- Home

- »

- Organic Chemicals

- »

-

1,4 Butanediol Derivatives Market Size, Industry Report, 2030GVR Report cover

![1,4 Butanediol Derivatives Market Size, Share & Trends Report]()

1,4 Butanediol Derivatives Market (2025 - 2030) Size, Share & Trends Analysis Report By Product By Application (THF, GBL, Spandex, PBT, PTMEG, NMP, NVP, PVP, PBS, PBAT), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-108-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

1,4 Butanediol Derivatives Market Trends

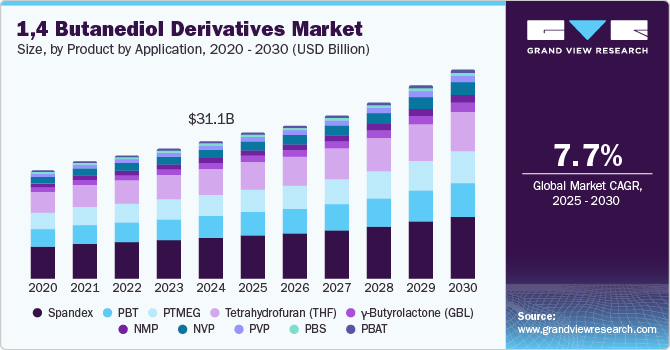

The global 1,4 butanediol derivatives market size was valued at USD 31,143.1 million in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. The wide application scope of 1,4-butanediol derivatives in various industries, such as electronics, clothing, pharmaceuticals, and packaging, contributes to their popularity. According to the International Organization of Motor Vehicle Manufacturers (OICA), global car production reached 61.6 million units in 2022 and increased to 93.56 million units in 2023. This rise in automobile production is driven by a growing population and increasing disposable income. As a result, consumers have greater purchasing power, leading to a surge in luxury buying behavior, particularly in rapidly developing countries such as China, India, several European nations, and Japan.

Butylene glycol (BDO) is also used to produce solvents and PTMEG, which is essential for manufacturing spandex and polyurethanes. In emerging markets such as India, the electronics industry is rapidly developing due to the growing demand for electronic products and supportive government initiatives such as Make in India and Digital India. These initiatives are complemented by including a beneficial foreign direct investment policy and favorable policies, for electronics manufacturing. As a result, the expanding market for electronic goods is expected to increase the demand for PBT (Polybutylene Terephthalate), which will, in turn, elevate the demand for BDO derivatives in the coming years, driving overall market growth.

The production of BDO involves the conversion of feedstock into 1, 4-butanediol through chemical processes. This includes reactions such as hydrogenation, catalytic reduction, or other suitable methods. Some of the key manufacturers of 1, 4-butanediol are BASF SE, Ashland, Mitsubishi Chemical Group, SINOPEC, and Evonik Industries AG. To produce 1, 4 Butanediol, numerous machines and equipment are used such as evaporators, gas-liquid stirred tank reactors, hydrolysis reactors, and melt crystallization apparatus. The production facilities can range from large-scale petrochemical plants to smaller specialty chemical plants, depending on the demand and application requirements.

The refined 1, 4 Butanediol product is then used in the manufacturing of its derivatives such as THF, GBL, Spandex, PTMEG, PBT, NMP, NVP, and PBAT among others. Johnson Matthey, a manufacturing company engaged in the production of 1, 4 Butanediol is also integrated at two levels as it undertakes the production of its derivatives as well by undertaking various processes such as esterification. Other companies which are forward integrated are BASF SE, and Ashland. The other prominent manufacturers of BDO derivatives are SABIC, Dow, SSB Polymers, Valco Group, Silver Fern Chemicals, and Capital Resin Corporation.

Drivers, Opportunities & Restraints

PBT is extensively used in automotive industry to produce ignition system parts, sensors, fuel systems, electrical connectors, components, door handles, and mirror housings. PBT is ideally used in these components owing to its chemical resistance, high heat resistance, and dimensional stability. The production of automobiles is rising owing to the increasing population and growing disposable income of the people. This has increased the purchasing power of consumers, thereby increasing luxury buying behavior in rapidly growing countries such as India, China, and Japan along with some European countries. Thus, with rising demand from automobile the demand for PBT is rising. This is expected to boost the market for 1,4-butanediol over the forecast period.

The manufacturing process of BDO releases toxic substances such as volatile organic compounds (VOCs), which have an adverse impact on the environment contributing to global warming. Moreover, the market growth is anticipated to be constrained by health risks associated with the use of 1,4-butanediol. BDO is commonly employed in the production of paint thinners and other solvent-based products. It exhibits low to moderate acute toxicity. Consuming or inhaling BDO can lead to various adverse effects on health. These effects include loss of consciousness, hallucinations, vision impairments, drowsiness, nausea, memory loss, and low heart rate. BDO acts as a central nervous system depressant, slowing down brain activity and impacting physical processes such as breathing and heart function. As a result, individuals with pre-existing heart or respiratory conditions, epilepsy, sensitivity to other CNS depressants, or those in generally poor health are at increased risk.

The production of bio-based BDO presents a significant opportunity for the market as it reduces the dependency on conventional oil-based resources. The increasing applications of THF and PBT are expected to boost the demand for bio-based BDO in the coming years. Moreover, companies such as BASF SE and Genomatica together produce bio based BDO from renewable feedstock.

Product by Application Insights

The spandex segment accounted for the largest revenue market share, 23.4%, in 2024 and is expected to continue to dominate the industry over the forecast period. Spandex, also known as elastane, is a synthetic fiber celebrated for its exceptional stretchiness and elasticity. Its unique properties have led to its growing use in the textile and clothing industry. Spandex is particularly popular in producing sportswear and leggings, which require a high degree of stretch and recovery. It can stretch up to 600% of its original length while returning to its initial form. In addition, spandex blends well with other fibers, creating fabrics with unique characteristics.

Polybutylene terephthalate (PBT) is one of the most notable derivatives of 1,4-butanediol. This polyester is known for its rigidity, strength, and solvent resistance. Because of its non-conductive properties, PBT is an insulator commonly used in the electrical and electronics industries. In addition, thanks to its high strength and impact resistance, it is widely used in the automotive sector for producing parts such as connectors, sensors, and housings.

Polytetramethylene ether glycol (PTMEG) is a linear, long-chain polyether glycol developed through tetrahydrofuran (THF) polymerization. PTMEG is a raw material for various applications, including elastomers, coatings, and adhesives. It is particularly significant in the manufacture of high-performance elastomers, especially polyurethanes. These elastomers are known for their high tensile strength, durability, and resilience, making them suitable for various applications, from automotive suspension systems to sports equipment.

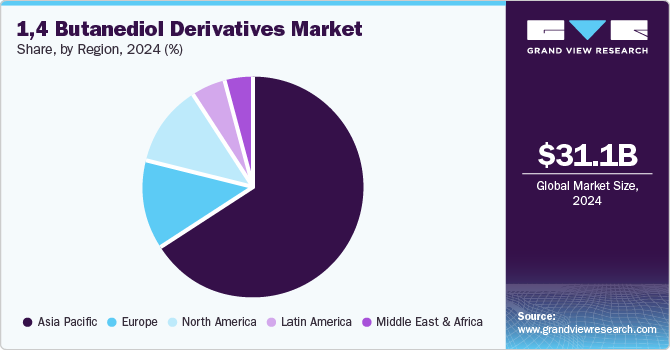

Regional Insights

The demand for North America 1,4-butanediol derivatives market is increasing due to the growth of various industries and the focus on sustainable production methods. Thus, the growing construction activities and the increasing demand for automotive, electronics, packaging, and paints & coatings in the region are anticipated to drive the demand for 1,4-butanediol over the forecast period.

U.S. 1,4 Butanediol Derivatives Market Trends

The growth of the U.S.'s1,4-butanediol derivatives market is primarily driven by its increasing demand in key industrial applications, particularly in producing plastics, resins, and synthetic fibers. As the demand for products such as spandex, polyurethane, and plastics continues to rise across various industries such as automotive, construction, textiles, and electronics, the need for high-quality BDO as a versatile chemical building block also expands.

Europe 1,4 Butanediol Derivatives Market Trends

Europe 1,4 butanediol derivatives market has witnessed significant strides in terms of advancements of chemical recycling and green chemistry initiatives, which has helped improve the overall cost-effectiveness of BDO production processes. As Europe continues to focus on decarbonization and achieving its climate goals, BDO is increasingly being produced via bio-based and low-carbon processes, aligning with the region's commitment to a circular economy.

Asia Pacific 1,4 Butanediol Derivatives Market Trends

The 1,4 butanediol derivatives market in Asia Pacific is witnessing growth backed by surging automotive, construction, and electronics industries in countries such as China, India, and Japan, which are major contributors to the demand for BDO. The rise in consumer demand for lightweight and durable materials in these sectors has spurred the need for advanced polymers and coatings, where BDO plays an essential role. Moreover, the shift toward bio-based BDO production methods is gaining traction, providing an added growth avenue for the market as manufacturers look to meet sustainability goals.

Latin America 1,4 Butanediol Derivatives Market Trends

Latin America 1,4 butadeniol derivatives market is set to display decent growth as Latin countries in this region continue to industrialize and consumer purchasing power improves, the need for high-performance materials in manufacturing processes is rising, further boosting BDO demand. In addition, the electronics industry's rapid expansion, especially in Brazil and Mexico, contributes to the demand for BDO in producing electronic components and consumer goods, further driving market growth.

Middle East & Africa 1,4 Butanediol Derivatives Market Trends

The Middle East & Africa 1,4 butanediol derivatives market is developing owing to its expanding manufacturing sector, especially in countries such as Saudi Arabia and the UAE, fosters a higher consumption of BDO as it is integral to producing materials such as polyurethane and polybutylene terephthalate (PBT). In addition, the rise in automotive production and construction activities across these regions further propels the need for BDO-based products, which are essential for enhancing durability and performance.

Key 1,4 Butanediol Derivatives Company Insights

Some of the key players operating in the market include BASF SE, Ashland, and Evonik Industries AG.

-

BASF SE is a chemical production company. It has more than 340 production facilities worldwide and conducts business through subsidiaries and joint partnerships in over 80 countries. The company also offers a variety of system solutions and services. These include products for the automotive, chemical, construction, agriculture, oil, electrical, plastics, electronics, furniture, and paper sectors.

-

Ashland is engaged in manufacturing and distributing specialty chemicals to several end-use industries including architectural coating, adhesives, automotive, construction, food & beverage, pulp & paper, energy, pharmaceuticals, and personal care. It operates through three business segments, namely, specialty ingredients, composites, and intermediates & solvents. The specialty ingredients segment includes cellulose ethers, vinyl pyrrolidone, and biofunctionals.

Key 1,4 Butanediol Derivatives Companies:

The following are the leading companies in the 1,4 butanediol derivatives market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Ashland

- DCC

- Mitsubishi Chemical Group Corporation

- Evonik Industries AG

- LyondellBasell Industries Holdings B.V.

- Sipchem Company

- SINOPEC (China Petrochemical Corporation)

- Genomatica, Inc.

Recent Developments

-

In September 2023, BASF agreed with Qore LLC to secure long-term access to QIRA's bio-based 1,4-butanediol. This strategic move supports BASF's expansion of its bio-based derivatives portfolio, including tetrahydrofuran and polytetrahydrofuran, with commercial quantities anticipated by Q1 2025.

-

In October 2022, BASF SE announced the manufacturing of 1,4-butanediol through renewable feedstock, which includes Genomatica's patented GENO BDO technology. The moves toward bio-based technologies for producing 1,4-butanediol align with BASF SE and Genomatica, Inc. goal of promoting sustainable development in the industry.

1,4 Butanediol Derivatives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32,984.1 million

Revenue forecast in 2030

USD 47,871.3 million

Growth rate

CAGR of 7.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product by application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; Russia; China; India; Japan; South Korea; Australia; Vietnam; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Ashland; DCC; Mitsubishi Chemical Group Corporation; Evonik Industries AG; LyondellBasell Industries Holdings B.V.; Sipchem Company; SINOPEC (China Petrochemical Corporation); Genomatica, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 1,4 Butanediol Deravatives Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global 1, 4 butanediol derivatives market report by product by application, and region:

-

Product by Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Tetrahydrofuran (THF)

-

PTMEG (Polytetramethylene Ether Glycol)

-

Solvents

-

-

γ-Butyrolactone (GBL)

-

NMP (N-methyl-2-pyrrolidone)

-

2 PY (2-pyrrolidone)

-

Others

-

-

Spandex

-

Clothing

-

Medical

-

Others

-

-

Polybutylene Terephthalate (PBT)

-

Electronics

-

Automotive

-

Consumer Goods

-

Others

-

-

PTMEG (Polytetramethylene Ether Glycol)

-

Spandex

-

Polyurethane

-

Others

-

-

NMP (N-methyl-2-pyrrolidone)

-

Petrochemicals

-

Electronics

-

Paints & Coatings

-

Others

-

-

NVP (N-vinyl-2-pyrrolidone)

-

PVP (polyvinylpyrrolidone)

-

Adhesives

-

Coatings

-

Others

-

-

PVP (Polyvinylpyrrolidones)

-

Pharmaceuticals

-

Personal Care/Cosmetics

-

Detergents

-

Others

-

-

PBS (Polybutylene Succinate)

-

Mulch Films

-

Packaging

-

Others

-

-

PBAT (Polybutylene Adipate Terephthalate)

-

Food Packaging

-

Agriculture Films

-

Others

-

-

TPU (Thermoplastic Polyurethane)

-

Footwear

-

Automotive

-

Electronics

-

Medical

-

Others

-

-

2 PY (2-pyrrolidone)

-

Coatings

-

Inks

-

Pharmaceuticals

-

Others

-

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 1,4 butanediol derivatives market size was estimated at USD 31,143.1 million in 2024 and is expected to reach USD 32,984.1 million in 2025

b. The global 1,4 butanediol derivatives market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2030 to reach USD 47,871.3 million by 2030.

b. Asia Pacific dominated the 1,4 butanediol derivatives market with a share of 65.8% in 2024. This is attributable to increasing construction activities, growing electronics, automotive, medical, and clothing production, and increasing foreign investments in the region

b. Some key players operating in the 1,4 butanediol derivatives market include BASF SE, Ashland, DCC, Mitsubishi Chemical Group Corporation, Evonik Industries AG, LyondellBasell Industries Holdings B.V., Sipchem Company, SINOPEC (China Petrochemical Corporation), Genomatica, Inc.

b. Key factors that are driving the market growth include increasing application of derivatives of 1,4 butanediol in different end-use industries, including electronics, clothing, pharmaceutical, packaging, etc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.