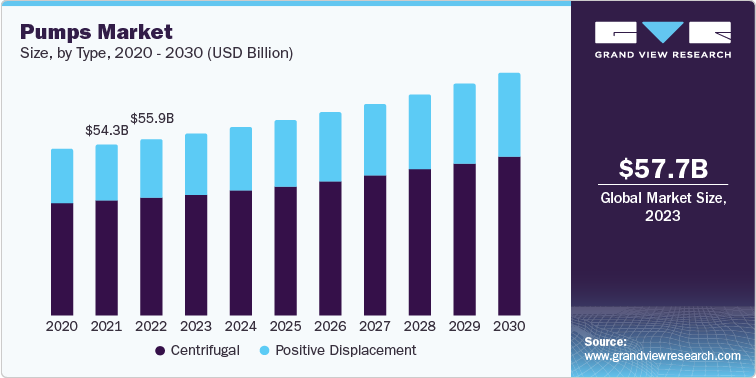

USD 57.7 billion in 2023

Centrifugal Pump Market Size

USD 38.6 billion in 2023

3.9% CAGR (2024-2030)

Positive Displacement Pump Market Size

USD 19.1 billion in 2023

4.8% CAGR (2024-2030)

Pumps Sector Outlook

The economic value generated by the pumps market was estimated at approximately USD 57.7 billion in 2023. The demand for pumps is on the rise owing to their varied use in such as water & wastewater, power construction, chemicals, and oil & gas industries. Rising expectations of customers in the past few decades have led to increased spending by the end-user industry globally to improve the quality of industrial pumps along with installing advanced process control. This has led to increased spending by the pump manufacturers in an attempt to improve energy efficiency, which is likely to drive the demand for improved energy-efficient pumps over the forecast period.

Recent innovations in pump technology have led to improvements in fundamental process tasks, boosting pump reliability and lowering operating costs over time. These advancements have also contributed to increased pump performance, reliability, and reduced energy usage. These technologically advanced pumps are widely used in various end-use industries, including industrial wastewater treatment, agriculture, power generation, and chemical processing, driving the product demand.

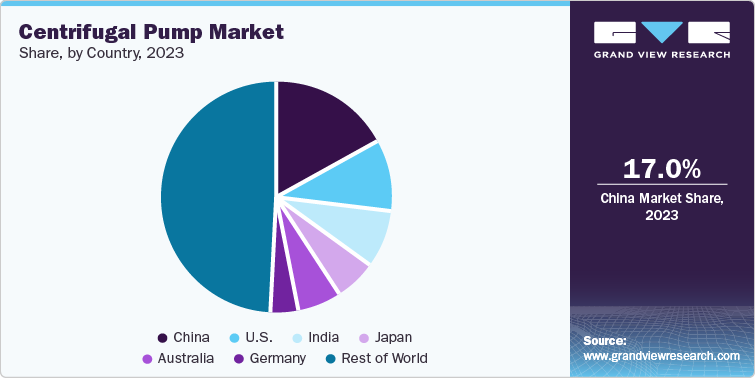

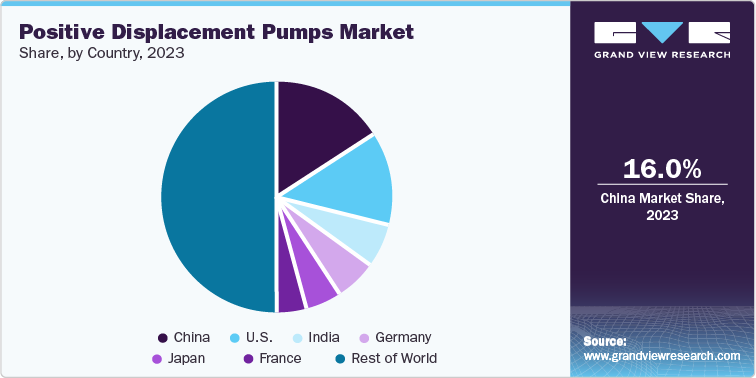

Table 1. Share of Major Pump Countries, by Type

Total

Centrifugal Pump

Positive Displacement Pump

USD Billion

57.7

USD Billion

38.6

USD Billion

19.1

China

17%

China

17%

China

16%

U.S.

11%

U.S.

10%

U.S.

13%

India

8%

India

8%

India

6%

Japan

6%

Japan

6%

Germany

6%

Australia

5%

Australia

5%

Japan

5%

Germany

4%

Germany

4%

France

4%

Rest of the World

49%

Rest of the World

49%

Rest of the World

50%

Source: Grand View Research

The growing competition among pump manufacturers for product differentiation has led to the development of technologies catering to the end-use requirements. However, the stringent safety regulations for pump manufacturing and the capability to meet the standards are likely to pose a challenge to market growth. There is a rising pressure to comply with various environmental regulations, which is majorly affected by the norms laid down by regional governments. Along with a focus on growth, continuous research and development (R&D) investments are essential for maintaining the market share. Newly introduced energy efficiency standards may require redesigning of pumps by manufacturers, which may incur high costs and time, thereby restraining the market growth.

Centrifugal Pump Market Analysis And Forecast

Centrifugal pumps, a subcategory of pumps, have emerged as critical equipment in numerous industries due to their versatility, efficiency, and ability to manage diverse fluid types. Centrifugal pumps are widely used in applications spanning water and wastewater treatment, agriculture, mining, construction & building services, and industrial manufacturing. Increasing requirements of centrifugal pumps on account of their excellent capability of rising pressure inside pump casing, high transmission velocity, and high flow rate deliverability are projected to promote the product’s importance.

The centrifugal pump market is further segmented into axial flow, radial flow, and mixed flow pumps. The market for axial flow pumps is expected to showcase significant growth over the forecast period, owing to increasing demand for high-power pumps in flood dewatering and water & wastewater treatment applications. Water and wastewater treatment is one of the largest end-use segments of this market. The increasing demand for water and wastewater treatment can be attributed to several factors such as population growth, urbanization, and industrialization. Emerging economies such as India, China, Brazil, and Argentina are experiencing rapid industrialization and urbanization, which is driving the demand for efficient pumping systems. Centrifugal pumps are a popular choice for these applications due to their relatively low cost and ease of maintenance.

Positive Displacement Pumps Market Analysis And Forecast

Positive displacement pumps transfer the fluid mechanically by repeatedly enclosing a fixed volume with the help of seals or valves. These pumps’ action is cyclic, which is driven by screws, lobes, diaphragms, vanes, or gears. However, these products work at lower speeds, making them less prone to damages caused by high viscosity oils and slurries. Hence, they are used in applications that require accurate dosing. These pumps are preferred in oil & gas industry mainly because of such limitations.

The positive displacement pump market is bifurcated into reciprocating and rotary pumps. Reciprocating pumps have been used for centuries. Plunger and piston are examples of reciprocating pumps that consist of a cylinder where the plunger or piston moves back and forth. This back-and-forth movement is referred to as reciprocation. Despite being expensive, these pumps are preferred for extreme durability and reliability. Diaphragm pumps also have the reciprocating back & forth movement. Instead of a plunger or piston, these pumps use a flexible membrane. These pumps are hermetically sealed systems, which makes them an ideal choice for pumping hazardous fluids.

Competitive Insights

The global pumps market is highly competitive owing to the presence of both multinational and local manufacturers. Some of the key players include Grundfos Holding A/S; Xylem; Flowserve Corporation; ITT INC.; Sulzer Ltd.; EBARA International Corporation; Ingersoll Rand; KSB SE & Co. KGaA; and Pentair. Other notable players include Iwaki America Inc.; HERMETIC-Pumpen GmbH; Vaughan Company Inc.; and SPX Flow. Pump manufacturers are involved in adopting several strategies including acquisitions, mergers, joint ventures, geographical expansions, and new product developments. These strategies aid the companies in increasing their market penetration and providing to the changing technological demand of various industries including agriculture, construction & building services, water & wastewater, power generation, oil & gas, chemical, and others.

-

In August 2023, EBARA Pumps announced the inauguration of a new branch, EBARA Pumps Europe S.p.A. Nordic (EPEN), located in Sweden.

-

In May 2023, Xylem, Inc. launched a global pump manufacturing site in Egypt. This plant will provide industry-leading water solutions to Egypt, North Africa and across Africa

-

In March 2023, KSB completed the acquisition of Bharat Pumps, a prominent producer of centrifugal pumps and various other products. The responsibility for managing this recent addition will fall under KSB SupremeServ, a specialized division within KSB focused on providing aftermarket services. KSB SupremeServ will oversee the spare parts operations and servicing of more than 5,000 BP&CL products that are currently in use across a wide range of industries and locations throughout India.

-

In February 2023, CPC Pumps International has extended its product range by launching its first-ever BB5 pump. The development of the BB5 opens opportunities in the more extreme high-pressure side of the business.

-

In August 2022, Grundfos has entered into an agreement to acquire Mechanical Equipment Company, Inc. (MECO). This acquisition will further expand Grundfos’ water treatment capabilities and strengthening Grundfos’ position as a provider of water treatment solutions

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified