- Home

- »

- Sector Reports

- »

-

Sealants Industry Trends & Analysis, Data Book, 2023-2030

Database Overview

Grand View Research’s sealants sector database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with a statistics e-book.

Sealants Industry Data Book Scope

Attribute

Details

Areas of Research

- Construction Sealants Market

- Automotive Sealants Market

- Other Sealants Market

Number of Reports/Presentations Covered in the buddle

1 Sector Outlook Report + 2 Summary Presentations for Individual Areas of Research + 1 Statistic eBook

Cumulative Coverage of Countries

50+ Countries

Cumulative Coverage of Application

03 Application Categories

Highlights of Datasets

- Demand/Consumption Data, by Countries

- Construction Sealants

- Automotive Sealants

- Other Sealants

- Competitive Analysis

Sealants Industry Data Book Coverage Snapshot

Markets Covered

Sealants Industry

2,312.8 kilotons in 2022

4.5% CAGR (2023-2030)

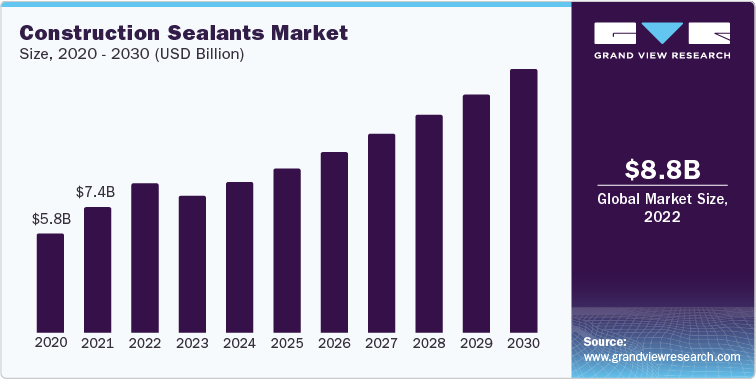

Construction Sealants Market Size

1,011.1 kilotons in 2022

4.6% CAGR (2023-2030)

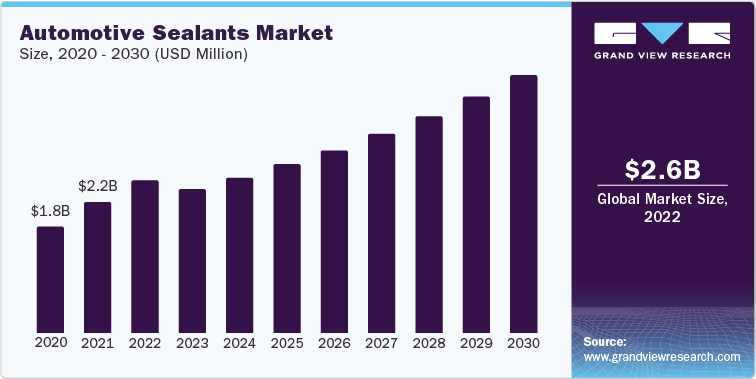

Automotive Sealants Market Size

417.5 kilotons in 2022

4.4% CAGR (2023-2030)

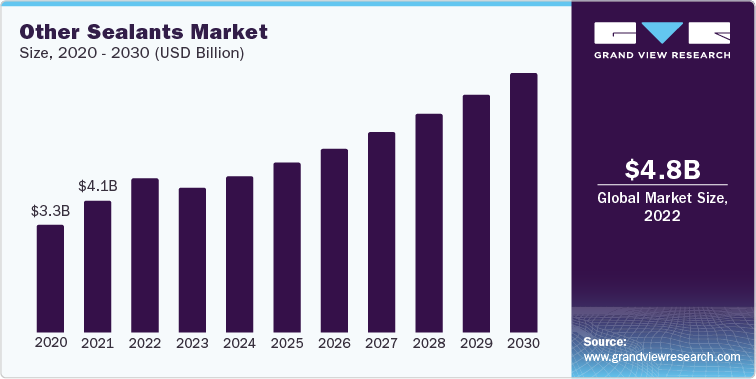

Other Sealants Market Size

884.2 kilotons in 2022

4.3% CAGR (2023-2030)

Sealants Sector Outlook

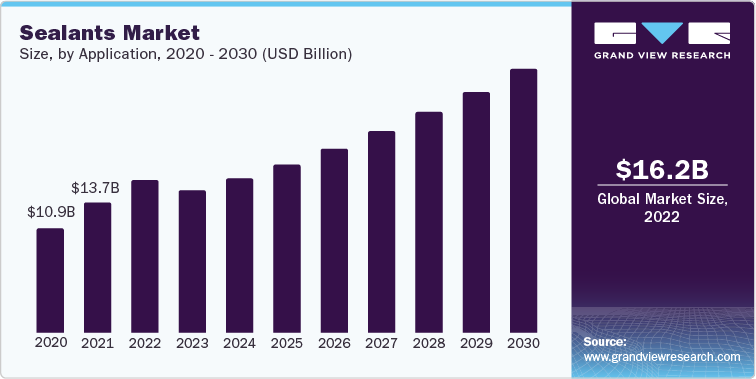

The economic value generated by the sealants industry was estimated at approximately USD 16.18 billion in 2022. This economic output is an amalgamation of basic sealant categories namely, construction sealants, automotive sealants, and other sealants.

The global sealants market has witnessed remarkable growth in the recent past due to the advancing construction industry worldwide. Sealants are extensively used in construction for various applications such as sealing joints, weatherproofing, and bonding. Thus, the increasing construction activities, including residential, commercial, and infrastructure projects, are driving the demand for sealants. The rise in spending on infrastructure development projects in emerging countries such as China, India, and the U.S. is another major reason driving the use of sealants in construction applications.

According to the U.S. Department of the Treasury June 2023 report, the U.S. experienced a rise in construction spending for manufacturing facilities. Since 2021, the spending on real manufacturing construction has doubled in the country. Additionally, the lowering of interest rates is expected to benefit future demand for sealants in construction applications. The highest growth in demand for them can be witnessed in countries such as China and India owing to the surged government spending for the construction industry.

Moreover, the recovery of the energy and mining sectors in Latin America and Europe is expected to benefit the market growth. In North America, government policies such as Fixing America's Surface Transportation (FAST) Act are expected to fuel the market demand in the region.

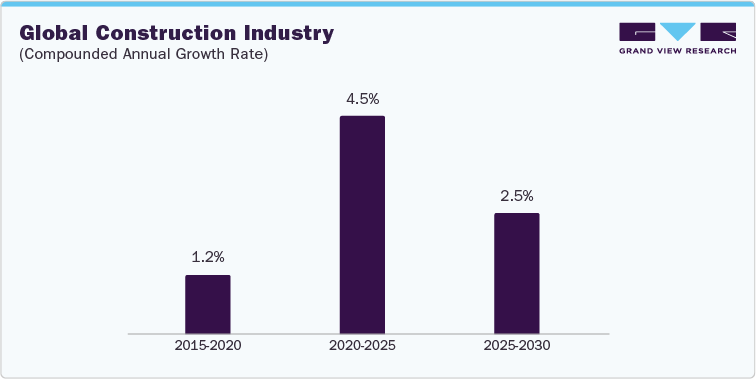

As depicted in the above figure the construction industry is anticipated to grow at a CAGR of 4.5% from 2020 to 2025 compared to 1.2% from 2015 to 2020. This growth in the global construction industry is anticipated to be driven by the demand for sealants used in construction activities. The use of sealants in the construction industry is widespread and plays a crucial role in ensuring the integrity and longevity of buildings and structures. Sealants are used to block the passage of fluids, seal joints, and gaps, and provide protection against environmental factors. Sealants are utilized for structural bonding purposes in construction. They are applied to bond materials together, enhancing the strength and stability of the structure. They can bond materials like glass, metal, stone, and composite panels, providing structural integrity and load transfer capabilities. This application is commonly seen in curtain walls, cladding systems, and precast concrete elements. Their versatile properties and ability to protect environmental factors make them an essential component in building construction, ensuring the longevity, performance, and comfort of structures.

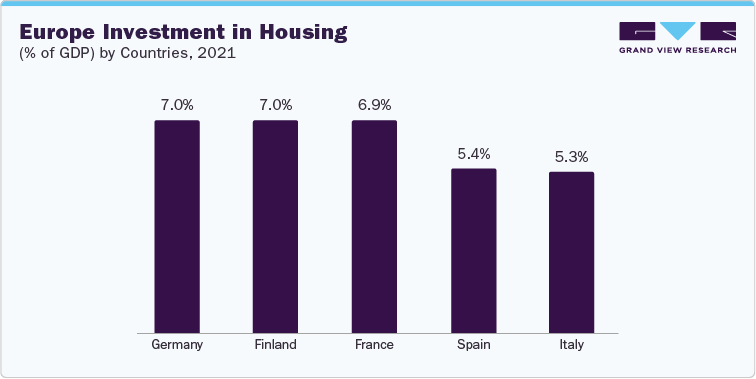

Moreover, the demand for sealants in Europe has been experiencing steady growth in recent years. This growth can be attributed to surging construction activities, growing automotive production, and ongoing advancements in technologies in the region. As Europe witnesses a rise in infrastructure development projects and renovations, the requirement for reliable and durable bonding materials has become paramount in the region. Renovation of dwellings in Europe is anticipated to create numerous growth opportunities for vendors of construction sealants. According to the European Parliament report, approximately 90% of the buildings in the region were built before 1990 and over 40% before 1960. This fueled the requirement for several buildings requiring renovation and reconstruction in Europe. Sealants play a crucial role in structural bonding, flooring, insulating, and waterproofing applications. Thus, the flourishing construction industry in the region contributes to the demand for sealants in Europe.

According to the Eurostat, in 2021 5.6% of the GDP of the European Union was invested in housing ranging from 7% in Germany to 1.3% in Greece and 2.3% in Poland. The growing construction and renovation activities in the region are anticipated to drive the demand for sealants over the forecast period.

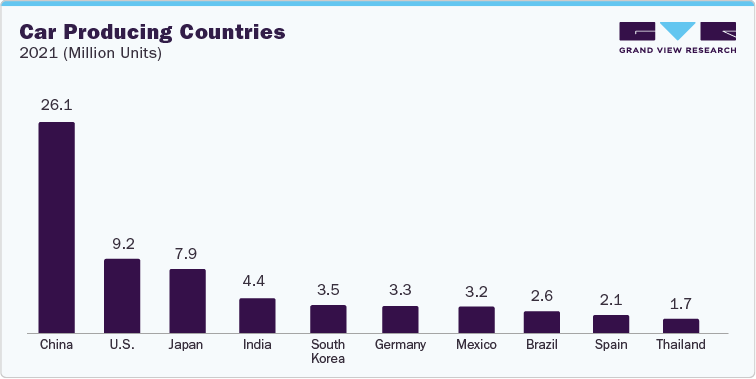

In addition, sealants are widely used in the automotive industry for waterproofing. They are used for repairing leaking windows in vehicles. Automotive is the fastest-growing application segment of the market. The growth of this segment of the market can be attributed to the increasing sales of vehicles in emerging economies such as China, India, and Brazil that fuel the demand for sealants used in automobiles. The demand for sealants is also anticipated to rise across the world as the global outlook for automotive production is stable. The consumption of sealants in automotive applications will be the highest in Asia Pacific and Eastern Europe during the forecast period as they are expected to register record car sales.

Sealants play a vital role in the automotive industry, providing numerous applications that contribute to the performance, durability, and safety of vehicles. Sealants are employed in bonding and joining different materials used in automotive construction. They provide strength and stability by creating a strong bond between components, such as body panels, windshields, roofs, and doors. This structural bonding enhances the overall integrity of the vehicle and ensures a secure connection, contributing to safety and crashworthiness. The advancing automotive industry in countries such as China, Japan, the U.S., and India is anticipated to drive the demand for sealants over the forecast period.

The sealants market is characterized by a high level of fragmentation, with numerous participants competing for market share. To strengthen their position in the industry, major players are actively pursuing product innovations, partnerships, expansions, and mergers and acquisitions across the value chain to retain their market share on a global scale. For instance, In March 2022, Wacker announced the expansion of its production and cartridge-filling capacities for silicone sealants at its Nünchritz site by 2024. The expansion will increase the company’s capability to supply customers, with ready-to-use silicone sealants for their direct sales.

Some of the prominent market participants include 3M, Henkel AG & Co. KGaA, RPM International Inc., Sika AG, Soudal Holding N.V., DOW, Arkema Group, Pidilite Industries Ltd. & Co. KGaA, Huntsman, and Wacker Chemie AG.

Construction Sealants Market Analysis And Forecast

Construction sealants accounted for an industry share of 54.6% in 2022. The global construction industry is increasingly relying on sealants for a wide range of applications as they play a crucial role in sealing joints, gaps, and connections in various building components, ensuring their longevity and structural integrity. Moreover, the demand for construction sealants is fueled by the need for flexible and durable solutions. Buildings are not static; they undergo movements due to factors like temperature changes and settling. Sealants with high flexibility can accommodate these movements without compromising their sealing properties. Durable sealants are resistant to degradation caused by UV exposure and other environmental factors, ensuring long-lasting performance.

The residential application segment dominated the market with a revenue share of 49.8% in 2022. Sealants play a crucial role in residential construction activities, providing a protective barrier against moisture, air leakage, and other potential sources of damage. These versatile substances are used in various applications throughout the building process, ensuring the longevity and performance of residential structures. From sealing gaps and joints to preventing water intrusion, sealants offer an effective solution for maintaining the integrity of residential buildings.

In addition, sealants are also widely used in waterproofing residential structures. Areas that are prone to water intrusion, such as bathrooms, kitchens, and basements, require effective moisture barriers to prevent damage caused by leaks and humidity. Sealants are applied to surfaces like tiles, countertops, and shower enclosures, creating a waterproof seal that protects against water seepage and mold growth. According to the US Census Bureau, the residential construction market witnessed a year-on-year growth of 1.6% in 2022. Thus, the advancing construction industry is anticipated to drive the demand for sealants over the anticipated period.

Automotive Sealants Market Analysis And Forecast

Automotive sealants accounted for an industry share of 15.9% in 2022. Sealants play a crucial role in the automotive industry, providing a wide range of applications that contribute to the performance, durability, and safety of vehicles. These versatile substances are used in various areas of automotive manufacturing and maintenance, ensuring the integrity of the vehicle's structure and components. From sealing gaps and joints to preventing leaks and corrosion, sealants offer an effective solution for enhancing the quality and reliability of automobiles.

Sealants are also used to prevent leaks in critical areas of the vehicle, such as the engine, transmission, and cooling system. These sealants are specially formulated to withstand high temperatures, pressures, and chemical exposure. They are applied to gaskets, seals, and other connections to ensure a reliable and leak-free operation. By preventing leaks, sealants help to maintain the proper functionality and performance of these vital automotive systems.

Passenger cars application segment dominated the market with a revenue share of 59.6% in 2022. One of the primary applications of sealants in passenger cars is in the sealing of gaps and joints. These gaps can occur between different components, such as doors, windows, and body panels. Sealants are applied to these areas to create an airtight and watertight seal, preventing the intrusion of air, water, dust, and other contaminants into the vehicle's cabin. By maintaining a tight seal, sealants contribute to the overall comfort and quietness of the passenger car's interior, while also improving energy efficiency by reducing air leakage.

Other Sealants Market Analysis And Forecast

Other sealants accounted for a share of 29.5% in 2022. Sealants play a crucial role in various industries, including packaging, consumer electronics, aerospace, and marine among others. In context to packaging applications, sealants are utilized to create airtight seals for a wide range of products such as containers, bottles, pouches, and tubes. These seals act as barriers for preventing the leakage of fluids, gases, or any other substances that can compromise the quality and freshness of packaged products. Silicone sealants are highly preferred in consumer electronics. These sealants are used to create a protective barrier around sensitive electronic parts, such as circuit boards, connectors, and sensors. By sealing gaps, joints, and openings, silicon sealants prevent the ingress of moisture, dust, and other contaminants, safeguarding the electronic components from damage and ensuring their long-term reliability.

Marine sealants are experiencing significant demand owing to the flourishing global shipbuilding industry. The refurbishment of existing ships is also driving the demand for marine sealants. The defense industry, although a niche one, can prove to be a significant source of revenue in the future owing to rising product innovations. Sealants are used in numerous applications in the aerospace industry. They are used in airplanes, satellites, helicopters, and unmanned aerial vehicles (UAVs). Technologically advanced high-performance sealants offer improved durability and are lightweight. As such, they enhance the fuel efficiency of business/commercial aircraft, rotorcraft, and satellites.

Reactive & other sealants in the technology segment dominated the market with a revenue share of 37.4% in 2022. One of the significant advantages of reactive sealants is their ability to bond with a wide range of materials, including metals, plastics, ceramics, and composites. This versatility makes them suitable for numerous applications, such as automotive assembly, construction, electronics, and aerospace. Reactive sealants offer excellent adhesion properties, ensuring a reliable and long-lasting bond between different substrates.

Competitive Insights

The sealants market is a highly competitive and dynamic industry that offers a wide range of sealant solutions for various applications. To gain a competitive advantage in this industry, companies must remain attuned to industry trends, customer needs, and technological advancements. Manufacturers of sealants, such as Henkel, 3M, and H.B. Fuller, typically source their raw materials from chemical suppliers, leading to a moderate level of integration in the value chain. Notably, major chemical companies like Dow have forward integration capabilities, enabling them to produce both raw materials and processed sealant products. Key market players include 3M, Henkel AG & Co. KGaA, RPM International Inc., Sika AG, Soudal Holding N.V., DOW, Arkema Group, Pidilite Industries Ltd. & Co. KGaA, Huntsman, and Wacker Chemie AG.

To enhance their market position, companies are implementing strategies such as expanding their operations and introducing new products. To contribute to the global shift towards renewable energy, Dow unveiled its expansion plans in March 2023. The company aims to enhance its line of silicone sealant products by introducing photovoltaic (PV) module assembly materials. This strategic move aligns with the growing demand for sustainable energy solutions. Dow's latest offering, the DOWSIL PV Product Line, comprises a selection of six silicone-based sealants and adhesive solutions. These products have been meticulously engineered to deliver exceptional durability and reliable performance across a wide range of applications. Notably, they are well-suited for frame sealing, rail bonding, junction box bonding, and potting, as well as materials required for building integrated photovoltaics (BIPV) installations.

Company Financial Performance, for Sealants Business Portfolio, 2022 (USD Billion)

Company

Contact Details

Revenue

DOW

2211 H.H. Dow Way

Midland, 48674, U.S.

Tel: +1 (989) 636-1000

Performance Materials & Coatings: 10.8 Billion

3M

2501 Hudson Road,

Maplewood, 55144, U.S.

Tel: +1 888-364-3577

Industrial Sealants & Tapes: 2.3 Billion

Arkema

420 rue d'Estienne d'Orves,

92705 Colombes Cedex France

Tel: 33 (0)1 49 00 80 80

Adhesive Solutions: 3.1 Billion

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified